Klaus Vedfelt/DigitalVision via Getty Images

The market as represented by SPDR® S&P 500 ETF Trust (NYSEARCA:SPY) is falling and the question on everyone’s mind is at what level does it find a helping hand of support and start bouncing again? September is historically the worst month of the year for the Index, so we should not be surprised at the sharp drop during the first week of September. The Stock Trader’s Almanac shows the first week is less than stellar, with some strength in the second week. Then there are options triple witching on the 20th, after which we will find out if this September is the worst month of the year.

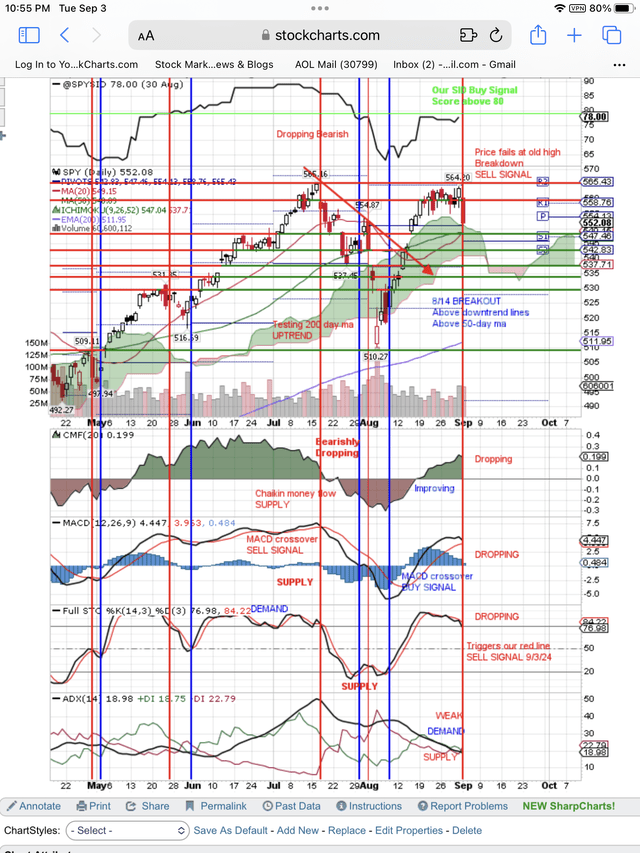

We will start with our daily chart because the drop in the SPY has just triggered our red, vertical line Sell Signal. As you will see on the chart below, the Full Stochastic signal is the one we use to trigger the Sell Signal. The red, vertical line enables you to compare where the other signals are relative to our Sell Signal.

More important on this daily chart are the support lines we have drawn across the price chart. You can see that the price has quickly dropped to test support at $550. It was shocking to see the price breaking below major support at $560 and moving down to test $550 in just one day.

The day traders saw a perfect storm in the morning to short the SPY. First there was the opening gap down, which is not unusual. But then the day traders saw that bad news on the economy made it a bearish, runaway gap down. Buyers could not fill the gap down as they usually do. Besides, the buyers were probably still on vacation after the holiday weekend.

The day traders and robots saw how easy it was to take this market down, a veritable perfect storm of bad economic news, lack of buyers after a holiday weekend, and a break in price below strong support at $560. The traders piled in on the short side and the robots blindly followed them without knowing any of the reasons why.

Now the question is: Will $550 support hold or fold the way $560 so easily folded? We have a long way to go for September and October selling to be over. We don’t expect it to continue dropping at this rate because there will be technical bounces at strong support levels like $550. Furthermore, we expect the bargain hunters to come if $550 turns out to be the short-term bottom with a technical bounce next week. Moreover, if the Fed drops rates in September, that might help.

After the buyers are done and the technical bounce is over, we expect the price to drop back and retest $550 during September. We will have to see if $550 support holds. If not, the SPY may go to $540 to find support for the Santa Claus bounce and another test of the old high at $565. It is really bearish that the SPY failed in its first attempt to put a new high in place above $565. Instead, it formed a bearish double top, and now the price is falling from that bearish double top.

Here is the daily chart showing our red, vertical line Sell Signal and the support lines under price, that are the targets for this move down. It is not surprising that price is going back down to retest the surprise breakout above that red arrow downtrend line shown on the price chart.

SPY daily chart, red line Sell Signal, targeting a retest of $540 support (StockCharts.com)

Conclusion

The SPY red, vertical line Sell Signal is targeting a test of support at the $550 line we have drawn across the price chart. After a technical bounce next week from this level, we expect a retest of $550. We think that the price will break below that level and fill the breakout gap up you can see in price going up from $540. We believe that gap will be filled, and the price will drop to retest $540 support by October.

To understand completely our fundamental and technical approach to making money in the stock market read my book “Successful Stock Signals” published by Wiley. This is the method that I taught to professional portfolio managers on Wall St. and now I share these secrets with you with 50 stock picking programs picking winners every day. You receive our daily email of stocks with Buy Signals before the market opens.