spxChrome

We previously covered XPeng (NYSE:XPEV) in October 2023, discussing the market's over-reaction to its deliveries to Israel as conflict broke out in the area, expanded production ramp up through September 2023, and mixed FQ2'23 financial results.

Despite so, we had upgraded the stock to a speculative Buy, due to the automaker's continuous investments in its R&D efforts "related to the development of new vehicle models" in the mass market segment, with the improved/ production scale likely to moderate its cash burn.

In this article, we shall reiterate our Buy rating despite XPEV's drastic decline by -54% over the past six months, well underperforming the wider market at +16%.

With the management opting to enter the mass market model with an extremely attractive pricing point, further aided by its expansion to the wider Asia and Southeast Asian countries, we believe that the automaker is likely to achieve accelerating sales from H2'24 onwards, significantly aided by its low break-even price-point and compelling XNGP ADAS platform.

The XPEV Investment Thesis Remains Promising, Despite The Growing Pessimism

For now, XPEV has reported a double beat FQ4'23 earnings call, with revenues of 13.05B Yuan (+52.9% QoQ/ +153.8% YoY) and adj EPS of -$0.14 (+36.3% QoQ/ +26.3% YoY), and FY2023 numbers of 30.67B Yuan (+14.2% YoY) and -$1.53 (-6.9% YoY).

Based on the moderating estimated ASPs of 203.32K Yuan in FQ4'23 (+3.7% QoQ/ -3.1% YoY) and 197.81K Yuan in FY2023 (-3.8% YoY), it is apparent that the automaker has achieved an excellent manufacturing scale, with it still reporting 4.1% in adj vehicle gross margins in FQ4'23 (+10.2 points QoQ/ -1.6 YoY) and 0.8% in FY2023 (-8.6 points YoY)

At the same time, XPEV has been able to successfully achieve its FQ1'24 delivery guidance of between 21K to 22.5K units, with 21.82K units delivered (-63.7% QoQ/ +19.7% YoY).

While this number pales in comparison to Li Auto's (LI) FQ1'24 deliveries at 80.39K (-39% QoQ/ +52.8% YoY), at the very least, XPEV has estimated its consumer demand rather accurately.

This is compared to NIO's (NIO) FQ1'24 delivery miss at 30.05K (-39.9% QoQ/ -3.1% YoY), against the original guidance of between 31K and 33K.

At the same time, XPEV is looking to launch mass-market models from Q2'24 onwards, with the launch prices of between 100K to 150K Yuan pitting it directly against BYD Company Limited's (OTCPK:BYDDF) most popular model, Yuan Plus crossover at approximately 119.8K Yuan.

This is a highly strategic decision indeed, since the 100K to 150K Yuan segment remains the most popular market for Chinese consumers, with 34% of market share in 2023 (+3 points YoY) and over 8M units sold annually.

With such a competitive entry point, we believe that XPEV may be greatly positioned in the mass market segment indeed, especially given its low break-even price-point for the premium models at an estimated sum of 195K Yuan as of FQ4'23.

This is compared to NIO's plan of introducing its mass market models at an estimated launch price of between 200K to 250K Yuan and an estimated break-even price-point of 271.78K Yuan for its premium models as of FQ4'23.

At the same time, XPEV is also looking to enter the wider Asia and South-East Asian market through the redesigned right-hand EVs by H2'24.

This is an excellent decision indeed, due to the EV supply glut reported in the EU, with some "Chinese EVs (supposedly) sitting in European ports for up to 18 months," on top of the ongoing conflict in the Middle East.

This further highlights the management's prudent decision to diversify its global footprints at a time of slowing domestic EV adoption.

