instamatics

By Erik Norland

At A Glance

- Declining inflation and slower growth have contributed to the rising potential for rate cuts in Europe

- The European Central Bank’s decision around rate cuts will likely be influenced by the euro’s strength

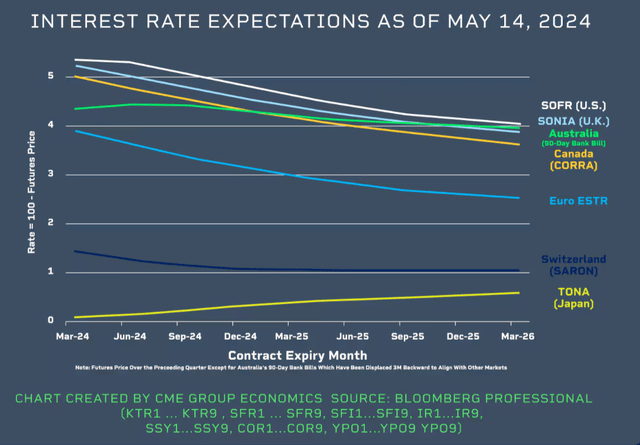

The CME Group Euro ESTR futures curve prices that the European Central Bank (ECB) is likely to cut rates further and faster than its peers, with the potential for around 125-150 basis points of cuts over the next couple of years. So, why is Euro ESTR more optimistic about rate cuts in the eurozone than other markets are elsewhere?

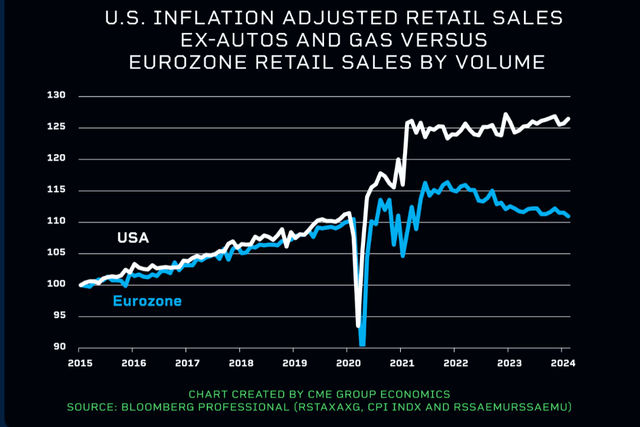

Part of the answer lies in Europe’s growth numbers, which have been much weaker than those of some other countries. For example, since late 2020, American consumers have been spending enough money to at least keep pace with inflation. By contrast, inflation-adjusted retail sales in Europe peaked over two years ago and have been gently declining ever since.

Additionally, eurozone core inflation has been coming down more quickly than similar measures in the U.S. and the U.K. The latest eurozone reading of 2.7% year-on-year core inflation is more than a full point lower than similar measures in the U.S. and nearly 2% lower than in the U.K.

A Weaker Euro?

Moreover, unlike the Fed, which has been pushing back on the idea of imminent rate cuts, the ECB has publicly embraced the idea. That said, there could be one potential obstacle: the euro currency itself. If the euro were to weaken and drop through parity, that might give the ECB pause about cutting rates.

A weaker currency could slow progress on core inflation by raising import prices. The ECB often stated in the past that it wants the euro to “be a strong currency.” As such, any weakening in the euro through parity could lead the ECB to reconsider the potential pace of policy easing.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.