Thomas Barwick/DigitalVision via Getty Images

Overview

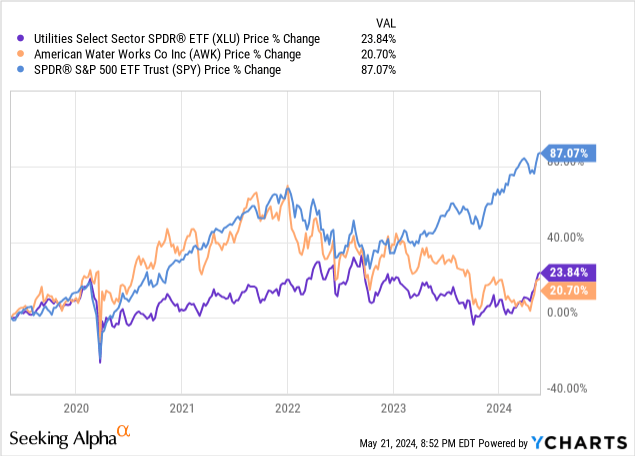

I really enjoy seeing the dividend income in my portfolio grow over time with the least amount of effort on my end. This enjoyment prompts me to spend a lot of time looking for the next opportunity to increase my annual passive income. I believe that utilities offer a ton of opportunities at the moment as these businesses are typically very sensitive to interest rate changes. Utility-based companies often depend on attractive debt financing to fund operations, expansion, project development, and more. Therefore, the entire sector remains suppressed and disconnected from the S&P 500 (SPY) at the moment.

This is where American Water Works Company (NYSE:AWK) comes in! I believe that the business currently trades at attractive valuations, and the suppressed price presents an opportunity to let us accumulate shares. I believe that this gap of underperformance in utilities versus the greater indexes will close over time when interest rates begin to get cut in the future. For the time being, however, AWK has a solid financial stance to ride out the higher interest rate environment while also providing clear and transparent plans around their capital investments.

While the current dividend yield of 2.3% isn't anything to get too excited about, the dividend growth here is where the value lies. In addition, the average dividend yield over the last 4 years is closer to only 1.7%, meaning that we sit at a more attractive entry point that rewards us with a higher yield. AWK has an excellent dividend history of growing their dividend on an annual basis while also maintaining a healthy payout ratio. This is exactly what makes it such an attractive candidate for my dividend growth portfolio.

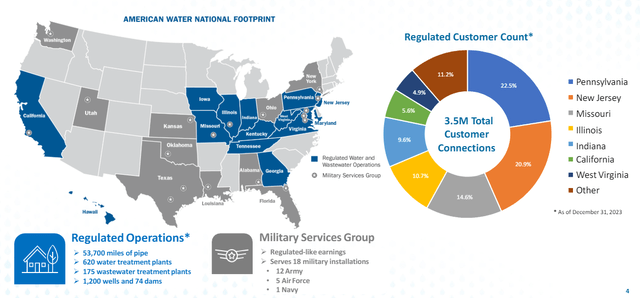

For some context, AWK is a utility company that provides water and wastewater services in the USA throughout 14 different states. Through this exposure, they service over 14 million customers and this is one of those businesses that I classify as essential since we all need water. To complement their business, they also service several military facilities with water as well. Most of their business is based within the northeast of the USA and this includes over 53,700 miles of pipe, 620 water treatment plants, 175 wastewater plants, 1,200 wells, and 74 dams.

Some initiatives that I like about AWK is that they project that by 2035, they will be able to meet consumer needs while also saving 15% in water delivered by customer. They also aim to increase their water system resiliency by 2030. Additionally, the company plans to continue to achieve these feats while also growing EPS between 7% to 9%.

Financials & Capital Expenditure

At the beginning of May, AWK reported their Q1 earnings and the results were mixed due to a strong revenue growth year over year, but earnings per share came in a bit short of expectations. Revenue amounted to $1.01B for the quarter, representing a 7.7% year-over-year growth. EPS (earnings per share) came in at $0.95 for the quarter, which missed estimates by $0.03. However, this shortcoming in EPS doesn't really concern me since Q1 seems to historically be one of the weakest quarters on a consistent basis.

