georgeclerk

QOE Capital - Co-Authored by Analyst Antonio Mello

Investment Thesis

BlackRock (NYSE:BLK) is one of the world's preeminent asset management firms, premier provider of investment management, and leading providers of investment, advisory and risk management solutions. BlackRock seems poised to continue scaling its Assets Under Management, which ultimately drives large revenue growth for the firm. Additionally, its AUM allows for guaranteed revenue through its fixed management fees from its sticky customer base, while allowing for potentially larger revenue streams through its performance fees. If markets remain hot, BlackRock's investments are likely to deliver even stronger value for clients, in turn, potentially triggering performance-based fees.

While the company’s business model is intriguing, it is not enough to justify a buy rating on BlackRock. The company is witnessing most of its growth through their Assets Under Management expansion, however, this may already be priced in. Additionally, on a comparables analysis basis, BlackRock is trading at a high premium when compared to its competitors. While they trade at a premium, this can be overlooked as they typically outperform in expanding their AUM, which fuels top line growth, and are differentiated in their data and technology capabilities.

Additionally, BlackRock seems to be active in improving the business technologically and aiming to diversify its growth. Specifically, on July 1st, they launched an ETF that offers a 100% downside hedge. While there have been others in this market, BlackRock has the size and performance background to eventually gain faster than competitors. This is one of the many examples of BlackRock expanding and penetrating different revenue streams. BlackRock has also been active in improving the business, as it recently announced acquiring a data provider in Preqin, enhancing its data abilities.

Ultimately, our valuation points to a fair value in BlackRock’s share price indicating their AUM expansion may already be priced in, however, we believe that BlackRock is a strong hold, as the company seeks improvement across all of its segments and could benefit in a hot market from extra growth in performance fees and performing above market expectations.

Company Background

BlackRock was founded in 1988 by Larry Fink and colleagues, and was originally a risk management and fixed income asset manager, but has since grown into the world's largest asset management firm. Through various acquisitions, including Merrill Lynch Investment Management and Barclays Global Investors, BlackRock has grown in its offerings and services.

BlackRock played a significant part in advisory during the 2008 financial crisis as well. BlackRock now manages trillions in assets, offering a wide spectrum of investment products and services, covering its most notable mutual funds and ETFs to its Aladdin (Asset, Liability, Debt, and Derivative Investment Network) technology platform. Under Fink's leadership, BlackRock has maintained a continued driving of innovation.

BlackRock is the world’s largest asset manager in a highly competitive industry, featuring Vanguard Group, State Street Global Advisors (STT), Fidelity Investments (FNF), JPMorgan Asset Management (JPM), Goldman Sachs Asset Management (GS), PIMCO, Invesco (IVZ), Charles Schwab (SCHW), Amundi, and UBS Asset Management (UBS).

BlackRock has a very strong Economic Moat, which has allowed it to become the world’s leading asset manager. Specifically, Porter’s Five Factors outline this:

Bargaining Power of Buyers:

The bargaining power of the buyers is relatively high. Clients have considerable bargaining power since BlackRock’s big revenue driver is fee-based, particularly management. In Particular, Institutional investors have the ability to compress fees by threatening to withdraw their capital.

Bargaining Power of Suppliers:

BlackRock faces minimal pressure from suppliers due to the structure of its business and the high focus on in-house technological capabilities, particularly its Aladdin platform.

Threat of New Entrants:

While high capital requirements and regulatory barriers make entry into this industry tougher, the advancement of certain technologies have lowered entry barriers in certain segments of the industry. While new entrants have lowered barriers to entry, BlackRock’s performance and marketing have minimized this threat from posing significant problems.

Threat of Substitute Products:

The threat of substitute products is moderate, as automated investing platforms, direct indexing, and alternative investment options pose a challenge to asset management services.

Rivalry Among Existing Competitors:

The asset management industry is highly competitive, with a large quantity of numerous massive players aiming to capture market share. This is largely indicative to their revenue, as they are fee-based. AUM expansion is highly competitive and has pushed for innovation among the competition to capture it.

Overview of Forces:

Overall, BlackRock leads a challenging competitive landscape, with notable possible pressure from buyers and ongoing evolution in investment products and services. However, its size, brand recognition, product diversity, and technological capabilities bolster it with competitive advantages that help minimize the threats that an asset manager faces. The company's ability to continue innovating and adapting to market trends will dictate whether BlackRock can maintain itself as the leader in a growing, competitive industry.

Key Considerations for Maintaining Position

BlackRock poses an interesting dynamic, while management is aiming to continue AUM expansion and innovation among its data-driven technology and acquisitions, it may already be priced in.

