GordonsLife

Introduction & Investment Thesis

Crocs (NASDAQ:NASDAQ:CROX) is a casual lifestyle footwear and accessories company that has outperformed the S&P 500 and Nasdaq 100 YTD. I initiated a “buy” rating on the stock on April 10, and my thesis was predicated on my belief that the company will continue to see outsized success of its Crocs brand where it can drive market penetration in the US and internationally, given its brand affinity, innovative product launches, and creative partnerships and collaborations to drive higher customer engagement, rising Average Selling Prices ((ASPs)) and improving profitability.

The company recently reported its Q1 FY24 earnings, where revenue and earnings beat expectations. While the company kept its projections for FY24 anchored, it did raise its revenue projections for its Crocs brand, where it is seeing accelerated growth in its International markets, coupled with double-digit growth in its Sandals and Jibbitz segments, where the company is rapidly launching new products. Meanwhile, the management has downgraded its revenue expectations for its HEYDUDE segment, which is now expected to contract between 8 and 10% in FY24.

Assessing both the “good” and the "bad," I believe that the appointment of Terrence Reilly as President of HEYDUDE should help the company revive growth in the coming years as it expands its retail outlet strategy, while the Crocs brand does most of the heavy lifting in the short term. I believe that the stock continues to be attractively priced at current levels to drive substantial upside over a 3-year investment horizon, making it a "buy.”

A quick primer about Crocs

Crocs designs, develops, markets, distributes, and sells casual lifestyle footwear and accessories under its two business segments, which include the 1) Crocs brand and 2) HEYDUDE brand. In Q1 FY24, the company generated 79% of its revenues from its Crocs brand, which consists of their clogs, sandals, and personalized Jibbitz accessories. Meanwhile, HEYDUDE brand contributed the remaining 21% of the revenue, where it sells lightweight and functionality-driven shoes.

The company sells its products in the US and internationally. In Q1, Crocs saw its international revenue grow 21.6% YoY to $361M, thereby contributing almost 50% of all revenue for the Crocs brand. In terms of distribution, Crocs leverages wholesale and direct-to-consumer (DTC) channels to get their products to market, with wholesale contributing 63.5% of all sales in Q1.

The good: Crocs brand continues to grow led by International Revenue and outsized performance in DTC channels along with Expanding margins

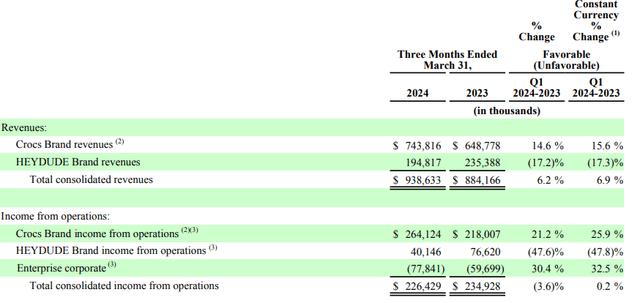

Crocs reported its Q1 FY24 earnings, where revenue grew 6% YoY to $939M. Out of the $939M in revenue, the Crocs brand contributed 79% of Total revenue growing 14.6% YoY, while HEYDUDE contributed the remaining 21%, declining 17.2% YoY.

Starting with the Crocs brand, they ranked 7 in the Top 10 footwear brands in the Piper Sandler Taking Stock with Teens Spring survey, as the company continues to create multi-product franchises in order to increase usage occasions for their consumers, which helped it grow its ASPs by 11% to $23.36. The Crocs brand has three pillars that include Clogs, Sandals, and Jibbitz, where the company continues to innovate its product lines, drive memorable consumer moments through partnerships and collaborations, and elevate their franchise management capabilities. During the earnings call, Andrew Rees, CEO of Crocs, talked about their successful licensing partnership with Toy Story Collections as well as their second collaboration with luxury brand Simone Rocha, which launched in 20 markets and sold out globally. Simultaneously, the company also launched Echo Storm, a fully molded sneaker, in their DTC channel as well as in Foot Locker (NYSE:FL) and JD customers, with 59% of all purchases coming from new consumers. Finally, the management remains optimistic for both its Sandals and Jibbitz segments, driving deeper market penetration and outpacing the overall revenue growth rate as the company launches new products in the market.

Q1 FY24 Earnings Slides: Product franchises for the Crocs brand

Looking forward, the company expects its Crocs brand to grow 7-9% YoY in FY24, which I believe it can achieve as the company continues to leverage its brand affinity to drive product launches, effective franchise management, and buzz-worthy partnerships and collaborations to attract new customers and accelerate the frequency and size of purchases, leading to higher ASPs. At the same time, I continue to remain optimistic about the company’s drive to gain market share internationally, which is now contributing close to 50% of Total Revenue, with triple-digit growth in Australia and China. Finally, as Crocs continues to drive a higher percentage of its sales through its DTC channels, where it contributed close to 38% to Total revenue for the Crocs brand, growing 18.3% YoY, it can continue to benefit from margin expansion through improved unit economics, where we saw income from operations grow 21.2% YoY on a GAAP basis with a margin of 35%, compared to 33% a year ago.

