Kira-Yan

Article Thesis

Meta Platforms, Inc. (NASDAQ:META) reported its first-quarter earnings results on Wednesday afternoon. The company beat estimates on both lines and showed strong results. The sell-off in after-hours trading could make for a nice buying opportunity, I believe.

Past Coverage

I have covered Meta Platforms several times here on Seeking Alpha, most recently three months ago, when the company reported its fourth-quarter earnings results. In this article, I gave the company a bullish rating, which has worked out well so far, as META has risen by 7% in the following three months.

What Happened?

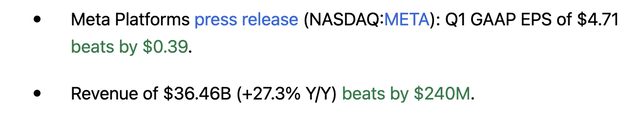

Meta Platforms, Inc. has announced its most recent earnings results, for its fiscal first quarter, on Wednesday afternoon, following the market's close. We can see the headline results in the following screencap:

META results (Seeking Alpha)

The company beat the consensus estimate on both lines, which naturally is a strong result. The revenue beat was pretty small, however, at less than 1% -- some might argue that this pales relative to the 27% revenue gain over the previous year's period.

The profit beat was significantly larger, at 9%, showing analysts continue to underestimate Meta's profitability improvement and the strength of its cost-cutting program. Looking back at the last five quarters, we see that META has beaten estimates on both lines during each of these quarters. Wall Street analysts thus seem to have a tendency of underestimating the social media giant's results.

Somewhat surprisingly, Meta Platforms' results did not cause any buying spree. Instead, shares are trading down sharply at the time of writing, with after-hours prices showing a 13% share price decline. This is a huge contrast to Tesla's (TSLA) results from yesterday, where a double miss resulted in significant buying activity -- sometimes the market is unpredictable.

META: Still Performing Well

I do not see any good reason why Meta would see its shares drop by 13% following this earnings report, but let's go into the details.

Starting with user activity across Meta Platforms' different social media offerings -- Facebook, Instagram, and WhatsApp -- we see that the company managed to grow at a nice pace despite being gigantic already. Normally, companies grow slower and slower the larger they get, but META still managed to see its daily active user count grow by a very nice 7% compared to the previous year's period, with the total now standing at more than 3 billion. It is astonishing that a company that has billions of users manages to keep that number growing again and again. To me, this indicates that Meta's offerings remain very relevant for consumers across different age groups and across different geographic markets -- otherwise, Meta's social media platforms would not attract more and more users. The risk of being disrupted by TikTok and other competitors is not very significant, I would say, considering that users still flock to META's social media platforms in large numbers.

A growing user count helps in growing revenues, of course, but Meta can also grow its revenues in additional ways. Showing more ads to its users is another way for META to drive sales, and last but not least, the pricing of these ads is a relevant factor. In its earnings report, Meta Platforms showed that average pricing per ad improved by 6% year over year. I believe that this indicates that demand for ads is strong and that the company has significant pricing power -- advertisers want to have their ads on META's platforms and are willing to pay more and more for that.

Between the last two factors, Meta Platforms was able to turn a nice 7% user count growth rate into a very strong 27% revenue increase -- this is the best growth rate since Q3'21, during the midst of the pandemic. Not only is META's revenue growth rate strong, but it is, in fact, accelerating, which could be seen as a positive indication for the company's results during the remainder of the year.

Revenue growth is great, but investors ultimately want to see profit growth. After all, rising earnings are a key factor for a rising share price in the long run. And while Meta Platforms is paying dividends now, the majority of the total returns the company will generate will come from share price appreciation, thus a growing net profit number is what investors want to see.

A company like Meta Platforms has high fixed expenses, as building and maintaining its platforms costs a lot of money. The company needs large data centers and many of its employees, such as its engineers, are costly. But on the other hand, a company like Meta Platforms has low proportional costs. When an additional user joins Meta's social media networks, the additional expenses are close to zero. This is why companies such as META benefit a great deal from operating leverage: When revenues are growing at a high pace, expenses oftentimes grow less than revenues (since many expenses are fixed), which allows for an expanding operating margin.

This is exactly what happened during the first quarter, as META's social media business expenses were up by just 6% compared to the previous year's period. The combination of very strong revenue growth of 27% and a meager 6% cost increase resulted in explosive operating income growth of 57% for the social media businesses, one of the best growth rates for the company in recent memory. Operating profit for META's social media business came in at $17.7 billion, or more than $70 billion annualized. The other businesses, such as the Metaverse unit, generated losses during the period (like in previous quarters), which is why company-wide operating profit was lower at "only" $13.8 billion -- which is still $55 billion annualized, and which was up by a hefty 91% year over year. The company also saw some tailwinds from a lower tax rate, which is why net profit was up by an even heftier 117%, but since the tax rate will likely not decline forever, that's just icing on the cake for now.

Some Negatives

I believe that these results were very strong -- user count growth, pricing power, operating leverage, cost controls, almost everything looked good.

The company's revenue guidance was a little disappointing, however, which likely explains the weak market reaction to META's results. The company guides for $36.5 billion to $39 billion of revenue for the current quarter, or $37.75 billion at the midpoint. That would be up versus the result from Q1 and would represent growth of 18% versus last year's second quarter. While this growth rate would be lower than the growth rate in Q1, I believe that there is a chance that management was conservative, although we won't know until three months from now. Even if management wasn't conservative, a high-teens growth rate for a huge company like META would still be a very appealing result.

The company also increased its capital expenditures guidance for the current year from $33.5 billion to $37.5 billion, which will result in somewhat lower free cash generation, all else equal. On the other hand, one can argue that higher capital expenditures in areas such as AI will help drive future business growth, thus this is not necessarily negative.

Nevertheless, the market reaction indicates that investors didn't like these two forward-looking items. I personally believe that the sell-off is way overblown, as free cash generation will still be strong even with increased capital expenditures, and since 18% revenue growth would still be a great result.

Is META A Buy?

META wasn't expensive before the earnings result, and following the 13% share price drop, it has become even less expensive. Based on forecasted earnings per share of $20.05 -- likely too low, as META was way more profitable in Q1 compared to estimates -- the company is trading at just 21.5x forward earnings right now. Contrast this with the valuation of other big tech companies, such as Apple (AAPL), which has significantly weaker business growth and which still trades at more than 25x forward earnings.

Meta Platforms' enterprise value to EBITDA multiple of 12 is also far from excessive, which aligns with my belief that Meta Platforms is attractively priced today.

Depending on sentiment, prices could decline further in the coming days. But with strong results, a fortress balance sheet, major AI exposure, and an undemanding valuation, Meta Platforms looks like an attractive tech investment to me right here.

Thanks for reading and happy investing!

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!