Olemedia

Market Commentary

In a volatile first quarter of 2024, markets moved choppily higher, delivering positive returns across most regions and countries. US stocks rose +10% (as measured by the Russell 3000 Index), led by large-cap stocks, which were likewise up just over +10%, followed by mid caps (+9%) and small caps (+5%), as measured by their respective Russell indices. From a style perspective, growth continued leading - as it has for the last several quarters. Large-cap growth rose more than +11%, while value was up just shy of +9%; mid-cap growth gained over +9% versus mid-cap value up +8%; and small cap growth delivered shy of +8%, while small-cap value rose less than +3% (all returns as measured by the respective Russell indices).

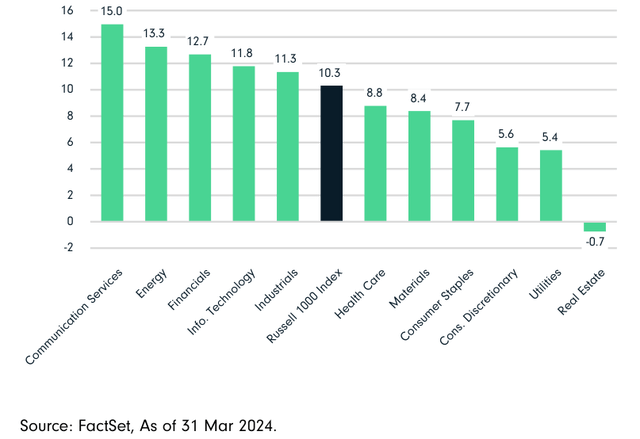

From a sector perspective, communication services (+15%), energy (+13%) and financials (+13%) led the way. Technology (+12%) and industrials (+11%) were also nicely positive, highlighting the growth-oriented nature of current market leadership. Relatedly, utilities, (+5%), consumer discretionary (+6%) and consumer staples (+8%) delivered more moderate (though still nicely positive) returns in the quarter as economic activity has generally remained robust, even against a tight monetary policy backdrop. Conversely, real estate was the only sector in the red (-1%), as investors seemed to reluctantly concede central banks, including the US Federal Reserve, will keep interest rates higher for longer than they'd anticipated (or would prefer).

1Q24 Russell 1000 Index Sector Returns (%)

As has been the case in recent quarters, markets-related headlines in Q1 seemed to focus narrowly on global monetary policy and its future direction - though the degree to which monetary policy is the dominant influencer of markets' direction may finally be diminishing. As some evidence of this, in mid-March, US inflation data were higher than analysts' expectations - yet markets largely shrugged in the wake of the news. A quarter or two ago, such a headline would've likely prompted a rather sharp selloff as investors concluded rates would need to remain higher for longer. Then, too, investors may be increasingly convinced central bank heads have achieved the proverbial soft landing, with economic data remaining relatively robust even as inflation data moderate more slowly. Only time will tell.

Of note on the monetary policy front was the long-awaited conclusion of Japan's ultra-loose monetary policy. After decades of deflation, Japan's economy is showing signs of mild inflation in the form of higher wages - which presumably lent the Bank of Japan (BOJ) confidence in its decision to end its ultra-loose policy regime. Accordingly, the BOJ made several noteworthy shifts, including raising its benchmark interest rate from -0.1% to +0.1%, ending its yield curve control policy (whereby it capped the 10-year Japanese government bond yield) and ending government purchases of exchange-traded funds and Japanese real estate investment trusts. However, it will continue purchasing roughly $40 billion monthly of Japanese government bonds - so there certainly is still room for monetary policy to tighten in the period ahead, should the inflationary and economic environment remain on their current paths.

Another country being closely watched is China, whose economy has been sluggish over the last year or so as the government struggles to lift it out of the malaise that started amid the pandemic and accompanying lockdowns. The backdrop is challenging: the real estate sector remains in crisis, foreign direct investment has plummeted and the country faces the prospect of trade wars with the US and Europe. Though government leadership is targeting 5% GDP growth in 2024, it remains to be seen whether they will be able to effect sufficient economic activity to hit their goal.

The calendar year began with a similar narrow focus on monetary policy as has prevailed over the past several quarters. Now, one quarter into 2024, it seems as though investors may finally be shifting their focus. Whether this proves beneficial for markets - or certain sectors of markets - will play out over the course of the year and beyond. Though valuations are above average, we believe it is still possible to identify compelling investing opportunities trading at reasonable discounts, and we will maintain our rigorous adherence to our bottom-up, fundamental research process that aims to identify them.

Performance Discussion

Our portfolio outperformed the Russell 1000 Index in Q1. Relative strength was concentrated among our financials and consumer discretionary holdings. Conversely, our health care and technology holdings, while positive on an absolute basis, trailed benchmark peers and consequently weighed on relative returns.

