Chatchai Limjareon/E+ via Getty Images

Second quarter earnings reports from Prologis (PLD) and First Industrial (FR) suggest growth is returning to industrial.

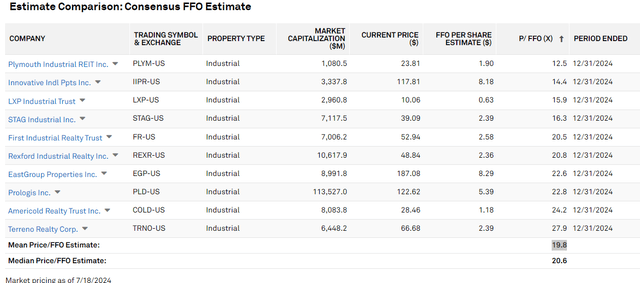

Industrial real estate market rental rates largely stopped growing in the back half of 2023 and early 2024. To reflect the cessation of further rate growth, FFO multiples of industrial REITs dropped materially to 19.8X from closer to 30X during peak growth. Recent data suggests, however, that supply is subsiding, demand is returning, and market rental rates are once again headed north. If market rental rates are returning in addition to the still massive mark-to-market opportunity, I think industrial REITs in general are opportunistic, and some of the better values are particularly interesting.

Let us begin with a history of the changes to industrial rental rates and then move on to the current fundamental outlook for the sector, along with implications for the growth and valuation of the various REITs within the sector.

Industrial rental rates over time

Industrial rent per square foot cratered during the Financial Crisis, in many cases getting as low as a couple of dollars per square foot, and there were even instances of sub $1.00 per foot rent.

Developers built heavily on spec resulting in a big wave of supply intended to be matched with fresh demand, but as the crisis hit, that demand did not manifest and left the sector materially oversupplied.

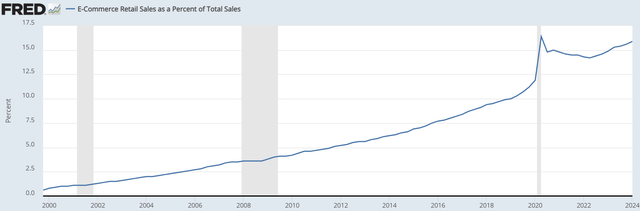

Coming out of the financial crisis, demand slowly rebounded over time, aided by the growth of e-commerce, which as of 1Q24 has reached 15.9% of all retail sales.

FRED

E-commerce requires massive square footage, with white papers estimating as much as 5 square feet of logistics warehouses necessary for each square foot of retail space replaced.

The demand surge most directly hit logistics style warehouses, while manufacturing and those facilities that support manufacturing continued to lag.

Market rent of industrial facilities recovered from the financial crisis lows, and slowly built over the ensuing decade. Rental rates began ramping nicely approaching the year 2020, and then surged as the pandemic hit. Once again, the surge was in logistics to a greater degree than manufacturing, as people stayed home during the pandemic and attempted to order just about everything online.

Given this demand surge and the extremely low-interest rate environment of 2021, developers got excited and started building an extreme amount of industrial facilities.

By 2023, these facilities were starting to be in lease-up mode and at the same time it was becoming clear that the pandemic was a pull-forward in e-commerce demand rather than a permanent increase.

With demand returning to the more normal upward trend rather than the surge trend developers underwrote, industrial real estate started to become a bit oversupplied in late 2023 and early 2024. 3PL or third-party logistics was the epicenter of oversupply, as companies like Amazon had over-expanded their networks in anticipation of the surge.

So, market rents began to flatten and even decline in some areas. Most submarkets have had flattish rent, while Southern California has had rents decline sharply. This was detailed in PLD’s 2Q24 earnings call by their CFO, Timothy Arndt:

“Globally, we estimate that effective market rents declined 2% during the quarter, with 75% of the decline attributed to SoCal”

Market rent decline has changed investor sentiment on industrial REITs and pulled the multiples of the sector down to a mean of 19.8X.

S&P Global Market Intelligence

We posit that 2Q24 is likely a trough in the market rental rates and that industrial market rates will return to growth.

19.8X does not seem cheap for a sector that is merely returning to positive market rent growth, but the 19.8X is on 2024 FFO and does not factor in the already existing mark-to-market. Stabilized FFO per share is being obscured by long lease terms, as we will detail below.

Mark-to-market based on location and lease vintage

For the second quarter of 2024, PLD reported 73.9% effective net rent increase on new leases and increased guidance by a penny per share at the midpoint.

First Industrial reported similarly strong leasing numbers and also increased FFO guidance (3 cents at midpoint):

“For leases commenced in the second quarter, cash rental rates on new and renewal leasing increased 43.4% and increased 59.4% on a straight-line basis.”

The difference between these leasing results and the -2% market rental rate globally that PLD reported is the mark-to-market.

Expiring leases were initially signed anywhere from 2005 to 2018 and since that time, rental rates have increased materially. Thus, the REITs are re-leasing old $5 per square foot leases at current market rates of closer to $8 or even $10.

Thus, 2024 FFO is not representative of the stabilized earnings power of the industrial REITs. Depending on the location of a given REIT’s properties and how long their average lease terms were, the industrial REITs have mark-to-market opportunities ranging from 20% to 100%.

