Ghing

Summary

- Volatility re-emerged in the third quarter. The initial catalyst was a better-than-expected Consumer Price Index report (indicating lower inflation) on July 11, boosting market confidence of the U.S. Federal Reserve likely embarking on a cutting cycle sooner than later. This excitement spurred a rotation out of large technology and “AI winners” into other market segments, many of which lagged in the first half of the year.

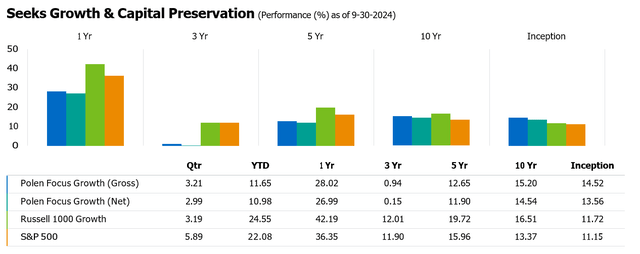

- The Focus Growth Composite Portfolio (the “Portfolio”) slightly outperformed the Russell 1000 Growth Index (the “Index”), with both delivering just over a 3% return, while the S&P 500 Index ended the quarter approaching 6%. Through the first three quarters of the year, the Portfolio’s performance has increased over 11%, putting it well on track to achieve our goal of mid-teens annualized returns in 2024.

- In the third quarter, the top relative contributors to the Portfolio’s performance were NVIDIA (NVDA), which we did not own, Shopify (SHOP), and ServiceNow (NOW). The top absolute contributors were Oracle (ORCL), ServiceNow, and Shopify.

- The largest relative detractors in the quarter were Apple (AAPL), Airbnb (ABNB), and Tesla (TSLA) (not owned). The largest absolute detractors were Alphabet (GOOG)(GOOGL), Airbnb, and Amazon (AMZN).

- We purchased new positions in Apple and Oracle and eliminated our small positions in Nike (NKE) and Salesforce (CRM). We also added to our positions in Adobe (ADBE), Workday (WDAY), Shopify, MSCI (MSCI), and Paycom Software (PAYC) and trimmed positions in Amazon, Alphabet, and Microsoft (MSFT).

- A hallmark of Focus Growth over our 36-year track record has been protecting in down markets, which typically coincides with recessions or rational fears of them. Though typically short periods, we were pleased to see the Portfolio outperform the Russell 1000 Growth Index amid two notable peak-to-trough drawdowns this quarter.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Periods over one-year are annualized. Performance figures are presented gross and net of fees and have been calculated after the deduction of all transaction costs and commissions, and include the reinvestment of all income. Please reference the GIPS Report which accompanies this commentary. The commentary is not intended as a guarantee of profitable outcomes. Any forward-looking statements are based on certain expectations and assumptions that are susceptible to changes in circumstances. Opinions and views expressed constitute the judgment of Polen Capital as of the date herein, may involve a number of assumptions and estimates which are not guaranteed, and are subject to change. Contribution to relative return is a measure of a securities contribution to the relative return of a portfolio versus its benchmark index. The calculation can be approximated by the below formula, taking into account purchases and sales of the security over the measurement period. Please note this calculation does not take into account transactional costs and dividends of the benchmark, as it does for the portfolio. Contribution to relative return of Stock A = (Stock A portfolio weight (%) - Stock A benchmark weight (%)) x (Stock A return (%) – Aggregate benchmark return (%)). All company-specific information has been sourced from company financials as of the relevant period discussed.

Commentary

Volatility re-emerged in the third quarter. The initial catalyst was a better-than-expected Consumer Price Index (“CPI”) report (indicating lower inflation) on July 11, boosting market confidence that the U.S. Federal Reserve (the “Fed”) would likely embark on a cutting cycle sooner than later. This excitement spurred a rotation out of large technology and “AI winners” into other market segments, many of which lagged in the year’s first half. In a rare illustration that index concentration does in fact cut both ways, 80% of Russell 1000 Growth constituents outperformed the overall Index return (-13.1%) from the intra-quarter high on July 11 to the low on August 5. During this stretch, the previously unassailable Magnificent 7 stocks (not our nomenclature) were in a -18% drawdown, headlined by a -26% decline in NVIDIA. From there, the volatility persisted for the balance of the quarter, including an 11% recovery off the August 5 lows, followed by a brief 6% decline, and subsequent 9% rally into the end of September.

