Abstract Aerial Art

Public Service Enterprise Group Incorporated (NYSE:PEG) is the largest electric and natural gas utility in the heavily populated state of New Jersey. The company’s website describes it thusly:

Today, Public Service Enterprise Group Inc. is a diversified energy company headquartered in Newark, N.J. PSEG’s principal operating subsidiaries are: Public Service Electric and Gas Co., New Jersey’s largest provider of electric and natural gas service, PSEG Power and PSEG Long Island. PSEG has approximately 12,500 employees, who are carrying forward a proud tradition of dedicated service that has continued over more than 120 years.

The utility sector in general has been a favorite of retirees and other income investors for a long time due to the stable cash flows and large dividends that characterize the companies in this industry. Public Service Enterprise Group is no exception to this, as the company’s common stock yields 3.22% at the current price. This is higher than the 2.40% trailing twelve-month yield of the iShares U.S. Utilities ETF (IDU), but admittedly, it is not particularly high when compared to some of the other utility companies that we have discussed in the past. For example, consider the following:

Company | Current Yield |

Public Service Enterprise Group | 3.22% |

DTE Energy (DTE) | 3.51% |

Edison International (EIX) | 4.16% |

CMS Energy (CMS) | 3.36% |

FirstEnergy Corp. (FE) | 4.29% |

Eversource Energy (ES) | 4.68% |

As we can see, Public Service Enterprise Group has a significantly lower dividend yield than some of its peers. This might reduce the company’s appeal among those investors who are seeking to maximize the income that they receive from the assets in their portfolio. The fact that Public Service Enterprise Group increases its dividend every year might help to improve it in this respect, though, since that means that anyone who purchases the stock today will end up earning a significantly higher yield on their initial investment after only a few years. However, most utilities increase their dividends annually, so this is hardly a unique selling point for Public Service Enterprise Group. The fact that the company has a lower yield than its peers is not necessarily a sign that it will prove to be a poor investment, though, so we should not stop our discussion of the company at this point.

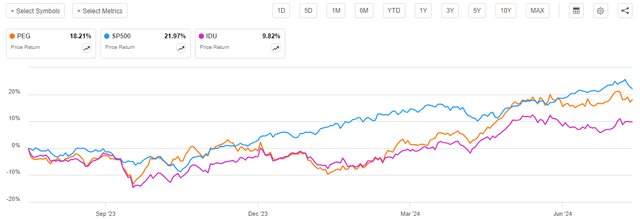

As regular readers might recall, we previously discussed Public Service Enterprise Group in August 2023. At the time, I showed that the company was on the path of delivering growth to its investors at a reasonable pace, but it was also extremely expensive compared to its peers. Interestingly, the company’s stock has performed very well since that date. The stock price is up 18.21% since that article was published, which is only slightly worse than the S&P 500 Index delivered over the same period:

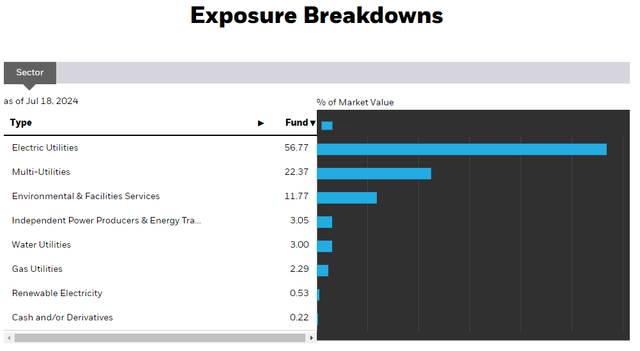

Public Service Enterprise Group did substantially outperform the utility sector as a whole, but that is not surprising. I have discussed in a few previous articles the struggles that many renewable energy companies have been having in the current monetary environment. For example, yesterday, SunPower Corporation (SPWR) announced that it stopped most of its operations, which caused analysts to begin predicting the company’s demise. The iShares U.S. Utilities ETF (IDU) includes renewable energy companies along with companies providing environmental services to the utilities industry:

Thus, it seems probable that the poor performance of some of these companies has been dragging down the performance of the index as a whole. The above sector allocation states that only 0.53% of the index currently consists of renewable energy companies, but the figure was far higher than that a few years ago when the “green energy bubble” was in full force. As such, there is every reason to assume that properly run traditional utilities such as Public Service Enterprise Group would outperform the broader sector index.

