Luis Alvarez

Dear Fellow Shareholders,

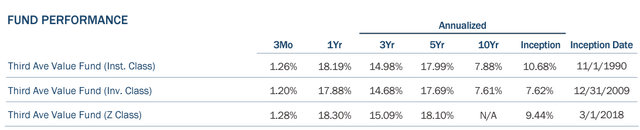

For the three months ended September 30th, 2024, the Third Avenue Value Fund (the "Fund") returned 1.26%, as compared to the MSCI World Index[1], which returned 6.46%, and the MSCI World Value Index[2], which returned 9.73%.

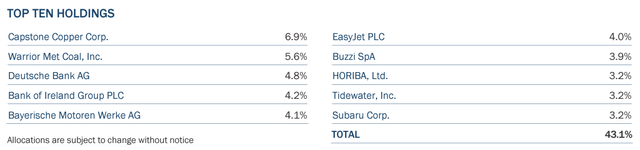

The Fund benefited from positive quarterly performance contributions by Capstone Copper (OTCPK:CSCCF), Lazard (LAZ), easyJet (OTCQX:EJTTF), Comerica (CMA) and CK Hutchison Holdings (OTCPK:CKHUY), among others. The list of positive contributions comprised a wide range of geographic and industry exposures. Positive influences on this group of investments were, in our view, primarily idiosyncratic to the individual companies and were not tied to any obvious common thematic developments.

On the other hand, negative performance contributions resulted from Tidewater (TDW), Valaris (VAL), Subsea 7 (OTCPK:SUBCY), Horiba (OTCPK:HRIBF), and BMW (BMWYY). Thematically speaking, offshore energy services companies represented the three largest detractors from performance during the quarter. In recent years, the Fund's investments in the offshore energy services industry have been among the largest contributors to Fund performance and we continue to perceive the prospects for owners of high-quality offshore service assets to be very bright. Typically, the beginnings of the end of an industrial cycle for offshore energy services companies would be marked by increasing orders of new assets slated to enter the industry after construction. Today, there is virtually no newbuild order book for the types of assets operated Valaris and Tidewater. There are a handful of new orders for the type operated by Subsea 7, though they are smaller, less capable, and not likely to compete directly with industry bellwethers, such as Subsea 7 and peers. Rates earned by offshore services companies and their competitors still need to move materially higher in order to justify new asset orders and, even in that scenario, it takes years for an asset to be constructed and delivered.

Furthermore, the Fund's two automotive companies, BMW and Mercedes-Benz Group (OTCPK:MBGAF), both detracted from performance even while both remain highly profitable, well run, extremely well-capitalized, and inexplicably cheap, in our view. We believe that there is very attractive value in several automotive industry OEM's, which is reflected throughout each section of this letter, and we are eager to own them at current valuations.

Not Dead, Just Playing Possum

It is possible that value investing is genuinely dead, as a few have surmised. To our knowledge, the coroner has not yet issued a final report, but the evidence is mounting. In the collection of evidence, we continue to note the valuation chasm between cheap and expensive companies in U.S. equity markets. This phenomenon is not unprecedented, but the current iteration grew gapingly large and seems unusually persistent.

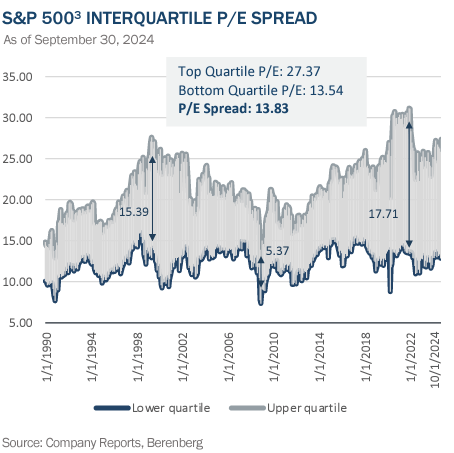

There are many ways to evaluate the valuation relationship between cheap and expensive stocks, within various indices and within specific industries, though every version of the analysis we have conducted or seen suggests very strongly that the ten-year period from 2011 to 2021 was associated with relentlessly elevating multiples assigned to the most expensive segment of the U.S. equity market. Meanwhile, multiples assigned to the least expensive segment of the U.S. equity market seemed to develop rigor mortis. The chart below depicts the historical price-to-earnings[4] multiple assigned to the most expensive quartile of the S&P 500, as well as the multiple assigned to the least expensive quartile, with the shaded area depicting the spread between the two. By 2021, cheap versus expensive valuation spreads in the U.S. eventually reached levels not seen in many decades. The chasm shrunk in 2022 but grew again in 2023 and 2024 and remains quite wide by historical standards.

