Blue Potash Evaporation Ponds in Moab, Utah - Aerial halbergman

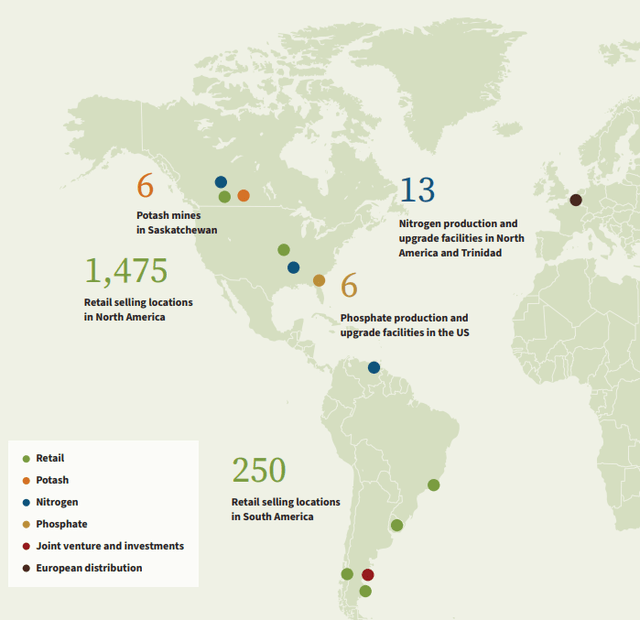

Nutrien Ltd. (NYSE:NTR) dons the hat of a producer as well as a retailer. This Canadian company produces Potash, Nitrogen and Phosphate. In fact, it holds the distinction of being one of the top 3 global producers for each of the three. On the retail side, it sells to over 2,000 locations spanning 7 countries. NTR retail products comprise crop nutrients, crop protection products, seeds and application services. Its geographical footprint is well presented in the following visual from the company's 2023 annual report.

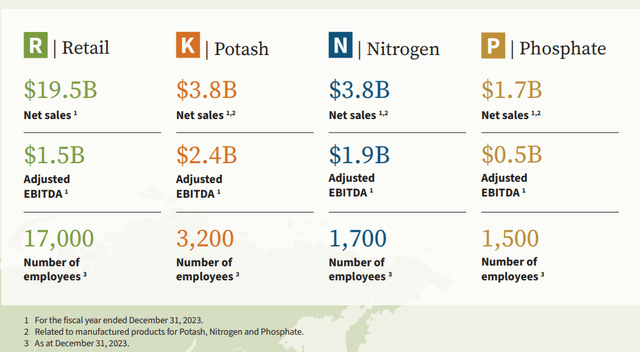

The retail side brings in most of the dough for NTR, followed by the Potash, Nitrogen and Phosphate production, respectively.

