jetcityimage

The Alimentation Couche-Tard Investment Thesis

Alimentation Couche-Tard (ANCTF / ATD:CA), or ACT for short, is an attractive long-term investment in my opinion, as management is very shareholder-friendly and growth opportunities abound. The downside is also limited by a solid balance sheet, and the competitive advantages and barriers to entry should be sufficient to safeguard profits.

I also think that the valuation is fair, as the current share price does not have an exorbitant multiple, as the company is relatively under the radar of many investors, as it is not headquartered in America and is more international in its operations.

ATD:CA's Capital Allocation

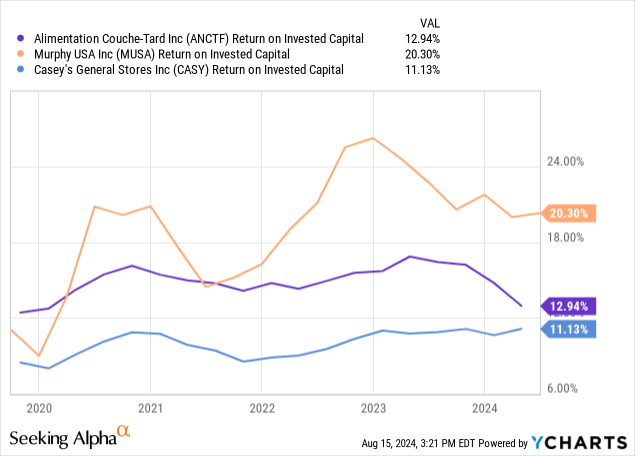

Today, ROIC is something that a lot of investors use as a screening tool, looking for companies with ROIC above 20%, and unfortunately, they miss companies like ACT, which are very high quality and have had a very strong share price performance, but are not shown because they are shining on other things.

However, ACT's ROIC of 15 to 16 percent on a normalized basis is above average and, together with the capital allocation, leads to very pleasing results for long-term investors. In addition, ACT has many growth opportunities in many countries, for example in Scandinavia or also in the area of electric charging points.

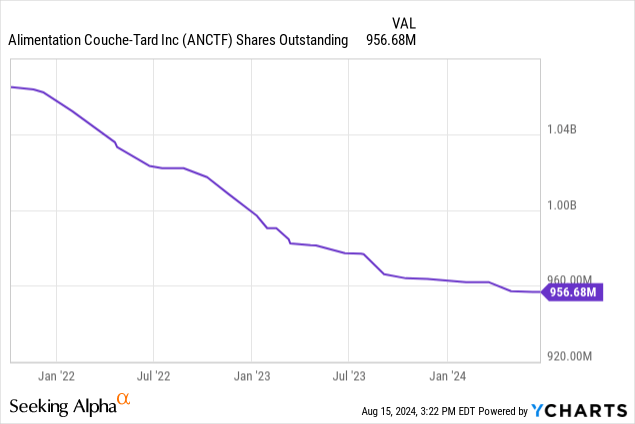

In addition to M&A activities, which play an important role in ACT's capital allocation, share repurchases are an important cash management tool, and the number of shares outstanding has been reduced by nearly 100 million shares over the last five years.

This means that shareholders do not have to worry about dilution and that EPS is likely to continue to grow faster than EBIT in the future as a result of further buybacks.

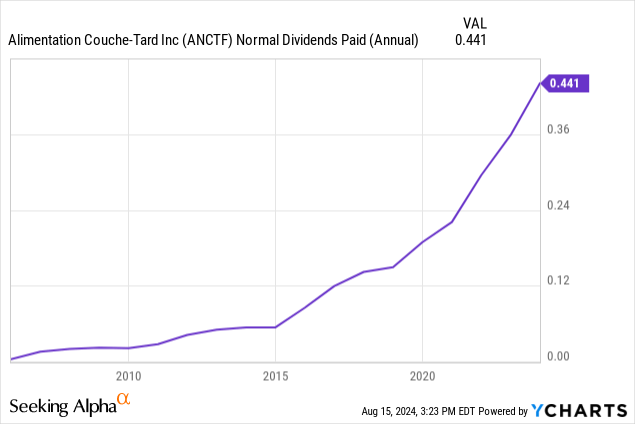

The fact that ACT is very shareholder-friendly is demonstrated not only by the numerous share buybacks, but also by the regularly increasing dividends. The annual dividend growth rate over the last 10 years is 22.72%. A very satisfactory result.

