Sean Anthony Eddy/E+ via Getty Images

Pinnacle West (NYSE:PNW) services Phoenix and the surrounding areas, which is one of the highest growth markets in terms of energy demand. We believe the growing demand will lead to substantial capital outlay and that the larger rate base will result in materially higher earnings per share. Despite potential for outsized growth, PNW trades at the low end of its peer set on price to earnings and EV/EBITDA. With its superior combination of growth and value, PNW is positioned to outperform.

We shall begin with a discussion of the demand drivers in PNW's service territory and follow with how that translates to growth on a per share basis.

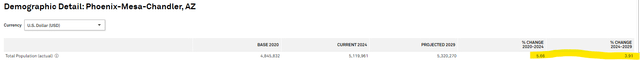

Phoenix is booming

Between 2020 and 2024, the U.S. population is growing by 1.42%. Phoenix is on pace for 5.66% population growth in that same period.

S&P Global Market Intelligence

Population is flowing to Phoenix because jobs are flowing to Phoenix. Per the Portfolio Income Solutions jobs and demographics tables, employment in Phoenix has grown by 10.2% since 2020.

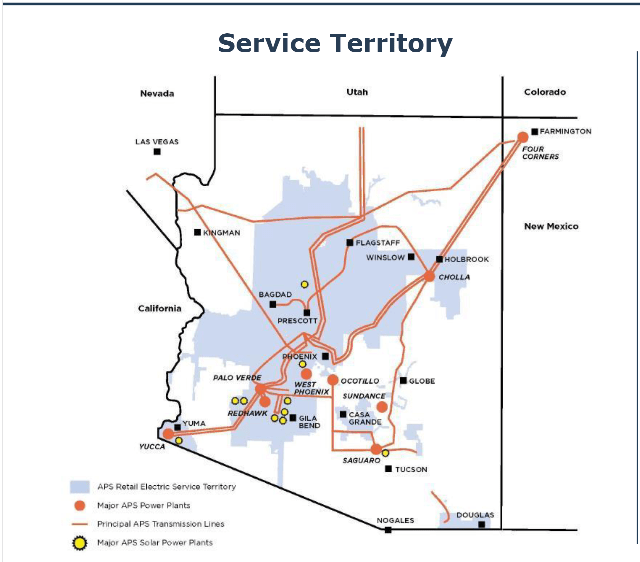

Pinnacle West, through their APS division, is the primary electric utility of Arizona and particularly the Phoenix area.

PNW

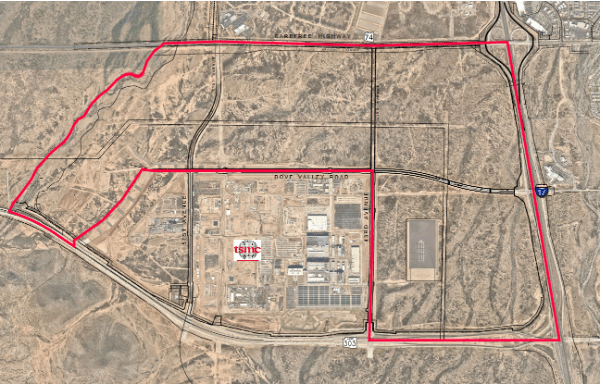

Right in the heart of their service territory is the Taiwan Semiconductor (TSMC) fabrication plant.

Google Maps

The plant itself will be using enormous amounts of electricity, but it is also inspiring massive development in the surrounding acres.

Mack Real Estate Group is executing a $7B development on the 2300 acres surrounding the fabrication plant.

Commercial Research

Between TSMC and the surrounding development, an additional 90,000 jobs are expected to be created in Phoenix.

In a recent article on the utilities sector, we discussed that the main drivers of electricity demand growth are:

- Population growth

- Manufacturing growth

- Data centers

Phoenix is well above the national average on all 3.

As the primary provider of electricity for the territory, the growth should accrue to PNW.

Pinnacle West's growth pipeline

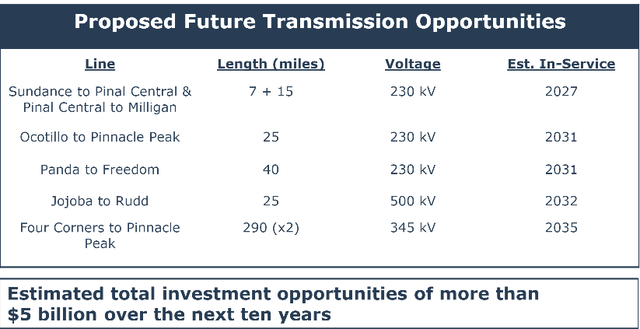

Higher demand will require both more generation and more transmission to keep everything running smoothly. PNW has both transmission assets and generation assets in its pipeline.

