Breaking News: You don't need to be in a growth industry to produce market beating returns simonkr

Investment Thesis

Nexstar Media Group (NASDAQ:NXST) is a media company with a strong position in local TV broadcasting. While it was a top performer during the decade from 2012 to 2022, it currently trades at extremely low multiples (at roughly 6x FCF) as investors are concerned that it has reached the end of its consolidator business model and is now operating in a dying industry (linear TV). While this is true, I will make the case that NXST is well-positioned to produce reasonable results even in a challenging environment, and thus, the current low valuation should provide good long-term returns.

To do this, I will first look at the state of the industry and then examine Nexstar's positioning within it. Finally, I will discuss the results of my DCF model, including my assumptions for the future development of key income streams and why I rate NXST a high-risk buy.

Introduction

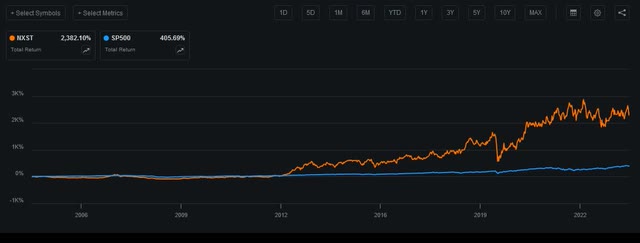

Nexstar Media Group was a smashing success until 2.5 years ago. It sizably outperformed the S&P 500 over the last 20 years (+2382% total return vs. 406%):

NXST outperforms S&P 500 (Seeking Alpha Charting)

As one can see, most of the outperformance occurred during the decade from 2012 to 2022. But since then, the stock has basically flat-lined with even a minor negative total return (-4.6%) and strongly lagged the S&P 500 in the last two years since August 2022:

NXST underperforms S&P500 (Seeking Alpha Charting)

To understand what is behind this difference in performance, one will have to look at Nexstar's business model and what has changed in recent years.

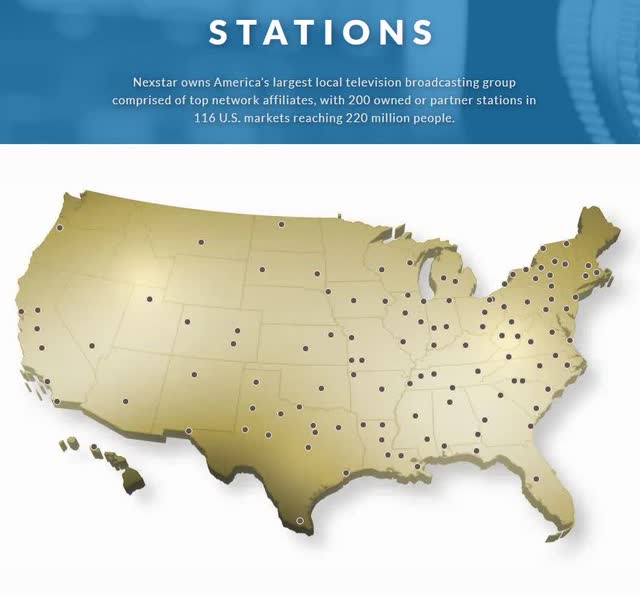

Nexstar was founded in 1996 by Perry A. Sook buying a local TV station. Since then, Sook (still the current Chairman and CEO) has been on an acquisition spree, helped by going public in 2003, culminating in the multibillion takeover of Tribune Media. Today they own or have partnered with 200 stations that reach 220m Americans. Now it claims to be the "largest local broadcast television and media company in the United States."

Nexstar national reach (Nexstar home page)

Nexstar was a successful consolidator in the highly fragmented local TV market and benefited from buying local TV stations at cheap multiples and with cheap debt.

However, this has now come to an end because the Federal Communications Commission ("FCC") has long established a nationwide ownership limit. NXST has reached this limit and was recently fined by the FCC for a violation of this limit. The FCC even ordered a disposal of a controlled station:

The FCC has fined Nexstar Media Group, Inc. and Mission Broadcasting, Inc. $1.8 million after finding Nexstar exercised de facto control over Mission's Station WPIX (TV) in New York without FCC consent.

