Kwangmoozaa

Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund [CEF] market activity from both the bottom-up - highlighting individual fund news and events - as well as the top-down - providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the second week of April. Be sure to check out our other weekly updates covering the business development company [BDC] as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

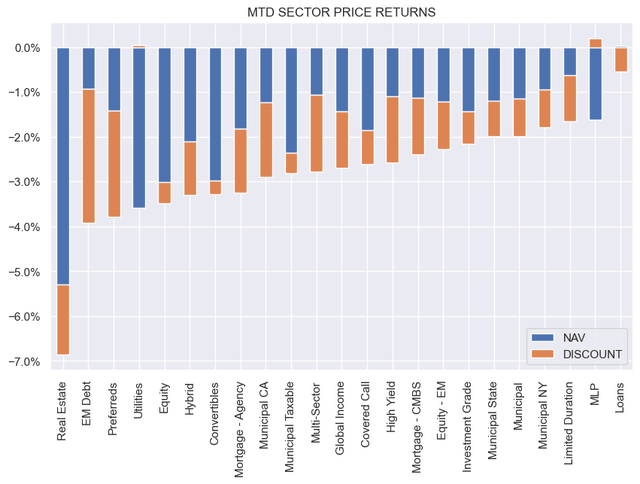

All CEF sectors registered negative returns over the week as higher-than-expected inflation continues to rattle markets. Month-to-date, the loan sector has outperformed though it is also in the red. REITs are the worst performers with a nearly 7% drop in April.

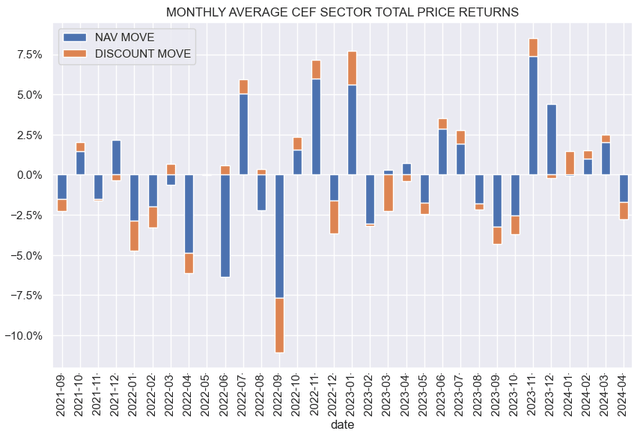

So far, April looks like a mirror image of March as CEFs have shaved off a big chunk of their positive return year-to-date.

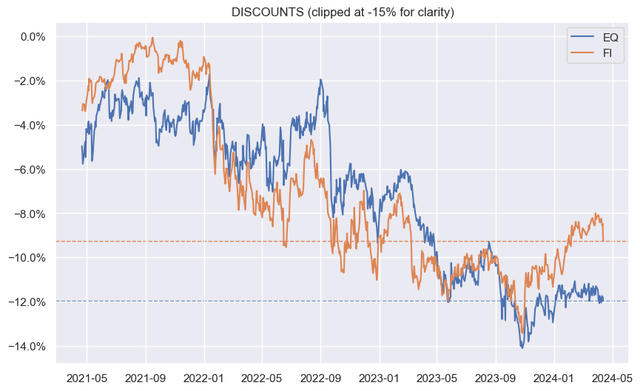

Fixed-income CEF sector discounts widened a bit more than 1% while equity CEF sectors have held in a bit better.

Market Themes

Voya investment management has changed the distribution frequency of a number of their CEFs (IGA, IDE, IAE, IHD) from quarterly to monthly. This has certainly been the trend in CEFs - recall that the PIMCO fund PDX recently shifted from quarterly to monthly as well. Nearly all credit CEFs distribute monthly however many equity-linked funds stick with quarterly distributions. Overall, a bit over 20% of CEFs have distributions that are other than monthly but the trend seems to be shifting more in favor of monthly distributions.

At first blush the shift to a monthly distribution is a win because, from a yield-compounding perspective, the same yield at higher-frequency leads to a higher overall annualized yield. This is because investors can reinvest the distribution earlier, allowing the distribution to earn its own distribution. In other words, a 10% yield paid monthly is "higher" than a 10% yield paid annually.

This is all fine and good for something like a preferred or a bond, however, this effect does not have the same strength for a CEF. This is because a CEF would itself compound the unpaid distribution internally just as the investor who reinvests the distribution back into the fund. In fact, because there is less friction for a lower-frequency dividend, a fund can even generate more wealth with a lower-frequency dividend because it can keep the cash invested for a longer period than a fund that sells the security, pays out the dividend, receives it back from investors and buys the security back, something which obviously keeps the cash uninvested for part of the time. The trading slippage that may be necessary to source cash for a higher-frequency distributing fund will have a negative impact as well. And if the fund uses borrowings to pay out the dividend (rather than selling a security), it has to pay something to the lender to facilitate that use of cash, leading to some wealth erosion as well.

