Abstract Aerial Art

Many investors like to turn to natural resource plays to hedge against inflation. If you're among them, the First Trust Indxx Global Natural Resources Income ETF (NASDAQ:FTRI) is worth considering, as it provides exposure to companies engaged in the upstream segment of the natural resources sector.

FTRI is an exchange-traded fund, or ETF, that seeks to mirror the performance of the Indxx Global Natural Resources Income Index. This index is a free float-adjusted, market capitalization-weighted composite designed to track the highest dividend-yielding companies involved in the upstream segment of the natural resources sector.

To qualify for inclusion, securities must meet stringent eligibility criteria based on liquidity, size, and dividend history. The index casts a wide net, considering companies domiciled in any country, including emerging markets, subject to certain exclusions determined by the index provider.

A Diverse Basket of Holdings

FTRI currently holds 48 stocks spanning various industries within the natural resources realm. The top 10 positions make up 55% of the fund, with Petrobras nearly 10%. Top positions include:

Petroleo Brasileiro S.A. (Petrobras) (PBR): A Brazilian multinational corporation operating in the oil, natural gas, and energy industry. It is a semi-public company with a market capitalization of over $100 billion.

Woodside Energy Group Limited (WDS): An Australian energy company focused on the exploration, development, production, and marketing of hydrocarbons. With a strong presence in the liquefied natural gas market, it has a market cap exceeding $30 billion.

Archer-Daniels-Midland Company (ADM): A leading American multinational food processing and commodities trading corporation, with a significant presence in the agricultural sector. Its market capitalization stands at around $45 billion.

Agnico Eagle Mines Limited (AEM): A Canadian-based gold producer with operations in Canada, Finland, and Mexico. It has a market capitalization of over $25 billion and is renowned for its low-cost, high-quality gold reserves.

Nutrien Ltd. (NTR): The world's largest provider of crop inputs and services, formed through the merger of Agrium and PotashCorp. With a market cap of around $45 billion, it is a prominent player in the fertilizer industry.

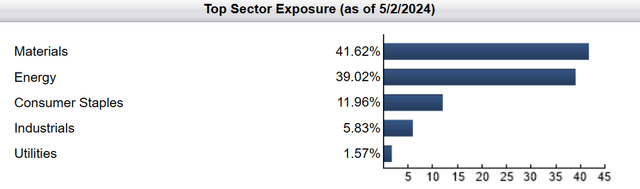

Sector Composition and Weightings

FTRI maintains a well-balanced sector allocation, with materials and energy commanding the lion's share.

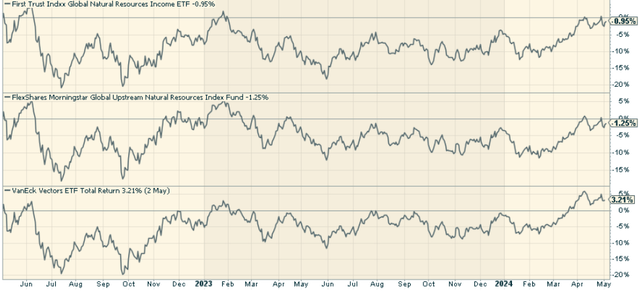

Peer Comparison: Stacking Up Against the Competition

Two funds worth comparing FTRI against are the Morningstar Global Upstream Natural Resources Index Fund (GUNR) and the VanEck Natural Resources ETF (HAP). Over the last two years, FTRI has outperformed GUNR by being down less but underperformed HAP. Much of this likely has to do with the high concentration of the top 10 securities more so than anything else.

The Pros and Cons of Investing in Natural Resources

Investing in the natural resources sector presents a unique set of advantages and challenges that warrant careful consideration:

Pros:

- Inflation Hedge: Historically, natural resources have exhibited a positive correlation with inflation, acting as a hedge against rising prices.

- Emerging Market Growth: As developing economies continue to industrialize and urbanize, the demand for natural resources is likely to increase, benefiting producers.

- Diversification: Adding natural resources to a portfolio can enhance diversification, as the sector's performance is often driven by factors distinct from traditional asset classes.

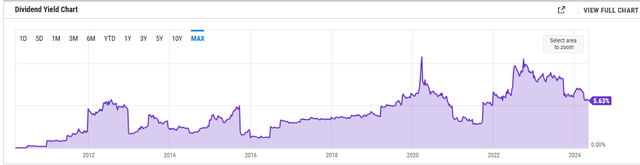

- Yield: At 5.63%, the income component is solid for those who prefer that being a larger portion of the total return.

Cons:

- Volatility: Commodity prices can be notoriously volatile, subjecting natural resources companies to significant swings in profitability.

- Geopolitical Risks: Natural resources are often concentrated in politically unstable regions, exposing investors to heightened geopolitical risks.

- Environmental Concerns: The extraction and production of natural resources can have significant environmental impacts, potentially leading to increased regulatory scrutiny and public backlash.

A Compelling Opportunity for Income-Seeking Investors

The First Trust Indxx Global Natural Resources Income ETF is a good fund for investors seeking exposure to the natural resources sector while generating a steady stream of income. With its focus on high-yielding companies, diversified holdings, and strategic sector allocation, FTRI is worth considering. I don't know how much of an actual inflation hedge it can be, but I like the areas it's exposed to.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.