Dragon Claws

Realty Income Corporation (NYSE:O) beat estimates with regards to FFO and sales for its 1Q24 yesterday and the retail real estate investment trust once more underlined its key value proposition for passive income investors: Realty Income remained a very high margin of dividend safety, particularly because the trust benefited from a QoQ improvement in its pay-out ratio.

Realty Income’s portfolio metrics also continue to look very robust with the commercial real estate investment trust posting high occupancy for its real estate portfolio as well as mid-single digit adjusted funds from operations growth in 1Q24.

The valuation, in my view, remains compelling for passive income investors that may want to lock in a high yield. Strong Buy.

My Rating History

I took a big risk in my last piece on Realty Income, in March 2024, because I insinuated that the real estate investment trust’s already bottomed. Realty Income, so I ventured, was poised to conduct a record amount of new transactions in 2024 and while I stand by this assertion, the trust’s core value proposition remains centered on the implicit promise of slow and steady dividend growth moving forward.

The valuation of Realty Income also remains enticing and I continue to evaluate Realty Income as a ‘Strong Buy’.

Strong Portfolio Metrics

Realty Income maintained very robust portfolio metrics and a very healthy growth profile in the first quarter. The trust’s adjusted funds from operations, on a per share basis, grew 5% YoY and Realty Income’s portfolio remained well-utilized with an occupancy of 98.6%.

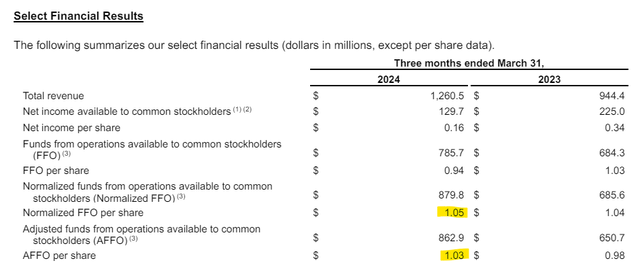

Realty Income’s normalized FFO, which adjusts for acquisition expenses, was $1.05 per share, beating the Street estimate by $0.01 per share.

Funds From Operations (Realty Income Corporation)

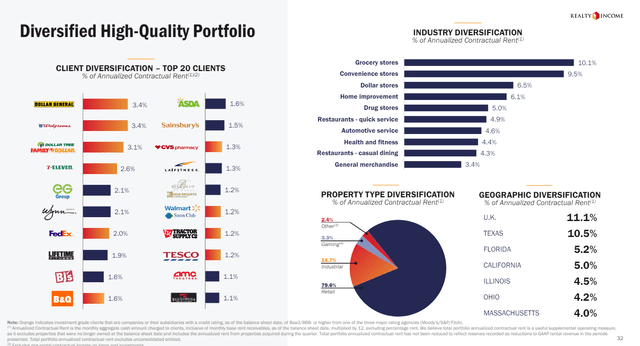

Key to Realty Income’s success is the maintenance of a well-diversified real estate portfolio that is anchored in the retail market. Retail outlets (grocery stores, convenience stores etc.) generate consistent foot traffic which in turn results in stable business income for companies such as Dollar General, Walgreens, 7-Eleven and Walmart. Retail accounted for 79.6% of Realty Income’s portfolio, though the trust is growing other revenue streams, such as Gaming and Industrial.

Moving forward, I anticipate more transactions in these two specific sub-sectors of the U.S. real estate market.

Diversified High-Quality Portfolio (Realty Income Corporation)

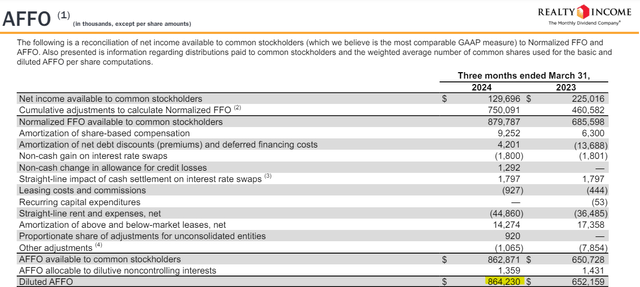

Realty Income’s core metric adjusted funds from operations skyrocketed 33% YoY to $864.2 million due to the company acquiring a boatload of new real estate last year.