Interestingly, when we consider the dividends that Public Service Enterprise Group has paid out, we see that it has actually outperformed the S&P 500 Index since my previous article on the company was published:

This is quite surprising to say the least, as there was a good deal of chatter in the financial media last year and early this year about how utility stocks were performing poorly. Admittedly, though, we do see that Public Service Enterprise Group did underperform the S&P 500 Index during the first four months of 2024. The recent rally is probably because the market is now expecting a 90% chance of an interest rate cut in September. The acceleration in the year-over-year rate of change in the core producer price index so far this year suggests that any interest rate cut could be a foolish decision, but the Federal Reserve does seem to be determined to lower interest rates this year, so it is a possibility. Utility stocks such as Public Service Enterprise Group frequently trade similarly to bonds due to their relatively low growth and higher-than-average yields, so interest rates are relevant to predicting the stock price performance of a company such as this.

About Public Service Enterprise Group

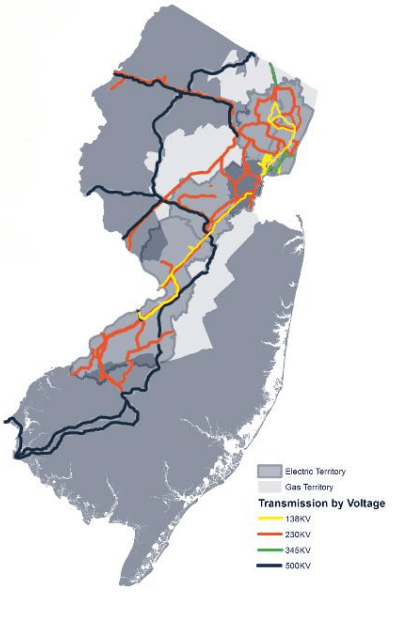

As mentioned in the introduction, Public Service Enterprise Group is the largest utility company in the highly populated state of New Jersey. The company’s service territory covers most of the state, at least when it comes to electricity:

Public Service Enterprise Group

We can see that its gas distribution territory is not nearly as large, although it still covers a sizable swath of the state. This would probably lead one to expect that the company’s electric utility is larger than its gas utility. This is the case, but the difference is not as great as might be expected. As of December 31, 2023, Public Service Enterprise Group served approximately 2.4 million electric and 1.9 million natural gas customers. Thus, its natural gas customer count is only 20.8% smaller than its electric one. That is not what we would have expected based solely on the map that is provided above.

We do see that the company’s customer count has increased slightly since the last time that we discussed the company. The company’s electric customers went from 2.3 million to 2.4 million over the course of 2023, which is a 4.3% growth rate. That is substantially above the 0.9% five-year average annual growth rate that the company stated previously. It is also well above the population growth rate of the state of New Jersey. The U.S. Census Bureau states that New Jersey’s population is only growing at a 0.32% growth rate. Thus, it is very surprising that the company managed to increase its electric customer base so substantially over the course of 2023. It is possible that some of this came from commercial entities, but that would require that a lot of businesses opened up in New Jersey in the past year. I can find nothing supporting that hypothesis in a search of publicly available information, so it seems likely that the company benefited from people relocating from areas of New Jersey that are outside of its service territory to areas inside of it.

The company’s gas customer base remained stable at approximately 1.9 million over the course of 2023. That is more in line with the demographics of New Jersey as a whole, and is therefore very unsurprising. The company claims that its gas customer base has grown at a 0.6% compound annual growth rate over the past five years, though, which is about twice the population growth rate of the state. This could be driven by housing construction inside of the company’s service territory, which is causing net migration into the company’s service territory. It could also be caused by the company expanding its territory somewhat and connecting housing plans that previously had no natural gas service to its network.