It expects to build over $5B of transmission assets over the next 10 years.

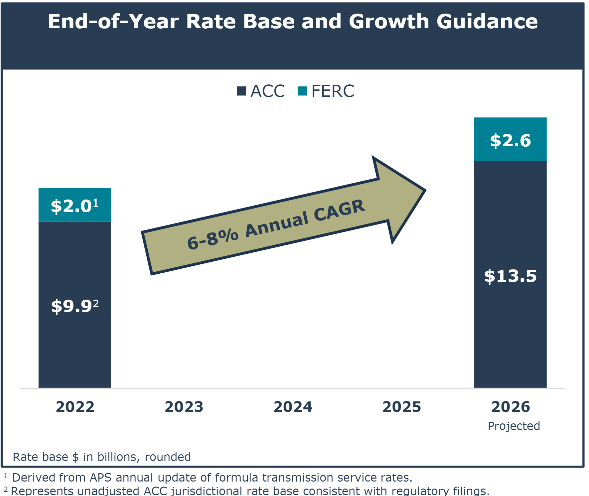

On the capital projects front, PNW's pipeline measures $7.8B by 2026.

Due to the regulated return on equity of utilities, new investments of this nature are underwritten to a certain level of profitability. For PNW, its electric assets have ROEs in the mid-9s and its gas has ROEs in the mid-10s.

There are multiple rate cases in progress to adjust revenues upward moderately to reflect the higher cost of capital environment.

Thus, PNW's growth should come from 3 sources:

- Positive adjustments from rate cases (small amount of growth)

- Increased rate base (substantial growth)

- Operating cost efficiencies (growth on existing assets)

The bulk of PNW's growth is likely to come from the new capital projects, increasing its rate base. Given the current pipeline, its rate base is expected to grow to $16.1B in 2026 from $11.9B in 2022.

PNW

That is 35% growth in its rate base.

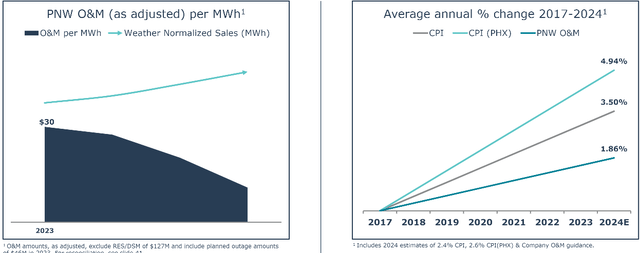

Operating costs are likely to grow significantly less than 35% due to efficiencies of scale.

Efficiency of scale

At $19.3B enterprise value, PNW is significantly smaller than its utility peers, which tend to be more in the $40B-$240B range. It has not yet reached full efficiencies of scale. As it grows, there is still room for operating cost efficiencies that come with scale.

PNW has already made significant cost improvements with operating and maintenance expense going up 1.86% annually in the last 7 years compared to CPI inflation increasing 3.5% annually.

However, there are still significant efficiencies to be achieved, and the large growth pipeline will help with the scale aspect of it.

Track record and operational competence

Regulation of utilities makes them a different sort of industry. Growth does not require brilliant ideas, rather it is the environment that determines how much demand will grow.

Phoenix happens to be one of the best environments in which to operate an electric utility, as forward electricity demand growth looks to be substantially higher than other markets. The opportunity is there and given the natural monopoly of electric utilities, all PNW has to do is not screw up.

In other words, their territorial advantage is maintained by demonstrating competence in providing its customers with reliable and affordable electricity.

So far, PNW seems to be doing a reasonably good job.

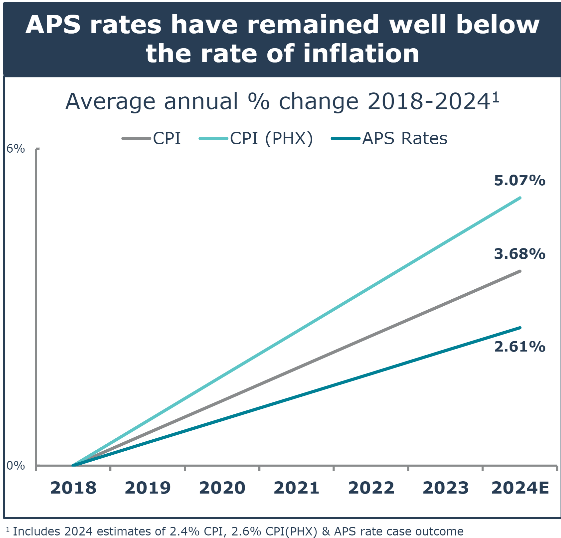

The national average cost per kWh is 16.68 cents. Arizona is a bit cheaper at 14.95 cents per kWh. The rate of cost increases has also been favorable to customers, with PNW charging only 2.61% more annually for the last 6 years, which is significantly below inflation.

