buzbuzzer

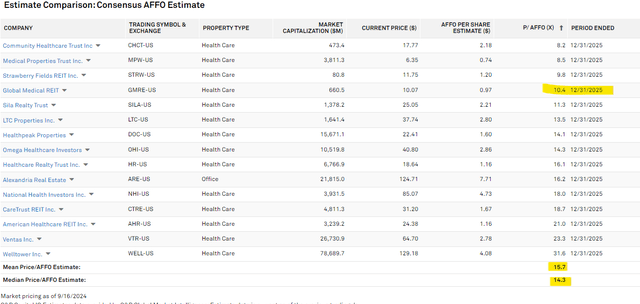

Global Medical REIT (NYSE:GMRE) is a medical office REIT trading at a substantial discount with a P/AFFO just under 11X compared to the healthcare REIT sector mean of 15.7X. Much of the discount has been related to the market viewing it as risky given recent troubles with Steward’s bankruptcy. However, strong underwriting of the property and a recently signed lease fully preserve GMRE’s forward cashflows.

GMRE’s operations have largely been derisked, yet its trading price remains highly discounted. Over time, I think GMRE will achieve parity with the sector average, which portends significant capital appreciation for those who get in at today’s market price.

There are 3 things which I believe GMRE does better than the rest of the healthcare REIT sector:

- Growth through single property acquisitions

- Acquisition underwriting

- Transparency and investor alignment

Superior growth

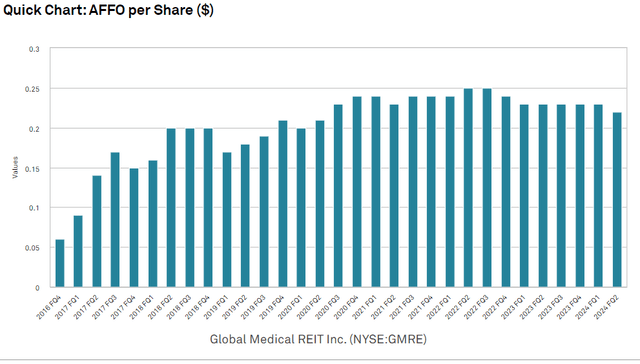

GMRE has had a business model of buying properties at cap rates well in excess of their cost of capital and doing so has allowed them to significantly grow AFFO/share since IPO.

S&P Global Market Intelligence

It is worth noting that the growth rate has trailed off in the last 6 years with GMRE going from $0.20 a share quarterly in 2018 to about $0.23 quarterly in 2024.

15% AFFO/share growth over 6 years is rather lackluster, but I think it should be considered in the context of the operating environment.

The last 6 years have been extremely challenging for healthcare operators and consequently to REIT landlords. I would characterize it as a period of calamitous change:

- Reimbursement rate struggles (not keeping up with cost inflation)

- Regulation particularly surrounding COVID

- COVID demand displacing higher profit patient demand

- Insurance changes

- Billing changes

Healthcare has been tough, but it is stabilizing, and operators are largely returning to profitability.

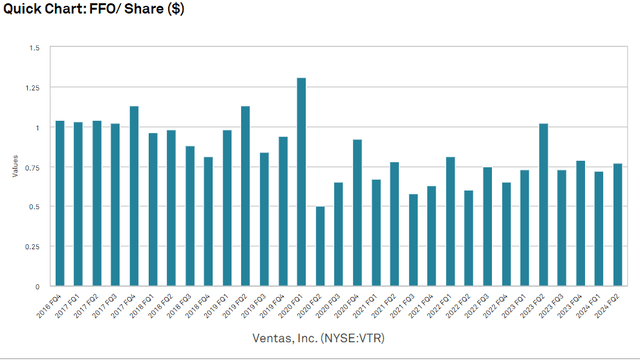

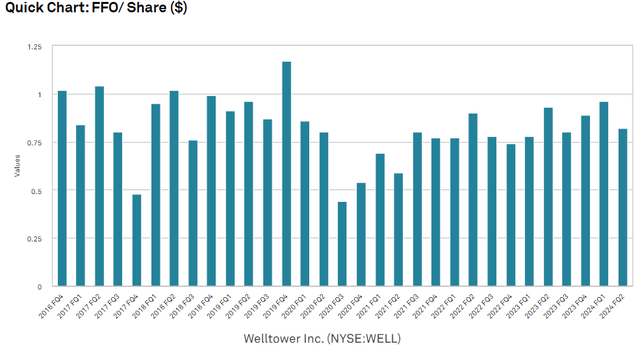

GMRE managed to grow AFFO/share through the storm. It is a feat that was not matched by the rest of the sector including the large caps Ventas (VTR) and Welltower (WELL) which both lost substantial amounts of earnings during the challenging period.

S&P Global Market Intelligence

Welltower did a little better than Ventas, but still came out with lower FFO/share than it went in.

S&P Global Market Intelligence

These are huge companies and diversified across a variety of healthcare property types. Their struggles further evince how difficult the environment has been for healthcare REITs.

I find it notable that GMRE was able to grow in the period where both VTR and WELL lost earnings and yet GMRE trades at 11X AFFO while VTR and WELL trade at 23X and 32X, respectively.

S&P Global Market Intelligence

Given the extreme discount, it would seem the market views GMRE’s growth as being quite risky in nature.

Most of GMRE’s acquisitions have been at cap rates 100 to 200 basis points higher than those of peers.

Similarly, high cap rates were seen at Community Healthcare (CHCT) which did indeed prove to be quite risky.

Just about any REIT can create a spread by simply buying a property at a cap rate above their cost of capital. It takes minimal skill and minimal underwriting to do this, and the market seems to think that is what GMRE has been doing.

