Bjoern Wylezich

APD is undervalued

We have been accumulating shares of Air Products and Chemicals, Inc. (NYSE:APD) over the past few days with an average cost basis of ~$230. The goal of this article is to explain our thought process and why we see a very asymmetrical reward/risk profile in the next 2~3 years.

For those who are new to the ticker, Air Products and Chemicals, Inc. supplies various atmospheric (oxygen, nitrogen) and process (hydrogen, helium) gases to energy, industrial, technology, and healthcare customers worldwide. The company is the world’s largest supplier of hydrogen, with leading positions serving the refinery hydrogen, semiconductor materials, and natural gas liquefaction markets.

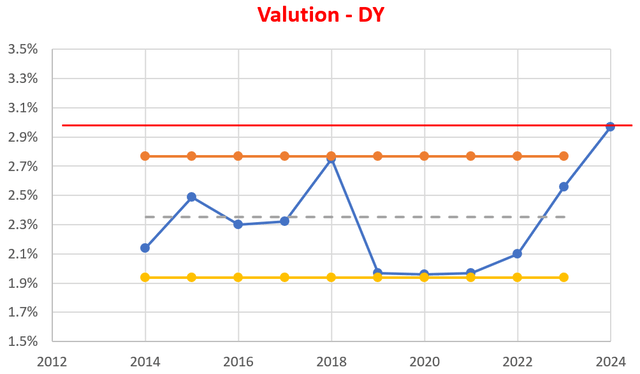

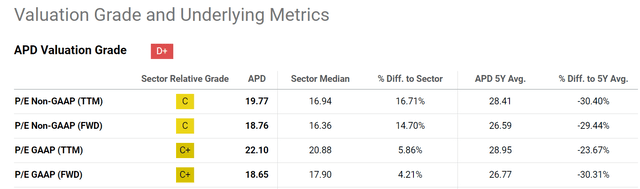

APD showed up on our radar recently when we were screening for stocks with yields noticeably above their normal range. And APD really caught our attention because it seemed undervalued by a large margin, as you can tell from the charts below. In terms of dividend yield (BTW, it is a dividend champion), its current yield (shown by the solid red line) exceeds 1 standard deviation (shown by the orange line with symbols) above its historical average (shown by the gray dotted line). In terms of P/E, at a price near $230, it is trading at about a 30% discount from its past 5-year average (see the second chart below).

When the yield and valuation are so out of whack, our experience has taught us to check if one of the following two scenarios is likely:

- The dividend payouts are unsafe, and a cut is imminent.

- The underlying business is chronically unprofitable and likely to stagnate permanently.

After digging into these, we conclude that neither scenario is likely. As a matter of fact, we see good odds for the opposite, as detailed next.

Author based on Seeking Alpha data Seeking Alpha data

Dividend safety

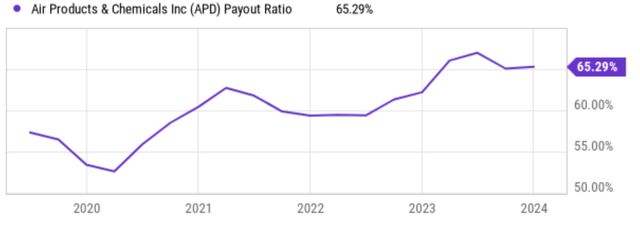

My projection for the payout ratio is about 56% for 2024 and 2025, well in line with its historical range as seen in the next chart below.

Besides the simple payout ratio(s), the strength of a business’s balance sheet is an important factor for its dividend safety. Unfortunately, it’s a factor that is not captured in the simple payout ratios. We have been reminding our members whenever we can to dig beyond those simple payout ratios. For APD, the news is all good the way I see it. Its credit ratings are in the upper medium end of the investment grade range, with either a stable or positive outlook. You can read S&P’s recent rating confirmation and the rationale in more detail following this report entitled “Air Products and Chemicals Inc. 'A' Ratings Affirmed On Adequate Liquidity; Outlook Stable.” You are encouraged to read the full report, and parts of it are quoted below (the highlights were added by me). In our view, the keywords here are earning stability due to APD’s unique strength and long-term contracts.

The company's credit strengths include its generally predictable earnings, very high EBITDA margins well above 30%, and market leadership in a stable business with long-term contracts.

The stable outlook reflects Air Products' solid business fundamentals. These include its well-established position in the global industrial gas market, significant entry barriers, and wide diversity of markets and applications, which support business stability and mitigate pricing and volume pressures. We anticipate the company will continue to focus on strengthening its market position in industrial gases through a mix of organic and inorganic growth while continuing to generate high margins and predictable volume growth.

Then what is the catch?

