Adam Gault/OJO Images via Getty Images

Fulgent Genetics, Inc., (NASDAQ:FLGT) is a leading provider of comprehensive genetic testing solutions, offering an extensive suite of testing services to healthcare providers, researchers, and individuals, mainly in the United States. The company specializes in next-generation sequencing (NGS) technology, enabling the analysis of various genetic conditions and diseases with high accuracy and efficiency. Following the acquisition of Fulgent Pharma, the company is also researching and developing a number of novel cancer therapeutic treatment opportunities.

Thesis

In my initial analysis published on February 21st, I recommended to buy FLGT at just under $25 due to its cheap valuation and compelling revenue growth and margin expectation prospects. Management guidance issued a few days later, on February 28th, significantly missed my original modeling assumptions on both top- and bottom-line for 2024, and kept the stock bound in the $20-25 range over the past 6 months.

After growing its core (non-COVID) business both organically and inorganically (with acquisitions of CSI Labs and Inform Diagnostics) by 48% in 2023 and 44% in 2024, I was projecting a 15% core growth for FY 2024 with operating leverage from integration synergies driving margin expansion. Instead, management is guiding to $280 million core revenue for this year, which only represents 7% growth. In addition, profit guidance implies only moderate operating margin expansion, due to continued investments both in the lab services and the pharma segment of the business.

In this article, I review H1 results and provide a revenue outlook for FY 2024 and 2025, explaining why I believe that the core revenue growth slowdown was temporary. I also shine the light on a couple of interesting potential growth catalysts moving forward. My valuation update, which reflects the delayed path to profitability following recent results, reduces the fair value to $34 from $40 (see my original analysis). Finally, I discuss key risks for FLGT shareholders, which continue to revolve around the company’s governance structure and M&A fantasies.

With all that, my investment thesis has not fundamentally changed, and I reiterate my "Buy" rating. At below $22, FLGT remains most likely undervalued, and offers market-beating prospects at reasonable risk for investors with an investment horizon of three to five years. If my growth acceleration estimates for 2025 materialize and unless management engages in disruptive M&A activities, I also see a potential 30-40% upside for the stock over the coming 12 months.

Precision Diagnostics: The Bright Spot Amidst Mixed H1 2024 Results

As a reminder, Fulgent Genetics reports financial results in two segments, Fulgent Laboratory Services and Fulgent Pharma. The latter is its recently acquired therapeutic development division, which I described in more detail in my previous analysis.

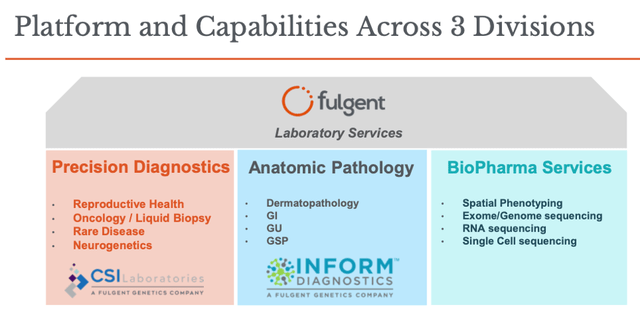

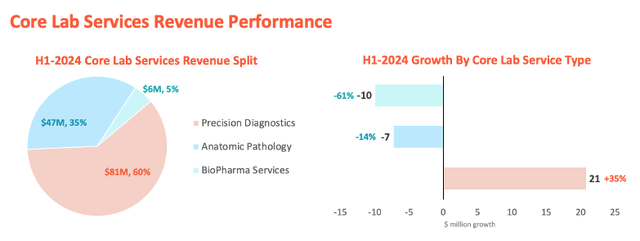

For now, all revenues are generated by Laboratory Services, which are broken out between core services and Covid-testing. The latter represented a mere $2 million in revenue for H1 2024, and is expected to remain irrelevant moving forward. Core lab services is divided into three divisions, (1) precision diagnostics, (2) anatomic pathology and (3) biopharma services, as shown in the picture below.

Fulgent Genetics Investor Presentation

After growing its core revenues in the mid-forty percentage range for two consecutive years, the slowdown to 3% growth in the first half of 2024 was very abrupt and unexpected – for me at least. To management’s credit, Mr. Ming Hsieh and team saw headwinds coming when they issued FY 2024 guidance on February 28th, indicating 7% core growth for the year (while I expected 15% when publishing my initial analysis a few days earlier).