Further, though subtle, it is notable that the chart below also shows that multiples assigned to the least expensive quartile actually declined in the decade from 2014 to 2024. Perhaps not surprisingly, the extensive duration of this episode, defined by cheap stocks becoming cheaper and valuation spreads growing ever-larger, has caused many market participants to ponder whether equity markets are genuinely fundamentally "broken." At the core, the "broken equity markets" and "death of value" investigations share quite a bit in common.

In the context of this valuation conversation, several potential contributing factors have been cited, including, i) a dramatic shift of assets to passive strategies, ii) the ability of individual investors to organize on the internet, which is a potentially powerful facilitator of what Charles MacKay dubbed The Madness of Crowds, and iii) hyper-low interest rates. We wrote a white paper in 2023 explaining why we don't believe interest rates offer a legitimate explanation, so won't belabor that here.

Regarding non-professional investors organizing on the internet, we do have some riveting anecdotes of rebellious, intentionally economically-irrational, coordinated behavior. Still, we simply don't have enough information to analyze the overall contribution of these collusions to the unusual valuation spreads within equity markets. A significant majority of the U.S. equity market is held outside of any types of regulated funds and lies in the hands of individuals, corporations, and institutions. In our experience, it is very hard to gain insight into the collective activity and motivations of that very large and disparate group of investors.

On the other hand, it does seem eminently reasonable to conclude that the trillions of dollars of capital that have been redeemed from actively managed funds and reallocated to passive strategies in recent years has likely had a significant influence on the U.S. equity market's price discovery process. Actively managed funds experiencing net outflows, which describes the vast majority, have been compelled to sell securities over time to meet net redemptions. According to Investment Company Institute ("ICI"), only 28% of long-term mutual fund complexes saw positive net flows in 2023. Presumably, the securities sold include the highest-conviction investment ideas of the active managers, whereby the selling contributes to the equity market's price discovery process in a manner completely disconnected from the active portfolio manager's fundamental view. In other words, price discovery is driven by transactions, not by a fundamental view. The ability of active portfolio managers to drive the price discovery process can be severely stunted if they are grappling with consistent outflows, which constitutes a threat to some of the underlying precepts of market efficiency.

Although correlation does not necessarily mean causality, it is not at all surprising that "cheap" versus "expensive," and large-cap versus small-cap, valuation spreads standout as particularly large within the U.S. equity market, as compared to non-U.S. markets. The U.S. is, after all, where active to passive portfolio flows have been exceptionally strong. According to the ICI, "from 2014 through 2023, index domestic equity mutual funds and ETFs received $2.5 trillion in net new cash and reinvested dividends, while actively managed domestic equity mutual funds experienced net outflows of $2.6 trillion (including reinvested dividends)". Flows of capital to actively managed domestic equity ETFs have been positive over that period but are extremely small in the broader context.

To conclude, we find it difficult to imagine that there has not been a material impact on price-discovery as a consequence of shifting a material percentage of the entire U.S. equity market from fundamental investment strategies to passive investment strategies, which ignore the relationships of security prices to corporate fundamentals by mandate. The entire raison d'etre of passive strategies is to rely upon a price discovery process conducted by active equity market participants, who are purported to digest fundamental information rapidly and efficiently. However, it seems there is good reason to be fearful that the collective ability of active managers to drive that process has been stunted by outflows and that the weight of flows into passive strategies has been effectively usurping the price discovery process. And while we tend to agree with industry observers who assert that it is not necessarily problematic for passive strategies to manage more capital than active strategies, we do believe that the process of getting to that point, which has entailed massive capital flows from active funds to passive funds, has likely impacted the price discovery process in a meaningful way.

Where Have All the Possums Gone?

Once a part of the structural foundation of equity markets, the community of value-oriented boutiques has been significantly impacted by these distortive phenomena. It is indeed a business strategy offering little insulation from these challenges. A number of firms have closed, while some others have adjusted their strategies to be more in keeping with the present investing zeitgeist. It also seems that very few of the remaining value-focused firms have been of a mind to grow staff and train the next generation of young enterprising value investors. Having observed this value community attrition for a period of years, you can imagine my surprise when, in the midst of considering whether I was personally a relic of bygone era, I came across the following passage from a well-known global auto analyst at one of the world's largest investment banks:

"Whilst BMW's new cash accounting highlights almost EUR 70 per share in industrial net cash and, hence, a very deep value investment, the lack of a short-term "dream" narrative and a lack of value investors leaves BMW often overlooked."