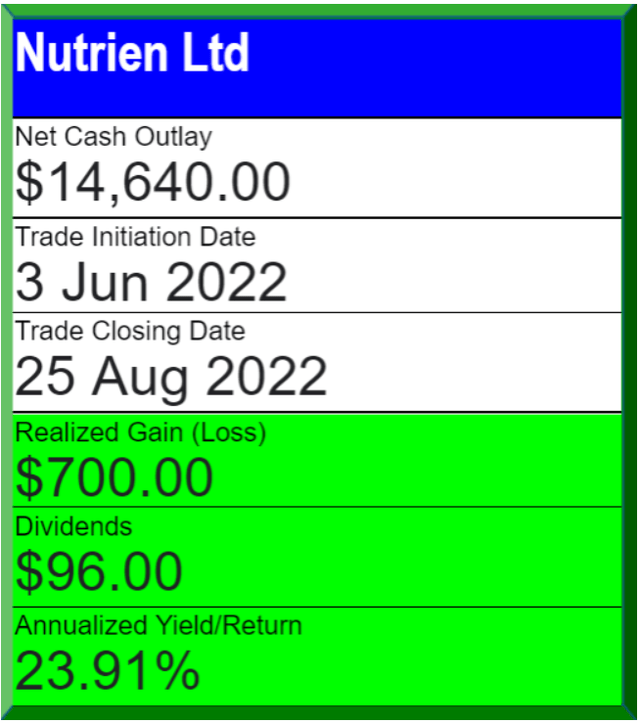

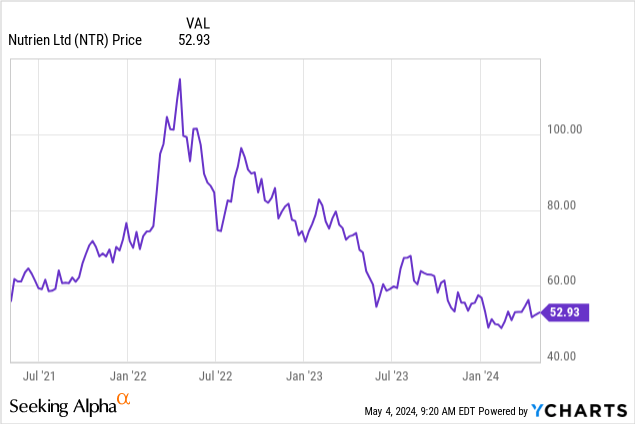

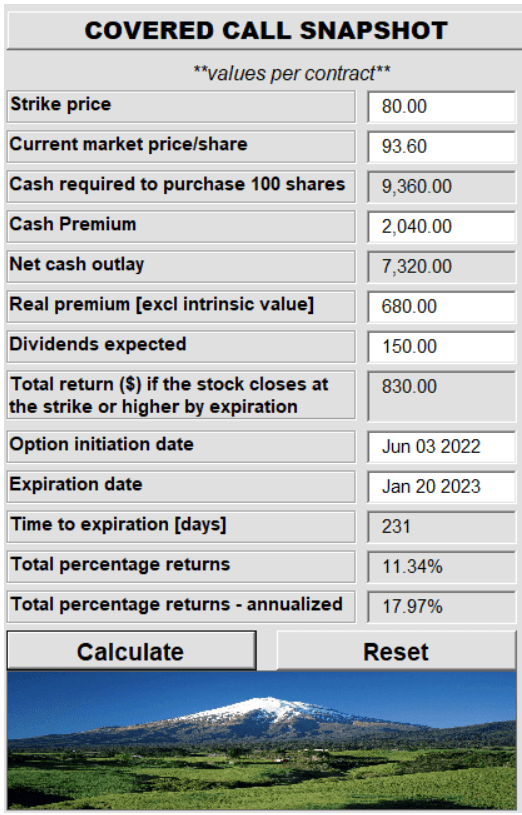

The stock was soaring in 2022, and we pulled the trigger on it via covered calls when it was on its way down in June of that year.

Supply disruptions were wreaking havoc on fertilizer inventories at the time, but analysts as usual were a step behind in estimating the earnings. Our entry via options was a bargain at $73.20, and we were not going to miss the chance to make close to 18% on this well run business.

Conservative Income Portfolio

We did not wait until expiration to close these out. When our valuation outlook changed (we expected the cycle to peak quickly), we exited a couple of months later with an annualized 24% in our pocket.

That was then. As we have seen earlier in this piece, the price is not what it used to be. We are buyers now and we shall elaborate on that next.

Recent Results

NTR has been missing estimates in general, and Q4-2023 was no different. Adjusted EBITDA came in at $1.075 billion and consensus was just a shade past $1.1 billion. This has been a bigger problem for NTR as it has come on the back of falling estimates. There are a couple of reasons for this. The first being that there was some forward purchasing at the 2022 highs. This pull forward of demand is what has damaged the latter part of the cycle. You can see that in the volume sold for the 3 fertilizers. You can also see that in the final EBITDA numbers. 2022 was over $12.1 billion in adjusted EBITDA, and 2023 was just a shade over $6.0 billion. The second part comes from the fact that there was some supply response to the 2022 shortages. This has also crushed margins.

2024 Preview

For 2024, the analyst community has gotten things well aligned with where we are. NTR is guiding for 13.4 million tons in Potash sales and 10.9 million tons of Nitrogen sales. Taking the current pricing and adding in the expected retail side margins ($1.75 billion) we should reach about $5.75 billion in EBITDA and about $4.25 in earnings. One point to note on this is that NTR has a fairly lumpy calendar year. The second quarter tends to capture about half the earnings for the year, as that is the main fertilizer purchase and application quarter.

