Adam Gault/OJO Images via Getty Images

Thesis

Hillman Solutions Corp. (NASDAQ:HLMN) reported 1Q 2024 results in line with expectations, with flat revenues and better margins and cash flow. The top line was flat despite the economy's overall strength because the company is leveraged to existing home sales, which are currently depressed by higher mortgage rates and lower inventories.

Despite the lackluster top line, margins are recovering from post-pandemic challenges and inflated costs, resulting in positive free cash flows and a much-improved balance sheet. Net debt is down to 3.2x adjusted EBITDA and is expected to improve further over the year.

Looking ahead, Hillman strategically targets growth through tuck-in acquisitions, similar to its recent successful deal with Koch Industries. In addition, the company is focusing on organic growth by winning new business from existing customers and introducing innovative products, such as next-generation key copying kiosks that can replicate RFID key fobs, including automotive keys. These strategic initiatives underline the company's commitment to long-term growth and ability to adapt to changing market conditions.

I am maintaining my long-term buy rating on HLMN stock.

1Q'2024 Results Overview

Like in my last article, I'd like to briefly recap the financial results and encourage readers to review the company's press release, presentation, and conference call for more details.

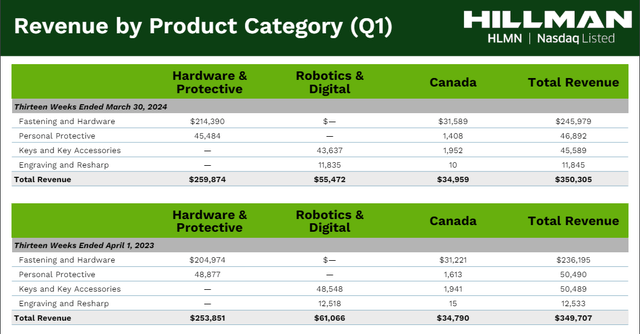

Breaking down the sales by product category, the increase in Fastening and Hardware was mainly due to the Koch acquisition. It was offset by declines in Personal Protective (e.g., gloves and goggles) and Robotics and Digital (keys and engraved pet tags).

Robotics and Digital declined 9.2% year over year and was the biggest disappointment. Revenues in this segment are more economically sensitive and were impacted by lower foot traffic in retailer's stores, lower pet ownership since the pandemic, and lower existing home and used car sales. In addition, Walmart (WMT) moved kiosks from the front end of its stores to departments further back, which impacted the amount of in-store foot traffic passing the kiosks.

HLMN 1Q'24 Income Summary (HLMN 1Q'2024 Form 10-Q)

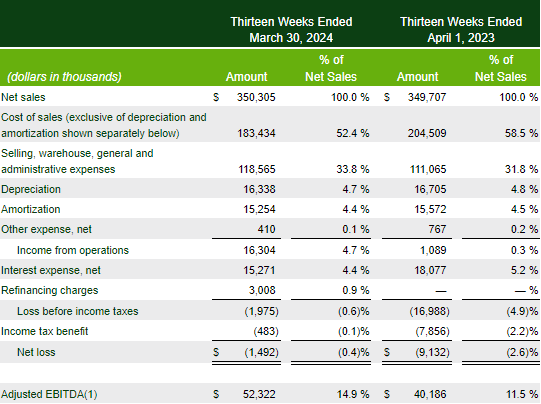

Although net sales were flat year-over-year in the quarter, gross margin increased to 47.6%, and Adjusted EBITDA increased to $52.3M, or 14.9% of sales.

Net debt increased by $25 million to $747.5 million as the company closed its $24 million acquisition of Koch Industries in the quarter. Net cash provided by operating activities was $11.7 million compared to $31.5 million in the prior year quarter, which benefitted from a $38.9 million reduction in inventories as supply chains recovered from the COVID-19 disruptions.

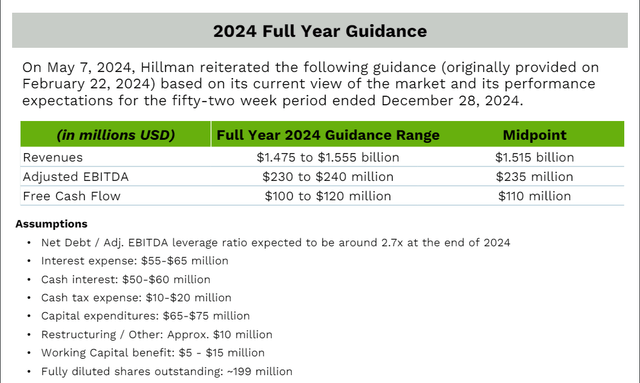

For the full year, management left guidance unchanged:

HLMN 1Q'24 Results Presentation

Acquisition Strategy

The Koch acquisition is a good model for the type of tuck-in acquisitions that Hillman Solutions seeks. As a supplier of rope and chain, Koch's 2,000 SKUs are adjacent to HLMN's existing products, which already include related hardware and accessories.

COO Jon Michael Adinolfi laid out some of the synergies in the 1Q'24 earnings conference call:

- Koch sources most of its products from Asia, and Hillman will integrate this with its extensive sourcing and shipping networks.

- Koch shipped its products to customers' distribution centers. Hillman will transition this to their direct-to-store model, giving the company cross-selling opportunities.

