ElenVD/iStock via Getty Images

By Scott Kennedy; Produced with Colorado Wealth Management Fund

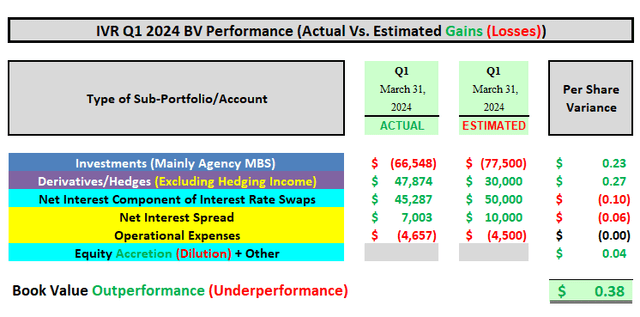

A modestly outperforming quarter regarding Invesco Mortgage’s (NYSE:IVR) BV fluctuation, in my opinion. First, IVR slightly decreased the company’s on-balance sheet fixed-rate agency MBS portfolio. This included a modest decrease to the company’s agency residential MBS sub-portfolio, while starting a very small agency commercial MBS sub-portfolio. In comparison, I projected a minor portfolio increase. This resulted in some BV outperformance when compared to my expectations (lower portfolio size as MBS pricing decreased during the quarter).

Second, unlike most sub-sector peers, IVR increased the company’s derivatives sub-portfolio during Q1 2024 via adding some interest rate payer swaps. In comparison, I projected a minor derivatives decrease. This also resulted in some BV outperformance when compared to my expectations due to the net increase in rates/yields.

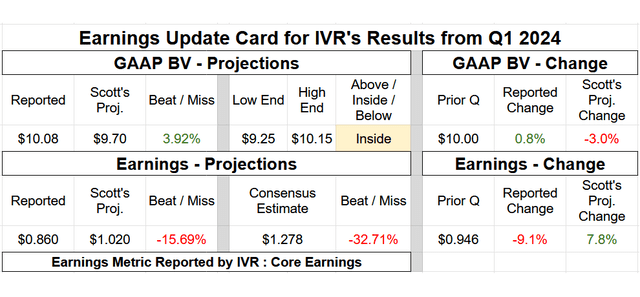

However, a modest – notable underperformance regarding IVR’s core earnings/EAD in my opinion. This was the 2nd consecutive quarter this metric was a disappointment. Let us briefly discuss this underperformance. First, as noted above, IVR’s total investment portfolio size was a bit smaller when compared to my expectations. However, on top of this fact, IVR’s portfolio yield decreased (0.01%) during Q1 2024 which was simply lower versus my projection (5.41% versus 5.55%). This negatively impacted IVR’s net interest income when compared to my expectations.

Second, with the aforementioned increase in IVR’s interest rate payer swaps (which increased the weighted average fixed pay rate), the company’s current period hedging income came in lower versus my expectations ($45 million versus $50 million). Third, IVR’s operational expenses came in largely as expected.

So, a good quarter regarding IVR’s quarterly BV fluctuation (basically at the sub-sector average; better than my expectations) while the company’s core earnings/EAD continued to quickly decline (more severe decrease versus sub-sector peers).

A risk/performance rating of 4.5 for IVR remains appropriate in the current environment/over the foreseeable future (“higher-for-longer” regarding rates/yields).

BV Performance (Actual Vs. Estimated)

Change or Maintain

- BV/NAV Adjustment (BV/NAV Used Interchangeably): Our projection for current BV/NAV per share was adjusted: Up $0.35 (To Account for the Actual 3/31/2024 BV/NAV Vs. Prior Projection). Price targets have already been adjusted to reflect the change in BV/NAV. The update is included in the card below and the subscriber spreadsheets.

- Percentage Recommendation Range (Relative to CURRENT BV/NAV): No Change.

- Risk/Performance Rating: No Change. Remains at 4.5.

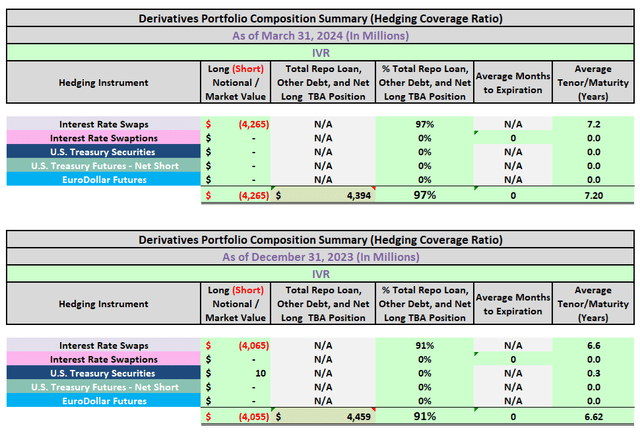

Hedging

- Hedging Coverage Ratio: Increase from 91% to 97%.

Earnings Results

Note: BV at the end of the quarter. Subscriber spreadsheets and targets use current estimates, not trailing values.

Ending Notes/Commentary

I would point out that I/we already have IVR priced at a discount to basically all of the company’s agency mREIT sub-sector peers. I continue to believe this discount is appropriate when compared to the better-run, over the long-term, mREIT sub-sector peers. During the trailing 24 months, IVR has continued to suffer the most severe decrease in both BV and economic loss (change in BV and dividends received) out of the 20 mREIT peers I/we currently cover. This is not a good distinction/trend to have. This even factors in IVR’s very strong core earnings performance during 2022 – third quarter of 2023 (which positively impacts BV). One also has to consider IVR’s notable dividend reduction from $0.65 to $0.40 per common share starting in Q1 2023. BV losses, especially on prior disposed/sold investments, directly equates to a permanent loss of shareholder value.

IVR currently does not present “good” value. At the time of publishing, IVR is at the high end of our fair value range. I continue to believe the near-term environment remains fairly challenging for the agency mREIT sub-sector (though should gradually improve looking into 2025 and beyond). April 2024 has proven this assumption correct regarding modestly notably decreasing BVs via a quick rise in spread/basis risk. Some of this has re-traced during May 2024 (through 5/17/2024). Instead of looking at IVR as a potential investment, I would continue to look for a mREIT sector/sub-sector peer who currently has a more attractive valuation and risk/performance rating.

Want the best research? It’s time to raise your game. Get access to several features you won’t find on the public side.

You can get access to everything we have to offer right now. Try our service and decide for yourself.