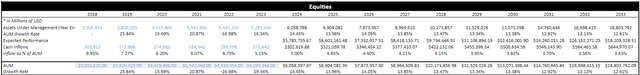

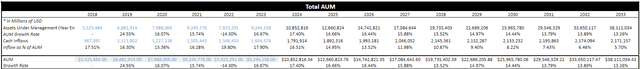

First, we will discuss BlackRock’s AUM expansion, as it is a large and accurate predictor of their top line growth. Over the last 5 years, BlackRock was able to nearly double their total AUM. This follows a trend of AUM growth at an accelerating rate over BlackRock’s existence. This logically makes sense, as they have been able to stand out from their competitors' performance and have drawn in more and more clients to their business from differentiation. Assuming that their growth continues at a similar rate, as they are the leader in this industry and thus may see a more stabilized growth, their expansion could follow a somewhat similar pattern, which will in turn increase their top line as their revenue is largely tied to their AUM. While BlackRock’s AUM growth trajectory has been impressive and has led to revenue growth, this may be reflected in the share price already. The market may have anticipated this growth pattern, possibly limiting upside potential.

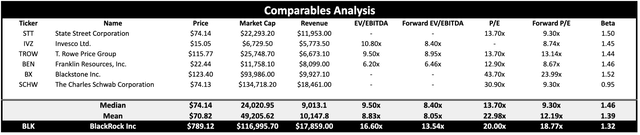

To assess this, we can compare BlackRock's forward P/E ratio to its historical average and industry peers. BlackRock has a forward P/E ratio of 18.77x compared to a historical P/E average of 15.86x across the last 50 quarters and a comps analysis mean of 12.19x. The forward valuation seems to exceed these benchmarks, possibly suggesting that the expected growth is already priced in. The trailing PE chart below further shows this multiple expansion over time.

Trailing PE Over Past 10 Years (Tickernomics)

Furthermore, while AUM growth has been a reliable predictor of revenue growth historically for BlackRock, fee pressure and market saturation could impact the strength of this correlation going forward.

Secondly, BlackRock is very active in improving its data and technology capabilities to drive investment decisions and open up new opportunities. BlackRock has consistently demonstrated a commitment to enhancing its data and technology capabilities, positioning itself ahead of the asset management industry's digital transformation. At the core is the continuing development of its proprietary Aladdin platform, which acts as both a powerful internal tool, as well as a revenue stream through offerings to other institutions. Not only does the company continue to internally improve Aladdin, but it also seeks out acquisitions to allow Aladdin to scale. Specifically, the company just announced the purchase of private markets data provider Preqin for approximately $3.2 billion in cash. Sudhir Nair, the global head of Aladdin, stated “Together with Preqin, we can make private markets investing easier and more accessible while building a better-connected platform for investors and fund managers”.

The firm has initiatives spanning the growing artificial intelligence and machine learning markets, as well as alternative data sources. Through acquisitions, partnerships, and investments in research and development, including the BlackRock Lab, the company aims to expand and maintain its market position.

This focus on tech and innovation will help fuel its AUM expansion by enhancing investment performance, improving risk management, creating innovative products, and increasing operational efficiency. BlackRock is well-positioned to adapt to evolving market headwinds in an increasingly technological industry.

Valuation Analysis

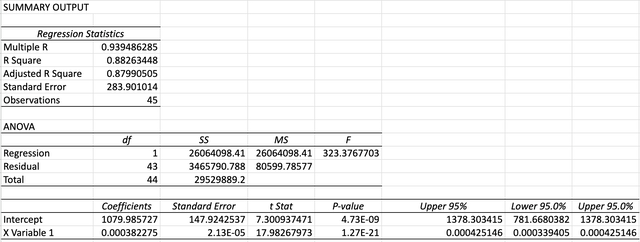

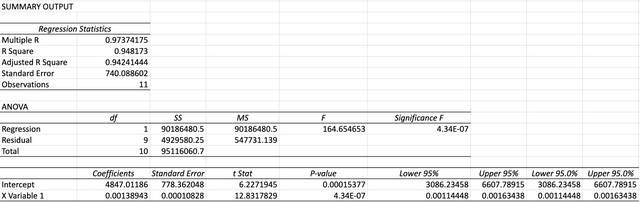

Before projecting revenue based on AUM, we decided to run both a quarterly and annual regression between revenue and AUM to determine how fit it would be. In our regression of AUM on quarterly revenue, we obtained an R2 of 88.26%, indicating that the model explains about 88.26% of the variability in the quarterly revenue.

By utilizing the quarterly revenue, we gathered enough data to ensure that this was a reasonable way to project future revenue. We also used an annual regression to project out revenue from AUM and achieved an even stronger R2 of 94.18%.

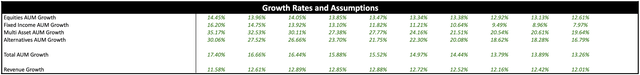

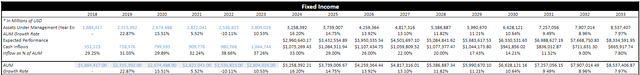

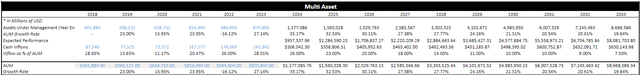

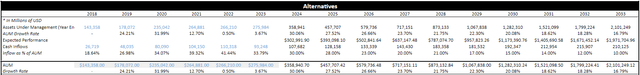

To project out AUM, we took an average of historical growth rates for each asset class in AUM, trimmed it down, and applied it into a Geometric Brownian Motion simulation to predict our expected performance. We also used the historic AUM growth to determine a standard deviation. For each year, we produced 10,000 standard normals, and took a fixed average of the standard normals, and applied them to the appropriate year.