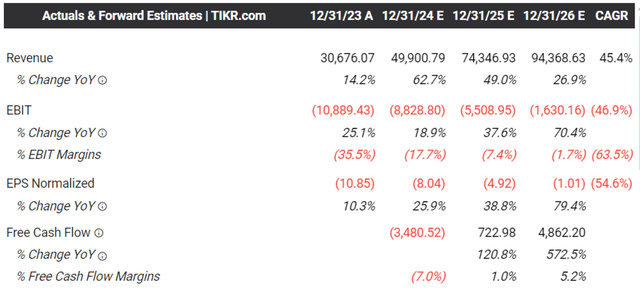

The Consensus Forward Estimates (In Yuan)

The same has also been observed in its promising consensus estimates, with XPEV expected to generate an accelerated top line expansion at a CAGR of +45.4% through FY2026, with decent Free Cash Flows from FY2025 onwards.

Assuming so, it appears that the automaker's cash/ others on balance sheet of 45.7B Yuan (+19.4% YoY) may be sufficient to weather the near-term transition to the mass market segment indeed.

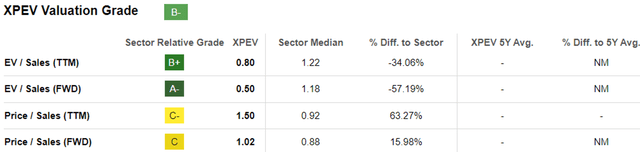

XPEV Valuations

The same quiet optimism is also observed in XPEV's FWD Price/ Sales valuation of 1.02x, compared to its Chinese-based automaker peers, such as NIO at 0.87x, LI at 1.07x, and BYDDF at 0.75x.

Assuming that XPEV is able to record the double-digit growths as projected, we believe that it is not expensive here indeed, when compared to NIO's top-line estimates of +27.1%, LI at +36.9%, and BYDDF at +20.3% through FY2026.

So, Is XPEV Stock A Buy, Sell, or Hold?

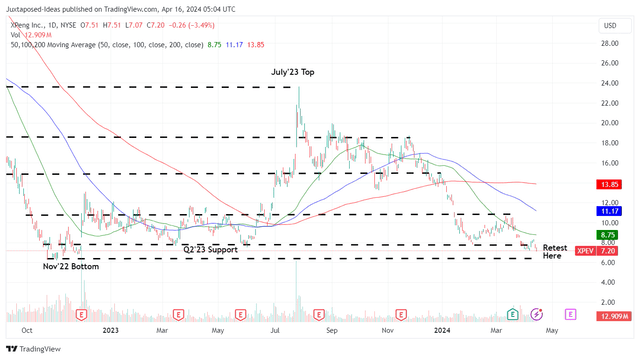

XPEV 2Y Stock Price

For now, XPEV has failed to retain much of its gains as it appears to retest the previous support levels of $7s, with the November 2022 bottom of $6s likely to follow soon.

If anything, based on the stock's lower highs and lower lows since the July 2023 top, we may see it enter penny stock ranges as similarly observed with NIO since early March 2024, as market sentiments remain pessimistic surrounding Chinese-based ADS and EV stocks in general.

With no floor in sight, does it make sense to rate the stock as a Buy?

Given the numerous near-term tailwinds as discussed above, yes indeed, though with a certain caveat for an improved margin of safety. Readers may want to monitor the XPEV stock movement for a little longer, while adding only after bullish support has materialized.

It goes without saying that the stock remains speculative to a certain extent, attributed to the elevated short interest of 7.7% at the time of writing, with any gains potentially negated by volatile short traders.

Nonetheless, we maintain our belief that the risk reward ratio remains attractive moving forward, with XPEV reporting a relatively stable book value of $5.73 per share (+25.6%/ -7.8% YoY), thanks to the growing balance sheet and tight share count.

At the same time, based on the projected Free Cash Flow generation in FY2025, we expect the automaker to utilize much of the profitability on new growth opportunities, particularly on the XNGP ADAS platform, which has been launched nationwide in China by early 2024.

Given that the XNGP ADAS platform is available to all XPEV drivers who purchased an XNGP capable EV with NVIDIA's (NVDA) Dual Orin-X SoCs without any additional subscription costs (at the time of writing), we can understand why the automaker reports an impressive driver penetration rate of 83% as of February 2024, compared to TSLA's FSD at 19% as of December 2022.

With the management setting a global launch of the XNGP ADAS platform in 2025, we maintain our belief that XPEV remains well positioned for great growth ahead.