The FCC also found that Nexstar's control over WPIX means Nexstar owns stations that serve more than 39% of the total households in the US, which violates the FCC's 39% national television ownership cap. The FCC said Mission would have to sell WPIX to a third party within 12 months. It could also sell WPIX to Nexstar, but then Nexstar would have to sell a sufficient number of its stations to avoid exceeding the 39% national audience cap.

[...]

WPIX is the flagship station of the CW Network, which is 75% owned by Nexstar. Nexstar and Mission operate so-called "virtual duopolies" in 25 markets.

Therefore, the prior highly successful growth strategy is no longer viable. Without this source of external growth, investors are now worried that NXST is stuck in a shrinking industry.

NXST has tried to alleviate these concerns by changing its strategy and acquiring assets outside the traditional local TV stations. These acquisitions include digital assets like "Best Reviews" for $160m in 2020 or "The Hill" for $130m in 2021. The big deal, however, was the acquisition of 75% of "The CW" network. The Hollywood Reporter stated that NXST got paid over $50m by CBS Studios and Warner to take the constantly loss-making CW off their hands.

These are bold steps but clearly a divergence from the prior tried and proven strategy of consolidating the local TV market. As such, it is met with skepticism by investors.

Nexstar Business Model

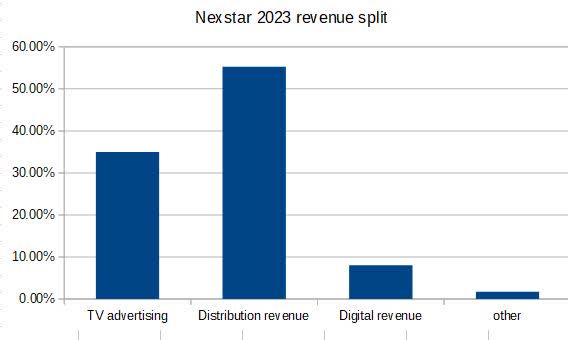

Nexstar produces content which it either airs directly via its TV stations, puts on its websites or sells on for others to use. Its main sources of income are advertising revenue and distribution fees, which are fees they get paid from other players for the use of their content.

Nexstar 2023 revenue split (Nexstar Q4/23 earnings release, own calculations)

Advertising revenue is dependent on reach, and distribution revenue also depends on the subscriber numbers to which the content is made available. Therefore, both sources of income depend on the number of people it reaches. This has been a source of concern for the traditional linear TV industry for some time.

Linear TV - A Market in Secular Decline

When assessing a seemingly cheap investment, it is always helpful to try to understand what the reasons behind the cheapness are. I believe for Nexstar it is fairly simple: The industry they operate in is seen as being in a secular decline.

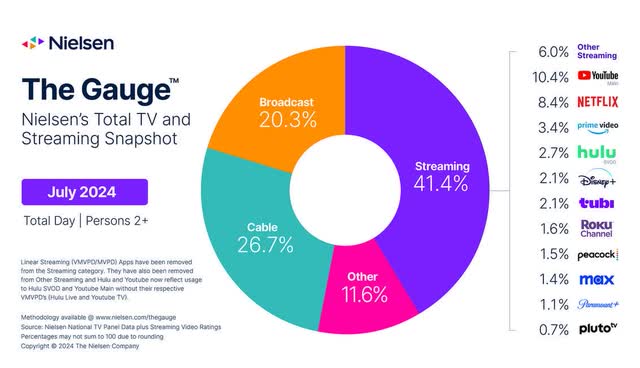

Nielsen reported last year that traditional linear TV (broadcast and cable) now makes up less than 50% of TV viewing time by US households for the first time and this trend continues as the latest Nielsen numbers show:

Traditional TV below 50% (Nielsen)

