PonyWang

The DoubleLine Income Solutions Fund (NYSE:DSL) is a closed-end fund that income-focused investors can purchase in an effort to earn a respectable level of cash flow from their assets. This is something that retirees might appreciate, as the persistently high level of inflation that has been dominating the American economy over the past few years has required all of us to take steps to increase our incomes simply to maintain the lifestyles to which we have become accustomed. The DoubleLine Income Solutions Fund does reasonably well at providing additional income, as its 10.90% yield is much more attractive than many other things that currently trade in the market. However, the fund's yield is admittedly not particularly impressive compared to its peers. We can see that here:

Fund | Morningstar Classification | Current Yield |

DoubleLine Income Solutions Fund | Fixed Income-Taxable-Global Income | 10.90% |

BrandywineGLOBAL - Global Income Opportunities Fund (BWG) | Fixed Income-Taxable-Global Income | 12.02% |

First Trust/abrdn Global Opportunity Income Fund (FAM) | Fixed Income-Taxable-Global Income | 11.22% |

Nuveen Global High Income Fund (JGH) | Fixed Income-Taxable-Global Income | 10.12% |

PIMCO Dynamic Income Opportunities Fund (PDO) | Fixed Income-Taxable-Global Income | 12.09% |

abrdn Global Income Fund (FCO) | Fixed Income-Taxable-Global Income | 15.25% |

As we can see here, the DoubleLine Income Solutions Fund has a lower yield than any of its peers, except for the Nuveen Global High Income Fund. This is something that might turn off those investors who are most interested in maximizing their income. However, there are times in which an outsized yield can be a warning sign from the market that the fund's distribution might not be sustainable. This was particularly true over the decade prior to the COVID-19 pandemic, as pretty much anything that obtained a double-digit yield was eventually forced to slash its payout. Today, it is not the case that a double-digit yield indicates the potential for future trouble, but we should still be cautious when a fund's yield is substantially out of line with its peers. As we can see, that is not the case here, so the fact that this fund's yield is a bit lower than its peers can give us a degree of confidence going forward.

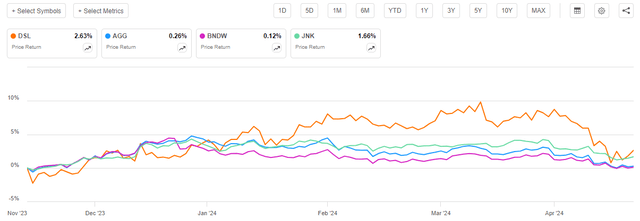

As regular readers may remember, we previously discussed the DoubleLine Income Solutions Fund in mid-November 2023. The market has been somewhat volatile since that time. From the time of that article's publication until early 2024, various market participants were highly confident that a string of interest rate cuts would be coming from the Federal Reserve in 2024 so they bid up the price of most assets. However, in recent months, inflation data has been showing signs of a resurgence and the market lost much of its previous confidence that near-term interest rate cuts were on the horizon. As such, fixed-rate bonds and long-duration stocks have been declining. However, other assets have been holding up reasonably well. As such, we might expect that the DoubleLine Income Solutions Fund has been somewhat volatile since the date that the previous article was published. This is the case, as shares of the fund have only gained 2.63% since that article was published:

As expected, we see that the fund's shares appreciated strongly during the final two months of 2023 and early 2024 before beginning to falter as a "higher for longer" scenario for interest rates began to look very likely. It did manage to beat three indices over the period, however: The Bloomberg U.S. Aggregate Bond Index (AGG), Vanguard Total World Bond ETF (BNDW), and the Bloomberg High Yield Very Liquid Index (JNK). The fact that this fund performed reasonably well versus the indices could appeal to many investors.

As I have pointed out in numerous past articles on closed-end funds, including my previous one on this fund:

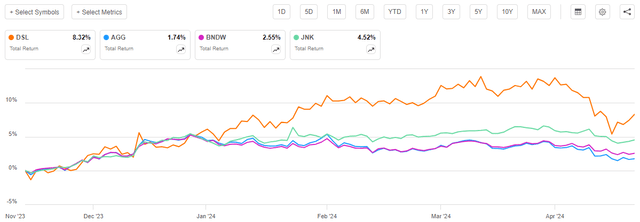

It is best to evaluate closed-end funds in terms of total return, not simply price return. This is because these entities pay out nearly all of their investment profits in the form of distributions. This tends to give them very high yields, and in some cases, these yields can be sufficient to offset declines in the share price. Exchange-traded funds that track indices do not do this because they do not tend to realize capital gains.

