H-Gall

Introduction

When I think of American Tower (NYSE:AMT) or any dividend-paying stock for that matter, my first thought it always, "Where will they be in a minimum of 5 years?" Of course, no one knows. But as a provider of cell towers to some of the largest telecom companies in the world like T-Mobile (TMUS) & Verizon (VZ), it's likely this REIT will be around for many years to come. So, as a long-term dividend investor, you might ask yourself: Is this a company I would invest my hard-earned money into for the foreseeable future? In this article, I discuss the company's financials and fundamentals, and additional reasons why if you're a long-term investor you should be euphoric with this buying opportunity.

Previous Coverage

I last covered American Tower this past September after the company posted its Q2 earnings in an article: Quant Says It's A Sell, I Say It's A Buy. During that time, Quant rated the stock a sell due to the company's 1-year price performance compared to the real estate sector. The company's share price was down 30.51% in comparison to 13.02% for the sector.

Two reasons I think for the steeper decline were AMT's higher debt load and higher interest rates. And these are still a concern for investors today. However, since my last thesis, American Tower is up roughly 4.5% so you would have made some capital gains despite REITs being in a bear market. I also covered how the REIT had been focusing on improving its balance sheet by deleveraging, a smart move considering the current macro environment.

Why AMT Is A Buy For Dividend Investors Right Now

Aside from the fact that the company provides cell towers, data centers, and communications infrastructure to some of the biggest telecom companies, mobile traffic is anticipated to increase 300% over the next 5 years. And this will likely be a strong growth driver going forward for AMT.

Additionally, the company delivered some solid growth for the fiscal year in lieu of the challenging economic backdrop. Although during Q4 earnings at the end of February they missed analysts' estimates on AFFO by $0.03, they still managed to grow this year-over-year. AFFO of $2.29 declined from $2.58 in Q3, but this was negatively impacted by approximately 7% in financing costs and another 1% from FX.

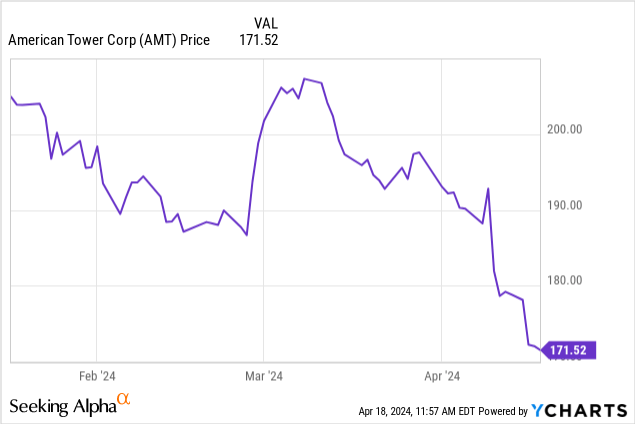

Revenue of $2.79 billion, however, managed to beat analysts' estimates by $50 million, so a beat on the top line for the REIT. But this also declined slightly from Q3's $2.82 billion. This coupled with negative sentiment surrounding interest rate cuts has driven the share price down from $218 where the stock was trading at the beginning of the year.

But despite this, total revenue also grew year-over-year from roughly $10.7 billion to $11.1 billion. Property revenues also grew year-over-year as well, from $10.4 billion to $11.0 billion. So, solid numbers in a tough environment, especially for REITs. And this solid performance was driven by property revenue growth of 4% in the U.S. & Canada and more than 5% internationally. The data center segment also contributed $835 million to total property revenue for the year.

Another reason besides their solid performance and continued growth that makes AMT a buy currently is the stock trades well-below its 5-year average P/AFFO multiple of roughly 25x. And looking at their forward P/AFFO ratio of just 16.6x using the midpoint of guidance, the stock is a bargain for long-term investors.

This is in comparison to SBA Communications (SBAC) who has a forward P/AFFO ratio of 14.88x. And despite the latter trading at a higher share price, AMT still trades at a higher ratio, proving its quality and longer track record. Let's be conservative here and say AMT trades at a 20x P/AFFO after interest rates are cut. That still gives investors 17% upside from the current price of roughly $171 at the time of writing.