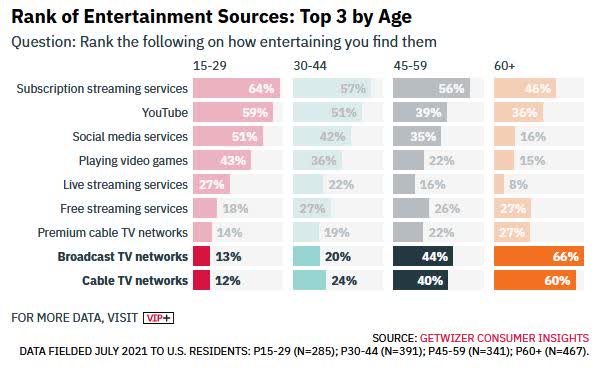

According to Variety, younger audiences don't care much about linear TV anymore as it is at the bottom of their entertainment choices in stark contrast to the older cohorts:

Ranking of entertainment sources by age (Variety/Getwizer consumer insights)

To be fair, "live streaming services" like YouTube TV are still important to a quarter of the young generation and should be seen as non-traditional linear TV. Nexstar also collects distribution revenues from those. This data was from 2021, and it has probably only gotten worse since then. Variety even makes the dire forecast, that "(i)n the early 2040s, many of those currently propping up traditional TV will no longer be alive. "

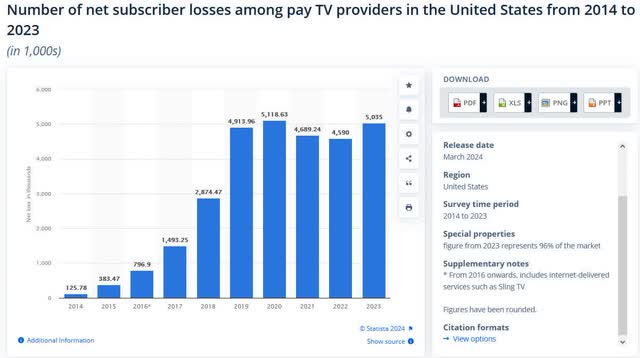

Cable TV is dying, not by a thousand cuts but by millions of them, as cord-cutting becomes ever more prevalent. According to Statista, subscriber losses for pay TV continue to be at around 5m annually:

Subscriber losses among pay TV (Statista)

These numbers include also internet delivered services, not only cable TV. It is clear that streaming services take their toll on linear TV providers.

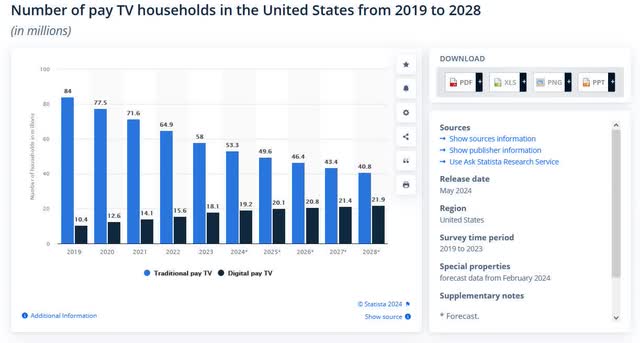

Statista also forecasts pay TV households to continue to decline going forward:

Number of pay TV households plus forecasted development (Statista)

There is little doubt by industry observers that these trends won't reverse. Many consumers are now used to being able to watch what they want when they want it. This is especially true for original content like high-quality TV series. Therefore, the decline of linear TV seems all but inevitable.

This now leads to Warner Brothers taking a $9.1bn goodwill impairment charge due to "continued softness in the U.S. linear advertising market, and uncertainty related to affiliate and sports rights renewals, including the NBA." An impairment charge means the value of assets on the books is no longer as valuable as they were once deemed, and as such, industry experts see this as the final admission of the lack of value in traditional linear TV:

"The huge impairment charge from Warner Bros. Discovery is essentially the final nail in the coffin of the traditional linear TV business," said Bob O'Donnell, chief analyst at TECHnalysis Research.

Nexstar's Positioning and Strategy to Deal With a Shrinking Market

How is Nexstar's position in this market environment? I would argue they try to position themselves in all the sweet spots of an overall sour market. There are several areas that still show growth and keep viewers, even though more and more people turn towards streaming or alternative sources of entertainment like user-created content on social media.

Local content rules

Firstly, Nexstar is mostly a local TV station network. As such, they service their local communities. And local content is seen as still relevant by many consumers. 65% of adults are attached to their local community. As such, local coverage is an important tool to stay informed and connected. Indeed, more Americans get their local news from TV than from any other source, and "more than half (62%) watch local news on television daily." Seventy-seven percent of respondents in the poll "think that local news provides viewers with important information about their community."

