Morsa Images

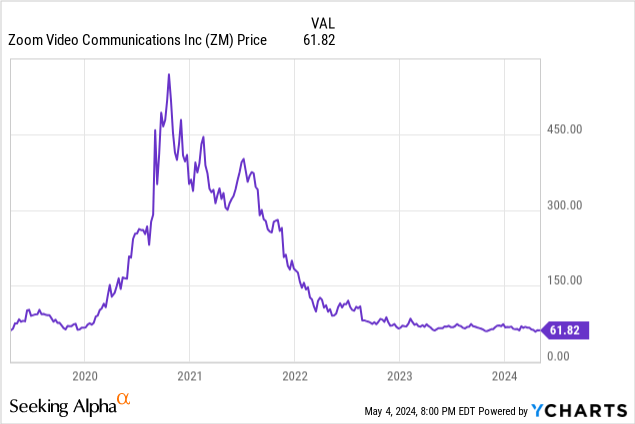

If there's one stock that seemingly can never catch a break, it's Zoom (NASDAQ:ZM). Once the hottest trade of the year during the pandemic, Zoom has faltered over the past couple of years, falling ~10% year to date after seeing ~flat price action over the past two years and falling from a pandemic-era high above $500. Once thought to be a company that could cross into tech mega-market cap territory, Zoom has now languished in penalty-bucket territory: despite the fact that its software is still the infrastructure by which the modern office runs today.

The threat of high-interest rates (or at least, a pullback in expectations on how quickly the Fed is willing to cut rates) should, in my view, be a boon to Zoom - especially since its value orientation separates it from the frothy tech stocks whose valuations are entirely forward-based and compete more significantly against yield-based products. Ahead of Zoom's upcoming Q1 earnings (scheduled later this month on May 20), I'd recommend investors take a position or add to an existing one.

Despite Asia weakness, look at the long term story

I last wrote a bullish note on Zoom earlier this year, when the stock was trading just shy of $70. Now, Zoom has fallen a fresh ~10%, while at the same time having also released strong Q4 results in February and issuing a robust outlook for the current year. In light of these conditions, I'm renewing my buy rating on Zoom, having myself added more to my portfolio on the recent dips.

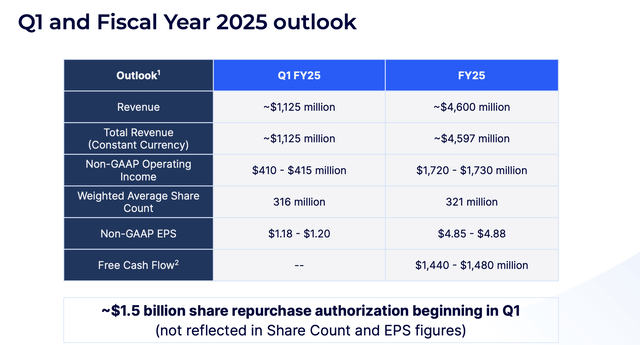

And management seems to judge its share price to be opportunistic as well. Zoom recently announced a new $1.5 billion share buyback program, which at current share prices covers roughly 3% of its outstanding market cap - a great way for the company to grow EPS to bolster an admittedly lagging top-line growth rate.

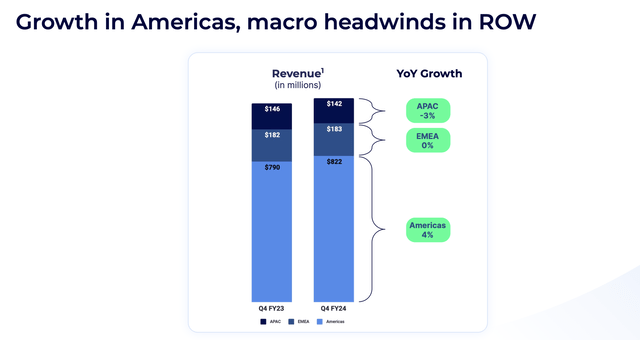

Much of Zoom's current situation is a macro story, and it's also centered in its Asia Pacific region. While the U.S. is growing and Europe is flat, Asia is being weighed down by China, where free-falling real estate prices and high unemployment have curbed spending for both consumers and enterprise.

Zoom growth by geo (Zoom Q4 earnings deck)

And yet, when we zoom out (no pun intended) and look at the long-term picture, there are a number of reasons to still be bullish on Zoom. Among my top reasons to be bullish on Zoom:

- Sticky product and the bedrock of the modern office. In today's world, almost every company has adopted some form of remote or hybrid working policy, which makes products like Zoom ubiquitous and incredibly sticky. Alongside Cisco's (CSCO) Webex, Zoom has few other competitors and is considered best-in-breed.