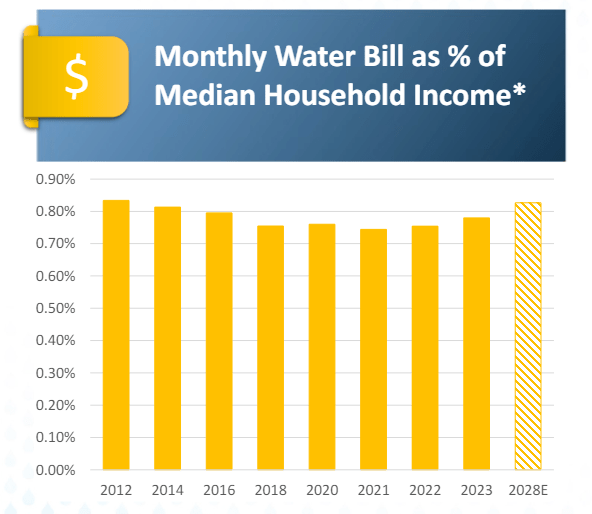

A part of AWK's strategy seems to be focusing on maintaining a customer that can afford their services. Between now and 2028, there is a focus to have customer's monthly water bill only account for a small percentage of the median household income by only increasing a mere 0.04%. The current monthly water bill accounts for approximately 0.78% of the median household income and that's projected to grow to about 0.82% I believe that most consumers will not be burdened by such a slight increase in cost. This will likely remain the case as the inflation rate slowly moves back down towards levels that we consider normal, around 2% - 3%.

AWK 2024 Presentation

Forward EPS growth on a three to five year basis has increased at a compound annual growth rate of 7.3%. This performance aligns with their stated target of achieving an EPS growth of 7% to 9% that will be driven by opportunities to maximize income as well as regulated acquisitions that can increase the customer base by 2%. This can easily be achieved when we consider the capital that AWK is pumping into expanding operations. Over Q1, they invested $720M of capital into infrastructure improvements. For example, AWK recently closed the acquisition of the Granite City Wastewater Treatment Plant for $86M. In addition to this, there is currently more than $500M of funds already allocated towards acquisitions that are under agreement.

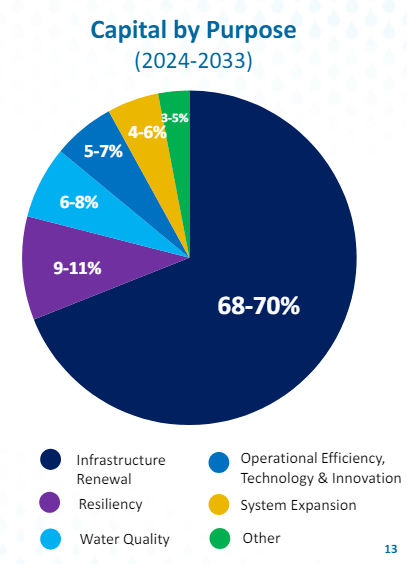

I love that AWK has transparently laid out their plans for the next decade, further reinforcing the company's strong capital management and staying power for the next ten years. We can see that the vast majority of their capital throughout 2033 will go towards infrastructure renewals that can enhance growth and help support a larger customer base. In addition, we see capital flowing into different channels such as resiliency, water quality investments, tech innovations, and system expansions. Capital investments actually grew by $200M over the prior quarter, which brings AWK closer to hitting their goal of $3.1B for fiscal year 2024. Over the last earnings call, we received confirmation that these investments are projected to contribute to earnings growth over time.