Among our top individual contributors in Q1 were American International Group (AIG) and HCA Healthcare (HCA). Property and casualty insurance company AIG made more progress selling its stake in life insurer Corebridge in the quarter while repositioning its portfolio via several divestitures - lending support to our thesis that the high-quality management team will continue executing a turnaround in the business.

Health care facilities operator HCA Healthcare benefited from a strong demand environment for hospitals in Q4, which is expected to continue into 2024 as nursing labor costs normalize and companies are able to improve margins tied to above-average physician costs. As a best-inclass operator with unique assets in favorable geographies, we believe the outlook for HCA Healthcare from here is favorable.

Other top contributors included Allstate (ALL), Caterpillar (CAT) and General Motors (GM). Allstate, one of the US's largest auto and homeowners' insurance providers, is benefiting from improving profitability in its primary auto insurance line. Further, milder weather during the quarter translated into lower catastrophe losses. Shares of heavy construction machinery manufacturer Caterpillar benefited from a positive US housing market, which despite rising interest rates, is seeing strong demand in the face of relatively short housing supply. Automobile manufacturer General Motors continues capitalizing on the shift to electric vehicles (EVs) while maintaining the strength of its core gas-engine truck and SUV business. Though it has experienced some setbacks - such as needing to roll back its Cruise driverless car project - we believe the company remains well positioned relative to secular tailwinds within the automobile business.

Among our bottom Q1 contributors were real estate investment trusts (REITs) Extra Space Storage (EXR) and SBA Communications (SBAC), as well as Humana (HUM). Self-storage REIT Extra Space Storage performed well alongside most REITs at the end of 2023 as investors anticipated interest rate cuts and easier financial conditions in 2024. As this sentiment largely reversed in early 2024 against a resilient economic backdrop and still-high interest rates, real estate (and REITs broadly) were pressured in Q1. However, we believe the company has a high-quality, long-term franchise with an industry-leading operating platform that should position it well in the future. Similarly, SBA Communications, one of the largest tower REITs, faced a challenging interest-rate environment entering 2024. However, we believe towers remain a good long-term business despite some near-term headwinds.

Shares of health insurance company Humana were meaningfully pressured in late 2023 against a backdrop of accelerating medical costs among its Medicare population, weighing on health plan profitability. Further, since Medicare Advantage plan pricing is set in June of each year for the following year, Humana is unable to offset increased medical costs with higher pricing - which in turn pressured shares in Q1. Nevertheless, we anticipate Humana will be able to improve margins over the next several years and maintain our conviction in our position.

Other bottom Q1 contributors included BorgWarner (BWA) and Laboratory Corporation of America (LH, LabCorp). Global automotive supplier BorgWarner has faced near-term volatility in the ongoing shift to electric vehicles and hybrids, which has, in turn, impacted results and weighed on shares. Given our expectation this volatility will continue for the foreseeable future, we exited our position in the quarter to upgrade our capital into more compelling opportunities.

Shares of life sciences company LabCorp were pressured in the quarter as management set expectations for a slower 2024 for the company. However, we remain optimistic about LabCorp's position as a leading US diagnostic lab operating in a duopoly and growing at a steady rate. LabCorp further benefits from its scale advantages, which create a significant barrier to entry for potential competitors. The company trades at a highly attractive valuation while generating significant free cash flow.

Portfolio Activity

Portfolio activity has remained modest as valuations have risen, and it is increasingly challenging to find high-quality companies trading at interesting valuations. However, we did identify two new investments in Q1: Sysco Corporation (SYY) and KeyCorp (KEY).

Sysco is the market-share leader in the US food-service industry, in which scale and size are critical. We believe Sysco is exiting the pandemic in a stronger position after investing organically and inorganically in its business. It is well-positioned to harvest these investments over the next several years. However, Sysco trades at a discount to its historical multiple, which we think makes for an attractive entry point into this high-quality company.

Retail and commercial bank KeyCorp is a high-quality financial institution that we believe is trading at a discounted valuation. Over the next several years, we expect KeyCorp will generate improved returns and tangible book value growth as net interest margins expand and Treasurys on its balance sheet mature. We also anticipate positive loan growth following a period of balance sheet optimization and improvements among its unrealized losses as the company's securities portfolio increases in value.

In addition to the aforementioned sale of BorgWarner, we partially funded these purchases with our sales of regional bank Truist Financial (TFC) and software and information technology services provider Microsoft (MSFT), whose valuations were less compelling than other opportunities.

Market Outlook

Equity markets continued higher in Q1 as the economy and earnings growth remained robust. The Russell 1000 Index increased 10% in the quarter - despite a 32-basis point increase in the 10-year Treasury (US10Y) and the market's now expecting far fewer interest rate cuts in 2024. The rally was fairly broad, with the S&P 500 Equal Weighted Index increasing more than 7%.

Markets were again led by mega-cap tech stocks, with the Magnificent 7 (Microsoft, Apple, Amazon, Alphabet, Nvidia, Tesla, Meta) collectively increasing about 13%. However, the performance of the Magnificent 7 varied quite a bit, with Nvidia (NVDA) and META up significantly, while Tesla (TSLA) and Apple (AAPL) shares fell meaningfully. Still, as mentioned, growth stocks continued their outperformance over value stocks in Q1.

