hapabapa

On the 18th of July, Taiwan Semiconductor Manufacturing Company (NYSE:TSM) (OTC:TSMWF), the principal foundry for both NVIDIA (NVDA) and AMD (AMD) chips, announced its Q2 results. At 673.51 billion New Taiwan dollars (NT$) in revenue versus expectations of NT$657.58 billion and a net income of NT$247.85 billion versus an expectation of NT$238.8 billion, it could be argued there is cause for cheer. However, an increasing number of investors have concerns for the sector as a whole.

Trend Drilldown

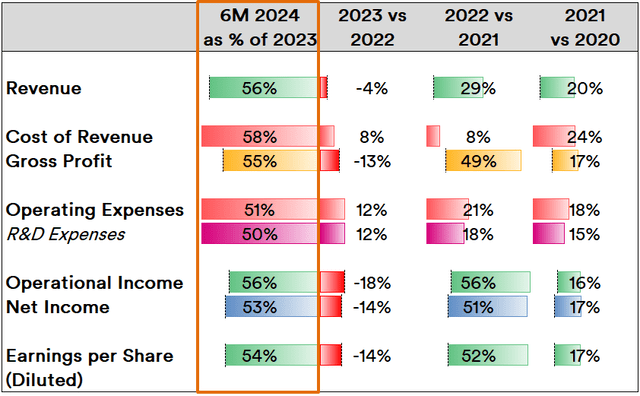

At first blush, the line item trends for the first six months of 2024 are generally positive with respect to the previous Fiscal Year (FY) 2023:

Source: Created by Sandeep G. Rao using data from TSMC's Financial Statements

If current trends were to continue, both revenue and earnings per share (EPS) can be expected to end 2024 at about 12% and 8% above those of 2023, respectively. With operating expenses only trending at a 2% excess in projections, the double-digit increase trend seen over the past three FYs could be ending. However, the cost of revenue is inching closer towards the Year-on-Year (YoY) increase last seen in 2021 and greater than the steady 8% increase seen over the past two FYs. This might have an impact on the current projections made on EPS and depress it lower.

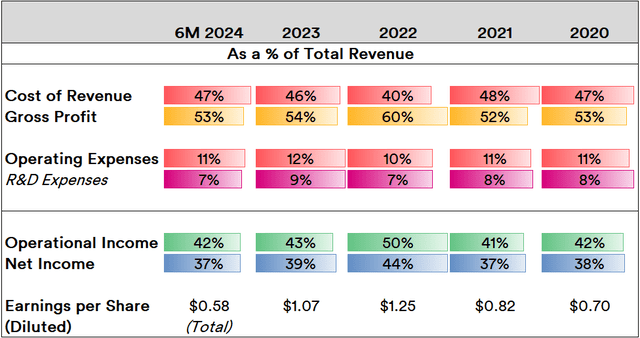

In terms of key line item relationship relative to total revenues, the year so far is very close to the performance seen in the previous year.

Source: Created by Sandeep G. Rao using data from TSMC's Financial Statements

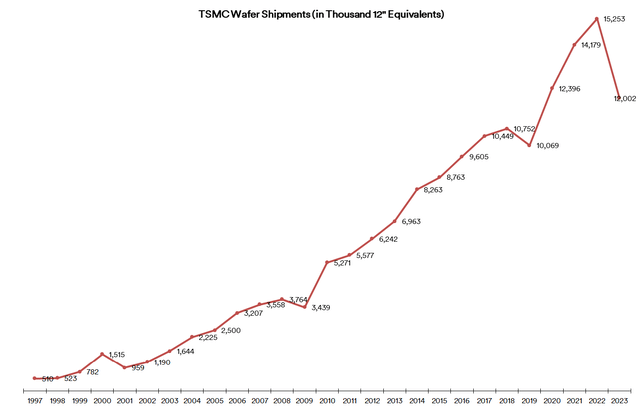

However, the impact on EPS by the end of the year remains dependent on the company's commitment towards evolution of output. As it stands, in terms of total wafer shipments, the company's shipment volumes decreased in 2023 relative to all-time highs seen in 2022.