- Koch used a third party to stock and service products on the shelf, but the Hillman teams already in the stores will now service them.

- Koch has no business with Home Depot or Lowe's and only has a rope business at Ace. Koch does not sell any of its products in Canada.

Management anticipates that Koch's $40 - $45 million revenues can grow by 20% next year.

As this example illustrates, Hillman can acquire niche suppliers and transition their products into its service-first model. As I wrote in previous articles, HLMN's service model creates a competitive moat and prevents customers from only considering price when sourcing what might be easily substituted for products.

Without any acquisitions, the target leverage ratio of 2.7x and EBITDA of $235 would imply ending the year with net debt of about $635 million. However, with net debt / EBITDA closer to 3x, management believes it can make two or three more acquisitions similar to Koch during the year and still target a multiple below 3x by the end of the year.

Organic Growth

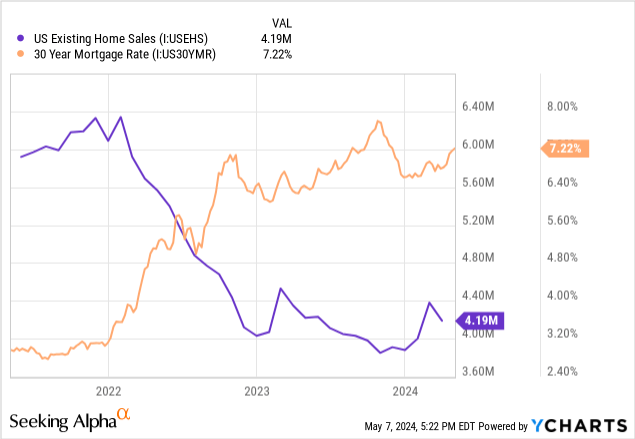

Beyond these niche acquisitions, Hillman targets long-term organic growth of 6%, which historically meant 1% pricing + 2%- 3% GDP growth + 2% - 3% new business wins. Unfortunately, the macroeconomic environment of the past few years has dented this goal, as has also been the case for the company's customers. The latest data on existing home sales from the National Association of Realtors shows continued weakness that will likely persist until mortgage rates decrease.

This leaves new business wins and product development as the company's organic growth drivers.

A major initiative at the company is developing the next generation of self-serve key duplication kiosks, MinuteKey 3.5. These new machines can copy smart auto fobs, transponders, and RFID fobs. The company has rolled out 101 new kiosks in two test markets and expects to have 800 machines in place by the end of the year. Hillman expects this product line to start impacting results in 2H'24 and 2025.

Risks

The company has shown that it can survive in a challenging macroeconomic environment by blocking and tackling while prioritizing customer service.

That said, I cannot predict whether or when mortgage rates will decline and existing home sales begin to improve, although there is likely to be pent-up demand when they do. Until then, consumer discretionary spending may decrease as well.

Another potential risk is the company's ability to identify, close, and successfully integrate acquisitions. The Koch Industries acquisition makes sense for the core hardware business. Another, albeit much smaller buy, was the Resharp automated knife sharpening business. This is small and has no longer been mentioned by the company. Sales are lumped in with tag engraving in the financials. I like to cook and am happy to occasionally run my knives through a $30 electric sharpener at home with satisfactory results rather than bring all of my knives to a hardware store.

Although I wouldn't expect it, there is a risk that a more significant acquisition fails to meet expectations.

The company's customers, which include The Home Depot (HD), Lowe's (LOW), Ace Hardware, Walmart, and Tractor Supply (TSCO), are substantially larger than Hillman and are facing headwinds in their own businesses, which may lead them to negotiate lower prices than the company is expecting.

Valuation

As I write this, the valuation and my outlook for the company are unchanged from when I last wrote about the company in February. As such, my base case has not changed:

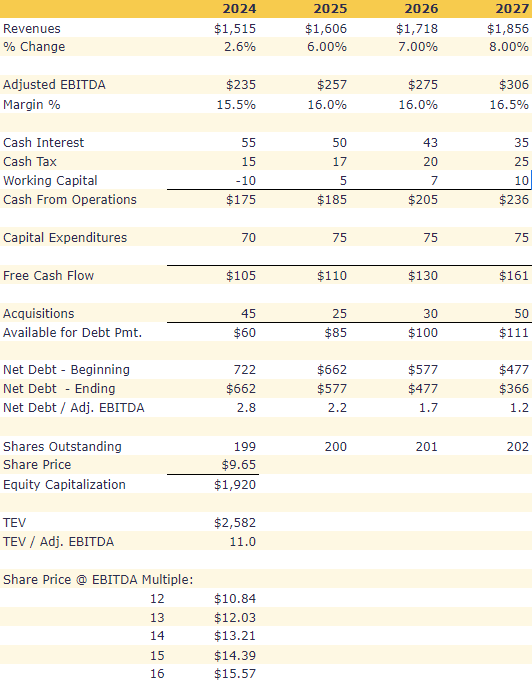

Author

Conclusion

At 11.0 TEV / Adjusted EBITDA, I think the company is undervalued. The company will continue to improve its results and balance sheet even in a challenging environment, and has shown discipline in its acquisition strategy. My target price is still $12.50, or 18% upside, with moderate risk.