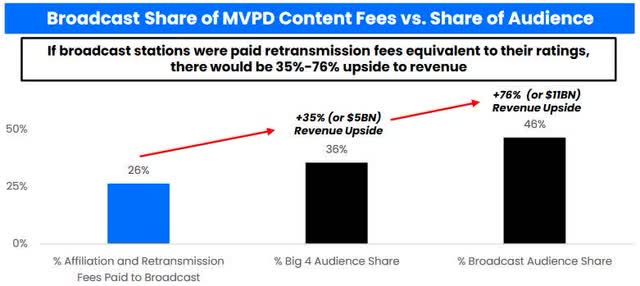

Therefore, this is something people are willing to pay to get access to, which bodes well for distribution fees. In fact, Nexstar makes the argument in their October 2023 presentation that they are still underpaid for the reach they achieve:

Broadcast distribution fees should be higher (Nexstar October 2023 presentation)

S&P agrees with this sentiment:

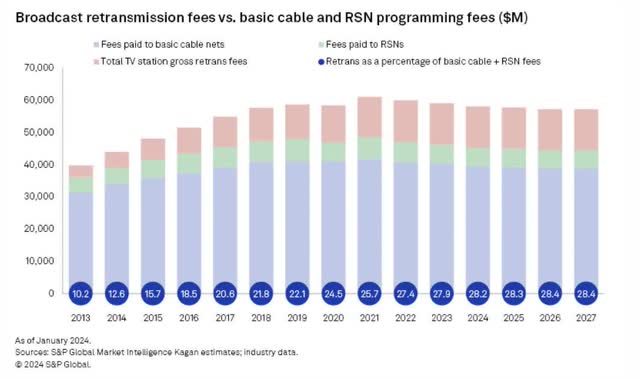

TV station group owners still see a disparity in broadcast audience delivery, which ranges from 30% to 40%-plus, depending on the market and what they receive in gross retrans fees versus the carriage fees that multichannel operators are paying for cable networks and RSNs, which we estimate was 27.9% at the end of 2023 and expect to grow to 28.2% in 2024.

Broadcast transmission fees to increase share (S&P Broadcast outlook 2024)

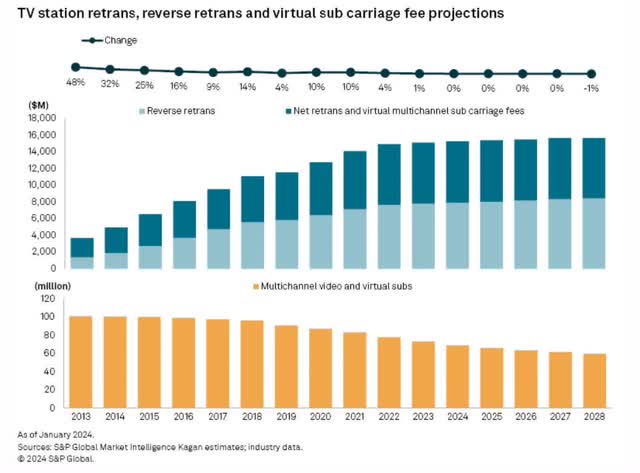

Broadcast transmission fees as a percentage of overall fees have increased sizably in the past years. While S&P forecasts this trend to moderate, Nexstar has reported a 5.5% increase in distribution revenue in Q2/2024 also due to among other things successful distribution contract renewals on "terms favorable to the company." I therefore believe that S&P's market forecast of retransmission fees stagnating of the next few years does not apply to Nexstar which should still show some growth.