Small caps continued to underperform large caps, with the Russell 2000 Index's (RTY) 5.2% gain trailing the Russell 1000 Index's return by more than five percentage points.

Interestingly, more than one-quarter of the Russell 2000 Index's return came from one stock, Super Micro Computer (SMCI), which increased more than 250% and now sports a market cap north of $60 billion.

Corporate earnings are expected to grow at a double-digit rate in 2024, driven by mega-cap tech stocks, a rebound in health care sector earnings after a large decline in 2023, and continued strong growth among industrials.

With the continued rally, equity market valuations remain above average. While the fall in interest rates since their peak in October 2023 has somewhat supported this, it may still be difficult to generate returns from current levels that match historical averages over the next five years. However, we continue to seek attractive opportunities with the potential to generate above-average returns over that period.

Our primary focus is always on achieving value-added results for our existing clients, and we believe we can achieve better-than-market returns over the next five years through active portfolio management.

Period and Annualized Total Returns (%) | Since Inception (30 Jun 2001) | 20Y | 15Y | 10Y | 5Y | 3Y | 1Y | YTD | 1Q24 |

Gross of Fees | 10.14 | 10.90 | 14.64 | 11.01 | 12.54 | 8.03 | 27.48 | 10.81 | 10.81 |

Net of Fees | 9.39 | 10.16 | 13.92 | 10.34 | 11.86 | 7.38 | 26.72 | 10.64 | 10.64 |

Russell 1000 Index | 8.81 | 10.21 | 15.62 | 12.68 | 14.76 | 10.45 | 29.87 | 10.30 | 10.30 |

Russell 1000 Value Index | 7.63 | 8.29 | 13.10 | 9.01 | 10.32 | 8.11 | 20.27 | 8.99 | 8.99 |

Calendar Year Returns (%) | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

Gross of Fees | 31.49 | 10.61 | 3.60 | 13.35 | 37.79 | 11.58 | -0.17 | 15.27 | 21.10 | -8.81 | 32.96 | 9.99 | 26.50 | -12.83 | 14.37 |

Net of Fees | 30.57 | 9.84 | 2.87 | 12.61 | 36.89 | 10.86 | -0.82 | 14.57 | 20.37 | -9.36 | 32.16 | 9.33 | 25.74 | -13.35 | 13.68 |

Russell 1000 Index | 28.43 | 16.10 | 1.50 | 16.42 | 33.11 | 13.24 | 0.92 | 12.05 | 21.69 | -4.78 | 31.43 | 20.96 | 26.45 | -19.13 | 26.53 |

Russell 1000 Value Index | 19.69 | 15.51 | 0.39 | 17.51 | 32.53 | 13.45 | -3.83 | 17.34 | 13.66 | -8.27 | 26.54 | 2.80 | 25.16 | -7.54 | 11.46 |

| Diamond Hill Capital Management, Inc. (DHCM) is a registered investment adviser and wholly owned subsidiary of Diamond Hill Investment Group, Inc.; registration does not imply a certain level of skill or training. Diamond Hill provides investment management services to individuals and institutional investors through mutual funds and separate accounts. DHCM claims compliance with the Global Investment Performance Standards (GIPS®). The Large Cap Composite is comprised of all discretionary, non-fee and fee-paying, non-wrap accounts managed according to the firm's Large Cap strategy, respectively, including those clients no longer with the firm. The strategy's investment objective is to achieve long-term capital appreciation by investing in companies within the market capitalization range of the strategy that are selling for less than our estimate of intrinsic value. The Large Cap strategy typically invests in companies with a market capitalization of $5 billion or greater. Index data source: London Stock Exchange Group PLC. Seediamond-hill.com/disclosuresfor a full copy of the disclaimer. To receive a complete list and description of all Diamond Hill composites and/or a GIPS® report, contact Scott Stapleton at 614.255.3329, sstapleton@diamond-hill.com or 325 John H. McConnell Blvd., Suite 200, Columbus, OH 43215. The performance data quoted represents past performance; past performance does not guarantee future results. Composite results reflect the reinvestment of dividends, capital gains and other earnings when appropriate. Net returns are calculated by reducing the gross returns by the highest stated fee in the composite fee schedule. Only transaction costs are deducted from gross of fees returns. Prior to 30 September 2022, actual fees were used in calculating net returns. All net returns were changed retroactively to reflect the highest fee in the composite fee schedule. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. The US Dollar is the currency used to express performance. Securities referenced may not be representative of all portfolio holdings. The reader should not assume that an investment in the securities was or will be profitable. The views expressed are those of Diamond Hill as of 31 March 2024 and are subject to change without notice. These opinions are not intended to be a forecast of future events, a guarantee of future results or investment advice. Investing involves risk, including the possible loss of principal. |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.