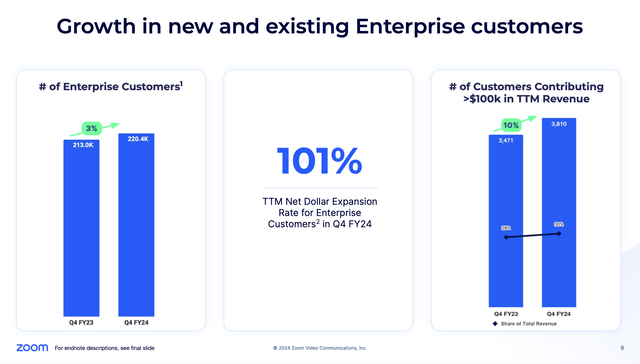

- Still a number of growth drivers, particularly in the enterprise. Contrary to popular belief, Zoom's higher macro-driven churn in the lower and mid-market is offset by enterprise expansion strength. It's worth noting as well that FX remains a ~1 point headwind to Zoom's growth rates.

- Zoom One. The company launched this new bundle in mid-FY23, giving it substantial opportunity to diversify its product sales beyond just virtual meetings and encouraging existing customers to broaden their Zoom usage.

- Price increases. Zoom has boosted pricing in its Online (self-service) segment, hoping to draw more value from smaller individual users and encourage them to step up to more stable annual plans.

- Margin tailwinds. Zoom has taken a razor-sharp blade to operating costs, cutting down on corporate travel and eliminating outside consultants. It has also sliced out 15% of its headcount. With strong gross margins and upside coming from enterprise expansion, Zoom has been able to substantially lift its operating profits.

Stay long here and buy ahead of the May 20 earnings release: in my view, expectations have dimmed to a point where even a whiff of good news can unleash a fresh rally for this stock.

Cheap valuation against a strong outlook for the current year

But above all, a cheap valuation is one of the best reasons to remain invested in Zoom. At current share prices just under $62, the company trades at a market cap of just $19.01 billion. When we adjust for the $6.96 billion of cash and securities on Zoom's most recent Q4 balance sheet, meanwhile, the company's resulting enterprise value is just $12.05 billion.

The below snapshot summarizes the company's guidance for the current year:

Zoom outlook (Zoom Q4 earnings deck)

Against a number of metrics, Zoom looks incredibly cheap trading at:

- 2.6x EV/FY25 revenue

- 8.3x EV/FY25 FCF

- 12.7x P/E, or just 8.0x P/E "ex cash"

Zoom's multiples might be appropriate if it was a legacy industrial company that was declining in revenue or bleeding customers. But this is far from the truth. While Zoom is no longer exactly growing like it did in the pandemic, it is still retaining its customers; in fact, enterprise clients have a 101% dollar-based net retention rate, indicating a 1% net upsell:

Zoom retention rate (Zoom Q4 earnings deck)

Opportunity in the margin and earnings outlook

Even taken at face value, Zoom already looks cheap. And yet there are a number of reasons to believe Zoom can materially outperform its bottom-line forecast for the year, even if revenue growth (pegged at just 1.6% y/y in the latest outlook) comes in only on plan.

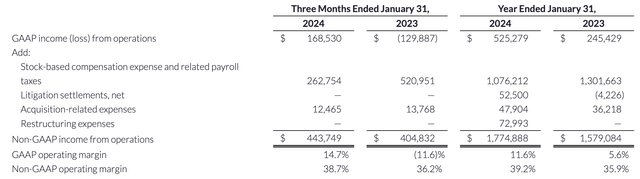

First, note that Zoom's operating income guidance points to just a 37.5% pro forma operating margin.

Zoom operating margins (Zoom Q4 earnings deck)

This is 170bps worse than FY24 actuals, despite the fact that Zoom has recently been increasing margins (in Q4, margins expanded by +250bps y/y). The company continues to rigorously manage expenses, announcing yet another round of layoffs in February, covering 2% of its global headcount.

Note as well that the company's $1.5 billion buyback authorization is not included in management's pro forma EPS forecast. If fully executed this year, the company has 3% of earnings growth from buybacks alone (and note that its FCF of ~$1.4 billion allows Zoom to fund a similar amount of buybacks every single year).

We note as well that with Zoom exiting Q4 at a 3.8% y/y constant currency growth rate, it's difficult to believe that it will land in FY25 at shy of a 2% growth rate. On the recent Q4 earnings call, CFO Kelly Steckelberg noted strong traction across a number of product categories:

In Q4, we saw traction in our emerging products, including a nearly 3x increase in Zoom Contact Center licenses as we not only added a significant number of new customers but also expanded average deal size. Zoom Phone customers with 10,000 or more seats grew 27% year-over-year to 95. And Zoom AI Companion has grown tremendously in just five months with over 510,000 accounts enabled and 7.2 million meeting summaries created as of the close of FY ‘24. We are excited about the strong growth across these new products and the benefits they drive for our customers."

All of these margin drivers, plus potential macroeconomic recovery in China, are potential upside drivers for Zoom.

Key takeaways

There are risks for Zoom, of course. Zoom isn't really an infrastructure software product, so it's relatively easy for companies to switch out of Zoom and into a competitor. A global slowdown in hiring / continued layoffs are also additional pressures for Zoom, which prices its products on a per-seat basis.

Still: at a ~8x ex-cash P/E ratio and an FY25 outlook that I believe to be quite modest, there are a number of ways for Zoom to exceed expectations and restart a rally. Buy with confidence here ahead of earnings.