Retransmission revenue to stall (S&P Broadcast outlook 2024)

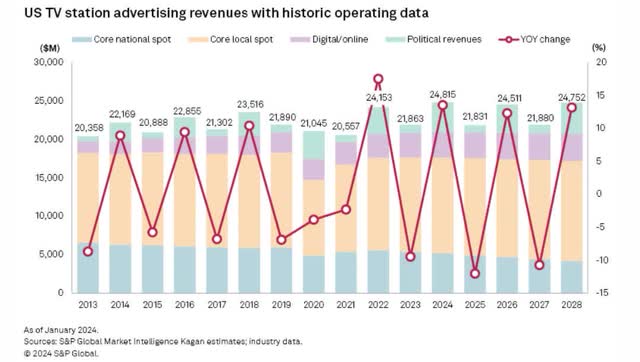

But also for advertisers, local TV is very interesting as it targets very specific markets. Local/regional businesses like law firms or auto dealerships will continue to use local TV for advertising. In their "Broadcast Outlook 2024" S&P provides interesting data on how TV ad spending has developed.

TV advertising split (S&P Broadcast Outlook 2024)

TV advertising revenues have been nearly flat, with only minimal growth (0.7% annually from 2013-2023). This, however, masks several important trends. Core national spot advertising has been the big loser and is constantly declining and is forecast to decline further. In contrast to that, local advertising seems to be roughly stable. Not surprisingly, digital/online has been increasing as has political spending.

As one can see, political advertising is exhibiting a two-year cycle, with presidential elections years showing the biggest ad spending and midterm not much behind. This spending has also increased sizably and is very focused on local TV:

Campaigns favor running their spots in local newscasts because they are watched by viewers who are politically engaged and more likely to go out and vote. They tend to be older and more likely to watch traditional TV than younger consumers.

Not surprisingly, Nexstar expects a major windfall from this year's political ad spending, which media investment Group M forecasts to be 31% higher across all platforms than what was spent on the last presidential election in 2020.

In terms of ad spending, it therefore seems that Nexstar is relatively well-positioned as about two-thirds of their non-political ad income is local as opposed to national. They are also well-placed to benefit from increasing political ad spending.

The CW turn-around

But Nexstar also has national exposure. Most prominently since their recent acquisition of loss-making "The CW." As we have seen above, national linear TV is in trouble. "The CW" has been a marketing outlet for high-quality series from CBS and Warner, but Nexstar now does a 180-degree turnaround. As expensive original series go up against streaming services with deep pockets, they decided this is a losing proposition. Instead, they decided to cut costs and go for cheaper foreign source material as well as unscripted shows like "Police 24/7."

Not surprisingly this has caused criticism by people invested in producing expensive shows like in this The Hollywood Reporter article: The CW's brand now may best be described as "Castoffs Wanted" or even "Curated Wreckage."

But it seems audiences like it as ratings improve, and it also pays off financially as Brad Schwartz, CW's president of entertainment, states:

We've improved our earnings by $100 million this year. I think we've improved our earnings by over $200 million in two years. So this team is really hitting on all cylinders. We've had three consecutive quarters of ratings growth. And we're doing it more efficiently and we're doing it with a smaller team. And it's kind of us against titans. We're the underdog, and it's all going really well. So I think if we continue on this track, and we play a little Moneyball and put really good content on the air and do it efficiently and keep growing our ratings

Besides more foreign-produced content and cheaper unscripted shows, one main focus of the new CW is showing more sports to attract viewers. Because the most prominent reason why people still watch linear TV is: Sports. One of the reasons for the Warner Brothers impairment charge was the loss of the NBA deal. The most watched events in linear TV are sport events. Samba TV states that:

"Sports remain the last line of defence for linear television, with women's sports demonstrating explosive growth in 2022."

Unfortunately, streaming services pay up to get access to those sports rights. And some rights owners like ESPN will set up their own stand-alone streaming service that "will give cord-cutters access to everything they would get if they were paying for a traditional cable package." Still, sports remains a category that people like to watch live and therefore lends itself to linear TV.

Instead of trying to compete with the big four networks or the streaming giants, Nexstar has decided to go for secondary sports rights. These are from sport rights owners that value the reach of a nationwide coverage can provide over maximum monetization. As such, those rights come cheap, it is a win-win for both sides. According to Schwartz, they added about 500 hours of sport vs. zero before. Here is a small excerpt from the interview linked above:

You can't be in broadcast television today without being in sports. It's just an incredibly important piece of broadcast television. Live, simultaneous viewing of a lot of people. Nobody does it better than broadcast. There's like 20 million homes just using digital attendance out there. The broadest reach is still broadcast. NXT wrestling, that's 52 weeks a year, two hours every Tuesday night of live, sports entertainment, that's a five year deal. NASCAR starts this fall, that's a seven-year deal. We have the second year of ACC football and men's and women's basketball, and we have LIV Golf and Inside the NFL. The greatest step that I can say when it comes to sports, a year ago zero people in history had ever watched sports on The CW. And according to Nielsen, if you just look at a six-minute reach number, 30 million people have now watched sports on The CW.