Fortunately, as the following chart shows, the story behind the sluggish growth is more nuanced than it seems on the surface. Let me unpack it for you.

Stock Research Platform, using FLGT 10Q Report Data

The impressive +35% increase in precision diagnostics revenue is driven by growth in Fulgent Genetics’ reproductive health services and specialized oncology testing services, both of which are expected to remain sustainable growth drivers for the company moving forward on the back of the successful acquisition and integration of CSI Laboratories. The fact that the fastest growing division’s sales now represent 60% of total core revenues provides confidence in the acceleration of total core revenues going into FY 2025.

The -13% decrease in anatomic pathology services was primarily due to decreased reimbursement rates from third-party payors. To a lesser extent, it was also influenced by timing factors, as the volume of anatomic pathology testing services can fluctuate during holiday periods and can decline, e.g., due to extreme adverse weather conditions. As the company points out in its 10Q report, the reimbursement rate from third-party payers, which are "subject to the complexities and ambiguities of billing, reimbursement regulations and claims processing, as well as considerations unique to Medicare and Medicaid programs", will continue to cause fluctuations in anatomic pathology revenues. That said, management expects "some really good momentum" for the second half of the year as the company was able to gain new accounts.

Finally, the decrease in BioPharma services, the division where Fulgent records revenues associated with service projects it completes for healthcare institutions and big Pharma customers, is attributed to project timing. This part of Fulgent Genetics’ core lab offerings, which in the first half of 2024 represented only 5% of total core revenues, is expected to remain lumpy as projects roll on and off. The good news is that the small absolute revenues in the year-to-date period set the company up for a rebound going forward.

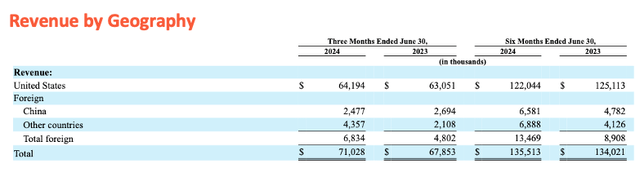

Fulgent Genetics, 10Q Report (Q2 2024)

Looking at the geographical revenue evolution, U.S. revenues are down year-on-year driven by the aforementioned declines in the anatomic pathology and BioPharma services divisions, only partly offset by precision diagnostics. Meanwhile, Fulgent Genetics was able to grow its international revenues by over 50% to $13.5 million, which highlights the future growth potential outside the U.S., even though the base is still small.

To conclude on revenue performance, given the relative size and growth dynamics across the three divisions, it is not hard to envisage that core revenue growth will re-accelerate going forward (more on that later). To hit the full-year guidance of 7% growth, H2 growth is expected to step up to 11%, a reasonable expectation in my view. Furthermore, if precision diagnostics continue to outperform and the other two divisions stabilize or even rebound, we should see even stronger double-digit growth going into 2025.

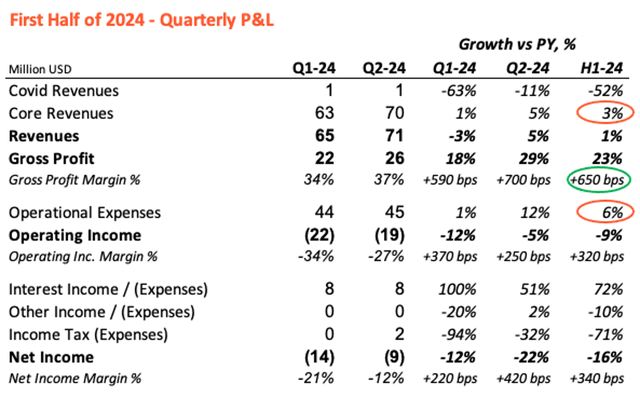

Let’s now turn to the rest of the P&L.

The significant gross margin expansion by 650 basis points, which management attributes to continued integration efficiencies and streamlining of its business post integrations, was a clear highlight in the H1 P&L. Guidance suggests we will continue to see improvement towards the 40% mark by the end of this year. On the flip side, the 6% growth in operational expenses is a reflection of increased R&D spend in the therapeutic development business, notably related to FID-007, while SG&A remained largely flat. Management expects these spending trends to continue into the second half.

Overall, the Lab Services segment contributed to $29 million and the Pharma segment to $12 million out of the $41 million operating loss in the first half of 2024.

