Imstepf Studios Llc/DigitalVision via Getty Images

We previously covered Hershey Company (NYSE:HSY) in March 2024, discussing its mixed FQ4'23 earnings call, with the management competently delivering stable bottom lines despite the multiple headwinds, with H2'24/ 2025 likely to bring forth improved numbers.

We had maintained our optimism that it remained well poised for growth, especially due to the aggressive M&A activities over the past few years, with salty snacks delivering double-digit growth, resulting in our reiterated Buy rating then.

Since then, HSY continues to trade sideways at +0.7%, relatively inline with the wider market at +2.5%. Even so, its robust FQ1'24 results and consistent cost optimization have delivered growing profit margins, lending strength to its profitable growth trend despite the elevated commodity inflation.

Combined with the stock's established support levels and the ascending resistance levels, we believe that it continues to offer a compelling investment thesis across capital appreciation and dividend incomes.

HSY's Investment Thesis Remains Sweet, Thanks To The Confectionary Segment

For now, HSY has reported a top/ bottom line beat in the FQ1'24 earnings call, with net sales of $3.25B (+22.6% QoQ/ +8.6% YoY) and adj EPS of $3.07 (+51.9% QoQ/ +3.7% YoY).

These numbers are impressive indeed, despite the commodity inflation.

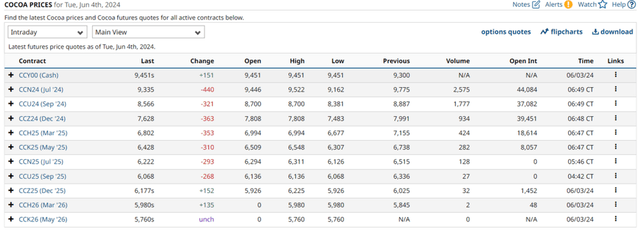

For example, HSY continues to face rising cocoa price headwinds over the past few years, with the commodity spot prices now at an eyewatering sum of $9.45K per tonne (+20.5% MoM/ +219.2% YoY/ +305.5% from 2019 averages of $2.33K).

The same has been observed with sugar prices at $0.19 per pound (inline MoM/ -20.8% YoY/ +58.3% from FY2019 levels of $0.12).

Despite the resultant price hikes by +5.9% YoY to cope with the commodity inflation, HSY has been able to report an excellent growth in the North America Confectionery volumes by +4.5% YoY in FQ1'24, implying its robust branded offerings and stickiness of its consumer base.

It is also important to highlight that the segment comprises the lion's share of the overall company's top/ bottom lines at 83% (-0.7 points QoQ/ +0.7 YoY) and 92% (-3.9 points QoQ/ +2.3 YoY), respectively.

It is apparent that the HSY management has been doing a great job in offsetting the COGS headwinds thus far, as the company continues to report excellent overall adj gross margins of 44.9% (+0.7 points QoQ/ -1.7 YoY/ +1.5 from FQ4'19 levels of 43.4%) in the latest quarter.

The same cost efficiency has also been observed in the expanding overall operating margin of 32.5% (+5.8 points QoQ/ +5.7 YoY/ +14.6 from FQ4'19 levels of 17.9%), despite the growth in its full-time employees by +3.2% in FY2023 (FQ1'24 numbers not reported).

Much of the tailwinds are attributed to the ongoing multi-year productivity initiative, namely Advancing Agility & Automation, which is expected to record an annual saving of $300K from 2026 onwards, aimed to improve supply chain and optimize manufacturing/ technology models.

Promising Cocoa Futures

At the same time, readers may want to note that cocoa futures and sugar futures have moderated to promising levels (albeit still elevated from pre-pandemic levels), particularly for forward contracts between July 2024 and September 2025, with HSY likely to benefit with improved gross profit margins moving forward.

Good news indeed.

Growing Risks In HSY's Salty Snack Segment

Despite so, readers must note that HSY continues to face demand softness in the North America Salty Snacks segment, with minimal volume growth of +0.2% YoY, though partly offset by higher prices by +1.7% YoY in FQ1'24.

As reported by the management, SkinnyPop's (popcorn) sales decline by -11% YoY has negated the robust growth observed in Dot's Homestyle Pretzels by +11.9% YoY.

Combined with the intensified advertising efforts and supply chain issues, it is unsurprising that HSY's North American Salty Snacks segment has been a bottom-line drag with operating margins of 14.1% (+9 points QoQ/ -3.2 YoY), well negating the robust growth observed in the Confectionary segment.