So sports has been just an incredible, incredible new viewer acquisition tool. It has been a revelation for all of our local affiliates and local stations because now they have sports on the weekend. They can compete with everybody else.

As mentioned before, The CW was loss-making throughout its history. When they acquired it, Nexstar wanted to achieve profitability by 2025. Seemingly this was not as easy as they thought because they have now pushed the goalpost out to 2026. But this is still a major turn-around story as ratings improve and costs go down.

NewsNation Now 24/7

And finally, "NewsNation" is their dedicated national news channel. And again, this is one of the sweet spots of linear TV. Major news or award events are something where consumers value live reporting. Oceanmedia states that:

News is another segment where linear TV maintains its relevance. In an election year, for example, news ratings typically see a significant boost. [...]Despite these challenges, news programming offers a consistent and reliable audience, making it a viable option for certain advertisers.

Nexstar has now extended NewsNation to 24/7 coverage since June, 1st. It intends to position itself as a reliable non-partisan news source. As they stated in their 2023 Annual Report, Nexstar is having high hopes for the already profitable NewsNation network:

NewsNation is America's fastest-growing cable news network in primetime [...]

We believe there is significant growth potential for NewsNation as news networks are among the most watched and profitable cable networks.

As one can see, Nexstar is relatively well positioned within the troubled linear TV market. They provide the holy trinity of linear TV: Local content, news, and sports.

More than just linear TV

While linear TV is clearly the bulk of their business, they also own some digital assets like "The Hill," "Best Reviews" or 140 websites of their local TV stations. This already represents around 8% of revenue and grew by 8.2% in 2023.

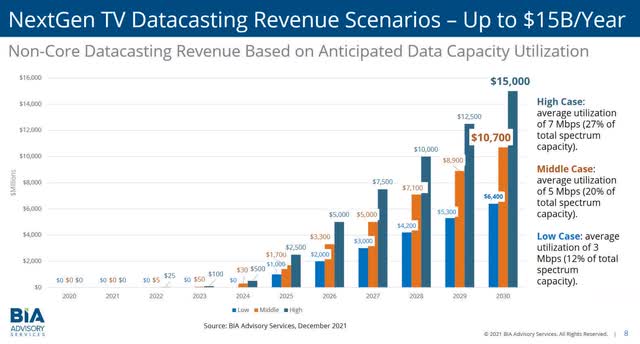

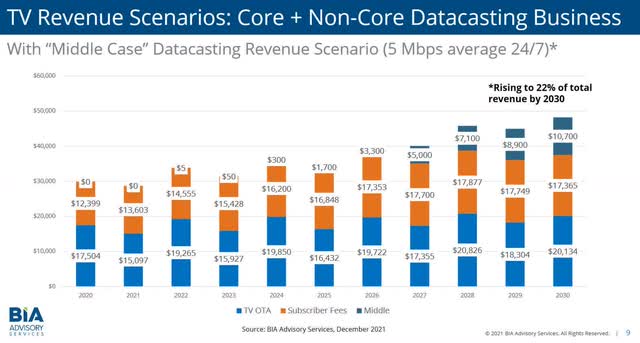

Nexstar also builds out ATSC 3.0 capabilities of its network. This is a high-quality standard for terrestrial television broadcasting. In the US, it is also known as "Next Gen TV." Besides Next Gen TV, it can also be used for high-speed data transmission (datacasting). A Deloitte white paper details several use cases for this technology. While this is currently an expense rather than a revenue item, some market research firms like BIA estimate datacasting via ATSC 3.0 could be an up to $15bn revenue opportunity by 2030 with a middle case still amounting to $10.7bn. In a presentation from 2021, they included the following charts:

ATSC 3.0 up $15bn revenue opportunity (BIA Advisory Services presentation December 2021) ATSC 3.0 providing growth in a stagnant market (BIA Advisory Services presentation from December 2021)

Well, this is, of course, marketing material by BIA, and I have too often seen lofty forecasts for all kinds of new opportunities in my career that never came to pass or much later and lower. Therefore, it is sensible to take these numbers with a grain of salt. But it nevertheless is an optionality that exists.