Below the EBIT line, Fulgent Genetics picked up over $15 million in interest income from its invested marketable securities and also recorded some tax benefits, reducing the net loss to about $22 million in the first half of 2024. While that marks an improvement relative to the $27 million loss in the first six months of 2023, sluggish revenue growth paired with increased Pharma R&D investments are slowing down Fulgent’s return to profitability.

Let’s now take a look at what growth could look like in the second half of 2024 and going into next year.

Growth Outlook for H2 2024 and 2025

FLGT stock is down -26% YTD and -12% since I first recommended to buy it in February. The main reason for this poor performance is lackluster growth in H1 2024 paired with a modest 7% core growth expected for the year. Indeed, while gross margins have nicely expanded, core growth is the single most important metric that will determine how quickly Fulgent Genetics’ laboratory services segment will start turning an operating profit.

Fortunately, there are good reasons to believe in a growth re-acceleration starting in the second half of 2024.

To start with, the relative performance and size of the three lab services divisions points to an inflection in the growth curve. As previously discussed when reviewing H1 results, precision diagnostics continued to grow strongly, offset by anatomic pathology and BioPharma services which were the laggards in the first half of the year. However, management signaled positive momentum in anatomic pathology going into H2, while BioPharma was only $9 million revenue already in the second half of 2023, leaving limited room for material absolute dollar decline.

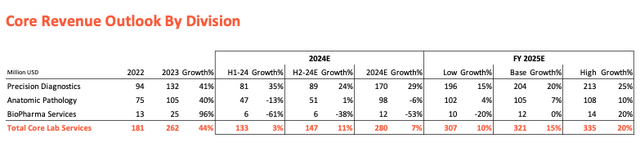

In the table below, I broke out H2 2024 sales estimates by division based on management’s qualitative comments, matching the $280 million full-year total core revenue guidance.

If we assume that BioPharma will remain sequentially flat ($6 million both H1 and H2) and that anatomic pathology did indeed bottom in H1, returning to moderate growth in H2 (+1%), then precision diagnostics would need to deliver +24% in the second half of 2024 for Fulgent Genetics’ to hit their full-year guidance. Given the 41% growth in 2023 and 35% growth in H1 2024, and absent material one-off effects, this seems reasonable (with some room for upside). In aggregate, this would imply 11% core growth in H2 2024.

Fasting forward to 2025, the poor first half of 2024 performance in both anatomic pathology and BioPharma services, both of which have been facing more seasonal and timing related rather than fundamental growth headwinds, sets these divisions up for a rebound. As a base case, I am assuming that anatomic pathology can climb its way back to 2023 revenue levels, implying a 7% growth for 2025, and that BioPharma projects will stay at least stable relative to 2024 (a conservative assumption as this was a rather difficult year for this division).

For precision diagnostics, year-over-year growth should remain strong as Fulgent Genetics continues expanding its genetic testing offering and penetrating new geographies, both within the U.S. and internationally. However, I factored in a sequential slowdown in growth rates to account for the division’s growing scale. With 41% growth in 2023 and an expected 29% growth in 2024, I am defining a 15% (low case) to 25% (high case) growth range for 2025, with 20% growth in the base case.

With that, I get to a base case total core growth of 15% for 2025 (range 10% to 20%), which would represent a significant re-acceleration from the 7% expected this year, and should act as an upside catalyst for the stock.

Other Potential Catalysts: NOVA Launch & New FDA Ruling

While the described growth mix dynamics are the main reason for me to believe in a near-term growth re-acceleration, I would like to touch on two other individual catalysts that might boost growth going forward:

- Fulgent’s recently launched Non-Invasive Prenatal Test (NIPT) sold under the brand name NOVATM,

- The recent Food & Drug Administration (FDA) ruling to enhance the safety and effectiveness of laboratory developed tests.

Both of these factors have been discussed during the last earnings call.

Starting with the new test, NOVATM is the "first NIPT to include common aneuploidies, micro-deletions, and monogenic conditions caused by de novo point mutations".

For reference, aneuploidies are genetic disorders where there is an extra chromosome (i.e., trisomy) or a missing chromosome (i.e., monosomy), making the total either 47 or 45 instead of the 2x23=46 chromosomes a human normally has. A common form of trisomy is the Down Syndrome, which is caused by an extra copy of chromosome 21. Meanwhile, micro-deletions and micro-duplications are another form of chromosomal abnormality associated with atypical development outcomes, including development delay and intellectual disability. They span over several genes, but are too small to be detected by conventional cytogenetic techniques. Next-generation sequencing (NGS) has been paramount to the discovery of many novel micro-deletions and micro-duplications associated with diseases in recent years, including very rare but clinically relevant rearrangements.