Through capital recovery mechanisms and forward test years, we can reduce regulatory lag and lessen the reliance on general rate cases. This not only helps us to seek to earn our allowed return but also to mitigate the size of general rate increases for our customers. We expect at least 75% of capital investments over the next five years to be recoverable through infrastructure mechanisms and through the use of forward test years, which is the key to driving modest bill increases and to unlocking a more consistent annual earnings growth pattern for the long term. - Cheryl Norton, Chief Operating Officer

AWK Q1 Presentation

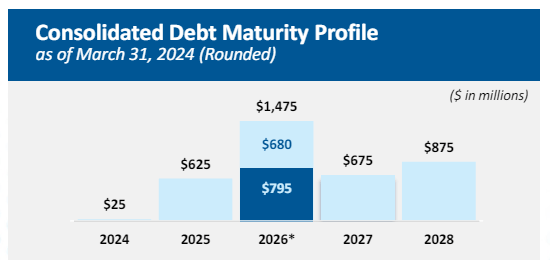

In terms of liquidity, AWK currently has cash and cash equivalents totaling $584M that they can access to help ride out any potential headwinds, alongside the inclusion of $2.675B in accessible credit. Additionally, they pull in $1.9B in cash from operations that can also be tapped if needed. Thankfully, their debt maturity schedule gives them plenty of time to continue accumulating cash as there are no large maturities taken place in 2024. In fact, the bulk of the debt maturities taking place will be in 2026, amounting to $1.475B.

AWK Q1 Presentation

Dividend

AWK has a great dividend history, with over 15 years of consecutive increases to the annual payout. The dividend was recently increased by 8.1% at the beginning of May to extend this streak. As of the latest declared quarterly dividend of $0.765 per share, the current dividend yield sits at 2.3%. While a low dividend yield like this is nothing to write home about, I want to focus on the growth prospects instead, as this is where the value lies.

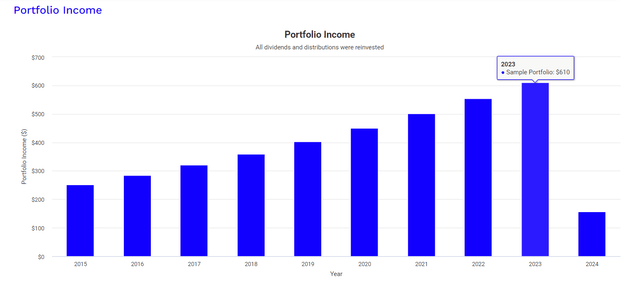

Despite unfavorable macro conditions, AWK as managed to continually raise their dividend. For example, the dividend has increased at a CAGR (compound annual growth rate) of 9.14% over the last five year period. Even zooming out to a longer time horizon of ten years, the dividend has increased at a CAGR of 7.28%. This growth has been fully supported by an average forward EBITDA growth of 7.5%. To better visualize this growth, we can reference what kind of dividend income growth an original $10,000 investment would have yielded with Portfolio Visualizer.

This visual represents an original investment of $10,000 at the start of 2015 and assumes that no additional capital was ever deployed. However, this does include dividends being reinvested every quarter. In 2015, your dividend income would have only been $252. Fast forwarding to 2023, your dividend income would have now grown to $610. While the amounts may still be small, the rate of increase remains high, with a CAGR growth of over 11%.

The amount of dividend income would grow even larger over time with fixed amounts invested on a monthly or annual basis. Not only has the growth been sufficient for me, but the dividend remains safe. The current payout ratio sits around 58.5% at the moment. For reference, the average five year dividend payout for AWK sits around 53.5%. As interest rates come down and revenues rise for AWK, this payout ratio should come back down to align with the average. As it stands now, the current payout ratio sits within AWK's stated range of 55% - 60%.

Vulnerability & Valuation

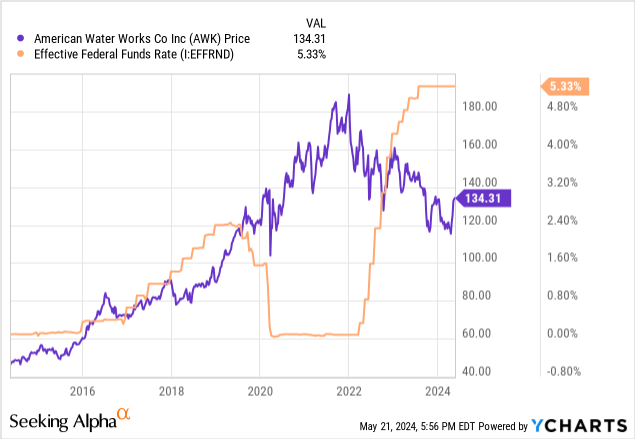

AWK as always been a consistent performer with a very solid track record of growth. However, as a utility company, AWK remains highly vulnerable to interest rates. Generally speaking, utilities companies are capital intensive businesses and require access to affordable debt in order to fund the expansion and operation of plants, developments, pipelines, and other things of that nature. Taking a look at the historical relationship with interest rates, AWK has managed to grow, no matter what fluctuations were happenings.