We only use a small amount of hyperbole in saying that this analyst has captured the current state of equity investing in a single sentence. Rephrasing his words; "Obvious substantial undervaluation doesn't matter because there are no value investors left to care and all the non-value investors care about is a "short-term dream narrative." Factual fundamental information concerning business value is not a focus, nor is its relationship to security prices." Maybe he is correct that we price-conscious, value-oriented investors are among the last of the Mohicans. Maybe the fundamental value investing community no longer oversees an asset base that is powerful enough to facilitate price discovery and reconcile undervaluation. Or, perhaps more accurately, the fundamental value investing community is currently unable to participate in the price discovery process in a manner broadly consistent with its fundamental views. So, maybe a tree doesn't make a sound if it falls in the woods and there is nobody to hear it? Maybe it doesn't matter if an obvious "very deep value investment" exists, but there are no value investors left to care? You almost can't blame folks for wondering if value investing is dead.

Well, while others may not care, we continue to care quite a bit. And furthermore, notwithstanding its lack of "dream narrative" and "lack of value investors," over the five years through September 30th, 2024, BMW has produced a total shareholder return, in U.S. dollar terms, of 10.9% per year, which stacks up well relative to equity market returns over long periods of time. Furthermore, it is most certainly worth noting that BMW's shareholder return occurred in spite of the company seeing its price-to-sales multiple decline by roughly a quarter and its price-to-earnings multiple cut in half over that period. Despite analyst apathy, a substantial derating, and "a lack of value investors", pretty good outcomes do still seem to follow when a valuable business is purchased very cheaply. Somebody pretty clever once called that a margin of safety.

"The idea of a margin of safety, a Graham precept, will never be obsolete. The idea of making the market your servant will never be obsolete. The idea of being objective and dispassionate will never be obsolete. So Graham had a lot of wonderful ideas." - Charlie Munger

Possum's Revenge

There are important practical implications of these developments and some of them actually seem quite favorable for fundamental investors. It has been said that "successful investing is about having people agree with you… later." Yet, other investors coming around to your point of view at some point in the future, deciding to purchase the stock, and becoming the source of upward revaluation of the company, is only one possible driver of a successful equity investment. Other sources of return sometimes stem from companies themselves responding to unusual valuations, rather than waiting for public equity market participants to come around.

Cheap stock prices often send powerful signals to managements and boards that capital reinvestment into a business is not desired and is unlikely to be rewarded by equity market participants. The decision to reinvest capital into a business, even at attractive returns on capital, may be value-destructive if opportunities to repurchase shares at even more attractive rates of return exist.

For example, in recent years the global oil and gas production industry has radically increased shareholder returns and debt paydowns, to the detriment of reinvestment in production. It is estimated by the International Energy Agency ("IEA") that upstream capital expenditure, as a percentage of earnings, for the entire global oil and gas industry fell from 82% in 2017 to 47% in 2022. Investment bank Barclays estimates that, across its entire coverage of European large-cap energy companies, the median shareholder distribution yield from dividends and buybacks will total 12% in 2024. Even higher shareholder returns are common among smaller-cap companies. Furthermore, capital returns to shareholders, in the form of dividends and buybacks, have also increased very substantially for many European banks and global auto companies, where valuation multiples remain quite compressed.

For a cheap, out for favor business, the recognition that business reinvestment may need to be relegated behind share buybacks and dividend distributions, when share prices are exceptionally cheap, can help to drive shareholders' realized returns closer to the actual economic earnings of the underlying business. In other words, if you bought shares of a company trading at 5x to 6x earnings and the company distributed the bulk of its earnings to shareholders, which is an apt description of a number of current Fund holdings, you may be able to earn superior equity returns even without a multiple rerating, though a rerating may follow at some point too.

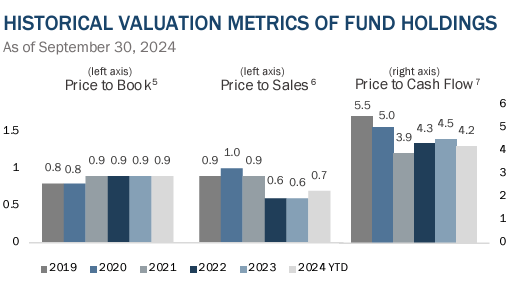

In academic terms, we are essentially suggesting that the price discovery process may have been working less well in recent years, which, to some, is a heretical claim akin to saying that inefficiencies exist. Many academics would argue that, if inefficiencies exist, investors should be able to exploit them for market-beating returns. We would argue that the record of the Third Avenue Value Fund in recent years is supportive of the notion that equity markets have been somewhat less efficient, in keeping with the idea that the price discovery process is working less well. Further, while declining multiples of already inexpensive companies has been a source of frustration, the Fund has been able to produce attractive returns in recent years even while valuation rerating remains relatively absent as a performance driver for many Fund holdings. Again, in our view, this is a result of paying low prices relative to the economics of the underlying businesses of our holdings.