And I believe that dividends and share buybacks will continue to be an important tool for ACT's capital allocation decision-makers. After all, it has been very successful in the past.

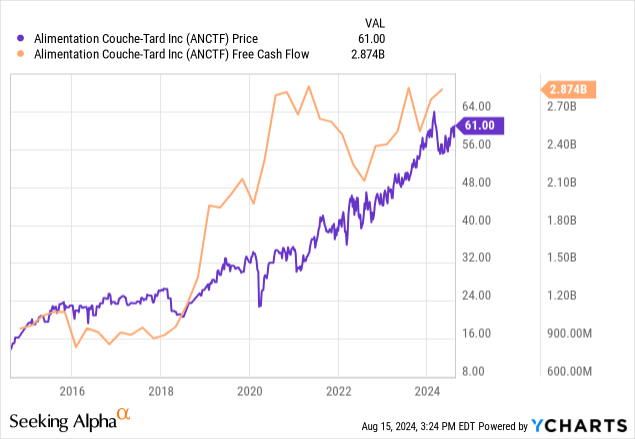

In this chart, you can see how similar the FCF line and the price line are over time. I think this shows that the capital allocation of FCF is also reflected in the share price. And that the strategy of allocating FCF to M&A, share buybacks and increasing dividends has borne fruit.

I therefore believe that ACT's great strength lies in its management, which has made excellent decisions in recent years.

ANCTF's Valuation

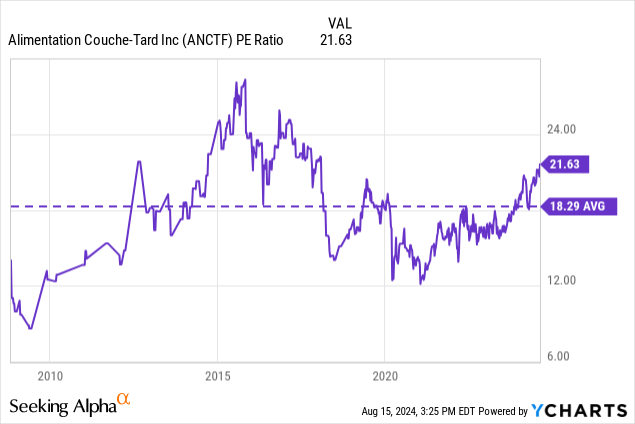

Currently, ACT is trading slightly above its long-term average of ~18x. But part of that is due to the economic headwinds that are hurting earnings. Unfortunately, year-over-year revenue, EPS, and FCF are all down. But I think this is temporary and ACT will bounce back to its old strength.

For further calculations, however, I will use the long-term average of the P/E ratio.

- Revenue: 3.22% 5Y, 6.20% 10Y

- EBIT: 8.50% 5Y, 14.49% 10Y

- EPS: 11.72% 5Y, 14.71% 10Y

- FCF: 11.55% 5Y, 15.35% 10Y

ACT is one of those investments that many investors overlook because they look at the low revenue growth rates and think this is not a high-yield investment. But the opposite is true because the management team is excellent and the EBIT, EPS and FCF growth rates are, in my opinion, world-class.

And combined with the large share buybacks and rising dividends, I expect strong total returns over the long term.

The analysts' EPS estimates are for a slightly lower growth rate than in the past, which, I think, is a conservative estimate. Estimates in CAD are 6.38 $CAD in 5 years, which at a multiple of 18.27 would be equivalent to a share price of ~ 116 $CAD.

This represents an upside of approximately 40% at the current price of 80 $CAD. However, I would expect EPS to be in the 8 $CAD range as I think the share repurchases will have a big impact. And that would put the stock at about ~144 $CAD if we use the same 18x multiple in 5 years.