Over the roughly five-month period that has passed since we previously discussed this fund, the DoubleLine Income Solutions Fund has handed its investors an 8.32% total return:

As expected, the fund outperformed its bond index fund benchmarks by a substantial amount. This is actually pretty typical for bond closed-end funds, as their yields are generally high enough to provide an acceptable level of income on their own. That has not been the case for bond indices over the incredibly low-interest period that persisted over the previous decade. The fact that this fund outperformed its indices is something that could very easily appeal to any investor, including those whose primary goals revolve around the generation of income.

However, past performance is no guarantee of future results. As such, we should not blindly rush into a fund just because it beat the indices over any past period. We should instead look at the fund as it stands now and proceed from there. This article will endeavor to do exactly that. Let us proceed and see if purchasing the DoubleLine Income Solutions Fund makes any sense today.

About The Fund

According to the fund's website, the DoubleLine Income Solutions Fund has the primary objective of providing its investors with a very high level of current income. The fund's website also states that it has a secondary objective of providing investors with capital appreciation. The strategy that the fund employs to achieve these objectives seems to support them:

The Fund will seek to achieve its investment objectives by investing in a portfolio of investments selected for their potential to provide high current income, growth of capital, or both. The Fund may invest in debt securities and other income-producing assets anywhere in the world, including emerging markets.

In various past articles, I have noted that debt securities deliver no net capital gains over their lifetimes. An investor purchases a bond or other debt security at face value, receives a steady stream of income over the life of that security, and then receives face value back when the security matures. Thus, there are no net capital gains provided by these securities over their lifetime. That would seem to suggest that the fund's secondary objective is impossible to achieve, except for two reasons:

The fund could buy a security, let it go up in price, then sell it and buy another elsewhere in the world that is poised to rise in price. The fund would not actually hold securities to maturity but would rather be moving its money around between various securities and monetary regimes to make trading profits. The term "income-producing security" does not specifically exclude dividend-paying common stocks. Common stocks can deliver capital appreciation indefinitely as they do not mature and have no theoretical maximum price.

The second possibility here seems to go against the basic theme of this fund, however. DoubleLine is known as a fixed-income house, not a common stock manager. Nevertheless, the fund's fact sheet states that the DoubleLine Income Solutions Fund has a small allocation to common equities:

Fund Fact Sheet

As we can see here, the fund's fact sheet shows a 0.50% allocation to common equity securities. This is too small to make a real difference in the return profile of the fund as a whole, however. As such, it appears that most of the capital appreciation objective will come from the fund actively trading bonds prior to maturity to exploit changes in monetary environments and interest rate movements all over the world. The fund only had a 20.00% annual turnover in the most recent fiscal year, though, so it cannot possibly be doing too much of this. Therefore, it appears that the overwhelming majority of this fund's investment profits come from the coupon payments that it receives from the securities held in its portfolio. This is not necessarily a bad thing, as interest rates in many countries are at the highest levels that have been seen in a generation. As this fund uses leverage to boost the effective yield, it can probably earn a reasonable yield just by buying and holding bonds. This is especially true because most of the bonds that the fund holds are below-investment-grade bonds:

Fund Fact Sheet

The Bloomberg High Yield Very Liquid Index, which tracks domestic below-investment-grade bonds, has a yield-to-maturity of 8.33% and an average coupon yield of 6.30% today. However, we already saw that 39.45% of the fund's holdings are emerging market bonds. These are going to have a different yield profile than domestic junk bonds for obvious reasons. The JPMorgan EMBI Global Core Bond Index (EMB), which claims to track a basket of emerging market bonds, has an average yield-to-maturity of 7.18% right now. Unfortunately, the fund does not state on either its website or fact sheet which specific countries the bonds that it holds come from, so we have no way of knowing how well its holdings correlate to the indices. This information is included in the annual report, which provides this chart:

Fund Annual Report

That chart is as of September 30, 2023, so it is several months old at this point. It also is somewhat difficult to rectify with the above chart that nearly 40% of the fund's assets are invested in emerging market securities. Thus, we can probably assume that it is not completely accurate anymore. Nonetheless, it is the most recent country-weighting breakdown that we have right now.

Despite the lack of transparency with the fund's holdings, it seems likely that most of the bonds that the fund is holding have a yield-to-maturity of over 7%. That is certainly a reasonable level for any income-focused investor or fund, especially when leverage is used to boost it.

