Flashpop

Annaly Capital Management, Inc. (NLY) is a mortgage REIT with a portfolio of primarily agency-backed securities. This strategy requires using a significant amount of debt and hedging against changes in interest rates. However, the agency mortgage-backed securities have excellent credit quality because of the agency backing. The biggest concerns are that interest rates could rise substantially, leading to a decrease in the fair value beyond what their hedges would offset, or that interest rates would fall dramatically and lead more homeowners to refinance, which would force the mortgage REIT to purchase new securities even though their hedges were locked in at higher rates. Generally, the preferred shares from these mortgage REITs offer a more reliable income stream than the common shares. However, in this case, we need to remain aware that the reduction in short-term rates by the Federal Reserve will reduce the dividend rate on the preferred shares.

Annaly Capital Management Preferred Shares

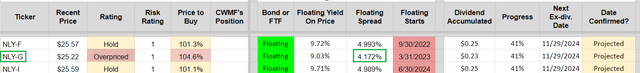

Annaly Capital has 3 preferred shares.

Annaly Capital Management, Inc. PFD SER G (NYSE:NLY.PR.G) is the preferred share I'll be talking about in this article. I have been surprised by the valuation the market gives to these shares. NLY-G has a smaller spread than the other NLY Capital Management preferred shares. That smaller spread may not seem like a big deal today, but it has the potential to become significant. Here are the differences in floating spreads:

Annaly Capital Management, Inc. 6.95% PFD SER F (NLY.PR.F) and Annaly Capital Management, Inc. 6.75% PFD SER I (NLY.PR.I) both have a spread over 4.9%. Meanwhile, NLY-G's spread is only 4.172%. The floating spread is what the preferred shares will pay in addition to the three-month rate for that dividend period. Because NLY-G has a materially lower spread, you would think it'd be trading at a bigger discount relative to the other two preferred shares.

The shares of NLY-G surprised me by trading so close to the call value - sometimes even above it. When interest rates drop, preferred shares with a smaller floating spread take a bigger hit. Here's how to think about it: If the payout is 8% and rates fall by 2%, that's a 25% drop. But if another preferred share pays 10%, the same 2% drop only drops it by 20%. The smaller the initial spread, the more noticeable the reduction when rates go down. This is why shares with a lower spread have their dividend impacted more (proportionally) when interest rates fall.

I don't believe that a call on NLY-G is even remotely likely, but it feels like the spread available on NLY-G is not particularly large. When investors are not concerned about a recession, they may be willing to accept that smaller spread, especially if short-term interest rates are high, since it makes the total yield more attractive. However, if we return to a period of very low interest rates, the income from a position in NLY-G could fall quite significantly.

Conclusion

I don't see the appeal in owning shares given those tight spreads. I would be more interested in some mortgage REIT bonds than in shares of NLY-G. The bonds trading within the sector are not from NLY Capital Management, but some of them offer a respectable yield, and a reduction in the Fed funds rate would not cause their interest payment to decrease. Shares of NLY-G do not use the Fed funds rate directly, but SOFR is still very closely tied to it. In this scenario, it seems like investors are getting a little bit of extra income with NLY-G, but no protection from lower rates. Additionally, preferred shares are lower in the capital structure, which requires additional yield or additional upside to justify the risk.

Want the best research? It’s time to raise your game. Get access to several features you won’t find on the public side.

You can get access to everything we have to offer right now. Try our service and decide for yourself.