Marilyn Nieves

Introduction

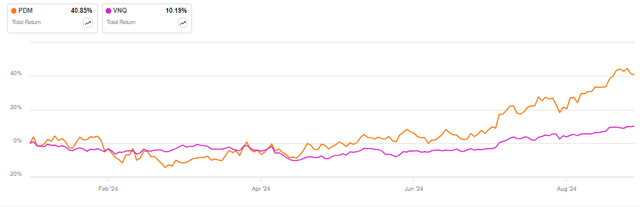

Piedmont Office Realty Trust (NYSE:PDM) has significantly outperformed the Vanguard Real Estate Index Fund ETF (VNQ) so far in 2024, delivering a ~41% total return against the circa 10% gain for the benchmark ETF:

PDM vs VNQ in 2024 (Seeking Alpha)

I also covered the shares back in April 2024 with a Neutral rating as I liked the valuation but was cautious due to elevated risks stemming from high leverage and weak occupancy that is plaguing the whole office sector. After reviewing the company's Q2 2024 results and taking into account the expectations for imminent Fed rate cuts, I think it is appropriate to upgrade my rating from Neutral to Buy. The upgrade is driven by:

- A consistently positive operating performance in terms of net operating income and occupancy growth.

- A debt-heavy capital structure that should benefit from real estate cap rate compression.

- An attractive valuation in terms of Core FFO multiple and market-implied cap rate.

Company Overview

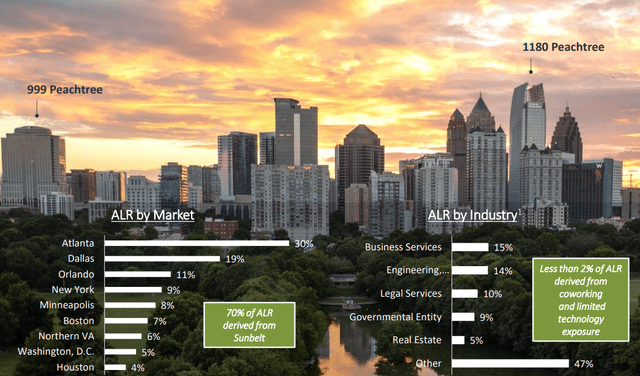

You can access all company results here. Piedmont Office Realty Trust is an office REIT focused on the Sunbelt region, which accounts for 70% of the company's annualized lease revenue (ALR). Atlanta is the single largest exposure, at 30% of ALR, followed by Dallas at 19% and Orlando at 11%:

ALR breakdown by market and industry (Piedmont Office Realty Trust Q2 2024 Presentation)

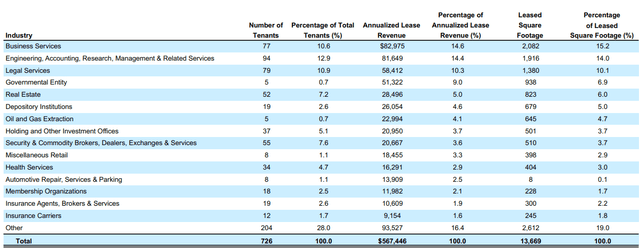

From an industry perspective Business Services account for 14.6% of ALR, followed by Engineering, Accounting, Research, Management & Related Services at 14.4% and Legal Services at 10.3%:

Tenant breakdown by industry (Piedmont Office Realty Trust Q2 2024 Supplemental Information)

Operational Overview

Piedmont Office reported a Core FFO of $0.37/share in Q2 2024, down 18% Y/Y, impacted mainly by higher interest expenses, but also the divestment of One Lincoln Park in Q1 2024. Occupancy performance was a bright spot, with 87.3% of the portfolio leased at the end of H1 2024, up 1.1% Y/Y.

Same Store net operating income (NOI) was up 3.7% Y/Y on an accrual basis as the company benefitted from higher leases on renewals (+23% on an accrual basis).

Overall I would note that the ability to raise rents and manage occupancy gains in a challenging office market speaks of the quality of the REIT's office portfolio.

Updated 2024 Outlook

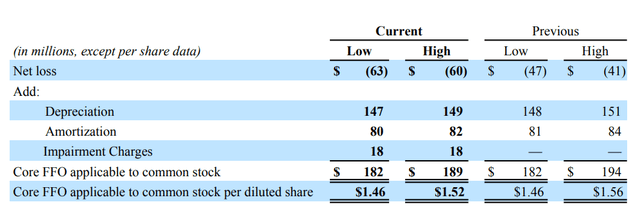

Despite increasing its Same Store NOI growth outlook to 2-3% for the full year, persistently high-interest rates prompted Piedmont Office to lower its Core FFO 2024 guidance midpoint to $1.49/share:

Updated 2024 Outlook (Piedmont Office Realty Trust Q2 2024 Results Press Release)

I think investors should look past the lowered Core FFO outlook, as the main driver behind the decrease - higher interest rates - is likely to reverse going into 2025 and beyond.

