Monty Rakusen

General Electric (GE) is breaking up its conglomerate into more concentrated segments such as aerospace, healthcare (GEHC) and power generation in its new GE Vernova (NYSE:GEV).

The GE Vernova buy thesis

Power demand is one of the key secular trends right now, and the companies that provide incremental power are well positioned. GEV has an enormous backlog in both equipment and services, which should translate to rapidly growing earnings as the company takes key steps to improve margins.

GEV's value proposition is obscured by a high PE ratio on current earnings, but just a few percentage points of margin improvement could send earnings drastically higher. We see a clear pathway to margin improvement, which, I believe, will justify a significantly higher stock price a few years down the road.

Let us begin by addressing the secular tailwind, and then follow with how GEV is specifically positioned to benefit.

Power demand spiking

3 concurrent forces are working in tandem to create enormous demand for new power infrastructure.

- Data center buildout for AI requires a lot of power

- Population growth along with increase in per capita power consumption

- Plans to retire coal power plants

We discussed the power demands from data centers more thoroughly here, so I won't repeat that in this article.

The population is growing faster in the U.S. than many other developed nations because in addition to the normal organic population growth from births, we are having an influx of immigration.

Temporary immigration came from 10.4 million new visas in 2023:

In fiscal year (FY) 2023, the State Department issued 10.4 million temporary visas for tourists, international students, and others, up from 8.7 million in FY 2019.

Permanent immigration came primarily from the millions crossing our border, which has increased in recent years. Many of the immigrants are applying for more permanent status:

[I]n FY 2023, the agency administered the Oath of Allegiance to more than 878,500 new U.S. citizens.

In total, the U.S. population rose by 1.6 million in 2023.

Concurrent with all this extra demand for power, there are plans in place to retire 30% of coal plants by 2035.

So not only do we somehow have to generate enough power to service all the new demand, but we also have to replace a substantial amount of existing power generation.

I understand that both power generation (green versus gray) and immigration are sensitive and politically adjacent topics. It is not my job to render a verdict in one direction or the other. We are here to examine the financial implications of what is happening and the investment opportunities that result. Politics do have financial implications, so we look for investments that work regardless of which political party is in power (since future elections are unknown).

GE Vernova is well positioned because it has full capabilities for servicing both green and gray energy. The company can flex to whatever form of energy is demanded.

GE Vernova as a supplier of power demand

As companies build out their power generation, many of their orders for equipment and services go to GEV, as it is the global leader in the space. The broad surge in demand for power has led to an influx of orders and increased GE Vernova's order backlog to $116B.

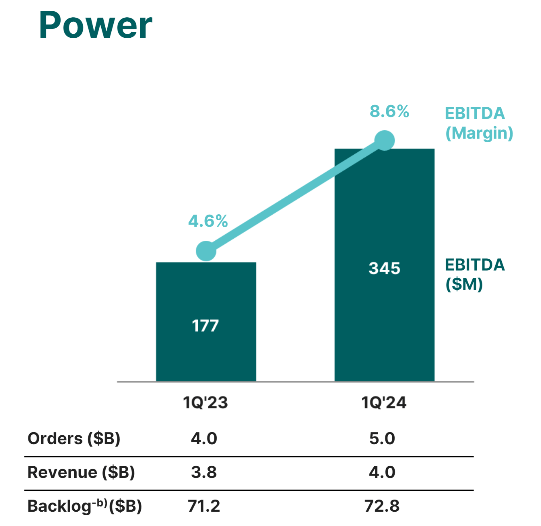

- Power segment backlog - $72.8B

- Wind segment backlog - $26.2B

- Electrification backlog - $18.1B

That is a large backlog for a company with an enterprise value of $41B.

As the power generation build out is in its early innings, order volume is likely to grow further from here.

CEO Scott Strazik on the conference call:

Significant demand exists for a number of our products such as transformers and switch gears, products key to ensuring a reliable electricity system and for connecting new generation. Orders this quarter were over 2x revenue, which we expect will drive revenue and profit growth well into the future given healthy margins on what we added to backlog.