Rather than provide a play-by-play of the quarter, we intend to call out what we believe will be an enduring feature of markets for the foreseeable future: heightened volatility, especially around the largest weightings in the indexes. The prevailing narrative now seems to be that a recession is not imminent and that the Fed’s late-September 50bps rate cut improved the odds of achieving the elusive “soft landing” scenario. One can build a convincing case that we’ve entered a goldilocks environment with inflation under control, a more accommodative rate backdrop, below-average unemployment, a resilient consumer, and improving earnings growth. That may end up being the case. There’s an equally plausible version of events where the consumer continues to weaken, unemployment ticks up, and it becomes clear that a recession was not avoided but rather deferred. Importantly, we don’t try to anticipate one or the other. If anything, the past several years have provided numerous reminders that market narratives - as loud as they can be in the moment - can and do change. And it's increasingly the case that the story changes quickly, as we saw this past quarter. This is why we invest across a spectrum of growth, intending to build resilient portfolios.

If we take a step back, one of the hallmarks of Focus Growth over our 36-year track record has been protecting in down markets, which typically coincides with recessions or rational fears of them. While these are typically short periods, we were gratified to see the Portfolio outperform the Russell 1000 Growth amidst two notable peak-to-trough drawdowns this quarter. The first 13.1% market drawdown came from July 11 through August 5, with Focus Growth declining only 7.6% during that stretch. Later in the quarter, from August 21 to September 6, the Index was down -6.4%, and Focus Growth declined only 2.4%.

Focus Growth outperformed in 20 of the 23 down days for the Index during the quarter. We were encouraged to see a number of our safety holdings leading the way.

These safety holdings included Accenture (ACN), Thermo Fisher Scientific (TMO), and UnitedHealth (UNH). Another notable contributor to relative performance came from our software holdings, with companies reporting strong earnings growth in the quarter in defiance of the earlier 2024 narrative that the software business model - broadly speaking - would be hit hard by AI. We believe AI is more likely to be a tailwind than a headwind for the competitively advantaged, mission-critical software businesses we own.

As we’ve stated previously, and we think bears repeating: our sole objective has always been to deliver mid-teens returns on the back of mid-teens earnings growth over time. Historical data shows that the Portfolio’s long-term, mid-teens annual earnings per share growth has been driven by companies with durable and consistent revenue and earnings growth, not those more likely to experience dramatic peaks and valleys. By definition, this means that, at times, we may seem to be driving in the slow lane. This happened in 2003-2005 and again in 2012-2014. It is just this sort of durable mid-teens earnings growth through time that has led to our strong track record over three and a half decades, rather than attempts to optimize the Portfolio for the prevailing market narrative. We have been committed to an unwavering compounding mission since the inception of Focus Growth in 1989, and we will adhere to that commitment as we look forward to delivering long-term value for our clients.

Portfolio Performance & Attribution

In the third quarter, the top relative contributors to the Portfolio’s performance were NVIDIA (not owned), Shopify, and ServiceNow. The top absolute contributors were Oracle, ServiceNow, and Shopify.

In a reversal from the past two quarters, NVIDIA represented our top relative contributor this quarter, despite the modest underperformance, declining -1.7%. In many ways, NVIDIA was a microcosm of the broader market’s heightened volatility. Beneath the placid surface, the company experienced a 27% drawdown followed by a +31% rally, only to repeat the cycle with a -21% drawdown followed by a subsequent 20% rally to finish the quarter. In our view, the stock’s volatility goes beyond fundamental business drivers, but the company in turn benefitted from increasing capital spending budgets from cloud service providers and large enterprises for generative AI (“GenAI”) infrastructure spending. Simultaneously, the stock endured weakness related to the delayed next-generation Blackwell chip, and an earnings forecast that exceeded expectations, albeit not as much as some investors hoped. While we continue to believe NVIDIA is a highly advantaged business, with significant demand for their chips and servers ahead of the need for that hardware from real-world businesses, we are cautious about its growth sustainability since it lacks recurring revenue.

Shopify, a recent addition to the Portfolio last quarter, was another top contributor. The company reported strong results across the board, allaying concerns around consumer weakness weighing on the business. Gross Merchandise Value (“GMV”) increased 23% year-over-year, driven by strength in same-store sales growth at existing merchants, new merchant growth globally, and omnichannel/offline. Additionally, Shop Pay (Shopify’s checkout service designed to streamline the online shopping process) continues to be a success story rolling out in new countries and should provide a nice tailwind for years to come.

With many powerful tailwinds (eCommerce, mobile commerce, social media, digital payments, seamless omnichannel, DTC, cloud software digitization) and a highly scalable business model, we think Shopify’s growth will likely prove stronger for longer than investors expect.

ServiceNow reported better-than-expected sales and bookings during the quarter, with subscription sales up +23%.

Encouragingly, GenAI offerings within its product suite, rolled out in late 2023, already appear to be an incremental driver of this growth. In our view, ServiceNow is a great example of a consistent grower, with a strong moat serving diverse and growing end markets with expanding margin opportunities over time.

