SeventyFour

I’ll be going over a preferred share from AGNC Investment (AGNC). We covered the Q2 2024 earnings release for AGNC. We will also be covering the Q3 2024 earnings release. That being said, we view AGNC as one of the better-managed mortgage REITs. We believe they carry materially less risk than many of the other mortgage REITs. However, AGNC is currently trading at a significant premium to book value. Therefore, we do not believe the common stock is worth investing in at this time.

AGNC Investment preferred share, AGNCM

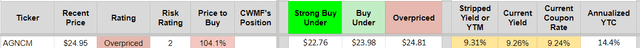

AGNC does have a few preferred shares currently within our hold range. I will be going over AGNC Investment Corp. 6.875 DEP REP D (NASDAQ:AGNCM) which is currently in our overpriced range and relatively expensive compared to AGNC’s other preferred shares. AGNCM is currently offering a dividend yield of over 9%:

The REIT Forum

We used the stripped yield because it accounts for the current dividend accrual. This preferred share pays a quarterly dividend. The next dividend amount will be $0.58 or $.59. You will receive that amount whether you buy shares 60 days or five days before the ex-dividend date. This is why it’s important to take dividend accrual into account. As of writing this article, the dividend accrual is at $0.13.

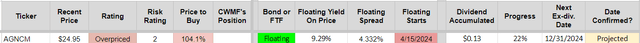

AGNCM’s dividend is based on a floating rate:

The REIT Forum

Investors will get the going rate plus a 4.332% spread. Floating rates tend to be favorable when rates are high. We’ve been seeing historically (compared to the last 20 years) high rates. However, there's a potential challenge when investing in preferred shares with a floating rate. The floating rate could decrease over the coming years as it's expected that the Federal Reserve will continue to lower interest rates. When the Federal Reserve lowers rates, it will also reduce SOFR, also known as Secured Overnight Financing Rate. These shares pay out according to SOFR. If SOFR goes down, it would lead to AGNCM paying a lower dividend amount.

Let me go over how the dividend is decided for those new to floating rate preferred shares. For each dividend period, shares will use the three-month forward rate, meaning the dividend is based on market expectations for the short-term rates. Because it’s a forward-looking metric, the rate will not be chosen directly by the Federal Reserve for each specific three-month period. However, the market generally does a decent job at projecting future short-term rates and is mostly accurate.

I would like to point out that the floating spread of 4.332% is one of the lowest spreads we cover. Some of the preferred shares we cover have a floating spread of over 6%. It should be noted that preferred shares with that high of a spread usually come with a significant amount of risk. For a comparison, Annaly Capital (NLY) has a couple of preferred shares with a spread of nearly 5%. We consider Annaly’s preferred shares to carry less risk than AGNC preferred shares. At recent prices, we would rather take the NLY preferred shares.

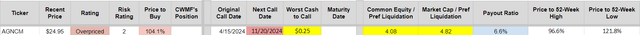

One positive aspect of AGNCM is the worst cash to call:

The REIT Forum

The worst cash to call is positive at $0.25. If AGNC were to call these shares immediately (with the required 30-day notice), investors would recover $0.25 more than what they paid. This includes dividend accrual.

One of the main reasons this preferred share has a risk rating of 2 is its common equity to preferred liquidation ratio. It’s currently sitting at 4.08, and we’d like to see that number be higher. A higher number means there's more common equity in relation to preferred equity. For instance, we have a risk rating of 1 for the NLY preferred shares. NLY preferred shares have a common equity to preferred liquidation ratio of 6.28.

Conclusion

In conclusion, AGNCM is currently trading too high for us to consider a buy rating. We generally don’t give sell ratings to preferred shares because the likely worst-case scenario still ends up with investors having a small positive return. There are much better options for investors looking to get into preferred shares at current prices. We believe AGNCM’s floating spread is too low for us to justify purchasing shares at the current price. If investors really want to invest in AGNC preferred shares, I would prefer AGNCO or AGNCP. Not huge bargains, but still better than AGNCM.

Want the best research? It’s time to raise your game. Get access to several features you won’t find on the public side.

You can get access to everything we have to offer right now. Try our service and decide for yourself.