Source: Created by Sandeep G. Rao using data from TSMC's Financial Statements

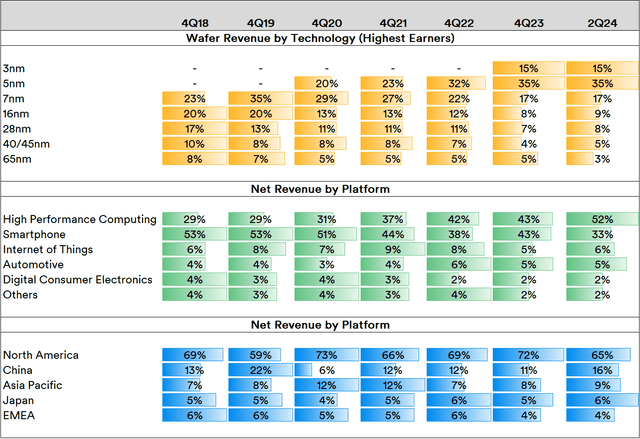

What propped up 2023 revenues, given decreasing overall shipments, is the evolution in product mix. The company's newly inducted 3nm ("3 nanometer") wafers were ready for shipments in bulk from 2023 onwards.

Source: Created by Sandeep G. Rao using data from TSMC's Financial Statements

The 3nm technology is highly prized as being the foundation of next-gen chips currently being sought by Apple (AAPL), Intel (INTL) and AMD: the A17 used in Apple's current-generation iPhone 15 Pro variants as well as the M3 chips in the MacBook are 3nm chips as are Intel's newest Meteor Lake mobile processors, and AMD's upcoming Zen 5 processors.

However, smartphone revenues have fallen by nearly 10% in overall revenue share relative to the end of 2023 while the share of computing processors have risen as a broad spectrum of the company's stable of technologies are used to build chips for data centers. In fact, Chairman and CEO C.C. Wei did address the relative lag in revenue contribution from the smartphone market as being due to "continuous smartphone seasonality".

Overall geographical trends remain stable, with North America contributing to nearly two-thirds of all revenue. China continues to exhibit continuance of a 3-year trend of increasing relevance for the company's revenues, while all other regions largely hold steady.

In the first half of this year, total wafer shipments are a little over 51% of 2023 levels, which suggests that there is a possibility of a slight improvement over the past year. However, given the rising share of the more expensive 3nm and 5nm technologies are being exported, overall revenues might close on par with or slightly better than those of 2022.

Market participants' behaviour with regard to the company's stock has some interesting variance by region.

Market Trends

The company's stock is originally listed in the Taiwan Stock Exchange with ticker code "2330" but is made available in U.S. bourses in much the same way as Chinese companies' shares are: the right to profits (as opposed to ownership) are vested into an "American Depositary Share" ("ADS", which is not the same as an American Depositary Receipt or "ADR") such that each ADS equals 5 shares.

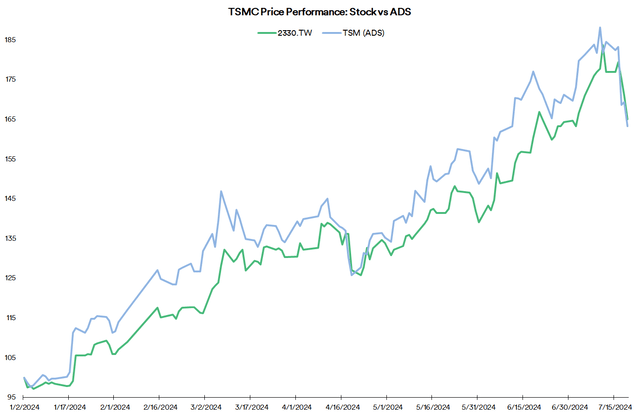

In the Year Till Date, the stock's performance has been generally more conservative than that of the ADS:

Source: Created by Sandeep G. Rao using data from Yahoo! Finance and Investing.com