Beyond these top relative contributors, it’s worth noting Oracle as a top absolute contributor, with reported quarterly profits and bookings ahead of estimates as AI demand boosted its cloud computing business. Given its recent addition to the Portfolio, please see additional detail in the Portfolio Activity section below.

The largest relative detractors during the quarter were Apple (AAPL), Airbnb (ABNB), and Tesla (TSLA) (not owned). The largest absolute detractors were Alphabet, Airbnb, and Amazon.

We added a new position in Apple during the period, which we discuss further in the following section. While Apple is a roughly average-sized position in Focus Growth, it is the largest holding in the Russell 1000 Growth Index, at over 12%, and the stock’s outperformance in the quarter weighed on relative results.

Airbnb declined in the period on concerns around a weaker demand outlook for the quarter as well as increasing marketing spend planned for the second half of 2024, pressuring near-term margins. Given the company’s exposure to the health of the consumer and related willingness to spend on leisure travel, we believe it’s important to take a step back to see the larger picture. Global accommodations have been and will likely continue to be a mid-single-digit growth market. Still, as private rentals become increasingly mainstream and the dependability of those private listings improves, we would expect private rentals to continue to gain market share. We continue to see Airbnb as a likely double-digit revenue grower over the next five years, and with modest margin expansion, we could expect mid-to-high-teens earnings growth.

We’ve spoken at length about our rationale for not owning Tesla. In short, the market seems to be pricing in a lot of positive optionality for this company in the near-to-intermediate term (and particularly a fully autonomous fleet of electric vehicles in the medium term). What exists today is an automobile manufacturer limited to the higher-income segment that is increasingly challenged to sell vehicles when interest rates are not zero. We continue to question the company’s long-term growth profile and governance.

Alphabet and Amazon were also top absolute detractors. Alphabet’s better-than-expected results were overshadowed by an adverse ruling related to the U.S. Department of Justice’s (“DoJ”) anti-trust case against the company. We expected an adverse ruling and are monitoring potential remedies recommended by the DoJ and subsequently ruled on by the judge. This will likely take a few years to play out; in the meantime, we see many mitigating factors that the company can pursue to protect its competitive position and growth. By contrast, Amazon’s position as a notable detractor speaks more to the size of the position than the magnitude of the underperformance, as the company delivered a solid set of results during the quarter.

Portfolio Activity

In the third quarter, we purchased new positions in Apple and Oracle and eliminated our small positions in Nike and Salesforce. We also added to our positions in Adobe, Workday, Shopify, MSCI, and Paycom Software, and trimmed positions in Amazon, Alphabet, and Microsoft.

We owned Apple from early 2009 through late 2016, a period characterized by the massive iPhone-driven growth phase propelling the company’s revenue and earnings to levels almost unseen previously. We moved on from the position in 2016 as we felt Apple had nearly fully penetrated the high end of the smartphone market, which by and large proved correct. Revenue growth has since compounded in the mid-to-high single digits, with earnings growth modestly higher, driven by heavy share buybacks. In the last two years, the company’s revenue and earnings growth has slowed to essentially 0%.

So why repurchase Apple now? Following the June iOS Worldwide Developer Conference (“WWDC”), it became apparent that the latest iOS operating system upgrade will bring GenAI advancements to the masses near-term.

Apple can now upgrade Siri to the true helpful digital assistance consumers hoped it would be all along. Not to mention, the new operating system brings useful new features to not only Apple apps and services but also seamlessly across third-party apps. We believe this means a multi-year upgrade cycle is coming for iPhones that will be unveiled later in 2024 and into 2025. The elongation of the iPhone replacement cycle over the last few years is likely to stop or even reverse, pulling forward stronger revenue, earnings, and free cashflow growth for Apple over the next few years. We expect this to not only accelerate iPhone volume growth but also likely a product mix shifting to higher-priced, higher-margin iPhones. We also expect the AI functionality to be more impactful with bigger screens, processing, and memory.

With consumer budgets getting tighter, we feel the new Apple phones with GenAI functionality will become a top priority for consumers versus other areas of spend, which we expect could give a safety-like quality to the acceleration. While the company’s valuation at just under 30x forward earnings is not cheap, we feel the earnings acceleration will allow Apple to generate at least double-digit returns (possibly even mid-teens) over the next few years, earning its place in our Focus Growth Portfolio.