As we saw above, the largest single sector holding in the DoubleLine Income Solutions Fund is emerging market bonds. This is actually pretty good to see today, due to the fact that emerging market bonds serve as a hedge against inflation. One reason for this is that inflation can also be thought of as a decline in the value of the U.S. dollar. If the dollar declines relative to the currency of the emerging market nation, then the foreign currency converts into more U.S. dollars when the fund converts it back for distribution to its investors. If we are talking about dollar-denominated emerging market bonds, then a decline in the value of the dollar actually makes it easier for the emerging market to carry the debt since it requires fewer units of its own currency to purchase the U.S. dollars needed to pay the interest on the bond. As I pointed out in a previous article, many emerging markets have lower deficits and debt-to-GDP ratios than the United States or other developed markets. This, when combined with the historically high interest rates offered by emerging market bonds, could make them attractive right now. This is especially true considering that the high deficits and cost of servicing the national debt in the United States could force the Federal Reserve to cut interest rates despite the recent resurgence in inflation.

I will admit though that I generally prefer that a fund not hedge currency risk if I am looking for protection against a declining dollar and inflation. This is mostly because the currency gain against the U.S. dollar provides an additional return. A look at the fund's most recent annual report seems to suggest that the fund is not hedging its currency risk. The fund reported a loss in foreign currency during the full-year period covered by the report. In addition, the schedule of investments does not list any currency derivatives that would ordinarily be used to hedge currency risk. The report's discussion of investor risks includes an explicit statement that the fund does receive foreign currencies from some of its bonds. This could be good long-term as a hedge against a declining U.S. dollar. However, recently, the U.S. dollar has been strengthening against most developed and emerging market currencies, so the apparent lack of currency hedges could prove to be a near-term risk, or at least result in a drag on the fund's portfolio.

As we have already seen, the majority of the DoubleLine Income Solutions Fund's assets consist of below-investment-grade bonds. This is something that might concern risk-averse investors. After all, we have all heard about how these bonds carry an especially high risk of losing money due to default. In October of last year, Moody's issued an alert that junk bond defaults could spike in 2024 due to the fact that many issuers cannot afford to refinance at today's interest rates. However, Moody's comments were specifically for U.S.-based corporate issuers and not necessarily for emerging market sovereigns or corporations that might also have junk bond ratings. After all, emerging markets have had higher interest rates than the United States for many years now, and entities in these nations are more adept at handling them. Unfortunately, we have no way to evaluate this risk precisely as this fund does not disclose the exact credit ratings of the securities in its portfolio. The fact sheet only provides the chart that was shown earlier, and there is nothing on the website breaking down the credit quality by rating agency scores. The annual report curiously also includes no information that would otherwise allow us to evaluate things more precisely in terms of default risk. This is quite disappointing, and I will admit that it would be nice if the fund were more transparent about its holdings. After all, one of the biggest concerns that many income-focused investors have is the protection of the principal. It is not as easy for a retiree to obtain a new principal as it would be for a 20-something who is just starting out, after all.

Leverage

As is the case with most closed-end funds, the DoubleLine Income Solutions Fund employs leverage as a method of boosting the effective yield that it earns from the securities in its portfolio. I explained how this works in my previous article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase bonds or other income-producing assets. As long as the purchased assets have a higher yield than the interest rate that the fund needs to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, that will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I do not generally like to see a fund's leverage exceed a third as a percentage of assets for this reason.

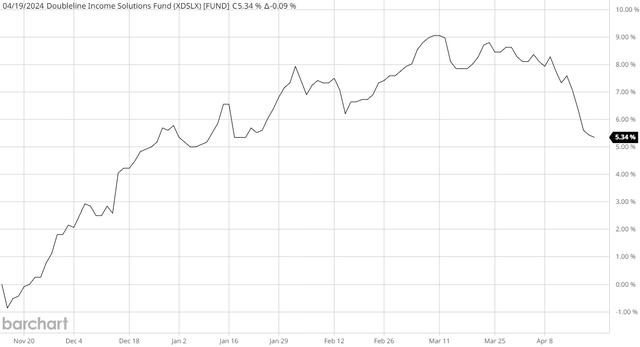

As of the time of writing, the DoubleLine Income Solutions Fund has leveraged assets comprising 23.21% of its portfolio. This represents a slight decline over the 24.54% leverage that the fund had the last time that we discussed it. The decline in leverage makes a lot of sense considering that the fund's net asset value is up 5.34% since the date of our previous discussion:

An increase in net asset value means that the fund's portfolio increased in size. As such, if the fund kept its borrowings stable, the outstanding debt would now represent a smaller percentage of a larger portfolio. This is almost certainly what we see here.