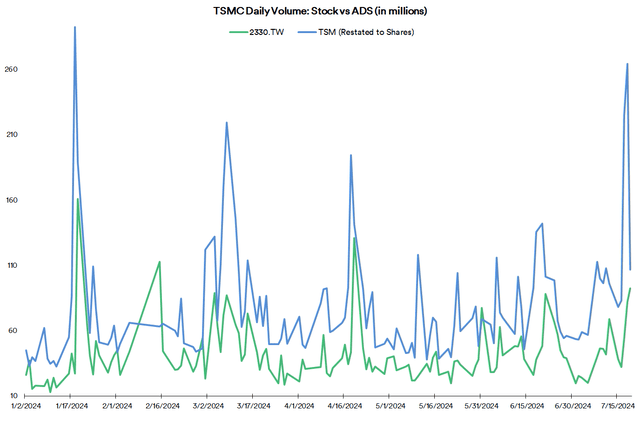

Relative to the ADS, the share's trajectory has been relatively more conservative, albeit highly correlated. When considering the daily volumes traded in the YTD, a significant underlying factor behind this disparity can be deduced:

Source: Created by Sandeep G. Rao using data from Yahoo! Finance and Investing.com

Upon "restating" ADS volumes to bring it on par with shares (by considering the trading of one ADS to be equivalent of trading 5 shares), it can be seen that considerably greater volumes are generally traded via U.S. bourses than are traded in the company's homeland. With greater volume comes greater momentum.

Despite relatively encouraging results for the first half of the year, market participants essentially turned on the stock in volumes a little before the earnings release. As of close on the 16th, the ADS outperformed the stock by 3.8% in YTD terms. As of the end of the week, i.e., the 19th, the ADS underperformed the stock by 1.7%. The greater the conviction, the greater the momentum regardless of direction.

The company's shifting product mix sees 3nm and 5nm technologies accounting for half of its revenue by the end of Q2, at the expense of nearly all other technologies. Both of these technologies are highly pertinent to AI-relevant data center infrastructure, which has enjoyed a massive boom in conviction for quite some time now.

Analysts now question whether this "boom" in investor conviction has gone too far.

Analysts Turn On AI Boom

By late June, a number of prominent financial advisors have been ringing alarm bells on the vast scale of AI-relevant investment which sees (among many others) Alphabet and Meta committing $48 billion and $35-40 billion in capital expenditures on the likes of chips, servers and data centers and Elon Musk's xAI - which has generated no business application yet - raising $6 billion in May alone.

Barclays research analyst Ross Sadler stated that large companies’ estimated AI investment in 2026 alone would be enough to “support the existing internet plus 12,000 new ChatGPT-scale AI products.” In other words, the data center capacities of Google, Meta, Microsoft, and Amazon at the time will exceed what people currently seem to ask of the internet. While Mr. Sadler concedes that incremental AI utilization will bring some new use cases to light, it most certainly wouldn't equal 12,000 new services.

