David Tran

Intro & Thesis

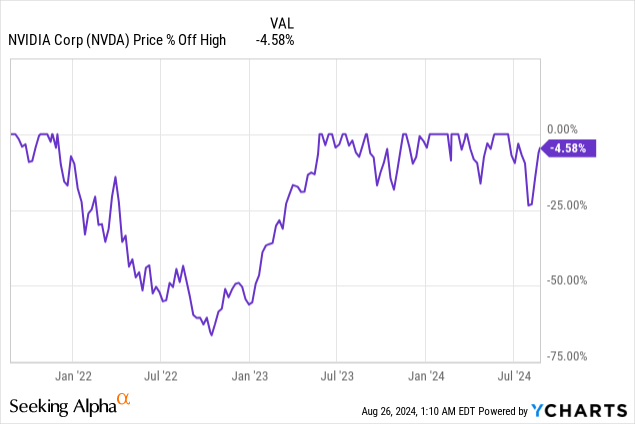

I want to make a disclaimer right at the outset: I've long been skeptical about how high Nvidia Corporation (NASDAQ:NVDA) stock could go. Unfortunately for my coverage history - and fortunately for buyers of Nvidia stock - my bearish rating aged like milk, including my most recent call (which was tactically correct initially, but the stock recovered too quickly from its 25% correction).

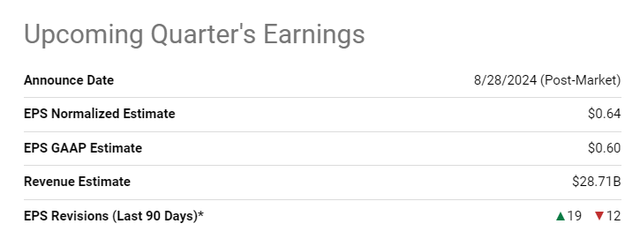

Today, I'd like to preview the company's upcoming quarterly report, set to be published post-market on August 28, 2024, according to Seeking Alpha. Based on the information I currently have on hand, I don't believe that the company's bottom line or revenue will be significantly impacted by the GB200 production delays that many are discussing right before the earnings report. However, even if there's strong growth and skepticism about these delays dissipating, as well as considering the current low market positioning, I think the stock remains far from its fair value, even under the most optimistic input assumptions.

Why Do I Think So?

After Nvidia reported its Q1 FY2025 results, Wall Street analysts have expressed varied expectations for Q2: While some remained optimistic about continued growth, 12 out of 31 have lowered their estimates, reflecting concerns about potential challenges that could hinder the company's progress.

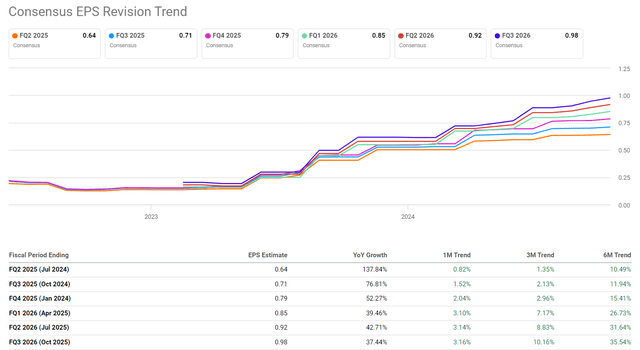

However, it's worth noting that even the most pessimistic analysts, or rather their opinions, couldn't impact the overall dynamics of EPS estimates. The consensus continued to rise for each quarter and each year:

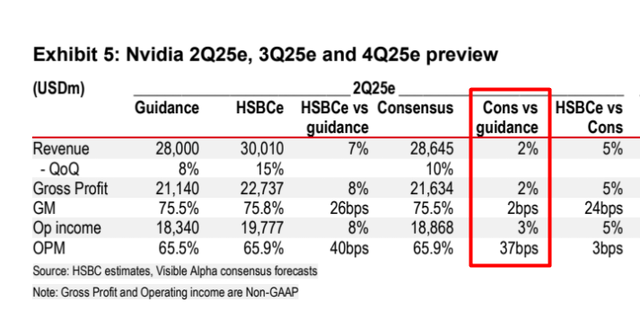

In fact, the market expects the company to achieve $28.71 billion in sales with a GP margin of 75.5%, and an operating profit margin of 65.9%, which is notably higher than the guidance provided by management.