As it relates to longer periods of time, we would also point out that the full 34-year record of the Fund is supportive of the notion that a fundamental, price-conscious approach to value investing has been successful at exploiting occasional securities mispricing over very long periods of time. It's also worth noting that large contributions to the Fund's long-term record have been achieved during periods in which reversals of apparent broad, large-scale inefficiencies occurred, such as the bursting of the dot-com bubble in 2000 - 2001, as well as the partial reconciliation of the "everything bubble" in 2022, the latter representing the Fund's largest-ever year of relative outperformance.

An investor for whom I have great respect once said, "In investing, most things will prove cyclical." Investing is, in our decades of experience, full of tradeoffs and dichotomies. For example, the more challenging an investment environment is from a performance perspective, the better it tends to be for identifying attractive new investment opportunities. The less popular and less competitive an area of investment tends to be, the higher the probability that inefficiencies and opportunities for outsized returns exist. In many ways, our most common areas of opportunity - cheap stocks, non-U.S. stocks, and small-cap companies - seem to have become those unpopular, unglamorous, less-trafficked backwaters of equity investing. And finally, the upside and downside of a cycle tend to be proportionate to one another. In industry and investing, outsized upcycles tend to produce outsized downcycles, and large, protracted downcycles tend to produce large, protracted upcycles.

This cyclical phenomenon was certainly the experience during the late 1990s, the last time value investing was declared "dead," and valuation spreads were at multi-decade highs. Analogously, value strategies had seen rampant outflows in the late 1990s, value firms shrunk, and portfolio managers jobs were threatened or lost. Several of the investors now considered among the legends of value investing were managers who just narrowly hung onto their jobs or firms during the late 1990s. Similarly, in recent years, many boutique firms have closed, and some have changed their stripes. A number of value investing luminaries have retired or passed away. As others in our industry have noted, we also don't see that fresh generation of enterprising value investors being trained today. As the dot-com bubble burst, a powerful performance tailwind led to one of the strongest periods of value strategy outperformance in many decades and rapid valuation spread compression. Let's not lose sight of the historical experience that the possum has been ferocious when awakened.

Quarterly Activity

During the quarter ending September 30th, 2024, the Fund initiated a new position in Subaru Corporation (OTCPK:FUJHF) ("Subaru") and exited its holdings of Seven & I Holdings Ltd.

Subaru is a Japanese-headquartered automobile manufacturer, which sold nearly one million cars worldwide last year. While headquartered in Japan, more than two-thirds of the Subarus the company sells are to car buyers in the U.S. and most cars it sells to U.S. customers are delivered from Subaru's manufacturing plant in Indiana. The brand is especially popular in U.S. regions where its all-wheel-drive capabilities and high ground clearance come in handy, like the Northeast or the Pacific Northwest. Subaru also enjoys a loyal and relatively affluent U.S. customer base.

When translated to US dollars, Subaru has more than $10 billion in net cash and short-term investments on its balance sheet, a figure nearly equivalent to its market capitalization, meaning its current market valuation assigns virtually zero value to Subaru's car making business. While there are other publicly traded companies that trade at or below the value of their net cash, we are not aware of another company of Subaru's quality being assigned a market value that imputes a negative valuation to its operating business, which, in Subaru's case, has demonstrated a long history of profitability. In the last 12 months, Subaru produced approximately USD 4.6 billion of operating cash flow from operations. Interestingly, Subaru is also not an obscure micro-cap company. With its USD 13 billion market cap, it is one of the larger companies in the Fund today. Cash and short-term investments on the balance sheet have grown considerably since 2020 when the company slashed the dividend by nearly two-thirds in order to fortify itself against the then unknown effects of the Covid-19 pandemic. Subaru remained very profitable in the ensuing period and has paid increasing annual dividends each of the past two years, though dividends per share are barely half of pre-Covid payouts despite profits hitting previous peaks. The company has also recently instituted a share buyback program for the first time in several years.

As Subaru has been slower than some other car manufacturers to introduce electric vehicle models, there seems to be some fear that it will be expensive for Subaru to catch up, or that it will miss out on the "EV revolution" entirely. It appears to us that, on the contrary, Subaru is preserving the option to offer whatever propulsion system(s) customers want in the future through collaboration with both battery and automotive industry leaders, including Toyota Motor, which owns 21% of Subaru's shares. It also appears that Subaru's model rollouts have been well-measured responses to actual customer and dealer demand, rather than hoped-for demand or in response to government incentives. As evidence of that strategic success, Subaru's U.S. inventory position remains in a very healthy position today, notwithstanding slowing battery electric vehicle demand, softening U.S. consumer activity, and significant U.S. inventory issues for some notable global peers.