The revenue side of GEV's business is impressive, with annual revenues approximating its enterprise value.

The aspect that will determine whether that makes GEV a good value is how much margin the company can produce on these revenues.

Margin improvement

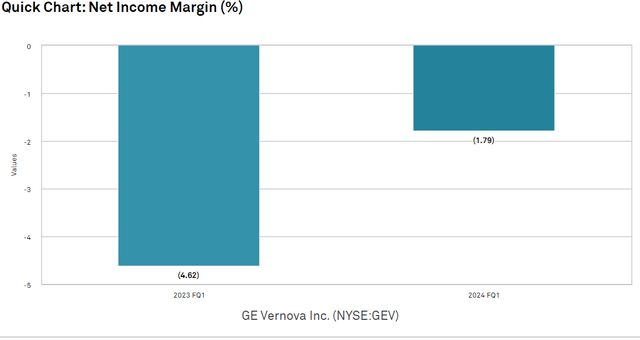

So far, GEV's margins have been quite weak with negative net income margin despite substantial improvement in the most recent quarter.

S&P Global Market Intelligence

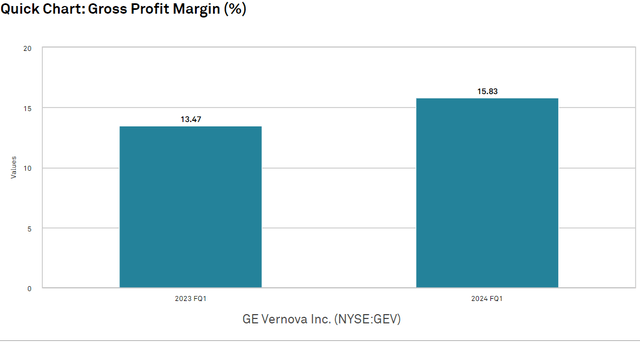

Gross profit margin improved from 13.47% last year to 15.83% in Q1'24.

S&P Global Market Intelligence

The improvement was broad-based, with every segment showing margin expansion.

GEV

Power, its largest segment, nearly doubled EBITDA margin to 8.6%. Electrification flipped to positive 4.0%.

GEV

Wind is the sore thumb here, with deeply negative margins becoming less negative.

GEV

Our analysis of GEV suggests there are 3 main sources of margin improvement:

- Mix shift toward services

- Getting past unprofitable backlog in wind

- "Leaning" of operations

Services are substantially higher margin than equipment, and the majority of GEV's backlog additions were in services. As the mix shift is primarily in the backlog and has not yet hit revenues, the consequent margin expansion is still to come.

Wind's negative profitability has been a result of weak pricing, as entities that were scheduled to be strong sources of demand were delayed by permitting red tape. The industry is adjusting to how long permitting takes and recalibrating orders. Forward orders are lower volume but higher profitability.

CFO Ken Parks discussed the wind situation on the Q1'24 call:

In wind, we expect revenue to be essentially flat and to approach profitability from positive price, productivity and cost savings.

It will likely be quite a few years before wind is a source of significant profits for the company, but starting as early as the back half of 2024 it will stop being a drain on profits.

The 3rd and, in my opinion, the largest source of profit margin improvement is in the efficiency of operations. On March 6th, GEV hosted an extended investor day presentation in which the primary theme was "leaning" or the internal focus on smoother and more efficient operations.

Over the years, we have seen countless investor day presentations and all of them are bullish. The aspects that set apart the really good presentations are those in which the bullishness is backed up with concrete evidence. I found this particular presentation to be quite compelling because of the examples they gave regarding operational improvement. The improvement is further backed up by the first quarter numbers, which came out a month later.

In particular, the aspect that stood out to me was the amount of low-hanging fruit. In other words, how inefficiently the company ran as a part of GE.

General Electric, even during its long era of terrible stock performance, has usually been fairly successful on the revenue side. It does a huge amount of business but has been burdened by corporate waste.