HSBC, proprietary source, the author's notes added

In other words, current expectations include a premium over management's guidance, which usually makes the probability of exceeding these expectations somewhat lower. On the other hand, in the last several quarters, Nvidia has beaten the EPS consensus figures by about 10-12% (quarterly), except for two earnings misses in Q2 and Q3 of fiscal 2023. So, today's 2-3% premium over the management forecast seems minimal to me, providing a significant chance of surpassing forecasts in Q2 FY2025.

A considerable amount of skepticism around Q2 has emerged, largely not only due to the premium over management's guidance, but first, amid news that the production of the GB200 is being delayed. In case you haven't heard of it before, Nvidia's top-tier Blackwell product, the GB200 NVL 72, is set to be the most densely packed AI computing rack in the industry. However, its complexity presents real challenges like managing unprecedented power density, advanced liquid cooling, new TSMC chip packaging, and integrating ARM-based Grace CPUs instead of the usual x86 CPUs. So due to these complexities, Nvidia may face growing pains.

Why do I believe it's an overreaction and there's no need to worry about these delays for the Q2 print?

I think Nvidia is shifting its focus to other products that should help it offset any potential revenue loss. Specifically, as HSBC analysts noted in their recent note (proprietary source), Nvidia plans to emphasize the production of its Hopper H200 GPUs and advanced packaging CoWoS-S chips, which are expected to contribute significantly to sales in the latter half of 2024. Additionally, they view the delays as "slight," and that they aren't expected to cause a material downside to the FY25/FY26 earnings.

BofA analysts also agreed (proprietary source) that Nvidia's earnings will likely face minimal impact from Blackwell GPU delays: they anticipate no impact for Q2 FY2025 at all, with sales "expected to align with or slightly exceed consensus at $28.6 billion, thanks to strong Hopper GPU performance." In Q3 FY2025, the impact is also expected to be limited, with BofA forecasting $30 billion in sales. That's slightly below the consensus, but again: They think the whole downside from the delays will be easily offset by stronger shipments of Hopper or other products. While Q4 FY2025 and Q1 FY2026 might see some effect from Blackwell delays, BofA expects any shortfalls to be recovered in the second half of FY2026, leading to solid growth for the year. The analysts also presented some potential workarounds to address the issues with GB200 delays I mentioned above: "Selling more flexible MGX boards, reducing the GPU count per rack, or lowering the amount of high-bandwidth memory to simplify packaging" would be a great solution.

It's crucial to understand that the market is a forward-looking mechanism that tries to predict future outcomes. Therefore, much of Nvidia stock's post-earnings price action will depend on how management comments on the results and what forecasts they provide for future periods. NVDA's management typically provides guidance only for the next quarter. So since we can assume that the impact of the Blackwell delays will be limited to this period, I think it's likely that the guidance for Q3 FY2025 will not be revised downward. This could, in theory, send a very positive signal to the market participants, in my view.