Here is how the fund's leverage compares to that of its peers:

Fund | Leverage Ratio |

DoubleLine Income Solutions Fund | 23.21% |

BrandywineGLOBAL - Global Income Opportunities Fund | 41.03% |

First Trust/abrdn Global Opportunity Income Fund | 19.28% |

Nuveen Global High Income Fund | 27.53% |

PIMCO Dynamic Income Opportunities Fund | 41.03% |

abrdn Global Income Fund | 28.22% |

(all figures from CEF Data)

As we can clearly see, the DoubleLine Income Solutions Fund currently has a very reasonable leverage ratio relative to its peers. This is a good sign due to the simple fact that higher leverage correlates to higher risk. Thus, risk-averse investors might prefer this fund over its more leveraged peers. That could be important if you expect that the Federal Reserve will not reduce interest rates in the near future, which could result in further dollar strengthening over the next few months.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the DoubleLine Income Solutions Fund is to provide its investors with a very high level of current income. In pursuance of this objective, the fund purchases bonds and debt securities issued by entities that are located all over the world. These securities primarily deliver their investment returns via coupon payments to their owners, which in this case is the fund. These coupon payments constitute a source of income for the fund, and it supplements them by trading securities in order to exploit changing monetary regimes over time and from nation to nation. This fund then takes things a step further as it borrows money to use to purchase more bonds that it could control solely with its own equity capital. That allows the fund to boost its income by the difference between the coupon payments that it receives from its assets and the interest that it pays on the borrowed money. All of the money that the fund receives from these various sources is pooled together and then paid out to its shareholders, net of its own expenses. When we consider the current yields that can be obtained on most speculative-grade bonds today, we can assume that this business model would result in the fund's shares having a very high yield today.

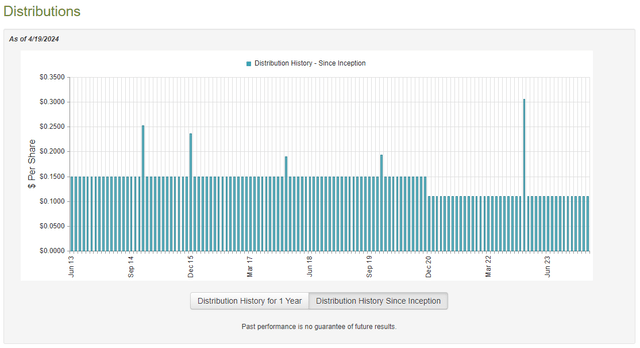

This is indeed the case, as the DoubleLine Income Solutions Fund pays a monthly distribution of $0.11 per share ($1.32 per share annually), which gives it a 10.90% yield at the current price. As we saw in the introduction, this yield is somewhat lower than many of its peers, but this can be partly explained by this fund's lower leverage relative to other funds. The fund has been reasonably consistent with respect to its distribution over its history, but it has not been perfect as the fund did cut its distribution back in 2020:

As we can see here, in late 2020 the DoubleLine Income Solution Fund cut its distribution by 26.67%, which reduced it from $0.15 per share monthly to the current level of $0.11 per share monthly. This is something that might prove disappointing and unattractive for those investors who are seeking to receive a safe and consistent level of income from the assets in their portfolios. However, this fund still exhibits much more stability than most debt-focused closed-end funds that change their distribution every year or two due to interest rate fluctuations. The biggest disappointment here is that we would ideally want our incomes to increase over time in order to keep up with the rising cost of living in an inflationary environment. There are very few closed-end funds that actually manage to deliver consistent distribution growth over time and at any rate, it is easy enough to achieve a rising income by reinvesting a portion of the distribution that is received.

There are very few bonds that have been able to successfully achieve the distribution consistency that we observe with this fund. After all, bond returns vary to a large extent on interest rates in the economy, and interest rates tend to fluctuate over time. This is the reason why most funds change their distribution on a fairly regular basis. As such, we should have a closer look at the fund's finances in order to determine how it is able to achieve a task that few other funds have managed. After all, we do not want the fund to be distributing more than it can afford and unnecessarily destroying its net asset value. This was the case the last time that we discussed it, and such things are not sustainable over any sort of extended period.