As a conglomerate, it seems as though it was unfocused and the leadership was not close enough to the operations of any particular segment. In recent years it has been deconsolidating by spinning off narrower and more focused businesses. These spinoffs have demonstrated substantially better performance once out of the shell of the conglomerate.

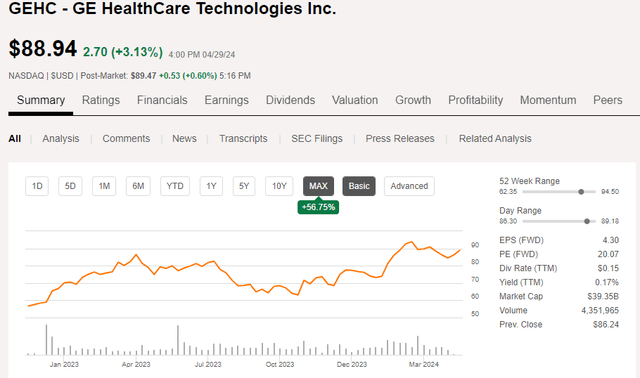

Despite the healthcare division being successful, the main GE has also performed much better since the spinoff.

The company has further narrowed its focus by splitting into GE Aerospace and GE Vernova.

Executives at the GEV Investor day discussed how much more productive and focused their jobs have become in recent years.

I believe them.

It is not often a company over 100 years old has margins expand by as much as 500 basis points in just a year's time. The first quarter's results show clear improvement, and I think they are just the tip of the iceberg.

GEV has world-leading equipment and services related to energy production and grid connection. There is no shortage of demand or revenues. Its profitability has just been stifled by inefficient operations.

I'm not expecting them to suddenly become an extremely efficient company, but rather to cut the waste and become a reasonably efficient company. The excess waste it has been carrying around operationally is the opportunity. Getting rid of that can produce the margins needed to dramatically improve earnings.

GE Vernova Valuation

At current earnings, GEV does not appear to be a value stock. It is trading at 46X estimated 2024 earnings and an enterprise value to EBIT of 34X.

S&P Global Market Intelligence

I believe the value is being hidden by the weak margins and that once margins expand earnings can improve materially. Consensus estimates seem to also see the margin expansion on the horizon, with massive growth estimated through 2028.

S&P Global Market Intelligence

If earnings can indeed triple in the next 4 years, I think the price tag on GEV is well worth it.

GEV is trading at 14.7x 2028 estimated normalized earnings. At that point in time, I think it will trade at a significantly higher multiple for 3 reasons:

- Almost no debt

- An increasing shift toward recurring revenue streams, which often trade at higher multiples.

- The tailwind of energy demand should extend well beyond 2028 such that growth is long-lasting.

Based on these attributes, I think an appropriate multiple would be in the low to mid-20s. Getting to that multiple on 2028 earnings would require the stock price to appreciate by about 50% over the next 4 years.

Risks to GE Vernova Buy Thesis

While GEV is low debt, the high volume of business they conduct relative to their market cap provides something often referred to as operating leverage. Each percentage point change in margins has an amplified impact on the bottom line. Our thesis is counting on the positive side of this effect, but it should be noted that the amplification works in both directions.

As such, investors in GEV may be wise to keep an eye on margin numbers as they come out, as well as forward indicators for how margins will change going forward. In particular, watch for factors such as regulation or input price inflation which could increase costs and try to gauge how effectively GEV is able to pass these costs on to their customers.

The bottom line

Power demand is expanding rapidly and GEV is involved in multiple modes of production at multiple layers in the vertical. It has the lion's share of an expanding pie, and we are long.

The REIT market has gotten egregiously underpriced, making it a great time to get into the right REITs. To help people get the most updated REIT data and analysis, I am offering 40% off Portfolio Income Solutions, but you can only get it through this link.

https://seekingalpha.com/affiliate_link/40Percent

I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic REITs.