PNW

Doing a good job for its customers helps maintain PNW's territory and even opens the doors for territorial growth.

From an investor standpoint, we also want to make sure the company knows how to translate asset growth into value for shareholders. In this regard, PNW's track record also looks solid.

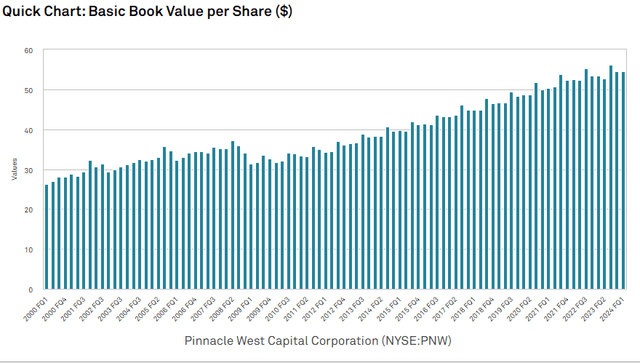

Book value per share has been rising consistently.

S&P Global Market Intelligence

Dividends have been increasing steadily for decades.

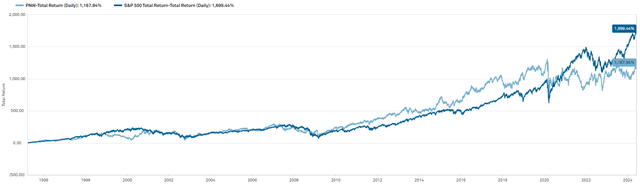

With exception to the post 2020 era, long-term total shareholder returns have been fairly good

S&P Global Market Intelligence

PNW was actually outperforming the S&P until 2020 from which point it has declined while the S&P surged.

I find this window of time fascinating because of the disparity between fundamental performance and market price performance.

Pinnacle West as a company just kept doing its slow and steady utilities thing.

S&P Global Market Intelligence

- Revenue kept growing

- EBITDA kept growing

- Cashflow per share kept growing

- Dividends per share kept growing

And yet, the stock price languished.

Essentially, valuation has gotten far more favorable, which makes me believe this is a great time to get in. Not only have forward growth prospects improved markedly with the industrial boom in Phoenix, but one can buy PNW at lower than normal multiples.

Valuation

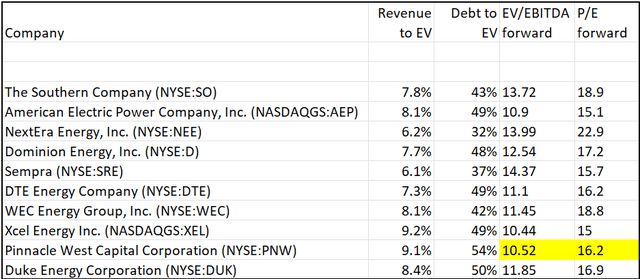

Within the Utility peer set, PNW is among the cheapest.

2MC with data from company filings and S&P Global Market Intelligence

PNW is trading at 10.52X forward EBITDA, compared to the sector average of 12.08. It is at 16.2X forward earnings, compared to 17.29X for the sector.

Given that PNW's service territory has faster demand growth than that for most of the other utilities, I find the discount at which it trades opportunistic.

Risks to investment

All the standard risks that would apply to regulated utilities are relevant for PNW, but for the sake of providing fresh information, I want to talk about the risk more specific to PNW: Fresh water availability.

While Phoenix is booming right now, there is a looming concern about the availability of fresh water to the area. City infrastructure engineers would be much more capable than I am of anticipating when or if this becomes a major threat to the city's growth, so I'm not going to speculate on the outcome. I merely wanted to make it clear that limited water supply could be a factor mitigating electricity demand growth in PNW's area.

The Bottom Line

PNW strikes me as a fairly standard utility company, but its stock has become opportunistic for 2 reasons:

- It is trading cheaper than usual

- The growth outlook is stronger than usual

Overall, I think it is positioned to outperform the market.

The REIT market has gotten egregiously underpriced making it a great time to get in to the right REITs. To help people get the most updated REIT data and analysis I am offering 40% off Portfolio Income Solutions, but you can only get it through this link.

https://seekingalpha.com/affiliate_link/40Percent

I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic REITs.