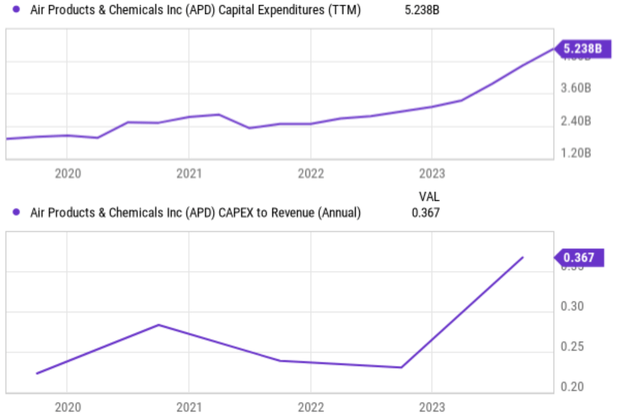

In our view, the valuation compression is largely driven by the elevated capital spending in the next few years. For example, its TTM CAPEX spending sits around $5.23B, and its CAPEX spending in 2024 will be likely between $5 billion and $5.5 billion, which is what Air Products has guided for. To better contextualize things, the chart below shows its CAPEX spending in the past 5 years. As seen, the spending in 2023 and the next few years are sharply higher both in absolute and relative terms (relative to revenue).

Looking further out, management plans to invest $15 billion of a total plan of $19 billion over the coming years to build production capabilities for low-carbon hydrogen and ammonia. Management believes hydrogen will replace fossil fuels in shipping in many countries and eventually will be used in carbon-intensive industrial sectors like steel production.

Such large-scale infrastructure expansion certainly entails uncertainties (budget overrun, delays, regulation changes, et al.). However, we think the current concerns are overblown. Many of the expansion projects are joint ventures with government entities, which helps with both funding and regulatory issues. For example, recently, a new facility under development in Louisiana was expanded from $4.5 billion to $7.0 billion after additional funding contributions from governments in Europe and Japan. Furthermore, long-term demand contracts are already in place that target double-digit returns on Air Products’ investment.

Growth and return projections

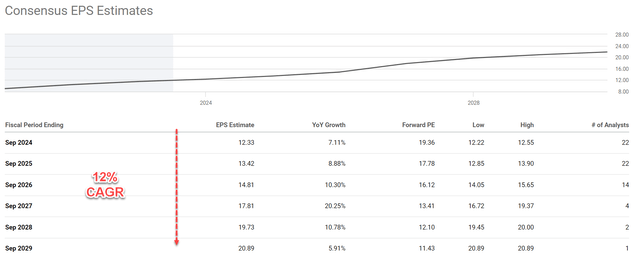

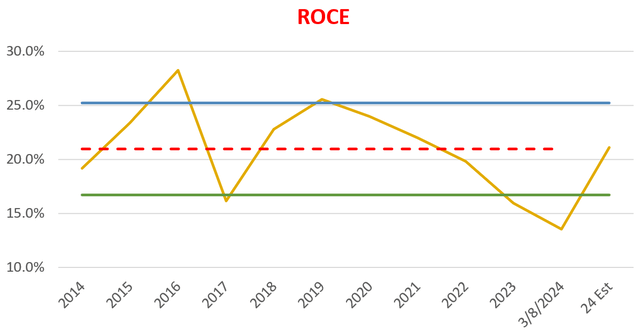

All told, consensus projects a double-digit growth rate in the next few years as well (about 12% CAGR in the next 5 years). Such a projection is in line with the above target ROI and also our own estimates. As seen in the second chart below, it has been maintaining an average ROCE of around 21% in the past (the horizontal lines again indicate the historical average and standard deviation). With the government subsidies, its effective reinvestment rate in the next few years would be more than 50%, resulting in a double-digit organic growth rate. Combined with the potential for a P/E renormalization (from the current ~19x to its historical median of ~24x), we are optimistic for a total annual return in the upper teens in the next few years.

Seeking Alpha data Author Based on Seeking Alpha data

Other risks and final thoughts

Besides the large CAPEX expenditures, there are two downward risks worth mentioning under our current conditions. APD’s business falls in the general category of basic materials. As such, the stock can be sensitive to raw material prices (which are notorious for their volatility). Its operations rely on consistent access to raw materials at stable prices. Fluctuations in the cost or availability of key resources can significantly impact profitability. Many chemicals that APE produces involve energy-intensive processes. Fluctuations in energy prices can squeeze margins.

All told, to us, Air Products and Chemicals, Inc. presents a compelling investment opportunity under current conditions. We think the market’s concern over its high CAPEX is overblown. Due to the price compression, APD now boasts an attractive valuation both in terms of P/E ratio and especially in dividend yield. The discounted valuation, when combined with its role as a market leader in a stable sector with long-term contracts, offers a return profile too asymmetrical to ignore in our mind.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

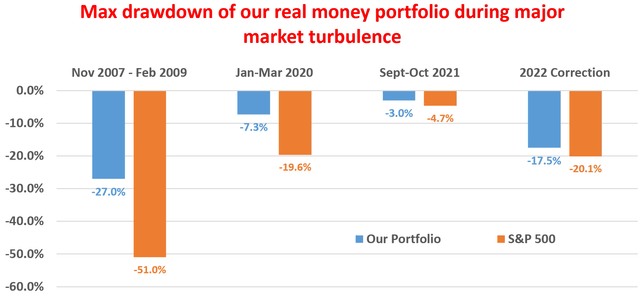

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.