Debt Position

Piedmont Office Realty Trust ended Q2 2024 with a net debt of $2.1 billion, implying that net debt still accounts for 64% of the $3.28 billion enterprise value even after the strong share price performance so far in 2024.

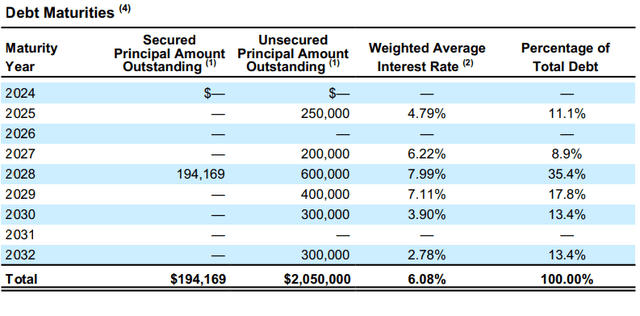

Only 5.3% of all debt is floating rate, implying limited immediate benefits from Fed rate cuts. The weighted average interest rate stands at 6.08% with just 11.1% of all debt maturing before 2027:

Debt maturity profile (Piedmont Office Realty Trust Q2 2024 Supplemental Information)

All in all, I would say the high proportion of debt in the capital structure positions the company well for a sector-wide compression in real estate cap rates, which I expect as the Fed normalizes monetary policy over the next few years.

Market-implied cap rate

I estimate Piedmont Office Realty Trust currently generates a core FFO of about $187 million on an annual run-rate basis. Furthermore, the company will pay circa $118 million in interest expenses at current interest rates. Thus combined cash flows to enterprise value stand at $305 million, resulting in a 9.3% market implied cap rate, which is quite attractive for a commercial REIT that manages to grow occupancy and NOI. Furthermore, the above amount already incorporates management overhead of $30 million. Without it, the market-implied cap rate increases to 10.2%, indicating a 0.9% burden from management overhead, which is in line with smaller peers.

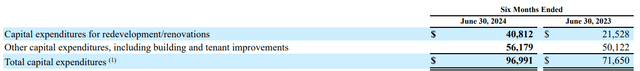

As discussed in my previous article, the high market-implied cap rate should be taken with a grain of salt as the REIT spends extensively on capital expenditures, with 42% of H1 2024 capex going for redevelopments/renovations while 58% is spent on building and tenant improvements:

Capital expenditures breakdown (Piedmont Office Realty Trust Form 10-Q For Q2 2024)

Valuation and prospects

I expect core FFO to mark a trough in 2024 as the result in 2025 should benefit from continued NOI growth and marginally lower interest expenses. At the $1.49/share midpoint of the REIT's 2024 guidance, the core FFO multiple stands at just 6.4x, which is quite attractive for a commercial REIT. Of course, it is also indicative of the REIT's high leverage, but also the weak across-the-board valuations of office REITs.

The company is also well-positioned to benefit from real estate cap rate compression, considering that net debt accounts for 64% of enterprise value, although the 5.3% proportion of floating rate debt is quite low.

The market-implied cap rate of around 9.3% is also attractive in light of the REIT's stable operating performance, notwithstanding the elevated capex needs of the portfolio.

All in all, I think it is appropriate to upgrade my rating to a Buy as the company has kept up its robust operating performance and is generally well-positioned for the Fed easing cycle.

Risks

The main risk facing Piedmont Office Realty Trust is a reversal of its excellent operating performance in terms of occupancy and NOI growth. Such a reversal would negatively affect the company's valuation, which is not as distressed compared to other office REITs experiencing lower occupancy.

The other key risk to mention is that the Fed may not cut rates as fast as the market currently anticipates. With futures markets currently pricing in a Fed funds rate of about 3.25% in July 2025, the expectations are already quite high. Even so, I would note that the Fed anticipates cutting rates to about 2.8% in the long term, hence the path for interest rates is clearly lower, with the exact timing of rate cuts admittedly uncertain.

Conclusion

Piedmont Office Realty Trust reported robust Q2 2024 results, but marginally reduced its core FFO outlook for the full year as interest rates were kept higher than initially anticipated.

I expect the Fed to decrease interest rates over the next few years, which will benefit the company, considering the 64% net debt proportion in the capital structure.

Piedmont Office Realty Trust remains cheap on a Core FFO multiple basis (~6.4x) and market-implied cap rate (~9.3% before capex) hence I have decided to upgrade my rating from Hold to Buy. I think the company is well-positioned to outperform real estate peers going forward.

Thank you for reading.