Finally, de novo mutations, which designate genetic alterations occurring for the first time in one family member due to a mutation in the mother’s or father’s germ cell, have shown to be "a major cause of severe early-onset genetic disorders such as intellectual disability, autism spectrum disorder, and other developmental diseases." Specifically, de novo point mutations producing monogenic disorders, which are caused predominantly by the lesion of a single gene, tend to present complex clinical symptoms and are often lethal or disabling. While rare on an individual basis, taken together, they represent a high disease load in the population.

According to Brandon Perthuis, Chief Commercial Offer at Fulgent Genetics, most existing NIPTs cover aneuploidies, microdeletions and microduplications, but none of them covers de novo point mutations for monogenic conditions, making this a key differentiator. Given NOVATM's innovative character, management expects it may take some time to see a significant pick-up in demand, as medical doctors and clinicians need to be educated first. However, they are convinced that the value-added will create a competitive advantage over time, which makes sense: everything else being the same, why not cover a broader spectrum of potentially devastating diseases in a NIPT?

By the way, according to Fortune Business Insights, Non-Invasive Prenatal Testing, a $5.2 billion market in 2022 (of which more than half in the U.S.), is expected to grow to over $19 billion by 2030. That’s 17% per year, or about twice the CAGR of the broader diagnostic labs market. So while it is hard to estimate the benefit Fulgent may get from its innovative test in the next six to 12 months, being at the technological forefront in this reproductive health market segment positions the company well for future growth.

Moving to the new FDA ruling issued on April 29th, 2024, and aimed at ensuring the safety and effectiveness of laboratory developed tests, Fulgent management explained in their prepared remarks that while uncertainties remain around the implementation of the new rules, it believes that the additional regulations could actually become a "positive catalyst" for the company.

At a high level, the FDA is concerned about the increasing number and complexity of in-vitro and lab developed tests being offered to patients without proper oversight, and thus issued a number of requirements that lab test developers will need to comply with according to a pre-set schedule over the years to come. In their ruling, the FDA states that it intends to exercise "enforcement discretion" (in other words, provide exemptions) for a certain period of time for tests developed before the ruling became effective (i.e., May 6, 2024).

This means that as long as they are not modified, Fulgent Genetics' current service offering of 20,000+ tests will not be immediately impacted by the ruling. Over time, they will need to comply with different requirements, which Brandon Perthuis summarized below:

Stage 1 [as from May 6, 2025] includes FDA medical device reporting, which will require laboratories to report certain device-related adverse events and product problems to FDA within a specific timeframe. Stage 1 also requires labs to maintain compliant files for each test they offer and to report any corrections or removals to the agency.

Stage 2 [as from May 6, 2026] requires each laboratory to be registered with the FDA and to list their commercial tests with the agency. It also phases in device labeling requirements and certain other compliance rules.

Stage 3 [as from May 6, 2027] applies certain other quality system regulations to laboratories and their tests with the specific requirements depending in large part on whether a currently marketed test is approved by New York State or not.

So, what is the potential good news here?

For Fulgent Genetics, these hurdles will be fairly easy to clear for existing tests, particularly on stage 3 since many were already approved by the New York State’s Clinical Laboratory Evaluation Program. Meanwhile, these "new regulations may make it more difficult for new labs to open or new tests to be launched at existing laboratories, potentially creating a competitive moat for [the] company".

With that, let’s move to my updated valuation model.