Finally, it bears mentioning that Toyota Motor (TM) considers its ownership of Subaru, as well as smaller stakes in Mazda (OTCPK:MZDAF) and Suzuki (OTCPK:SZKMF), as a loose alliance. Like many other companies in Japan, Toyota is being asked to reduce cross-shareholdings and improve capital efficiency. We acknowledge the possibility that, on the other hand, Toyota could acquire Subaru and its valuable niche brand to substantially enhance significant synergies already being capitalized upon through existing partnerships and collaboration.

Thank you for your confidence and trust. We look forward to writing again next quarter. In the interim, please do not hesitate to contact us with questions or comments atclientservice@thirdave.com.

Sincerely,

Matthew Fine

| Performance is shown for the Third Avenue Value Fund (Institutional Class). Past performance is no guarantee of future results; returns include reinvestment of all distributions. The above represents past performance and current performance may be lower or higher than performance quoted above. Investment return and principal value fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. For the most recent month-end performance, please visit the Fund's website at www.thirdave.com. The U.S. Lipper Fund Award for Best Equity Small Fund Family is based on a review of 185 qualified fund management companies that were eligible for the three-year period ending on 11/30/23. To qualify for Lipper's Overall Small Fund Family Group Award, Small fund family groups must have at least three equity portfolios. The group award will be given to the group with the lowest average decile ranking of its respective asset class results based on the three-year Consistent Return measure of the eligible funds. From LSEG Lipper Fund Award© 2024 LSEG. All rights reserved. Used under license. Important Information This publication does not constitute an offer or solicitation of any transaction in any securities. Any recommendation contained herein may not be suitable for all investors. Information contained in this publication has been obtained from sources we believe to be reliable, but cannot be guaranteed. The information in this portfolio manager letter represents the opinions of the portfolio manager(s) and is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed are those of the portfolio manager(s) and may differ from those of other portfolio managers or of the firm as a whole. Also, please note that any discussion of the Fund's holdings, the Fund's performance, and the portfolio manager(s) views are as of September 30, 2024 (except as otherwise stated), and are subject to change without notice. Certain information contained in this letter constitutes "forward-looking statements," which can be identified by the use of forward-looking terminology such as "may," "will," "should," "expect," "anticipate," "project," "estimate," "intend," "continue" or "believe," or the negatives thereof (such as "may not," "should not," "are not expected to," etc.) or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any fund may differ materially from those reflected or contemplated in any such forward-looking statement. Current performance results may be lower or higher than performance numbers quoted in certain letters to shareholders. Date of first use of portfolio manager commentary: October 15, 2024 [1] The MSCI World Index is an unmanaged, free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of 23 of the world's most developed markets. Source: MSCI. [2] MSCI World Value: The MSCI World Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 Developed Markets (DM) countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. Source: MSCI. [3] The S&P 500 Index, or the Standard & Poor's 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S. It is not an exact list of the top 500 U.S. companies by market capitalization because there are other criteria to be included in the index. [4] The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings. [5] Price to Book: Weighted harmonic average of the ratio of current share price to its book value per share of each security holding invested in the portfolio. [6] Price to Sales: Weighted harmonic average of the ratio of current share price to its trailing 12-months sales per share of each security holding invested in the portfolio. [7] Price to Cash Flow: Weighted harmonic average of the ratio of current share price to its trailing 12-months cash flow per share of each security holding invested in the portfolio.   Past performance is no guarantee of future results; returns include reinvestment of all distributions. The above represents past performance and current performance may be lower or higher than performance quoted above. Investment return and principal value fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. For the most recent month-end performance, please visit the Fund's website at www.thirdave.com. The gross expense ratio for the Fund's Institutional, Investor and Z share classes is 1.20%, 1.47% and 1.13% , respectively, as of March 1, 2024. Risks that could negatively impact returns include: fluctuations in currencies versus the US dollar, political/social/economic instability in foreign countries where the Fund invests lack of diversification, and adverse general market conditions. The fund's investment objectives, risks, charges, and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 800-443-1021 or visiting www.thirdave.com. Read it carefully before investing. Distributor of Third Avenue Funds: Foreside Fund Services, LLC. Current performance results may be lower or higher than performance numbers quoted in certain letters to shareholders. Third Avenue offers multiple investment solutions with unique exposures and return profiles. Our core strategies are currently available through '40Act mutual funds and customized accounts. |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.