Overall, I do believe that Nexstar should be able to at least stay stable going forward, with some pockets of opportunity for growth. As we will see in the next section, this is all that is needed as Nexstar currently trades at a very depressed valuation.

Nexstar Financials

I think it should be obvious, by now, that one should not buy Nexstar for its growth profile. The opportunity lies in its cheap valuation and the fact that expectations are very low.

Should Nexstar be able to simply continue producing stable FCFs, this should lead to a rerating of the company from its current valuation. While waiting for this rerating investors collect a 4% yield and the company can buy back lots of cheap stock. The current quarterly run rate of buybacks is 1.7% of outstanding shares. This is nearly 7% yearly and should accelerate going into the second half as NXST then gets the additional cash flow from political advertising. The board just approved an additional $1.5bn buyback authorization. Last year NXST did reduce share count from 36.8m to 33.6m or roughly 8.7%.

To properly evaluate the different drivers of value, I built a DCF for Nexstar. One major caveat right at the beginning: Due to Nexstar's high acquisition activity, it is very difficult to figure out true underlying company-specific trends. I therefore very strongly look for industry data which I then adjust as I think is sensible. Here are my basic assumptions:

Revenue:

Core advertising: I distinguish between local and national advertising, with local making up 68% of overall core advertising (given in their 2023 Annual report, page 4). As I have shown above, local is much more stable than national. Therefore, it is important to distinguish this here.

My basic assumption here is a 5% decline in 2024 like the H1/2024 results indicate (-4% local, -6% national) and then another decline of 4% for local and only 2% for national as I model a minor 2025 recession for local and a positive impact of better rating for CW. After that, I go for a short recovery of +2.5% in local followed by an eternal decline of 1% in local. National starts shrinking 6% annually from 2026 onward. This is worse than what S&P or BIA forecast. While S&P has some shrinkage, BIA has it very modestly growing. I do believe they might still underestimate the secular shift in advertising away from TV ads.

Political advertising I have $600m for this year, in line with the BIA estimate of a 20%+ increase over 2020 which they provided in their Q2/2024 conference call. I have this going down by 5% in 2027 and growing by 3% annually from there, in line with its two-year cycle. Reasons for the relatively strong showing, see above. Nexstar mentions that political advertising crowds out some non-political advertising. This impact is hard to estimate from NXST's results, but I modelled it by a 15% cannibalization rate, meaning that in addition to shrinking core advertising by 5% in 2024 I also deduct an additional $90m from crowding out.

Distribution I have grow by 4.5% in 2024 as they continue to successfully renegotiate rates higher. I have it then slowly decline to 2% by 2029 where I keep the growth stable at 2% as non-linear players should also be willing to pay for the content.

Digital I grow by 6% initially, dropping to 4% by 2029. 'Other' I have dropping to 50m in 2024 and from there growing by Inflation of 3%.

I do not model in any ATSC 3.0 revenues.

Overall, this leads to operating revenue growing by 1-2% annually. This reflects my assumption that the business is not dying, but on the other hand, as a percentage of overall GDP, it continues to shrink as other media become more important.

Costs:

I have the different cost items increase by 2.5-3% annually, roughly in line with inflation. Nexstar is a fairly cost-conscious company, and with revenues growing by only 1-2%, this still means a continuous decline in margins.

I did however model two important improvements in costs within the next 2-3 years:

CW to break even by 2026. This means a $200m FCF improvement over 2023 (Q4/2023 press release shows a $199m negative FCF from 'The CW' after minorities) which should be mostly done by removing expensive shows.

Short-term interest rates to drop back to roughly 3% over the next two years, in line with Fed dot plots. This reduces interest payments by over $40m per 100 bp drop. As a highly levered company ($6.7bn net debt) NXST will be a clear beneficiary from falling rates.