However, there seems to be a huge disconnect after interest rates started to rapidly rise at the mid-point of 2022. When rates were at near zero levels after the 2020 covid crash, the price of AWK took off and flew to new highs. However, once rates started rising, the price fell back down to its 2020 levels and has since stabilized a bit. I believe this presents an attractive opportunity since there are ongoing discussions about the Fed cutting rates by the end of the year or potentially in early 2025. For now, though, it seems like the Fed remain patient and await more economic data to roll in as inflation remains high, and the labor market is still strong.

This price suppression gives us the opportunity to accumulate a top-tier utility-based business at an attractive valuation. For reference, the average Wall St. price target sits at $138.42 per share. This represents a very small upside potential of 3%. The highest price target sits at $159 per share and the lowest price target is $123 per share. However, I believe this average price target to be a bit conservative when we consider other valuation metrics. For example, the current price to earnings ratio sits at 27.09x, but AWK has traded at an average price to earnings ratio of 35.10x over the last 5 year period. In addition, the forward price to book ratio sits at 2.54x but the forward price to book ratio over a five year time period has averaged 3.54x

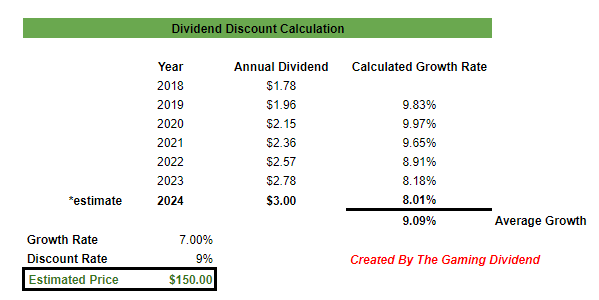

In order to get another estimate, I decided to calculate a dividend discount model to see if I can get to an estimated fair value. I first compiled all of the annual dividend payout amounts dating back to 2018. We can see that since then, the dividend has increased at a CAGR slightly above 9%. Management is targeting a growth rate of EPS between 7% to 9% so let's stay on the conservative end and input 7% for our estimated growth rate. I think this is fair and achievable since we've already seen the business reach this 7% growth mark.

Author Created

With these inputs in mind, I come to an estimated fair value of $150 per share. This falls within the range of the previously listed Wall St. price targets and also represents a potential price upside of 11.7%. When you combine this with a dividend yield of 2.3%, you are looking at a total upside potential of about 14% from the current levels if we assume AWK is able to reach that 7% growth rate. While interest rates remain elevated for now, I believe that a combination of AWK's strong performance, capital investments, and efficient capital management should easily help them surpass this growth rate once interest rates start to come down. When interest rates start to come down, they can acquire and refinance existing debt at more attractive rates and operate with larger profit margins to fuel EPS growth.

Something that may threaten my thesis is an even longer period of higher interest rates. While AWK has been able to maneuver the higher rates for the last two years, the possibility of another year of higher rates may further delay growth by stalling these ongoing acquisitions, stopping growth in customers, and having higher interest payments chew into operating margins.

Takeaway

In conclusion, I believe that this disconnect of utility companies from the greater indexes presents an opportunity for accumulation while valuations are lower. Using my dividend discount model, I assign a fair value estimate around $150 per share. When combined with the dividend yield of 2.3%, we are looking at the potential to lock in a double-digit return assuming that AWK can achieve their 7% growth target. Not to mention, the dividend sits above its four-year average, which further reinforces the attractiveness here. When interest rates eventually get cut, I believe that we will see utilities outperform and eventually see the sector's performance close the gap of underperformance against the S&P.