Aksonov/E+ via Getty Images

The AGNC Investment Corp. (AGNC) preferred shares can be a bit wild at times.

Most of the time they are just a steady source of income, though.

We’re going to focus on the four shares that are fixed-to-floating.

That means we’re leaving aside (AGNCL), since it is a “fixed-to-reset” share and uses the 5-year Treasury (US5Y) instead.

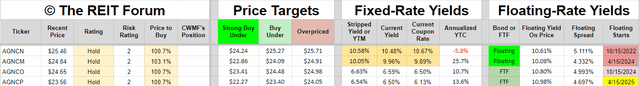

Let’s start by taking a look at those shares:

Looking at the 4 fixed-to-floating shares, we can see that 2 of them are already floating:

- AGNCN

- AGNCM.

We can see that the annualized yield to call is negative for AGNCN, so investors clearly really like the shares.

I didn’t set these targets up right before the screenshot. The market is simply moving well enough with our targets that 3 of the 4 shares are trading at 100.7% of the target price.

The one that stands out is AGNCM.

AGNCM:

- Has the highest yield to call, but we don’t expect a call.

- Has the lowest floating spread. That’s the downside.

- Has the lowest floating yield on price (uses today’s stripped price on the dividend rate we would have if shares reset today).

In my opinion, AGNCM should be discounted a bit more relative to peers due to this difference.

What Does the Market Like?

AGNCM still trades under call value (unlike AGNCN) and the big stripped yield means investors are getting a return of cash right away.

By the time AGNCO floats, AGNCM will have paid about $.40 more in dividends than AGNCO.

Consequently, AGNCO will need to make that up over future years. That could take about 2.75 years.

On the other hand, if neither share is called by that point, AGNCO will be ahead indefinitely because it will be paying a higher dividend every quarter (due to the higher floating spread).

Some readers will still choose AGNCM. That’s okay. You’re not here to simply adopt whatever I say.

It isn’t a bad choice, just because it isn’t my choice.

AGNCM vs. AGNCP

How about we compare AGNCM vs. AGNCP instead?

AGNCP takes one extra year to float. One year means four dividends.

During that time, if interest rates are held steady:

- AGNCM will pay out about $2.4359. Higher rates mean more dividends. Lower rates mean less.

- AGNCP will pay out about $1.6250. That happens regardless of interest rates.

- The difference is about $.81.

Note: We’re assuming AGNC doesn’t collapse, which is extremely unlikely given their portfolio structure.

The price gap between the two shares is worth more than the dividend difference:

- AGNCM: $24.84

- AGNCP: $23.56

- Difference is $1.28.

After 1 year, AGNCP’s dividend is always bigger than AGNCM’s dividend because a floating spread of 4.697% is bigger than a floating spread of 4.332%.

AGNCP will pay out an extra $.09 per share per year because of the bigger floating spread.

Given those figures, we can demonstrate AGNCP owners always have more cash.

Why Neutral Ratings?

I want a bigger discount to enter positions. The returns here aren’t bad, but I think we can do a little better.

I would be inclined to go after AGNCO or AGNCP if I were to enter a position.

- When AGNCO floats, the price should be similar to AGNCN.

- When AGNCP floats, the price should be higher than AGNCM.

But why don’t we go bearish on AGNCM?

Because that’s a fool’s bet. Shares are paying out about 10%.

Do I think AGNCM’s price is going to fall by over 10% in the next year? Probably not. It could happen with a recession. But it isn’t a great bet.

I believe AGNCO or AGNCP will provide superior returns to AGNCM over the next 365 days. For AGNCP, the level of certainty is higher because of the cash flow equation.

If I were to take a bearish view on AGNCM, and it returned even 1% over the next year, that would be a bad view.

I want to take the view with the highest probability of being right. The way to do that is to focus on relative performance.

Of course, in this case, I don’t expect a vast difference. As indicated by the “price-to-buy” targets, I’m really projecting AGNCO and AGNCP to outperform AGNCM by less than 3%.

Let’s say that it comes in at a mere 1% to 1.5%.

Does that matter?

Well, I was never one to throw away money. I would still find that relevant.

If you can buy a Treasury for 1-year and get 5%, would you buy a 1-year Treasury to only get 4%?

If you would, and you have enough money to buy a bunch of Treasuries, we should get in touch!

There are some great Treasuries for you to check out….

Conclusion

Thanks for reading.

Unfortunately, the gap for AGNC preferred shares isn’t as big as it was at some points. We had a long period where the gap in projected future returns was absolutely massive. Today, the gap is smaller, but it’s still worth knowing about and acting on.

Note: This article isn't really about the common shares. However, in case it needs to be added, we have a bearish outlook on the common shares. That view is based on the high price-to-book ratio. We model book value throughout the quarter and use that to guide our price targets on the common shares. I think AGNC's Core EPS is significantly overstating the long-term level of return they can produce. I went over that in more depth in a guide on how to trick core EPS. However, our bearish view on AGNC's common share price does not indicate fundamental problems for the preferred shares.

You should try our service. Unlike most services, our service is backed by a real portfolio. Not a "model" portfolio. Not hypothetical positions. Not 7 different portfolios we made up in Google Sheets so we can brag about the good one. None of that crap.

You get real-time alerts on every trade. See current and past positions. I'm sick of analysts who have to retroactively pick a "portfolio" or get creative about defining "returns". Beat the index or get out.

Ask your analyst to share their portfolio value each month so you can verify their returns. When they object, try us.