FCF adjustments:

I do ignore D&A in favor of actual cash costs. That said, I also consider stock-based compensation a real expense and do therefore not add it back to FCF. Furthermore, I do not give credit for pension plan credits that only result from assuming a high return on pension assets or for deferred taxes that will have to be paid ultimately. And finally, I do add the higher cash income from equity investments, most prominently "Food Network." Overall, this leads me to lower FCF values than the analysts.

DCF results:

This leads me to an FCF estimate of over $930m for 2024 and $747 for 2025 modelling a minor recession increasing to a peak FCF of $1149m by 2026 (mid-term elections). Over the next four years, I have an average FCF of over $900m. As costs increase faster than revenues, this shrinks going forward, but NXST stays FCF positive till the end of my modeling period by 2045.

Now, it is always sensible to sanity check the outcome against what the market thinks. Here, earnings estimates from Seeking Alpha point into a similar direction. A minor upward trend initially before earnings stagnate.

Seeking Alpha earnings estimates for NXST (Seeking Alpha)

That said, it is important to note that from 2028 onward only one analyst provides data. But overall, it is not too far away from my results.

My DCF produces a fair value of $245/share with a 10% discount rate or well over 40% upside from the stock currently trades. The current share price equates to a discount rate of 17.5%. These are outstanding numbers! But these numbers do, of course, assume that NXST remains a going concern and does not eventually go out of business, having to repay its $6.7bn of net debt.

Sensitivity:

Make no mistake: NXST is a highly levered company (S&P has them as junk) and as such minor changes move the needle a lot. Some examples:

Having distribution revenue flat instead of increasing by 2% from 2029 onward drops the fair value to $157. This is because this massively increases the negative gap between cost and revenue growth, leading to an eventually loss-making position by 2040s.

If, on the other hand, I grow local ads by 1% instead of shrinking them into oblivion, fair value increases to $279.

The $2bn buyback could also increase fair value by 10-15% depending on the price it gets executed.

Therefore, NXST is a very high-risk investment that needs regular monitoring. This is no SWAN stock.

Risk and Opportunities

I hope I made it clear that NXST is a risky investment.

Main risks include:

- linear TV declining faster than expected, including ad income and distribution fees

- limits put on political advertising could theoretically cripple this very important income stream

- going out of business would necessitate a repayment of debt leaving less to shareholders

- misplaced acquisitions in an attempt to evade the secular decline of the industry

- The CW never gets to breakeven

- Forced disposal by FCC could negatively impact NXST

But there are also opportunities. Should the situation stabilize, and the market develop in line with some of the more optimistic forecasts, it could lead to some sizable uplift in valuation.

Ad and distribution revenue could very well hold up better than I modeled. Also, they claim "The CW" has strong ratings improvements due to their changed content. Together with NewsNation, this could actually lead to growth on core national ad income for some time. I regard this as a distinct possibility.

ATSC 3.0 is currently ignored by pretty much everyone, myself included. If they can really live up to the rosy industry projections, this could result in a massive value uplift together with a major rerating as NXST starts growing again.

Management has been outstanding in consolidating the industry and pushing for structural changes in how they get paid. While the risk of poor acquisitions remains, the opposite is also true. As a highly cash-generative company, management might be able to add several opportunistic acquisitions which create additional value.

Summary

Nexstar Media is a highly levered company in an industry that is in secular decline. So much for the bad news.

The good news is that everyone is aware of this, and therefore, NXST trades at an extremely cheap multiple of only 6x FCF. It has done basically nothing for the last two years, while reducing shares outstanding from 41m by the end of 2021 to only 32.5m now.

I do believe investors underestimate the resilience NXST exhibits due to its excellent positioning within the industry and its proven management.

I view NXST as a high-risk buy and have recently bought it for my personal portfolio. That said, NXST is no SWAN stock but needs constant monitoring. Its high leverage and generally unfavorable industry trends make this a risky investment. but one that might pay off handsomely.

If you found this article helpful, please vote for it as a compelling analysis. If you have questions or remarks, please comment below. I would love to hear from you. Many thanks!