10Q: Breakdown of income from operations by business segments

The bad: Crocs faces headwinds from HEYDUDE with slowing revenue and profits, hires a new brand President.

However, Crocs continues to face pressure from its HEYDUDE segment, where revenues declined 17.2% YoY to $195M. Although the company continues to establish their Wally and Wendy icons through color, graphic, and height, while adding Hudson for Him and the Hudson Lift for Her in the sneaker franchise, along with opening six new outlet locations with plans to open at 30 outlets in FY24, the decline in units sold coupled with a declining ASP is leading to margin pressure, where income from operations declined 47.6% YoY to $40M on a GAAP basis, representing a margin of 20.6% compared to 32% in the previous year. While HEYDUDE contributes 20% to Crocs’s total revenue, the severity of the margin pressure from HEYDUDE has negatively impacted total margins from operations, which shrank over 200 basis points on a GAAP basis to 24.1% in Q1 for the whole company, despite outperformance from the Crocs brand.

As a result, the management has revised their expectations downward for HEYDUDE, where they expect revenue to contract 8–10% in FY24, compared to their previous guidance, where they projected sales to be flat to slightly up. In order to bring back growth in its HEYDUDE segment, especially as it looks to expand its retail locations both in the US and internationally, Crocs has hired Terrence Reilly as President to lead the segment, especially given his track record of creating and executing go-to-market playbooks for iconic products to build brands and communities. I believe that executive hiring is a step in the right direction, as Crocs needs to take a focused approach to inventory allocation while stabilizing gross margins through full-price selling in order to build the growth story for HEYDUDE.

Tying it together: Crocs is still a “buy”.

Looking forward, Crocs expects to grow its revenues by 3-5% YoY, with the Crocs Brand projected to grow faster than previous guidance at 7-9% YoY, while revenue from HEYDUDE is expected to contract 8–10%. I believe that Crocs should be able to achieve its revenue target, especially as it drives deep customer engagement and conversion to sales from product innovations, partnerships, and collaborations for the Crocs brand, coupled with accelerating revenue growth from its international markets and DTC channels. Meanwhile, I am optimistic that the new leadership appointment should drive renewed hope for HEYDUDE in the coming quarters.

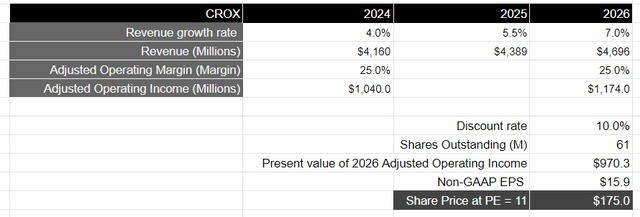

Shifting gears to profitability, Crocs is expected to see its non-GAAP operating margin shrink 270 basis points YoY to 25% in FY24, which would result in a non-GAAP operating income of $1.04B. I believe the YoY decline in margins is primarily led by margin pressures at HEYDUDE, while I expect margins from the Crocs brand to remain robust.

Over a 3-year horizon, I maintain my previous projections, where I believe Crocs will continue to grow its revenue at least in the mid-single digits as it drives deeper market penetration of both its Crocs brand and HEYDUDE in the US and internationally, attracting both new and existing customers to increase usage, leading to higher ASPs. This would mean that the company would produce approximately $4.7B in revenue by FY26. Assuming that Crocs is able to maintain its non-GAAP operating margins at around 25%, it should generate roughly $1.17B in non-GAAP operating income, which would be equivalent to a present value of $970M, when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings by an average of 8% over a 10-year period, with a price-to-earnings ratio of 15–18, I believe that Crocs should be trading at roughly 0.5–0.6x the multiple, given the growth rate of its earnings. This would translate to a PE ratio of 11–13, or a price target of $175, which represents an upside of 22.35% from its current levels.

Assessing the competitive landscape, where I include Nike (NYSE:NKE) and Deckers (NYSE:DECK), I can see that Nike is expected to grow 0.9–2% over the next 2 years as per consensus estimates, but has a PE ratio of 23. Compared to Nike, Crocs looks attractively priced given that its revenues and earnings are expected to grow at least in the mid-single digits over the next 2 years, while trading at half Nike’s PE ratio. On the other hand, Deckers is expected to grow almost twice as fast as Crocs; however, Deckers valuation reflects that, as its PE ratio is more than double that of Crocs.

Assessing both the “good” and the "bad," I believe that Crocs remains a “buy” at current levels, given the risk-reward, as I expect to see the continuing success of its Crocs brand as it launches new products to attract new customers and engages existing ones to drive higher frequency and size of purchase, leading to higher ASPs both in the US and internationally, allowing it to capture higher margins. While the company has some work to do to bring back growth in its HEYDUDE segment, I believe that hiring Terrence Reilly is a step in the right direction.

Conclusions

I believe that Crocs continues to have upside over a 3-year time horizon, and therefore I will maintain my “buy” rating at the moment, given the potential upside of 22.35%, as the company continues to drive the success of its Crocs brand in the US and internationally while revamping its efforts with HEYDUDE to return to growth.