The expected performance row in the 5 tables below reflects the expected end of year AUM using our simulated performance analysis before cash inflows. With our expected end of year AUM established, we added cash inflows to calculate a total projected AUM. To forecast cash inflows, we calculated the yearly cash inflows as a percentage of AUM. The AUM for each forecasted year then ends up equaling the performance adjusted AUM plus the inflows from the previous year.

QOE Capital QOE Capital QOE Capital QOE Capital QOE Capital

With AUM, we applied the appropriate coefficients from the annual regression to assume revenue growth.

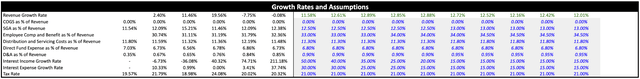

BlackRock’s costs as a percentage of revenue were very consistent historically, so we followed this trend and kept these costs in line with their trend.

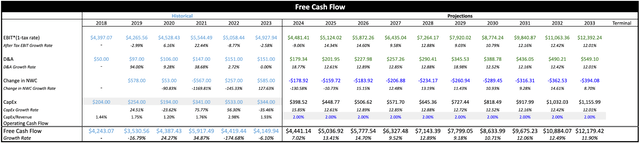

In calculating the Free Cash Flows, we kept Capital expenditures in line with a historical range and left it consistent at 2%. For the change in Net Working Capital, management has not strayed far from its successful strategy, and we attached the revenue growth rate to current assets and their AUM growth rate to the current liabilities.

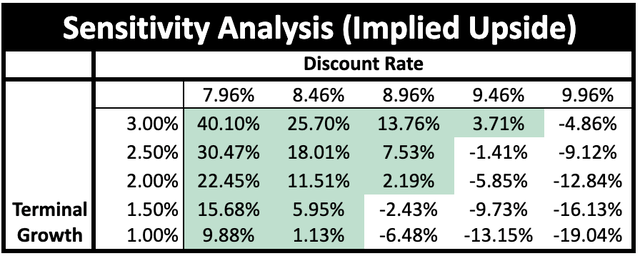

In discounting these future free cash flows, we discounted with a WACC of 8.96% to achieve an implied share price of $806.39 with an upside of 2.19%. Sensitivity analysis shows that the upside, however, is volatile regarding its WACC and terminal growth rate.

Our multiples valuation was weighted very lightly, particularly because BlackRock is differentiated and many of its competitors, like Fidelity Investments, Vanguard Group, and Capital Group are private.

We calculated a mean forward EV/EBITDA valuation of $498.32 and a mean forward P/E valuation of $231.12. Both indicate severe overpricing of the market, yet they are not representative of all of the companies and all of BlackRock’s true competitors, so we weighted the DCF valuation at 95% and the EV/EBITDA multiple valuation at 5% leading to an implied price of $790.98 and an upside of 0.24%.

Risks

The first major risk that BlackRock faces is market risk. As BlackRock’s revenue is heavily tied to its AUM, market downturns have significant implications for BlackRock. While BlackRock has some control in its AUM as it can influence larger inflows through higher performance, it is also dictated by overarching market conditions. In this case, bear markets pose a significant risk to BlackRock, as withdrawing funds can shrink their AUM and depress their fees and revenue. This risk is one that is impossible to eliminate and more difficult to minimize.

The second major risk that BlackRock faces is the rising competition in the industry. There are continuous pressures on fees as new asset managers enter the market and develop technologies. Specifically, automated investing platforms, direct indexing, and alternative investment options pose a threat to BlackRock. BlackRock will have to adapt and develop its data and technology to maintain its leading market position. New entrants and growing asset managers could also be a concern in compressing BlackRock’s fees as well.

Finally, the last major risk to consider with BlackRock is the reliance on its technology. The data and technology abilities that BlackRock possesses have been a key component in separating itself from its competitors. With this being said, as the world pushes towards digitizing more and more, cybersecurity threats pose a more severe issue. Particularly, BlackRock relies on its Aladdin platform operationally and as a revenue stream to be sold to other institutions. Cybersecurity threats or significant technological failures could disrupt operations and damage client trust.

Conclusion

BlackRock is a “hold” with its current position and the industry's headwinds. BlackRock maintains a favorable position currently as they are aiming to continue AUM expansion and innovation among its data-driven technology and acquisitions. As these are the big drivers in successful asset managers moving forward, BlackRock will be able to grow and maintain its dominance as the market leader, capturing new market share as the industry expands. While things look favorable, the market may already be expecting this and reflecting this growth in the current share price.

BlackRock’s forward P/E ratio is higher than historical ratios as well as the mean of its competitor’s ratios, indicating that much of its future growth could be accounted for. Additionally, BlackRock has developed a reputation within the industry and is considered to lead the growth in the industry by consensus, suggesting that expectations are built in as well.

We grade BlackRock a “hold” as the company still maintains and will continue to have a dominant position in this industry. Additionally, if markets continue to stay hot into the near future, BlackRock should benefit from the rebounding markets on top of its excellent performance.