Realty Income, for instance, acquired Spirit Realty Capital in an all-stock transaction valued at $9.3 billion in 2023 and the transaction closed this January. The trust is presently guiding for an acquisition volume of $2.0 billion for 2024, but Realty Income often acquired real estate opportunistically, so I would not be surprised to see Realty Income snap up a larger block of real estate from other REITs in 2024 or make full acquisitions.

Realty Income’s adjusted funds from operations is what supports the trust’s consistent dividend increases and present yield of 6%.

AFFO (Realty Income Corporation)

Dividend Coverage Improved QoQ

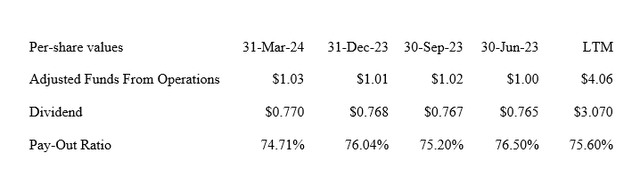

Realty Income earned $1.03 per share in adjusted funds from operations in the last quarter, reflecting a YoY growth rate of 5% which is in-line with the company’s long-term AFFO growth of also 5%.

Since the commercial real estate investment trust paid out $0.7695 per share in common stock dividends in 1Q24, Realty Income sported a dividend pay-out ratio of less than 75%.

In the last twelve months, the trust paid out a little less than 76% of its adjusted funds from operations and the pay-out ratio remained broadly stable in the last four quarters as well.

A low degree of volatility in the dividend pay-out ratio further attests to the quality of Realty Income’s underlying cash flow (and dividend). The dividend thus continues to exhibit a very high margin of dividend safety which practically guarantees that the trust will continue to grow its dividend moving forward.

Dividend (Author Created Table Using Trust Information)

Guidance And AFFO Multiple

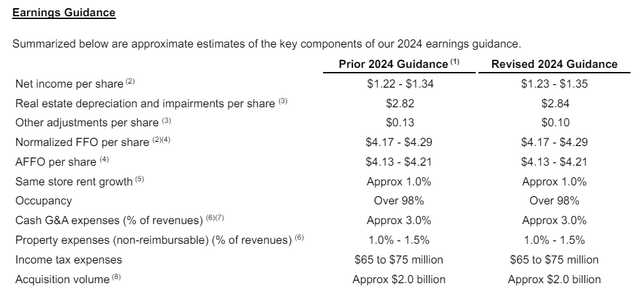

Realty Income’s guidance for 2024 adjusted funds from operations has not changed. The REIT continues to anticipate $4.17-$4.29 per share in adjusted funds from operations which equates to a 13.0x AFFO multiple.

Earnings Guidance (Realty Income Corporation)

Because Realty Income didn’t change its AFFO guidance my intrinsic value estimate remains at $63.45. I applied a 15x earnings multiple last time I valued Realty Income, primarily because Federal Realty Investment Trust (FRT), another retail-focused REIT, had a similar valuation multiple. Federal Realty Investment had slightly better dividend pay-out metrics (in the 66% range), but is not nearly as big and diversified as Realty Income.

Why The Investment Thesis With Realty Income Might Disappoint

Realty Income is focused on the retail real estate market, which reflects approximately 80% of investments.

A downturn in commercial real estate might hurt Realty Income’s large real estate portfolio, even though the commercial real estate investment trust is making an effort to diversify its property footprint.

In addition, Realty Income depends on acquisitions to grow its adjusted funds from operations which comes with its own unique set of risks, such as Realty Income overpaying for AFFO potential.

My Conclusion

Realty Income’s first quarter results were slightly better-than-expected as the company achieved solid, 5% YoY AFFO growth from its underlying real estate portfolio.

Realty Income continues to grow its dividend and provides passive income investors with a very high margin of safety. As a matter of fact, Realty Income’s margin of dividend safety increased QoQ due to robust adjusted funds from operations growth in 1Q24.

The commercial real estate investment trust’s portfolio metrics also continue to look robust. The valuation multiple did not change much since I last reviewed the commercial real estate investment trust, but the risk/reward relationship is very much intact.

Realty Income, given its demonstrated history of growth over time, is the ultimate set-it-and-forget-it stock in the REIT market. Strong Buy.