I posit that GMRE has a much more rigorous underwriting process and evidence is increasingly surfacing that their acquisitions are of very high quality despite the high cap rates.

Superior acquisition underwriting

It can be quite difficult to discern the quality of a REIT’s acquisition. Press releases will usually announce the price paid for the property, the tenant, and perhaps a rent per square foot type of figure.

An analyst can verify that the rent looks appropriate for the building size and type, but short of physically traveling to each asset there is still a significant margin for error.

We gained more comfort in GMRE’s underwriting process by listening to conference calls and meeting with management a dozen or so times. The way they described underwriting made sense. They find properties that have strong long-term demand drivers.

I believe our diligence process is rigorous, but it still involves judgment calls. We trust GMRE’s management, but assessment of management is still subjective. We have been comfortable owning GMRE for years.

As time went on, GMRE’s seemingly intelligent underwriting process had time to prove itself.

Leases began to roll over, which provides crucial data on the success of initial underwriting. Retention rates have been strong and 2nd generation leases are in line with previous or slightly higher on rent. That is compelling evidence of property quality and that rental rates are at or below market, indicating future growth.

Perhaps the most compelling evidence came on September 17th as GMRE announced the re-leasing of the vacated Steward asset.

Any REIT even remotely associated with Steward has been clobbered in market price with an insinuation that Steward’s catastrophic failure would somehow bring down their landlords. Global Medical REIT is of course only tied to Steward through its rent payments. Their investment is in the property, not the tenant. Times of failure make for excellent stress tests, so as Steward declared bankruptcy in May of 2024, the market waited in anticipation of what would come of GMRE’s large Beaumont facility that was then leased to Steward.

The Maryland headquartered REIT handled the situation with transparency, fully discussing the situation on the 2Q24 call. CFO Bob Kiernan stated:

“Steward Healthcare announced to file for Chapter 11 bankruptcy. At the time of the bankruptcy filing, Steward represented 2.8% or $3.1 million of the company's annualized base rent, of which 86% related to our facility located in Beaumont, Texas”

GMRE took an $800,000 impairment charge in 2Q24 related to expenses of running the vacated facility and uncollectable rent. At that time, management was already looking for new tenants.

On September 15th, Steward officially rejected the lease in bankruptcy court, which allowed GMRE to bring in a new tenant.

Already on September 17th, a new lease was signed.

“The lease is a triple-net lease that will cover the entire Beaumont Facility, which is a two-story medical facility consisting of 84,674 leasable square feet, located at 6025 Metropolitan Drive, Beaumont, Texas 77706. The lease term is 15 years with three, seven-year renewal options. Annual base rent for the first lease year equals $2.9 million with 2.5% annual rent increases thereafter. Rent payments will commence three months after the delivery date of the facility, and we expect to deliver the facility to CHRISTUS during the fourth quarter of 2024”

Despite the speed of execution, the rental rate looks excellent at $34 per square foot. GMRE’s other Texas assets are leased at $28 per square foot.

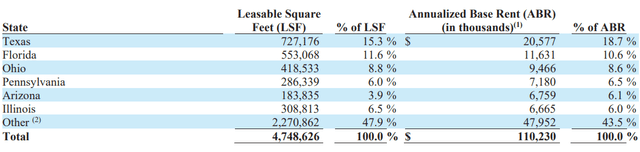

Supplemental

Its overall portfolio is at just over $23 per foot.

In fact, CHRISTUS is going to be paying more rent than Steward was.

- Steward Beaumont annual rent: $2.666 million

- CHRISTUS initial annual rent: $2.9 million

The terms of the lease are excellent with a 15-year term and 2.5% annual escalators.

GMRE has successfully converted a point of failure into a gain. They could do so because of strong acquisition underwriting and actively managing the asset.

Increased AFFO

AFFO was $0.22 in 2Q24 inclusive of an $800,000 loss on the vacant Steward property. This $800,000 was for both missed rent and operating expense of Beaumont.

Once the lease commences, GMRE will be getting $2.9 million annually and the operating expenses will be covered by the tenant as it is a triple net lease which makes it a delta of about $3.2 million annually compared to 2Q24. Divided by 65.587 million shares outstanding that adds about 4.9 cents to the annual AFFO run rate.

I calculate new AFFO/share run rate at 93 cents. With GMRE trading just over $10 a share, that is an AFFO multiple of less than 11X.

Global Medical REIT Forward growth

With interest rates coming back down, GMRE once again has an excellent spread on acquisitions, which reopens the external growth pipeline.

Medical office is performing well fundamentally, which, I believe, will give GMRE some organic growth at a pace of 2%-3% a year (mostly from lease escalators).

Between external and internal, GMRE has a nice runway of mid-single-digit annual AFFO/share growth.

Such a growth rate would typically be associated with an AFFO multiple closer to 18X. I don’t think GMRE will trade quite that high as it has above-average debt at about 7X debt to EBITDA.

Debt is well covered by both property value and EBITDA coverage of interest expense, so I don’t see it posing substantial risk. However, the multiple should be adjusted lower as a result.

In my opinion, fair value would be about 15X AFFO or right around $14 a share, which represents 38% upside from today’s price.

The bottom line

GMRE’s assets are of much higher quality than the market seems to think. Asset strength is evinced by broadly strong re-leasing as well as swift, favorable recovery from a failed tenant.

Given the quality and growth, we believe an 11X AFFO multiple is far too cheap for GMRE shares.

At Portfolio Income Solutions we do ad hoc analysis of special situations as well as full reports on specific stock. If you found this analysis compelling please check out our library of work which you can access at a discounted rate through this link.

https://seekingalpha.com/affiliate_link/40Percent

I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic stocks.