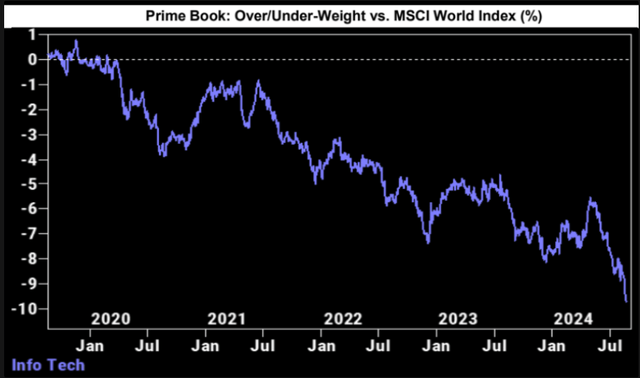

Strange as it may sound, positioning in tech stocks has fallen further recently, according to Goldman Sachs Prime Desk (proprietary source). I think this also creates a favorable environment for NVDA stock to rise even further if its triple beat streak - EPS beat, sales beat and raised guidance - continues.

Info-Tech was net sold for the 4th straight week (13 of the last 16) and saw the largest net selling in 2 months as the sector was net sold in every region

Goldman Sachs Prime Desk (proprietary source)

However, despite all these positive aspects for the company, I still believe that the stock is too expensive to buy at current price levels.

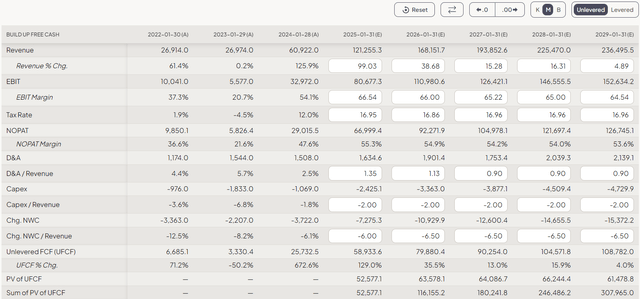

Since about half a month has passed since my last analysis and much has changed in the world during this time, I propose updating my model based on new, more recent consensus forecasts, as well as my assumptions.

The first change I want to note in my updated model is that the consensus assumes somewhat more modest revenues by the end of FY2029 than 3 months ago (the difference is ~$30 billion). I can't say what this is related to, as most of the earnings revisions recently have been positive. Perhaps the longer-term estimates have become a bit more realistic because they expect a faster slowdown in industry growth in a few years. In any case, this is a rather curious point that I can't overlook.

Even though Nvidia operates in a cyclical industry with constantly changing market conditions, let's assume that the current cycle turns out to be very long and constant - this will enable the company to achieve consistently high EBIT margins. Previously, I assumed that the company's operating profit margin would gradually reach 65%. Now, I anticipate that by the end of next year, they will achieve a margin of 66.54%. However, I expect this margin to gradually decline to 64.54% by the end of the 2029 fiscal year.

To maintain a leading position in the high-tech industry, constant expenditure on R&D and CAPEX is necessary - I therefore expect the CAPEX-to-sales ratio to level off at around 2% of sales.

So this is what the intermediate data looks like for my discounted cash flow ("DCF") model:

FinChat, the author's notes added

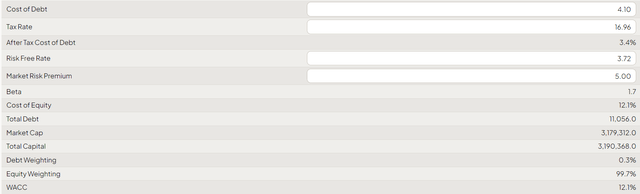

Today, Nvidia's relatively liquid bonds are trading at a yield of ~4.1% (last price). I assume this is what the company's cost of debt would look like today. Assuming an effective tax rate of 16.96%, a risk-free rate of 3.72%, and a market return premium (MRP) of just 5%, I get a WACC of 12.1%. This looks good given the Fed's still-restrictive policy, and it's 60 basis points lower than I got in early June.