FLGT Valuation Update

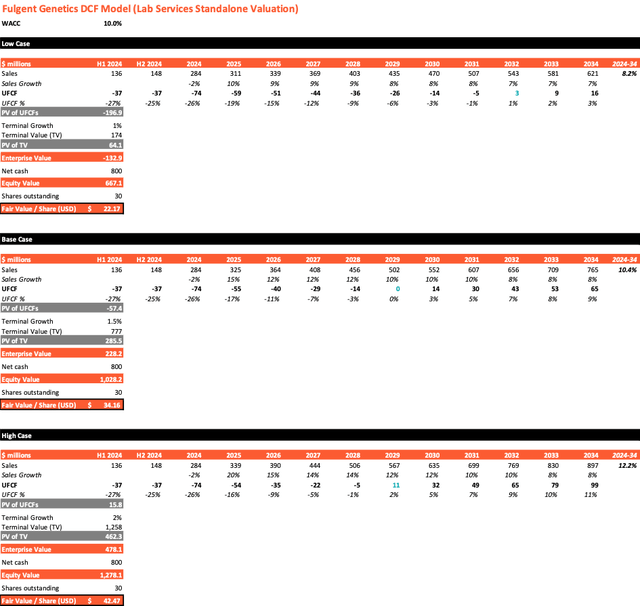

After running a simplified valuation model in my initial analysis, I opted for a discounted cash flow (DCF) valuation this time to better account for the phasing of free cash flows within the next decade. Indeed, the key changes since my last assessment are the slower revenue growth and higher Opex spend in 2024. Despite the expected growth re-acceleration into 2025, these trends will delay the return to (GAAP) profitability and the generation of positive unlevered free cash flow.

Another methodological change I made when moving to the DCF model is that instead of assuming that the $800+ million of cash and marketable securities currently on hand will be deployed into M&A and return a given amount of cashflow over time, I am calculating enterprise value based on the existing business only, and adding the $800 million net cash back to determine equity value. Assuming Fulgent Genetics does indeed use this capital for M&A, the inherent assumption is thus that the discounted cash flows from future acquisitions are equal to the cash employed. Reality could, of course, be better or worse (we will talk about this in the risks section)…

What I did not change is my approach to ignore Fulgent Pharma for valuation purposes, which implies the assumption that negative cash flows in the near-term will be offset by future positive cash flows: not more, not less. Again, reality could be better or worse. To get a sense of the sensitivity around this assumption, let’s assume that Fulgent Genetics keeps burning $15 million cash per year in its Pharma business for the next 10 years, never makes a dollar in return, and then terminates it at no residual value. The present value lost would be roughly $100 million, or a little over $3 per share. That’s not nothing, but it also does not make or break the valuation.

Turning to operational assumptions for the lab services business, I assumed a 10-year revenue CAGR of 8% to 12% (base case: 10%), with a phasing as shown in the table below. Given positive recent developments, I did not change my gross margin expectations from my previous model, reaching and stabilizing in the mid-forties on the back-end of the decade. Operational expenses will benefit from scale, as they should continue to grow at a lower rate than revenues, ending between 30% (high case) and 40% (low case) of sales by 2034. I assumed Capex to normalize in line with past years and industry average (5% of sales for the low case, and 4% in the base & high case). Finally, I kept terminal growth between 1% (low case) and 2% (high case).

Using a risk-free rate of 4%, an equity premium of 4%, and a beta of 1.5, I used a WACC of 10% as discount rate.

With that, I get a fair value of $34 in the base case, with a range of $22 to $42.

The low case, which has an enterprise value of -$133 million, is fairly aligned with the current stock valuation (about $22 per share). To be clear, in my model, the negative enterprise value is not due to negative assumptions around Fulgent Pharma or potential M&A – both of those are assumed "neutral" to valuation by design. Instead, it is the assumption that lab services growth will not re-accelerate, maintaining an 8% CAGR over the coming decade, which slows down operating margin expansion to the point that unlevered FCF turns positive only by 2032. This is not enough to offset the negative cashflows accumulated in prior years.

This shows how essential the growth re-acceleration we discussed in previous sections, is, to the valuation. Let’s now take a look at other risks of owning FLGT.

Main Risks Linked To Governance And M&A

In my previous analysis, I explained why I believe that Fulgent Genetics’ business should be fairly insulated against a possible economic downturn. The main argument is that the company’s sources of revenue, i.e., insurance reimbursements as well as the spend of health institutions, hospitals and big Pharma clients, are typically not (much) correlated with economic growth. This is why the healthcare sector is a defensive play in challenging times.

I also discussed how potential regulatory or political changes may negatively affect Fulgent's business model, and notably insurance reimbursements, which still represents 45% of Fulgent Genetics’ H1 2024 revenues. We discussed how the recent changes in FDA requirements may rather be an opportunity than a risk. In addition, I continue to see positive economics of genetic testing for rare/severe diseases from an insurer’s perspective, as prevention is always cheaper than cure. This should limit the risk of a material impact from changes in insurance policies.

On the competitive front, Fulgent Genetics operates in a very fragmented market, in which it is well positioned for continuous growth thanks to its cost-effective next-generation sequencing (NGS) technology platform and extensive test menu offer. Besides, the U.S., the company also has plenty of room for international growth.