Valuation

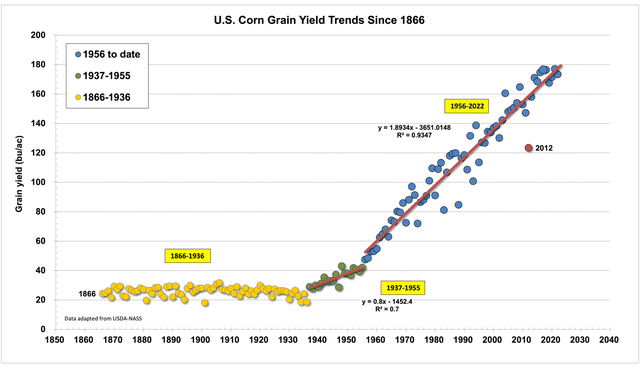

You tend to hear "buy land, they are not building it any more". This can refer to real estate (residential, retail etc.) or to farmland. We think NTR and its fertilizer production are the backbone of making that arable farmland work to the maximum. Our production per acre of farmland has risen substantially over the last 100 years.

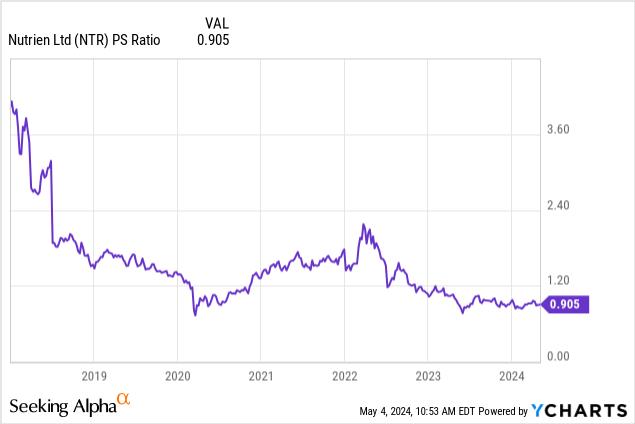

This has widely been attributed to proper use of insecticides and broader application of fertilizers. As arable land per capita gets scarce and demand for food increases with development of the 2.5 billion strong population in India and China, fertilizers will become a key commodity. Of course, we tend to get excited about these when there is a crisis. That is unfortunately not the best time to buy. The time to buy is when things are in the dumps and these producers are being ignored. One of the best metrics on this front is a multiple of sales that the companies are fetching. At 0.9X, NTR looks far more fetching than what it did in late 2022.

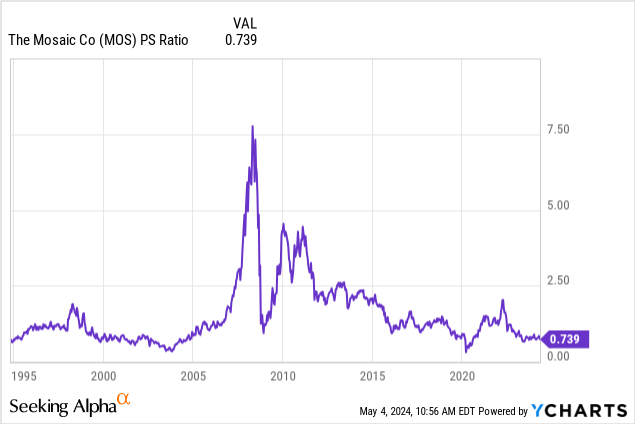

This chart does not go back, as Y-charts seems to have difficulty retrieving what the standalone NTR did before it merged with Potash in 2018. So we don't have a longer term history, but we can be creative on that front. Here is Mosaic (MOS) which does pretty much what NTR does. We have 30 years on that chart.

Maybe that is not rock-bottom, but we are getting to fairly attractive levels for fertilizers.