FinChat, the author's notes added

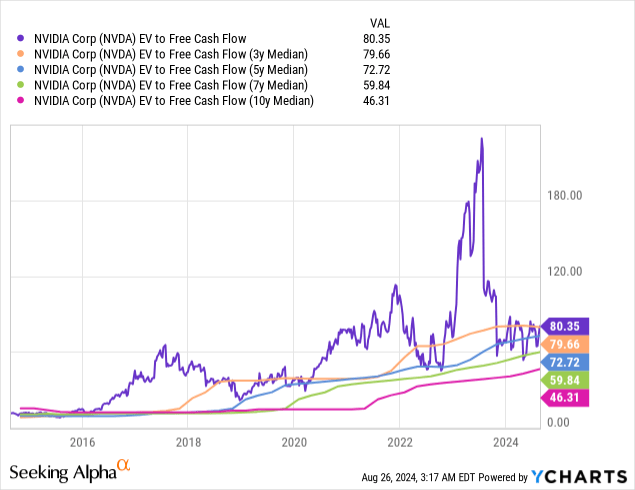

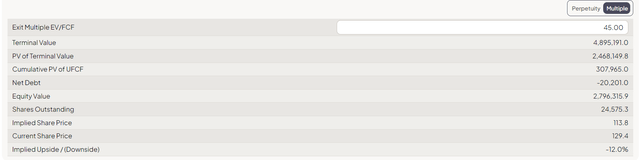

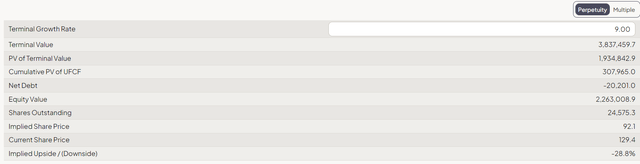

As I noted last time, it's really tough to figure out how fast Nvidia's free cash flow will grow in the future or what its EV/FCF ratio will be by the end of the forecast period (FY2029). I think the end market will eventually get saturated, which makes sense, and this will slow down the business growth rate - I think we may take Gordon's g rate of a maximum of 9% for our TV calculation. As for the EV/FCF, the current multiple of 80x seems far too high to me. Given that growth is bound to slow down by FY2028, as suggested by sales growth predictions, I believe the EV/FCF should be more like 45 times (at best), which is closer to the average over the past decade.

So, all these assumptions lead me to the following conclusions:

FinChat, the author's notes added FinChat, the author's notes added

In other words, if we round up, Nvidia stock turns out to be 12-29% overvalued, even if we assume that Wall Street analysts are wrong again and their forecasts once again underestimate the company's true growth potential (by the same amount as recently). But compared to what we saw 3 months ago, the overvaluation today got even more stretched, not allowing me to rate NVDA as a "Buy."

The Verdict

My conclusions today are quite mixed. On one hand, I believe that the short-term challenges highlighted by some bears recently are exaggerated - the delays of the GB200 are unlikely to significantly impact Nvidia's expected earnings this fiscal year. While current price forecasts suggest another beat, the premium size (2-3%) is below the average quarterly positive surprise (about 10%), so I think NVDA still has a strong chance to exceed both EPS and sales expectations for Q2.

Regarding potential guidance and commentary, I also do not believe management will lower Q3 FY2025 guidance. So given the low positioning of investors in Info Tech (compared to the MSCI World Index), everything points to a positive reaction of Nvidia stock to the upcoming earnings.

However, I'm concerned about Nvidia Corporation's valuation, which has increased even further recently. Even assuming a positive scenario for future business growth, I believe Nvidia is overvalued by 12-29%, depending on the method used to calculate its terminal value. While it's true that many investors don't use discounted cash flow models for fast-growing companies like Nvidia, due to the challenges of forecasting far into the future, the company does generate strong FCF. Thus, I believe DCF analysis shouldn't be ignored here, as it may be one of the best ways to value a business.

Based on this mix of insights and findings, I think a neutral rating best characterizes the company. Therefore, I've decided to raise my rating to "Hold," despite being skeptical about any upside from the current price (I believe the stock has limited potential for further gains). Any massive spike from here would result in a "Sell" rating.

Thank you for reading!

Hold On! Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!