JamesBrey/E+ via Getty Images

Mortgage REITs or mREITs have generally been weak investments with a history of book value erosion. Most of the erosion has been caused by shocks to the financial system or unfavorable macro conditions. As such, we generally stay away from common shares of mREITs finding the preferreds more opportunistic.

The macro environment is shifting, however, in ways that make the future of mREITs look significantly brighter. We believe the majority of mREITs will have strong 3Q24 reports as well as improved forward earnings outlooks. This could provide an opportunistic trading window for common shares but also bolsters the reliability of preferred dividend payments.

Favorable Changes

There are 4 significant positive changes to the macro environment in which mREITs operate:

- Reduced RMBS spreads improve book value.

- Alleviated negative convexity.

- Lower cost of capital.

- Positive carry returns with an uninverted yield curve.

Let us discuss each in more detail.

Reduced RMBS Spreads

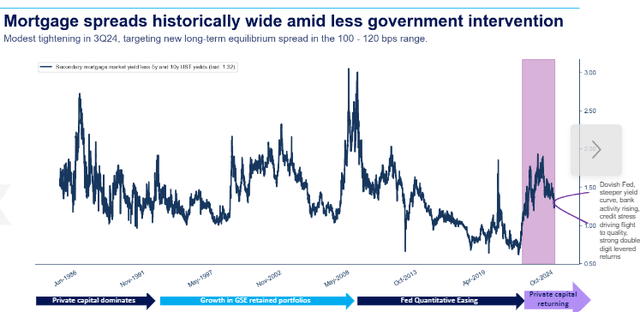

Residential Mortgage Backed Security or RMBS yields are correlated with Treasury yields, but the premium over Treasuries at which they trade is variable. Mortgage spreads are the difference between RMBS yields and Treasury yields.

Spreads are typically closer to 110 basis points, but they gapped up to about 200 basis points in the chaos following the onset of COVID.

In recent quarters, however, RMBS spreads have started to drop back down, now sitting at 132 basis points.

Lower spreads have 2 main effects:

- Increased market value of existing instruments.

- Lower going-in ROIC.

New capital has not really benefitted from lower spreads because the yield is now lower, but mREITs already own billions of dollars of RMBS. These financial instruments that were already on their books had to trade up in price to match the now lower Yield to Maturity.

Thus, due to reduced RMBS spreads, most mREITs that deal in RMBS should see significant book value gains in 3Q24. Dynex Capital, Inc. (DX) and AGNC Investment Corp. (AGNC) were the first to report in the sector and both had nice book value gains. We anticipate others will follow suit.

Alleviated Negative Convexity

With fixed duration bonds the relationship between price and yield is quite simple.

- Yields up = prices down.

- Yields down = prices up.

RMBS is different because its duration can change with yields. Lower yields encourage prepayment which can reduce expected duration. Thus, the pricing impact of a change in yield is unclear because the shift in expected duration can offset the price movement needed to cure the yield to maturity.

Since prepayment is entirely at the option of the borrower, it is strictly a bad thing for any RMBS trading at a premium to par. RMBS trading at a premium to par has the following reactions to changes in yield:

- Yields up = prices down.

- Yields down = prices up or down depending on whether the negative convexity impact on expected duration outweighs the normal price reaction.

If premiums are large enough, which was the case in the zero interest rate environment where mortgage yields dropped to around 2%, RMBS was set up to have a negative price reaction whether yields went up or down.

It was a true "damned if you do, damned if you don't" situation.

They had to either face higher yields which dropped prices or higher prepayment rates which also dropped prices because expected duration decreased.

Today's outlook is much better because negative convexity is not a problem when RMBS is trading at a discount.

Most of the mortgages currently outstanding were initially signed at lower coupons than current mortgage rates. Therefore, a large portion of RMBS is trading at a discount to par.

With discounted RMBS, prepayment is favorable. If you buy a mortgage at 97 cents on the dollar, getting back full par value ahead of schedule is a good thing. Therefore, RMBS-owning mREITs now benefit from falling interest rates.