Unfortunately, we do not have a recent document that we can consult for the purposes of our analysis. As of the time of writing, the most recent financial report that is available for the DoubleLine Income Solutions Fund is the annual report that corresponds to the full-year period that ended on September 30, 2023. A link to this document was provided earlier in this article. This report will unfortunately not include information about anything that occurred over the past seven months. This is disappointing due to the fact that a great many things occurred over the intervening period. For example, the final two months of 2023 and parts of January 2024 were characterized by rapid asset appreciation in both the domestic and international bond markets. This was caused by various major participants in the market believing that the Federal Reserve would rapidly reduce interest rates in 2024 and spark other central banks around the world to take similar actions. That undoubtedly provided this fund with the opportunity to earn some capital gains. The reverse has occurred over the past few months, as investors are starting to realize that rapid interest rate cuts in the United States are unlikely. We might still see some foreign central banks cut interest rates this year, however. Unfortunately, the most recent financial report will not provide us with insight into how well the fund navigated these two disparate markets. However, it is a more recent report than the one that we had available to us the last time that we discussed the fund, so it will still be useful for an update. The report will also give us a good idea of how well the fund navigated the challenging conditions that existed over the summer of 2023, which will be nice to see.

For the full-year period that ended on September 30, 2023, the DoubleLine Income Solutions Fund received $149,307,876 in interest and $1,094,798 in dividends from the assets in its portfolio. The fund had no income from other sources, so this gives it a total investment income of $150,402,674 for the period. The fund paid its expenses out of this amount, which left it with $110,933,525 available for shareholders. This was, unfortunately, not enough to cover the $154,900,124 that the fund paid out in distributions during the period. At first glance, this may be concerning as we would ordinarily prefer that a fixed-income fund fully cover its distributions out of net investment income. This fund obviously failed to achieve that goal over the full-year period.

There are other methods that a closed-end fund can use to obtain the money that it requires to cover its distribution. For example, it might be able to take advantage of the fact that bond prices move with interest rates to earn some trading profits. These trading profits are considered to be realized capital gains and are not investment income for tax or accounting purposes. Obviously, though, realized capital gains do represent money coming into a fund that can be paid out to its shareholders.

The fund, unfortunately, generally failed to earn money via these alternative sources over the period. For the full-year period that ended on September 30, 2023, the fund reported net realized losses of $185,094,728, but these were mostly offset by $178,776,041 net unrealized gains. While the unrealized gains were nearly enough to offset the net realized losses, the fund's net assets still declined by $43,448,574 after accounting for all inflows and outflows during the period.

The DoubleLine Income Solutions Fund therefore failed to cover its distributions over the full-year period that is covered by this report. This is the second year in a row that this was the case, as the fund's net assets declined by $637,188,554 for the full-year period that ended on September 30, 2022. This is worrying as no fund can sustain net asset value destruction of this degree for very long.

The fund does appear to have corrected this problem somewhat in the current fiscal year. This chart shows its net asset value per share since the market close on September 29, 2023:

This chart shows that the fund has managed to increase its net asset value per share by 5.34% since the closing date of the fiscal year discussed in its most recent financial report. This tells us that the fund has managed to cover all of the distributions that it paid out since that date with money left over. This is a good sign, but given the two straight years of net asset value destruction, we still want to keep an eye on it.

For now, it does not appear that we need to worry about a distribution cut in the near future.

Valuation

As of April 19, 2024 (the most recent date for which data is currently available), the DoubleLine Income Solutions Fund has a net asset value of $12.22 per share, but the shares currently trade at $12.19 each. This gives the fund's shares a slight 0.2% discount on net asset value at the current price. That is a more attractive entry price than the 0.79% premium that the shares have averaged over the past month, but it is not much of a discount.

Unfortunately, this fund looks a bit expensive relative to its actual underlying portfolio. It is okay if trading at a discount, but that does not appear to be a common occurrence. As such, caution may be a good idea if considering buying the fund's shares today.

Conclusion

In conclusion, the positioning of the DoubleLine Income Solutions Fund is reasonable. The fund has a surprisingly large exposure to emerging markets, which is probably a good idea given the likelihood that the U.S. dollar will decline over the coming years as large deficits weaken the international appeal of U.S. government debt and force the monetization of the deficit. However, right now the U.S. dollar remains strong relative to other world currencies, and this could be a headwind to the fund's ability to profit from the emerging market bonds in its portfolio. Overall, my opinion of this fund has improved, but its low transparency is a bit of a turn-off.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!