In summary, the above macro-risks are unlikely to fundamentally threaten the investment thesis. Instead, corporate governance, and more specifically the powerful position of Ming Hsieh, majority shareholder, CEO and Chairman of the Board, is still the main source of risk moving forward. For the full background on governance risks, please refer to my previous article and the article of SA author Siyu Li.

The fact that FLGT trades at -20% below its cash value despite moderate cash burn is, at least to some extent, the materialization of this risk. Indeed, without a majority owner that can block a hostile takeover, either a competitor or private equity would have most likely stepped in with an offer. Besides being able to potentially buy the company for the value of its cash, a new owner could decide to unload the recently acquired Pharma business (making some immediate cash and reducing cash burn going forward), focus on driving growth and profitability in lab services, and more aggressively buy-back shares.

At least near-term, this approach would seem like a no-brainer way to maximize shareholder value. Yet, it is not happening, as Ming Hsieh is pursuing his agenda and vision to make Fulgent Genetics a "One-Stop Solution for Cancer Care". Whether or not this strategy will end up generating more shareholder value in the long-run is an uncertain bet at this time. As we know, investors don’t like uncertainty, and the price action suggests they don’t trust management to be successful in therapeutic development, either.

So, what does this mean for (potential) Fulgent Genetics shareholders going forward?

First of all, as long as Mr. Hsieh stays at the helmet, nobody should invest in Fulgent Genetics in hopes of the above takeover scenario playing out.

Before you invest in (or as you hold) FLGT, make sure you are comfortable with two key assumptions:

- First, you need to believe in the fundamental growth and margin expansion story of the company’s laboratory services business: this is where we need to see continuous progress towards GAAP profitability, with cash flow growth over time (as reflected by the low case vs. base & high case fair value calculations) ;

- Second, you need to trust management (and mainly, the CEO) not to make materially bad decisions, whether it is regarding the cash-burn in the Pharma segment, or future M&A.

The second assumption is inherently the biggest uncertainty. Again, Mr. Hsieh will not intentionally make poor decisions hurting the business. After all, most of his wealth is invested in it. However, he may or may not make decisions that ultimately pay off, and even more likely, he may make decisions that do not pay off within the time horizon you want to be invested.

When asked during the Q2 earnings call, Mr. Hsieh was very clear that the company continues to actively look for M&A opportunities (while funding internal R&D):

We are looking for opportunities for the M&A and as well as our internal development. So that's the way we will spend our cash.

He pointed out how strategically important the previous acquisitions of Inform Diagnostics and CSI Labs were in becoming a major player in the Reproductive Health area, and to generate synergies to grow Precision Diagnostics while improving profitability. That said, even if these acquisitions were, I believe, a good fit at a reasonable price, it will take years for them to pay off. Even assuming the company continues to choose good acquisition targets at a fair price, any further acquisition will result in immediately less cash for an uncertain return in the future. This is one of the reasons why the stock is already trading below its cash value today.

In summary, if you are not convinced that Fulgent Genetics can re-accelerate growth in lab services, or if the thought of more M&A makes you feel uncomfortable, I would recommend you better stay clear of this stock.

Conclusion

On the Stock Research Platform, I am looking for asymmetric low risk, high reward investment opportunities. While Fulgent Genetics’ impressive cash position of over $27 per share is likely to prevent significant downside pressures from current levels, the meager 7% core revenue growth expected in 2024 has capped the upside in the short term.

That said, core growth is well positioned to reaccelerate in H2 2024 and going into next year (I expect low to mid-teens growth in 2025), driven by continued strength in precision diagnostics and stabilization in anatomic pathology and BioPharma services. This could allow the stock to return to the higher $20s over the next 12 months, implying 30-40% near-term upside. However, this opportunity is contingent not only on growth re-acceleration in lab services, but also on the absence of surprises in the Pharma business (i.e., no increase in cash burn) and on the M&A front (i.e., no new "questionable" acquisition).

I previously recommended to buy the stock at around $25, and I am long the stock myself after selling puts in the $20-$25 range. Despite the known risks and uncertainties, I continue to believe that owning Fulgent Genetics in this price range has the potential to generate market-beating returns, possibly over the next 12 months, and more probably over the next three to five years. This is why I am reiterating my "Buy" rating.

If, like me, you hold FLGT shares and would like to generate cash flows while waiting for fundamentals to drive the stock higher, you can consider selling covered calls on your position (at or above your cost basis). While this approach could create an opportunity cost in case of an unexpected strong near-term catalyst, it will secure decent returns even if the stock continues to trade sideways for longer.