While we have previously been highly optimistic about its salty snacks diversification, it appears that it may be more prudent to give the management a little more time to integrate its new acquisitions into the legacy operations.

Readers must also note that the king of convenience food, PepsiCo (PEP), has reported that more US consumers are pulling back from discretionary spending and increasingly switching to cheaper "store brands in the face of higher prices," with near-term headwinds likely to persist, for so long that the macroeconomic environment remains uncertain.

As a result, HSY investors may want to temper their near-term expectations.

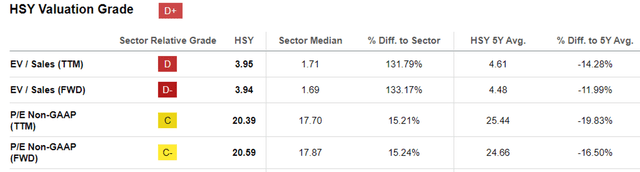

HSY's Discounted Valuations Appear To Be Fair

HSY Valuations

And it is for these reasons that we believe HSY's discounted valuations at FWD P/E of 20.59x appear to be attractive, compared to the previous article at 21.01x, the 1Y mean of 22.57x and 3Y pre-pandemic mean of 23.03x.

At the same time, HSY remains reasonably valued compared to its direct confectionary/ salty snack peers, such as Mondelez (MDLZ) at FWD P/E valuations of 19.56x and PepsiCo at 21.17x.

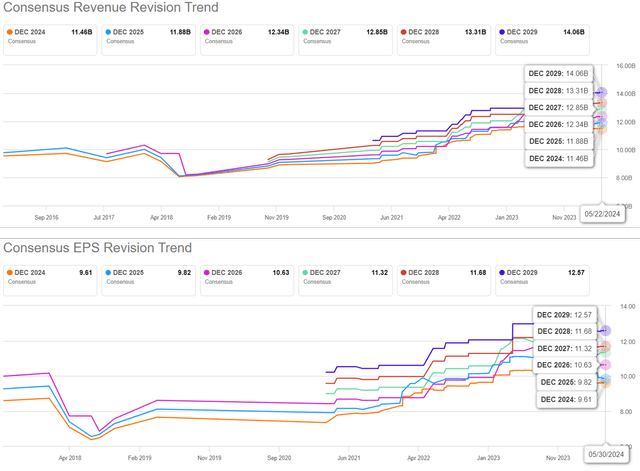

The Consensus Forward Estimates

This is because HSY is expected to generate a stable top/ bottom line growth at a CAGR of +3.4%/ +3.5% through FY2026, compared to MDLZ at +3.9%/ +8.1% and PEP at +4.1%/ +7.5, implying that HSY's discounted valuation is reasonable indeed.

This is especially since HSY remains more than capable in monetizing its branded confectionary offerings, as observed in the growing volumes and improving bottom lines, despite the headwinds observed in the salty snacks.

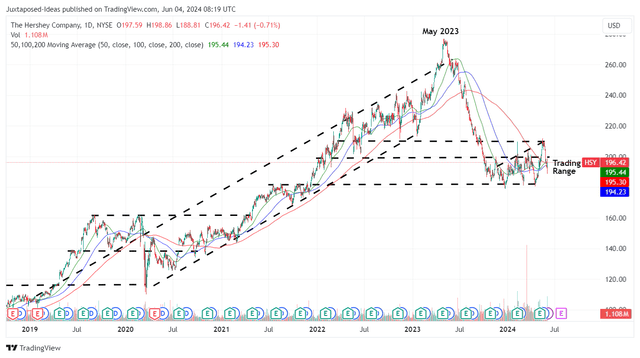

HSY 5Y Stock Price

For now, HSY continues to trade sideways since October 2023, though the established support levels of $181s and the ascending resistance levels (last observed at $210s in mid May 2024) imply growing bullish support.

With our fair value of $193.50 and our long-term price target of $252.50 remaining consistent since our last coverage in March 2024, we believe that there remains great opportunities for those looking to add.

This is especially since patient investors will be paid to wait with expanded forward dividend yields of 2.77%, compared to the 4Y average yield of 1.95% and the sector median of 2.79%.

As a result of the excellent dual pronged return prospects through capital appreciation and dividend incomes, we are maintaining our Buy rating for the HSY stock.

Based on the established trading pattern, investors may consider waiting for another retracement while adding at its support levels of $181s for an improved margin of safety.