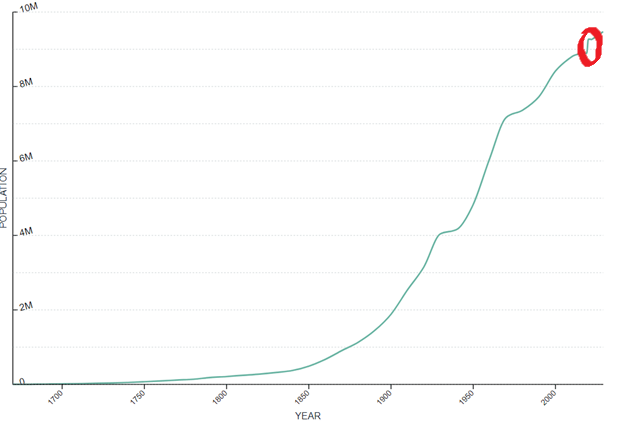

It is also possible that the company’s reported five-year customer growth rates (0.9% for electric and 0.6% for natural gas) are artificially high due to a one-time inflow of people that occurred during 2020. As we can see here, New Jersey’s population increased by approximately 400,000 people in 2020:

World Population Review

During the pandemic, it was not at all uncommon for people to move away from big cities (New York City and Philadelphia in this case) to suburban or even rural areas. This could be the driver of the New Jersey population increase. The inflow of new customers almost certainly resulted in a large one-time increase in that year, and that raises the reported average customer growth rate for any time period that includes 2020. Thus, the company’s growth rate in a normal year might not be as high as the company’s reported growth rate suggests. It is still likely that it is positive, though, as New Jersey is a growing state population-wise.

To paraphrase a statement that I made in the previous article on Public Service Enterprise Group:

As anyone reading this will likely point out, the growth that the company is generating simply by increasing its customer count is insufficient to excite any investor. Thus, the company needs to have a way to grow its revenue and profits more rapidly than its customer base. One way that it can do this is by growing its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base allows the company to increase the prices that it charges its customers so that it can earn that allowed rate of return. The usual way for a utility to increase the size of its rate base is by investing money into upgrading, modernizing, and possibly even expanding its utility-grade infrastructure.

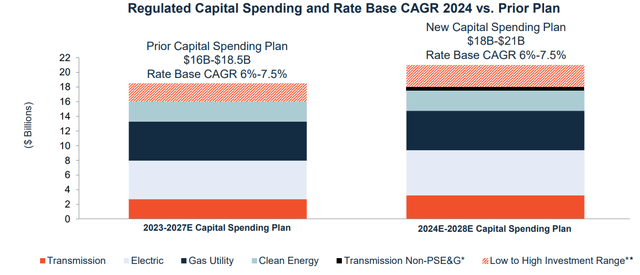

In the previous article, we saw that Public Service Enterprise Group was planning to invest between $15.5 billion and $18 billion into its infrastructure over the 2023 to 2027 period. The company has since increased that original amount to $16 billion to $18.5 billion for the 2023 to 2027 period. It also gave us some idea of what it is planning for 2028:

Public Service Enterprise Group

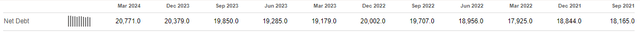

As we can see here, the company’s new proposed capital spending plan calls for it to spend $18 billion to $21 billion over the 2024 to 2028 period. This is a clear increase over the previous plan, but we can see that it will not increase the compound annual growth rate of the rate base. This is normal because any capital spending that it does in one year increases the rate base for the following year. Thus, in order to maintain the same growth rate in percentage terms, the company must increase its capital spending every single year. This is one reason why the company’s net debt has been consistently increasing over the past few years:

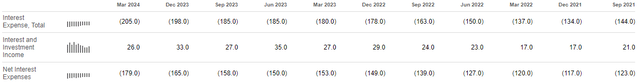

This is probably not the kind of thing that anyone wants to see, given the fact that interest rates increased over the same period as shown in the chart. The company’s net interest expenses have climbed from $123.0 million in the third quarter of 2021 to $179.0 million in the most recent quarter:

This has naturally been a significant drag on the company’s net income growth. The company itself notes this in the first-quarter 2024 earnings press release:

PSE&G’s first quarter results benefited from growth in investments with current rate recovery in Transmission, which were offset by higher depreciation and interest expense associated with Electric and Gas distribution investments awaiting rate recovery in our pending rate case, as well as higher O&M costs and the cessation of OPEB related credits compared with the first quarter of 2023.