In practice, however, most funds keep some level of cash in the portfolio as a buffer which likely means that the distribution frequency is not as relevant for overall wealth. What is true is that many investors prefer monthly-paying funds over their quarterly counterparts. The view is that bills arrive monthly and so should distributions.

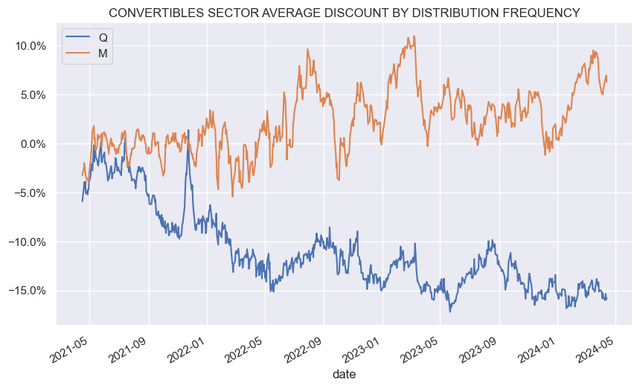

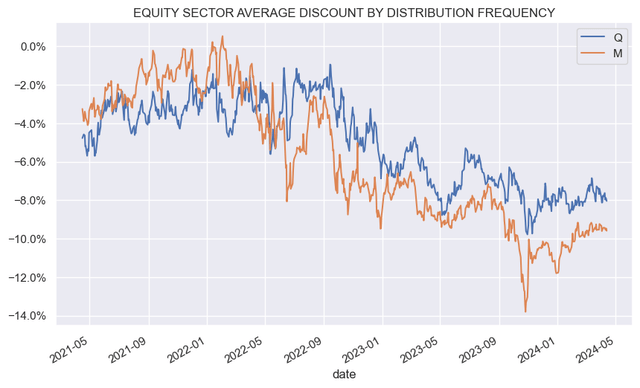

By this logic, monthly-paying funds should trade at tighter discounts than their quarterly counterparts. The evidence on this front is mixed. For example, while MLP, Convertibles and Utility monthly payers have tended to trade at tighter discounts, this is not true of either Covered Call or Equity CEFs.

Systematic Income Systematic Income

This is not particularly scientific as it doesn’t account for fees or alpha but it’s something worth keeping an eye on. The pattern of higher-paying funds trading at tighter discounts is definitely there (regardless of their actual underlying income), something which allows discerning investors to generate more alpha (by, say, choosing lower-distribution funds with wider discounts). So in the same vein, it can pay to stick with a quarterly distributing fund over a monthly payer if it looks cheap for no apparent reason.

Market Commentary

The record date for the AIF/AFT/MFIC merger is behind us which means that if shareholders exit the CEFs now, they can still vote on the merger. There are two main reasons to vote no. One, is that if the vote fails, the funds could easily move back to a double-digit discount (from a mid-single digit discount now) where they can be bought back.

And two, the CEFs basically participate in much the same kind of business as MFIC with a third of their portfolios (i.e. a third of the 2 CEF portfolios are in private credit). In other words, the CEFs piggy back on work done by Apollo but without having to pay incentive fees which BDCs like MFIC collect. Once the CEF capital is absorbed into MFIC, the fees on the previous CEF allocation will increase.

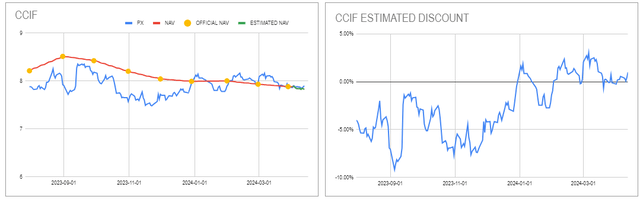

A number of CLO CEFs (ECC, EIC, CCIF) have already published their March NAVs. Overall, the performance has been mixed. EIC and OXLC have seen an uptrend in NAVs, as would be expected in a strong market environment while ECC, OCCI and CCIF have been flat or fallen somewhat. One consequence of this is that CCIF is no longer as cheap as it has been in the past. The NAV downtrend means its discount has been erased so it’s less of a slam dunk at this point. The yield has exceeded the NAV downtrend so the performance is still positive at around +2.5% in total NAV terms year-to-date but, arguably, its performance has been disappointing so far.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!