DamianKuzdak

The equity market's unwind is real and could even mark the end of the "bull market." The sell-off may only accelerate in the weeks ahead, driven by an unwind of a higher for longer mega-cap led rally.

A Fed that signals rate cuts are coming soon, coupled with a Bank of Japan rate hike, could be the driver of this unwind, leading to a shift in market sentiment where bad news is once again bad news as interest rate spreads contract, and financial conditions tighten, leading to higher levels of volatility.

However, it's a close call because the Fed and BOJ could push back on market expectations if they get out of line, while the job report on Friday is a wildcard.

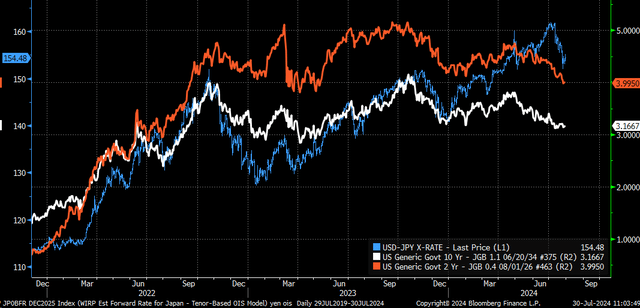

Interest Rate Spreads

The underlying backdrop for this trade has been the widening differentials between US and Japanese interest rates. Now, those spreads are narrowing as investors see weakening US economic data and the potential for the Fed to cut rates, leading to an unwinding of the yen carry trade.

The Fed and the BOJ can play an integral role in this process by either confirming market expectations or delaying the unwind by pushing back on market expectations, using forward guidance. That is if the Fed signals that rate cuts are possible as soon as September or if the BOJ signals a monetary policy tightening by a reduction in its bond-buying or goes ahead and raises rates. Either way, it would seem that the time is coming for interest rate spreads to the contract.

This will put the market back into a bad news environment because economic data pushing US interest rates lower will also affect the future of this trade unwind. Falling US interest rates mean contracting spreads pushing the USDJPY lower, a sign of the yen strengthening vs. the dollar. This move lower will weigh on the equity market.

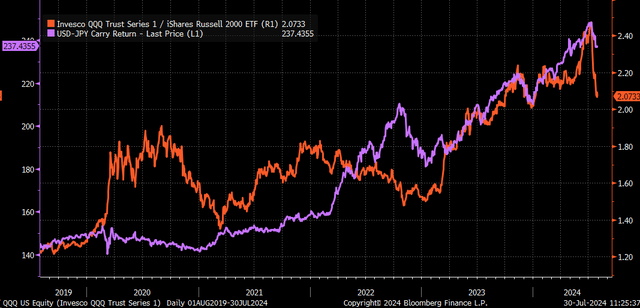

The Higher For Longer Trade

The unwinding of the carry trade will lead to the unwinding of the short small cap, short yen, and long mega-cap technology trade that started in March 2023. It has become increasingly clear, based on market behavior, that short small caps, short yen, and long mega-cap technology was the higher for longer trade that was put in place starting in March 2023. Starting around that time, the QQQ to IWM ratio, when overlaid with the USD-JPY Carry Return Index, has had a solid relationship despite not having one prior.

The carry trade, coupled with the short small-cap trade, most likely had a dampening effect on implied volatility, allowing the implied volatility dispersion trade to flourish. The unwinding process, though, will likely lead to greater future volatility, making dispersion harder to put in place.

Fundamentals Friendly

Fundamentals are not this market friend either, especially when looking at this like the P/E ratio because earnings estimates for 2024 have been and continue to be unchanged at around $241.50 per share. They have been between $240 and $245 per share since December 2022 and have basically just gone sideways, which means that a rising P/E ratio has driven the entire rally. The S&P 500 was trading at 16.9 times earnings in October 2023 and now trades at 22.4, but earnings estimates for this year are nearly identical. So what's to stop the S&P 500 from trading back at 16.9 times 2024 earnings? Nothing is. It could as easily trade at 16.9 times earnings as it could at 30 times earnings because earnings estimates are flat.

It Is A Close Call

Look if the BOJ and Fed can push back on market expectations, or if the jobs data pushes rates higher. The unwind can be pushed off, and the USDJPY could go back to rising, allowing the higher for longer trade to be put back in place. But that is how critical of a point the markets have reached.

If the unwind is allowed to continue, the sell-off we have witnessed is just the start.

Join Reading The Markets

Reading the Markets helps readers cut through all the noise, delivering daily video and written market commentaries to prepare you for upcoming events.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.