If we were to adjust FFO multiples for stabilized rent rather than current rent, the sector is trading closer to 10X to 14X FFO. One could produce a more precise number using the largely known mark-to-market, but there are quite a few assumptions that go into how it impacts FFO such as margins, leasing expenses, and discount rates to get future rental rates back to present terms. Thus, I don’t want to give a precise number like 10.2X because that would imply a greater degree of certainty than is feasible here.

I do feel confident, however, that the mark-to-market adjusted P/FFO of the industrial sector would be somewhere in the 10X to 14X range.

At that multiple, very little future growth of market rates is priced in. Until recent data, this multiple seemed largely correct.

Given the oversupply, the industrial sector was potentially headed for a prolonged period of weak market rate growth. However, we have seen quite a few encouraging signs in recent data points that point to a swifter return to growth

Fundamental strength returning to industrial

Construction activity has slowed considerably.

FR CEO Peter Baccile detailed the U.S. industrial supply in the 2Q24 call:

“The national pipeline is down to about 289 million square feet from a high of over 600 million. So we're getting there. And hopefully, net absorption will continue to improve as the year goes on.”

Demand is also returning, with more tenants looking for space. On the same call, Executive VP Peter Schultz said:

“We're seeing more inquiries, more inspections, more RFPs”

We attended EastGroup Properties’ (EGP) REITWEEK meeting in early June, and they discussed the hesitancy of tenants to sign leases. There was plenty of preliminary interest, but tenants were overwhelmingly slow to pull the trigger.

In that meeting, EGP discussed that activity was starting to pick up in May, but it was still quite preliminary.

The FR and PLD leasing results and commentary suggest that demand is actually coming back.

Given the improved fundamentals and the reasonable valuation of industrial REITs when accounting for the mark-to-market, I think the sector is opportunistic. Within the sector, there is quite a bit of mispricing, making select securities look substantially better to us.

The nuanced approach – strength in select areas, weakness in others

There are four notable points of differentiation:

- Nearshoring and reshoring confirmed drivers

- Southern California markets suffering

- Coastal industrial worried about tariffs

- Smaller footprints are performing better

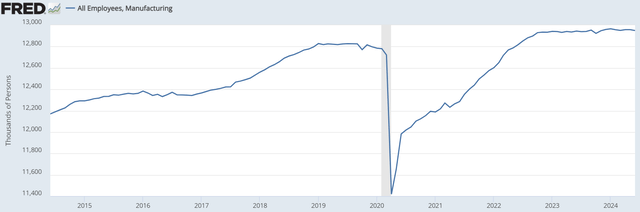

Leasing strength is shifting from logistics to manufacturing and the industrial facilities that support the manufacturing. Manufacturing employment has already rebounded nicely.

FRED

Worth noting is that the level of automation in factories has increased steadily, so employee headcount increases materially understate the uptick in overall manufacturing activity in the U.S. We anticipate further manufacturing growth as planned factories open up over the next five years.

Without getting too deep into politics, it is worth noting that both presidential candidates favor tariffs in some form, which would tend to decrease overseas trade. This too would lean in favor of domestic manufacturing and hurt coastal logistics facilities that rely on trade.

These trends are becoming well known and increasingly getting confirmed by leasing numbers, yet they have not been priced into the REITs as the coastal industrial REITs still trade at premium multiples relative to the group.

I find the inland REITs to be better positioned for capturing future market rent growth, and these particular REITs happen to trade discounted to the sector.

For a while, I have favored STAG Industrial (STAG) and Plymouth Industrial (PLYM) for these reasons, in combination with their cheaper valuation. I think they remain opportunistic today.

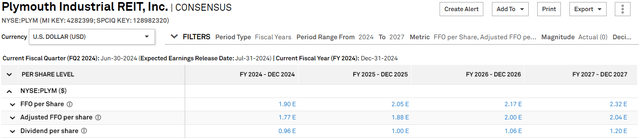

Even after the recent run-up, PLYM trades at 12.5X 2024 FFO. I think that is far too cheap relative to the growth trajectory.

S&P Global Market Intelligence

STAG is a bit pricier at just over 16X, but it is a company that thrives on acquisitions and the previously quiet transaction activity is starting to pick up. With one or two rate cuts, the prices buyers and sellers are seeking should reach parity, at which point, STAG is positioned with its very low leverage to scoop up a couple billion dollars of acquisitions.

Another industrial REIT that is getting interesting is EastGroup as they own well-located properties particularly suited for nearshoring. EGP’s portfolio is also advantaged by its relatively smaller footprints. Leasing activity has been weaker in the 100K-450K square foot range, with tenants being very deliberate and slow about signing leases. Leasing for smaller square-foot properties has come in much stronger.

Risks to industrial

The sector has historically been cyclical in nature. It managed to avoid the downside of the brief COVID recession, but I think that was specific to the nature of that environment. With the economy softening a bit lately, it is worth keeping an eye on the possibility of a recession in the next few years. Such an event would likely hurt demand for both logistics and manufacturing focused industrial facilities.

The REIT market has gotten egregiously underpriced making it a great time to get in to the right REITs. To help people get the most updated REIT data and analysis I am offering 40% off Portfolio Income Solutions, but you can only get it through this link.

https://seekingalpha.com/affiliate_link/40Percent

I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic REITs.