t_kimura

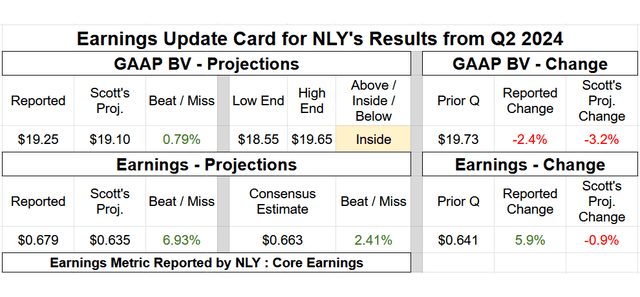

- Quarterly BV Fluctuation: Nearly an Exact Match (At or Within a 1.0% Variance).

- Core Earnings/EAD: Minor-Modest Outperformance (High End of Projected Range).

An "as expected" quarter regarding Annaly Capital Management, Inc.'s (NYSE:NLY) BV, in my opinion. If anything, a very minor outperformance. NLY's minor quarterly BV decrease was slightly less severe versus my projection. NLY very slightly increased the company's on-balance sheet fixed-rate agency MBS sub-portfolio. In comparison, I projected a slightly larger increase to this sub-portfolio. This resulted in some BV outperformance when compared to my expectations (lower portfolio size as MBS pricing decreased during the quarter). NLY continued to increase the company's residential whole loan/securitized and MSR sub-portfolios. The increase in size of these two sub-portfolios was slightly larger when compared to my expectations which also resulted in some minor BV outperformance. However, this was partially offset by a very minor underperformance within NLY's derivatives sub-portfolio regarding valuation fluctuations (nothing material). Unlike DX and AGNC, for the second straight quarter, NLY really did not utilize the company's at-the-market ("ATM") equity offering program. As such, not much regarding quarterly equity activity.

A bit of an outperforming quarter regarding NLY's core earnings/EAD in my opinion. This minor-modest outperformance was a nice "bounce back" to last quarter's minor-modest underperformance. Along with some coupon rotation and continued increase in weighted average yield (slightly higher versus my modeling), NLY's core earnings/EAD outperformance was mainly due to the company not really altering the company's interest rate payer swaps position during the quarter. NLY's interest rate payer swaps actually had a fixed pay rate decrease of (7) basis points ("bps") during Q2 2024. This outperformed my expectations of an increase of 20 bps. This was in stark contrast to AGNC's Q2 2024 increase of 46 bps. While NLY's net periodic interest income on interest rate swaps (current period hedging income) slightly decreased during the quarter, the severity was less than anticipated. NDR income came in basically as expected (very little income due to the very flat yield curve). Operational expenses also came in largely as expected.

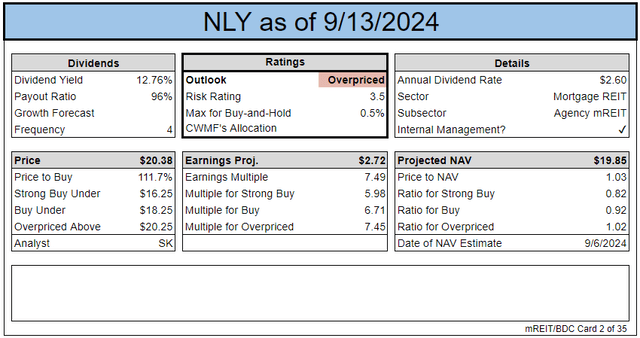

A pretty good quarter overall for NLY. NLY reported a slightly - modestly less severe quarterly BV decline versus sub-sector peers (as previously anticipated) and the company was able to increase quarterly core earnings/EAD a bit. A risk/performance rating of 3.5 for NLY remains appropriate in the current environment/over the foreseeable future.

We will use many terms in this article that may be unfamiliar to readers. We've created a glossary for those that are interested.

Change or Maintain

- BV/NAV Adjustment (BV/NAV Used Interchangeably): Our projection for current BV/NAV per share was adjusted: Up $0.15 (to account for the actual 6/30/2024 BV/NAV Vs. prior projection). Price targets have already been adjusted to reflect the change in BV/NAV. The update is included in the card below and the subscriber spreadsheets.

- Percentage Recommendation Range (Relative to CURRENT BV/NAV): No Change.

- Risk/Performance Rating: No change. Remains at 3.5.

Hedging

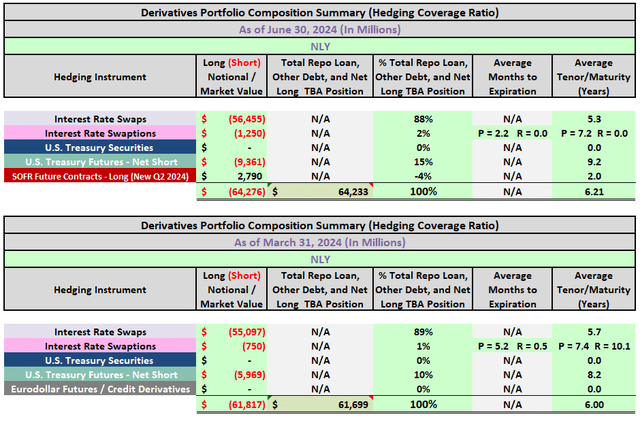

- Hedging Coverage Ratio: Unchanged at 100% (includes factoring in receiver swaptions and includes MSR-related financing when applicable).

Earnings Results

Note: BV at the end of the quarter. Subscriber spreadsheets and targets use current estimates, not trailing values.

Valuation

Ending Notes/Commentary

NLY's lifetime CPR expectations decreased from 8.9% as of 3/31/2024 to 8.5% as of 6/30/2024. This exactly matched my expectation of 8.5%. NLY remained somewhat defensive regarding risk management strategies, with a hedging coverage ratio of 100% as of 6/30/2024. This generally bodes well in a rising (or elevated) interest rate environment - typically lowers the severity of BV losses via more enhanced derivative valuation gains when spread/basis risk remains subdued. However, a hedging coverage ratio that high would become a burden if rates/yields quickly net decreased; lowers the enhancement of BV gains via more severe derivative valuation losses, especially if spread/basis risk rises. Of course, a company's net duration gap matters as well, but this is a general tendency.

I believe NLY remains in relatively "good shape" to maintain its current quarterly dividend of $0.65 per common share. Yes, that even includes the fact NLY's core earnings/EAD for Q1 2024 "dipped" below this amount. NLY fairly recently had a large dividend per share rate "reset" that management continues to believe can be sustained over the foreseeable future. As correctly pointed out last quarter, I believed NLY's core earnings/EAD would creep back above $0.65 per common share in the coming quarters. I just did not expect it to occur during Q2 2024 (projected during Q3/Q4 2024).

NLY currently does not present "great" value, but its valuation is not "horrible" either (hence the HOLD recommendation). I continue to believe the near-term environment remains fairly challenging for the agency mREIT sub-sector (though should gradually improve looking into 2025 and beyond). I would like to see spread stabilization over a period longer than a couple of weeks, along with NLY's stock price trading at a slightly - modestly more attractive valuation before considering an investment.

Want the best research? It’s time to raise your game. Get access to several features you won’t find on the public side.

You can get access to everything we have to offer right now. Try our service and decide for yourself.