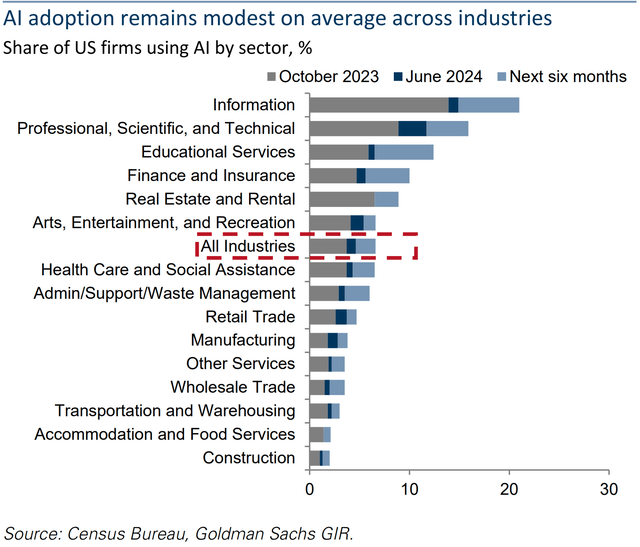

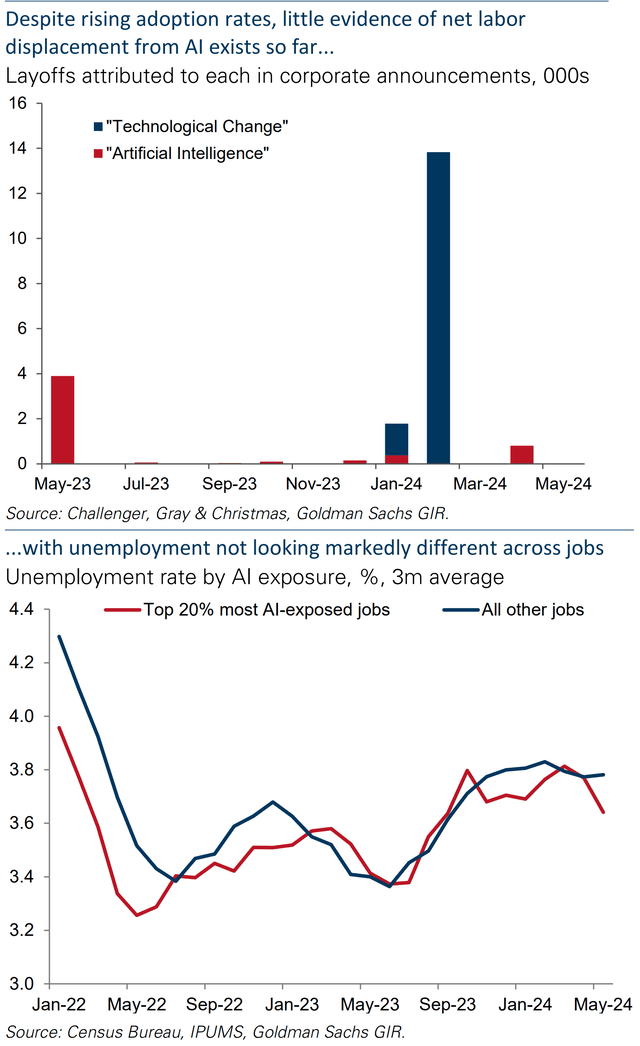

One great promise of AI would be the automation of low-wage jobs and subsequent cost savings. Jim Covello, Goldman Sachs’ head of global equity research, pointed out that, at current commitment levels, companies' investments wouldn't be recouped even if that were to hold true. Goldman Sachs' senior US economist Joseph Briggs, in the very same note that held Jim Covello's commentary, was relatively more bullish on AI and estimates that well under 10% of U.S. firms by sector use AI:

Source: Goldman Sachs

but agrees that the AI hasn't displaced a substantial volume of human labour:

Source: Goldman Sachs

Within this Goldman Sachs newsletter, a number of Goldman Sachs analysts quoted were relatively bullish on AI. However, Mr. Covello remained fairly unwavering: he estimated that the next several years will see $1 trillion in AI investment and asks, "What $1 trillion problem will AI solve?". He goes on to state a very fundamental "human" reason for the AI investment frenzy: FOMO (i.e., "Fear of Missing Out" for the uninitiated). Contending that "over-building" often tends to things ending badly, he stated that if AI tech doesn't have as many use cases as people expect, it will be "problematic for many companies spending on the technology today."

David Cahn, head of the growth team at venture capital firm Sequoia Capital - which partly funded Elon's xAI's $6 billion capital raise - contends that AI will continue to be a part of the economic engine in the years to come and considers the current investment cycle to be part of the "speculative frenzy" that is inherent within the tech industry. However, he deemed the idea of some companies (like Microsoft) stockpiling chips in anticipation of needing them later is a "delusion that has spread from Silicon Valley to the rest of the country, and indeed the world".

As analysts have begun to cool off over what AI will actually accomplish in light of where AI-relevant investment values and AI-related stock valuations have risen to, investors have been turning increasingly lukewarm to earnings news. This is why TSMC's earnings success didn't immediately translate to substantial bullish movement: in fact, the opposite occurred.

In Conclusion

TSMC Chairman and CEO C.C. Wei stated that it was very difficult to meet customer demand so far this year and that he's worked very hard to do so. He warns that supply constraints will continue through 2025 but will ease off by 2026. However, beyond not ruling out the conversion of 5nm production capacity towards producing 3nm technologies, he remained coy on whether any massive increments in capacity are being planned. Given his decades of experience in the industry, it's equally likely that he sees the FOMO subsiding or that he's keeping business plans a secret.

If the FOMO cools, TSMC's customers such as AMD and Nvidia might witness a massive decline in their sky-high valuations. However, given the fact that TSMC is integral to the manufacturing of so many companies' products, it stands to reason that its stock would be relatively less affected.

Thus, even if TSMC's earnings release didn't generate a massive bump, it's a viable "risk-off" from the potential bearish volatility inherent within the likes of Nvidia and AMD.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.