Verdict

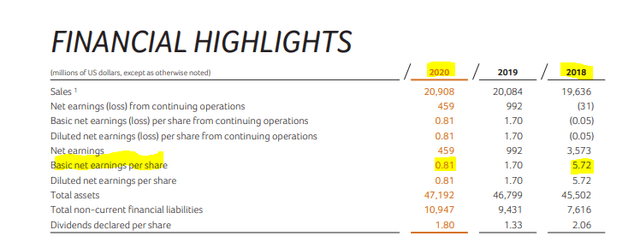

One of the best reasons to invest in NTR today is that they are extremely profitable at what appears to be the bottom of the cycle. Generally, here they are showing very modest EBITDA levels and tiny earnings per share. You can see the 2018-2020 cycle where they troughed at 81 cents a share.

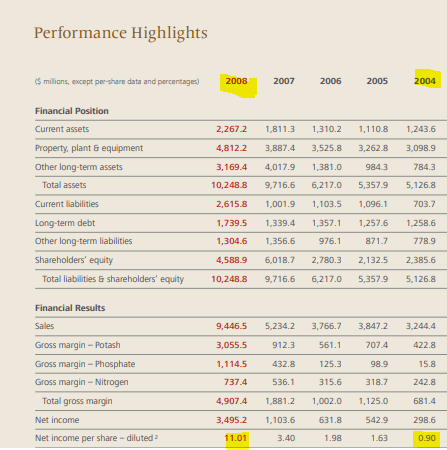

Here, near the trough of that sales multiple, we are down to just $4.25 in expected earnings. In the next cycle, you are likely to get one peak year of at least $20/share in earnings. This may sound outlandish, but that is what happens with cyclical companies. The former Potash Corp saw earnings go from $0.90 to $11.01 in 5 years during the 2004-2008 cycle.

Potash Corp 2008 Annual report

NTR's earnings went from $0.81 to $13.19 from 2020-2022. We see potential here for a strong upcycle in the next few years as fertilizer application levels pick up. In the interim, you have a boring company that is doling out a nice 4% yield. We rate this as a Buy and will be adding shares on weakness if we get it.

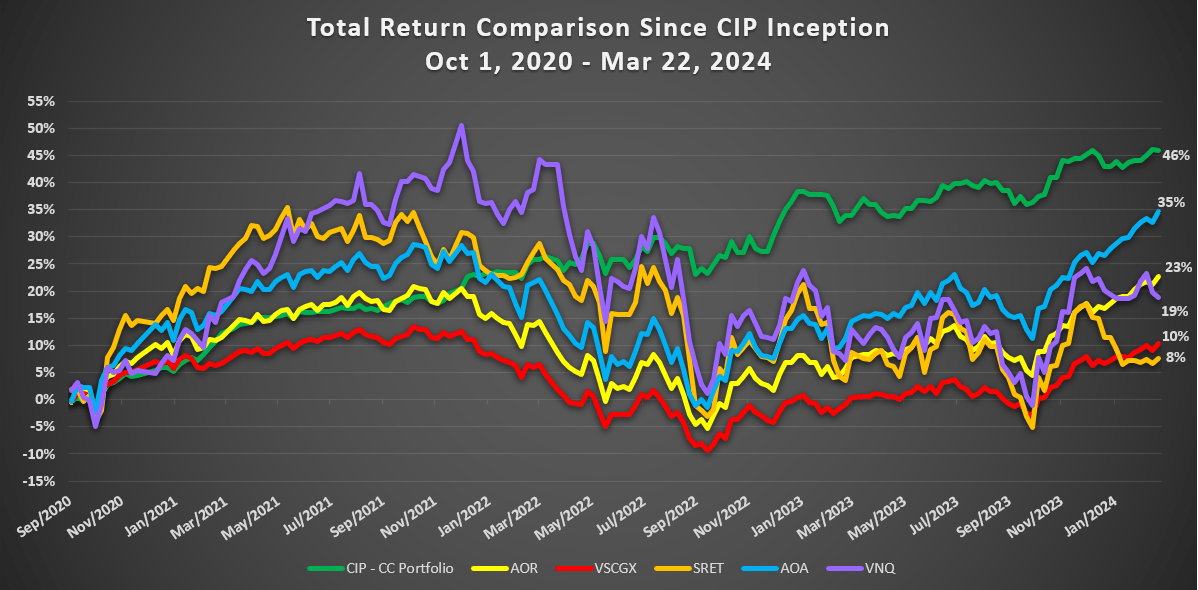

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.