The company will probably benefit once interest rates start coming down, as it can refinance any high-rate debt that it took on over the past few years into lower-rate debt. As mentioned in the introduction, the Federal Reserve seems to be determined to cut interest rates this year, regardless of whether or not it risks restarting the inflationary problems that the original interest rate hikes intended to prevent. If this proves to be the case, then we could see a boost to the company’s earnings in 2025 simply because its interest expenses will have less of a drag on its net income. That is probably what the market expects, and it is why the stock price has performed so well compared to other utilities over the past year.

Financial Considerations

As I stated in the previous article on Public Service Enterprise Group:

It is always important to investigate the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is normally accomplished by issuing new debt and using the proceeds to repay the existing debt as very few companies have the ability to pay off their debts with cash as they mature. Since new debt is issued with an interest rate that corresponds to the interest rate in the market at the time of issuance, this process can cause a company’s interest expenses to increase following the debt rollover. This is an especially big concern today due to the fact that interest rates in the United States are currently at the highest levels that we have seen since 2001. In addition to interest-rate risk though, there is also the fact that a company will need to make regular payments on its debt if it is to remain solvent. As such, an event that causes a company’s cash flow to decline could push it into financial distress if it has too much debt. Although utilities like Public Service Enterprise Group tend to have remarkably stable finances over time, there have been bankruptcies in the sector before so this is not a risk that we can ignore.

As regular readers are likely well aware, the usual way in which we determine whether a company’s financial structure is reasonable or not is by comparing its net debt-to-equity ratio to its peers. A company whose ratio is substantially higher than its peers could be using too much debt in its financial structure.

As of March 31, 2024, Public Service Enterprise Group had a net debt of $20.7710 billion compared with $15.7180 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.32 today, which is quite a bit higher than the 1.27 ratio that the company had the last time that we discussed it. This could be problematic, as the company’s leverage is moving in the wrong direction during a period of elevated interest rates.

Here is how Public Service Enterprise Group compares with its peers:

Company | Net Debt-to-Equity Ratio |

Public Service Enterprise Group | 1.32 |

DTE Energy | 1.93 |

Edison International | 2.02 |

CMS Energy | 1.76 |

FirstEnergy Corp. | 1.74 |

Eversource Energy | 1.91 |

(all figures as of March 31, 2024)

As we can see, Public Service Enterprise Group appears to be considerably less leveraged than its peers. This is similar to the situation that we saw the last time that we discussed this company. We do see, though, that most of these companies increased their net debt-to-equity ratios over the period. The debt increase is not limited to this company alone. Overall, this is not the best sign for utilities in general, as we should be cautious about companies that take on more debt in a time of high interest rates. However, due to the fact that these companies need to keep increasing their rate bases in order to grow their earnings, it is completely understandable.

Overall, Public Service Enterprise Group appears to be okay due to the fact that it is less leveraged than any of its peers. We should still be somewhat cautious about the company, though, and we should keep an eye on its borrowings to try and make sure that it does not keep moving in the wrong direction.

Valuation

According to Zacks Investment Research, Public Service Enterprise Group currently trades at a price-to-earnings growth ratio of 2.95. Here is how that compares to the company’s peers:

Company | PEG Ratio |

Public Service Enterprise Group | 2.95 |

DTE Energy | 2.11 |

Edison International | N/A |

CMS Energy | 2.44 |

FirstEnergy Corp. | 2.51 |

Eversource Energy | 2.35 |

(all figures from Zacks Investment Research)

Unfortunately, we see here the same problem that we saw the last time that we discussed Public Service Enterprise Group. The company appears to be substantially overvalued compared to its peers. This is obviously and almost certainly due to the very strong performance that the stock price has delivered over the past year, especially when compared to other utility companies.

It might be best to wait until buying into this company.

Conclusion

In conclusion, Public Service Enterprise Group is a very well-financed utility company that serves most of the state of New Jersey. While New Jersey is one of the most heavily populated states in the country, it is not one of the most rapidly growing states, and this has naturally proven to be a bit of a drag on the company’s earnings growth. This company is making up for that by investing heavily in its infrastructure network, and it has increased such spending compared to the prior year period. Unfortunately, the company also looks to be quite expensive right now, and so we should be cautious about purchasing it.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!