HeliRy

Note:

I have covered Nordic American Tankers Limited (NYSE:NAT) previously, so investors should view this as an update to my earlier articles on the company.

At the beginning of the year, I upgraded shares of Suezmax tanker pure play Nordic American Tankers Limited, or "NAT," to "Buy" as I expected the company to be among the prime beneficiaries of the Red Sea crisis.

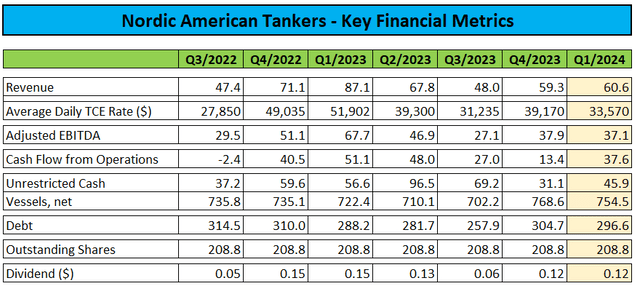

Unfortunately, my thesis hasn't played out, as NAT's charter rates have underperformed peers by a wide margin in recent quarters:

Company Press Releases and Presentations

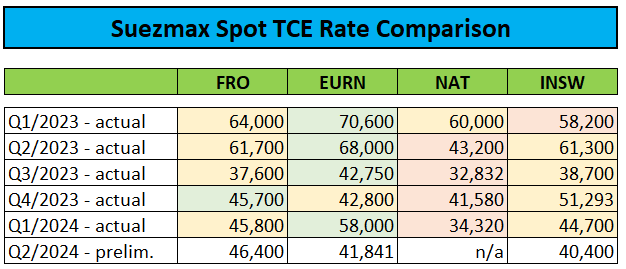

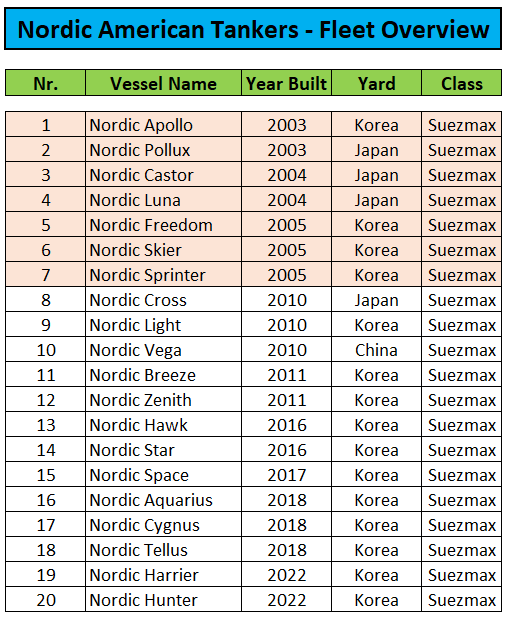

While some of the underperformance can be explained by the higher average age of the company's fleet relative to competitors like Frontline (FRO), Euronav (EURN) and International Seaways (INSW) as well as the lack of scrubbers, Wednesday's Q1 2024 results represented one of the weakest performances relative to peers recently:

Please note that the company's average time charter equivalent ("TCE") rate is derived from a combination of spot market- and time charter employments, with 80% of NAT's fleet currently operating in the spot market.

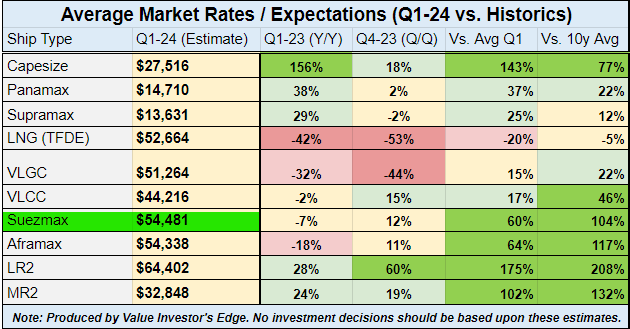

While the company's preliminary Q1 average TCE spot rate of $40,690 was already well behind peers, the final rate of $34,320 was a far cry from competition and approximately $20,000 below the average Suezmax spot rate in Q1:

Value Investor's Edge

On the flip side, the company generated $37.6 million in cash from operating activities and declared a generous quarterly cash dividend of $0.12.