But with uncertainty around when interest rates will be cut, this may be the perfect time to dollar-cost average. Until there's more clarity on interest rate cuts, American Tower along with its REIT peers will continue to trade near their current prices. And when the first interest rate cut happens, whether that's sometime in 2024 or later, that's when investors will likely see some upside in my opinion.

Forward Outlook

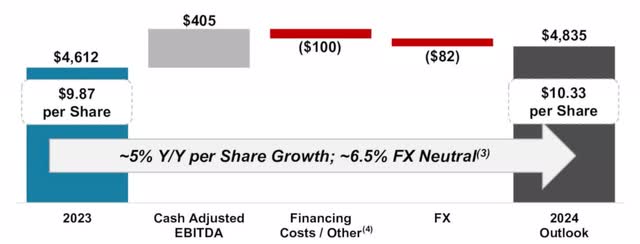

Aside from projecting to build an additional 3,000 tower sites this year, mostly internationally, American Tower also issued 2024 AFFO guidance in a range of $10.21 to $10.45. But as management gets more clarity on the economy, this will likely move to the right, similar to the guidance raise in Q2 '23. Furthermore, management is assuming a full-year contribution of their India business, which is expected to contribute $1.16 billion in property revenue, $360 million of adjusted EBITDA, and $285 million of unlevered AFFO. The sale is expected to close sometime later in the year. Total property revenue at mid-point is also expected to post slight growth of 1%, growing to $11.1 billion.

Deleveraging

What I enjoyed most is American Tower managed to continue to strengthen its balance sheet, achieving a net-debt-to EBITDA ratio of 5.2x, down from 5.3x since my last buy rating. Additionally, this declined from 5.4x year-over-year, and they increased their liquidity to $9.6 billion, up $2.5 billion over the past year.

This also gives AMT financial flexibility to make accretive investments if financial tightening eases in the near future. They also decreased their exposure to floating rate debt and had only 11% exposure, down from roughly 15% in the second half of the year. And this stood at 22% at the beginning of 2023, so American Tower has been aggressively deleveraging towards their 3x - 5x target.

Dividend Safety

With the current macro environment, some investors may be worried about the dividend safety of REITs as some are highly leveraged. But American Tower's dividend is completely safe and covered by AFFO. In 2023, the company brought in $9.87, surpassing the $9.61 - $9.79 range set in the second half of the fiscal year.

For fiscal year '23, they brought in roughly $4.6 billion in AFFO and even if this remains flat in 2024, this still gives them ample cushion and a conservative payout ratio as they expect to pay $3 billion in dividends this year, or $6.48. This gives them a payout ratio of roughly 65% and the option for further dividend increases in the foreseeable future.

Risks To Thesis

I think the biggest risk for American Tower and its cell tower peers is interest rates. With stubborn inflation and the rate cut likely to be kicked further down the road, this will continue to place downward pressure on REIT share prices. And although American Tower has worked to deleverage its balance sheet, investors will still continue to be skeptical of investing in the sector. AMT also has a lower yield at less than 4%, and investors can get higher ones from safer fixed-rate investments like bonds. Moreover, with the 10-yr treasury rate moving to its highest levels since November, this will likely continue to negatively impact AMT and lower-yielding investments alike.

Conclusion

Although rate cuts are looking less likely, this is the perfect time to accumulate shares in high quality REITs like American Tower. Despite the challenging economic backdrop, the company has been focusing on improving its balance sheet by deleveraging and increasing its liquidity. Furthermore, the stock delivered some solid growth year-over-year and will likely deliver solid growth for 2024, especially if rates decline in the near future.

With mobile traffic projected to grow 300% over the next 5 years and American Tower likely to capture some of this growth, I think investors should be buying at current levels. And when rates are finally cut, I suspect American Tower's share price will power past $200 a share, offering investors double-digit upside. This coupled with their healthy balance sheet and strong fundamentals make them a buy at current levels.