That is an increase of about 80% over the next five years. A relatively strong result if share repurchases and earnings develop as I expect. But it is a bit below my benchmark for new investments, which is 100% upside in 5 years.

Nevertheless, given the high probability of long-term outperformance versus the S&P 500, I believe a Buy rating is appropriate.

Alimentation Couche-Tard's Balance Sheet

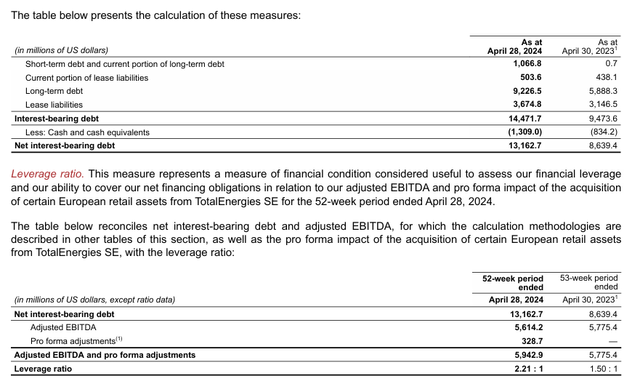

ACT has been very active in the M&A market, and with the $3.8 billion transaction in which they acquired 2175 sites from Total Energies, the leverage situation has deteriorated somewhat. However, with a leverage ratio of 2.1x, they are still not overly leveraged.

Long-term debt $9.2bn vs EBIT $3.8bn. To me, anything less than 4x EBIT is a safe bet, and I, personally, feel comfortable with that because I think the company has enough room to maneuver in tough times.

ACT's BBB+ and Baa1 credit ratings also speak to its solid balance sheet.

Earnings Quality of ANCTF

I think the two best measures of quality of earnings are Days Sales Outstanding and Days Payables Outstanding. And here ACT has shown the following development.

- Days Sales Outstanding: 8.8 in FY20 and 12.3 in FY24

- Days Payables Outstanding: 16.7 in FY20 and 24.6 in FY24

And here we have a double-edged sword. On the one hand, ACT has extended the payment period for its suppliers from 16 to 24 days, but its own customers are also paying a little later, on average after 12 days instead of 8. On the positive side, however, ACT's customers pay twice for their goods in the same time it takes to pay its suppliers.

Risks

37% of in-store sales are currently cigarettes, and sales of cigarettes in general are of course declining, which could have an impact on this position. However, ACT is already investing in private brands in the beverage and food sectors, which are expected to offset the loss of cigarettes with their higher margins.

Fuels still account for the largest share of sales, currently 51 billion, or nearly 74% of total sales. And here, of course, is a serious competitor that could eat into revenues because electric cars don't need fuel, they need EV charging stations.

But even here, ACT is already investing in EV charging stations and car washes to attract customers to its own convenience stores. In addition, the switch to electric cars does not seem to be as rapid and massive as initially thought, as some countries are already starting to believe that internal combustion engines will remain on the road for longer.

Conclusion

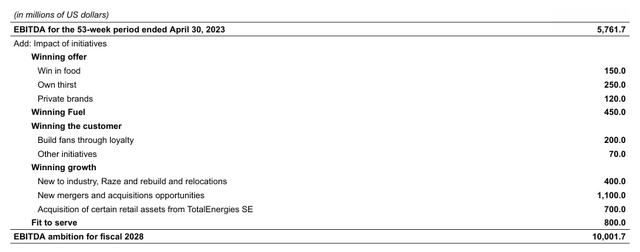

ACT's management plans to nearly double EBITDA over the next five years through new M&A activity, increased food and fuel revenues, new customers and new locations. All of this, along with the share buybacks, I think will lead to EPS estimates being exceeded. Unfortunately, I don't think we should expect a big multiple expansion, but rather a multiple closer to the long-term average.

But I think the EPS growth rate should be enough to beat the S&P 500 on a five-year basis even without a higher multiple. In fact, its large store network, distribution channels, and well-known brand should be enough to protect its profits and keep new competitors from entering the market. Therefore, I believe that an upside of about 80% in 5 years is realistic.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.