NAT ended the quarter with $45.9 million in unrestricted cash and $296.6 million in debt, thus resulting in a very moderate Loan-to-Value ("LTV") ratio of 22%.

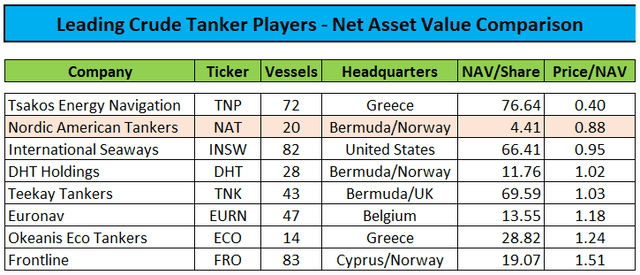

Following Wednesday's selloff, the company now trades at a 12% discount to estimated net asset value ("NAV") of $4.41 per share:

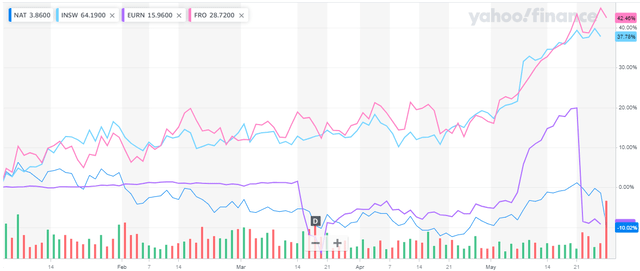

While I previously expected the company's generous dividend policy to be a strong catalyst for the shares, NAT's disappointing earnings have resulted in massive underperformance vs. peers year-to-date:

Please note that following a recent change of control, Euronav has paid a special dividend of $4.57 per share last week and will no longer be a tanker pure play going forward.

Unfortunately, there's little reason to believe in near-term improvement. While Suezmax spot rates remain at elevated levels when compared to historical trends, they are down by more than 10% from Q1 quarter-to-date.

Moreover, NAT's decision to abstain from providing preliminary TCE guidance in the earnings press release for the first time in recent history doesn't bode well for the company's Q2 performance. For my part, I wouldn't be surprised to see the average Q2 TCE rate coming in below $30,000.

While I would expect the dividend to provide some support to the stock price until the company's Q2 report in late August, even weaker results might very well require a reduction of the quarterly payout going forward.

Quite frankly, given the company's disappointing charter rate performance and elevated second hand vessel values, management should seriously consider divesting the oldest vessels in the fleet for estimated proceeds of above $250 million:

Regulatory Filings

A sale of all seven Suezmax tankers built before 2010 would likely result in NAT moving to a net cash position. In addition, the company would save a decent amount of cash on otherwise required near-term special periodic surveys.

On the flip side, even assuming an average TCE rate of just $25,000, these vessels would still contribute meaningful operating cash flow.

Anyway, the company's operating performance remains disappointing and might have actually gotten worse in Q2, as otherwise there would have been no reason for management to abstain from providing preliminary TCE guidance.

Consequently, I am downgrading the company's shares from "Buy" to "Hold" and apologize to readers for a bad call.

To be perfectly honest, picking virtually any other major U.S. exchange listed crude tanker player at the beginning of the year would have resulted in outsized gains, but I somehow managed to place my bet on the sole loser.

Bottom Line

Nordic American Tankers' results continued to underperform peers by a wide margin in Q1. While the company is sticking to its generous dividend policy, the disappointing operating performance has impacted investor sentiment in recent quarters.

With Q2 likely to be sequentially weaker, a dividend cut might be in the cards.

Consequently, I am downgrading Nordic American Tankers Limited shares from "Buy" to "Hold" with a price target of $4 based on an assigned 10% discount to net asset value to account for NAT's operational issues.

Massively Outperform in Any Market

Value Investor's Edge provides the world's best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.