Lower Cost of Capital

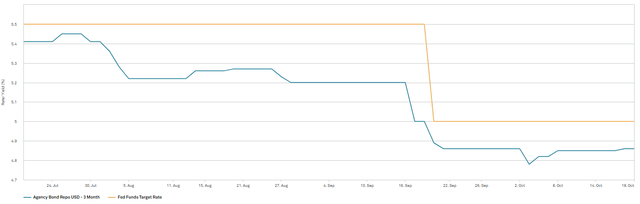

Repo rates tend to correlate with Fed Fund rates but often anticipate moves ahead of the Fed. As the Fed was hiking, repo rates went up in advance of Fed hikes and now repo rates are falling in anticipation of further cuts. For example, repo rates dropped in August, well before the Fed actually cut in September. Repo rates are anticipating further cuts as current repo rates sit below the current Fed Funds target rate.

S&P Global Market Intelligence

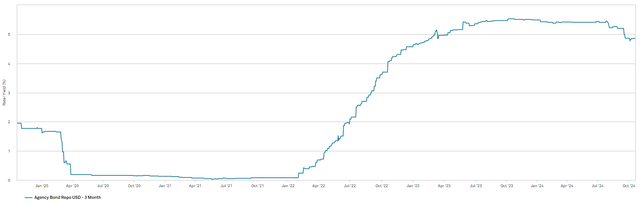

Despite recent drops, repo rates remain well above normal levels which is more visible if we zoom out to a 5-year chart.

S&P Global Market Intelligence

The cost of capital has declined a little bit for mREITs and is expected to decline more as Fed Funds reaches its terminal level. Of course, we don't know exactly where the Fed will end, but most analysts think somewhere in the vicinity of 350 basis points which implies mREIT cost of capital will continue to decline.

With a lower cost of capital, spreads on investment are improving.

Positive Carry from Yield Curve

The inverted yield curve has been challenging for mREITs in recent years. A portion of their income can come from borrowing short and owning higher duration assets such as RMBS. That portion of Net Interest Margin (NIM) does not exist when the curve is inverted and may be partially why book values have eroded precipitously in recent years.

The forward outlook looks better as the yield curve has been uninverted.

S&P Global Market Intelligence

10 and 30-year Treasuries are already well above 2-year Treasuries, and it is anticipated that the short end will drop below the long end soon with just a couple more Fed cuts.

Dynex sees opportunity in uninversion as discussed by their Co-CEO on the 3Q24 earnings call; Smriti Laxman Popenoe - Co-CEO:

"From a macro perspective, we are moving into a regime with a less restricted Fed, which brings with it the opportunity to earn positive carry from the yield curve. This is a powerful source of forward returns."

In a sector that deals with small spreads and amplifies those spreads with leverage, every small factor that contributes to a wider NIM is quite impactful.

A better forward outlook for mREITs

We still don't think mREITs are a great asset class in general, but given the macro changes, they are looking significantly better. As such our change in investment allocation is that the hurdle is a bit lower.

In the formerly bad environment, it took an extreme discount for us to actually invest in mREIT common shares. Given the better environment, we would now consider investing in moderate discounts.

In other words, if 60% of book value was the threshold at which mREIT common shares were worth considering, maybe now it is 80% of book value.

Larger and better-managed mREITs like AGNC could potentially become opportunistic at 85%-90% of the book. Currently trading at a slight premium to book we aren't pulling the trigger, but it's close enough to go on the watchlist.

Potential ways to trade it

Given the tightening in RMBS spreads that happened in 3Q24 we see it is highly likely most mREITs will have strong 3Q earnings reports. There could be potential to capture pops on the release of strong earnings.

mREIT preferreds remain good investments where discounts to par are met with strong underlying company fundamentals. Dividend payments and liquidation preference of preferreds are freshly bolstered by the now higher book values of the companies and capital markets opening back up to common share issuance.

We continue to like Arbor Realty Trust, Inc. (ABR) preferreds, Chimera Investment Corporation (CIM) preferreds, and a few others that can be purchased opportunistically from time to time due to volatile short-term market pricing.

At Portfolio Income Solutions we do ad hoc analysis of special situations as well as full reports on specific stock. If you found this analysis compelling please check out our library of work which you can access at a discounted rate through this link.

https://seekingalpha.com/affiliate_link/40Percent

I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic stocks.