Oracle is another new addition to Focus Growth. Like Apple, It’s a company we previously owned from 2005 to 2019. Its database business was dominant during this period, and they were building an applications business through several large acquisitions. We exited our position when the company’s revenue growth slowed to a low-single-digit rate as Oracle was late shifting its applications and databases to the cloud. Today, revenue growth is accelerating as Oracle has made progress in bringing its applications and databases to the cloud. An even greater impact, though, comes from the cloud service infrastructure business Oracle has built to compete with the large hyperscalers (Amazon Web Services, Microsoft Azure, and Google Cloud). Oracle Cloud Infrastructure (“OCI”) is the newest entrant in cloud services infrastructure and the company has taken a differentiated approach versus larger peers. Instead of building giant datacenters around the globe, OCI is comprised of many smaller datacenters that can act either as public or private clouds. Many of these private clouds reside onsite at customer locations for the highest data security and privacy.

This approach is especially beneficial for large enterprises like banks and healthcare companies, as well as governments that are highly regulated, and must be concerned about privacy, cybersecurity, and fraud. These are also some of Oracle’s biggest database customers. Inside OCI, Oracle’s Autonomous Database is the most advanced relational database in the world, with almost zero downtime or human interaction, allowing for high reliability and far lower cost. It also allows for some of the most complicated on-premise database workloads to be moved to the cloud more seamlessly. While OCI is a lower-margin business than Oracle’s software businesses, it often pulls with it Oracle Autonomous Database revenue, which is high margin - allowing the overall corporate margin opportunity to expand. The shift to the cloud for Oracle applications and databases will likely provide a nice revenue tailwind for years to come as the Software as a Service (“SaaS”) migration of Oracle applications is still in the relatively early stages, and databases are just beginning to move to the cloud. We expect the company’s earnings growth to be in the low-to-mid-teens range with potential upside. The current mid-20s forward P/E multiple is what we consider to be reasonable for a highly advantaged company with strong and accelerating growth likely for years to come.

We exited our position in Nike in the early part of the quarter after owning it continuously for over a decade. If we take a step back, the Nike brand has been built over many decades on product innovation and storytelling - the magic one-two punch for sustainable growth of a consumer brand. Over the last few years, it has become increasingly clear that the company has underinvested in these key areas. Results in recent quarters have been subpar due to a vacuum of new products. We expected to see a marked improvement starting with this summer’s Paris Olympics, but the demand for Nike products appears more challenged than we expected and will take longer to recover. As such, we decided to liquidate our small position, partially to fund Apple, which, conversely, is likely to see accelerating revenue and earnings growth for at least the next few years.

We exited our position in Salesforce to fund better opportunities in Shopify and MSCI. Salesforce is seeing slower revenue growth than we would have expected, given the weakening macroeconomic environment. Furthermore, since its core end markets in customer relationship management (“CRM”) and Service are fairly mature, a lower growth level versus our expectations could persist for some time.

We added to several existing positions in the quarter including Adobe, Workday, Shopify, MSCI, and Paycom Software. We feel Adobe is poised for re-accelerating revenue and earnings growth partially due to the monetization of its Firefly GenAI product embedded in its creative software. Workday is still growing revenue at a mid-to-high-teens rate, but in recent years, slower macroeconomic growth has made closing deals more challenging. Amidst a pullback, we increased our position as we found the valuation attractive for a well-positioned, recurring revenue business with still strong growth potential. The company also recently stated publicly that it will be focused on expanding profit margins meaningfully over the next five years - something we have expected and are pleased to see.

As we detailed in the previous section, Shopify’s robust performance in the quarter confirmed the company continues to see attractive revenue growth and margin expansion in line with our investment thesis. With MSCI, we re-initiated a position last quarter after having previously owned it from 2019 to 2022. We were able to purchase the shares at an attractive valuation on the back of a quarter that saw elevated cancellations in their index business. We expected this to be a one-off event, and strong results from the most recent quarter gave us confidence to bring the position up to a more average weight. Finally, we modestly added to our small position in Paycom Software, given our view that the growth slowdown the company is still experiencing is due to temporary dynamics, and growth should reaccelerate with normal blocking and tackling around product development and salesforce training. While macroeconomic headwinds and lower float income (due to lower interest rates) will be a challenge, we believe Paycom remains an advantaged payroll/human capital management (“HCM”) software player with a long runway for growth ahead.

We trimmed our positions in Amazon, Alphabet, and Microsoft during the quarter. As we have previously, we trimmed Amazon slightly to bring the weight back to 15% for risk management purposes. We remain very positive on our investment thesis of strong revenue growth and even stronger earnings and free cash flow growth continuing over the next few years. We trimmed our positions in Alphabet and Microsoft by 1.5% each to fund the purchase of Oracle. They both remain top five holdings at the new weights.

Outlook

As we enter the fourth quarter of 2024 and look ahead, we see slowing economic growth globally presenting a tougher growth backdrop. In addition, with tremendous spend on AI infrastructure with a good portion earmarked for future use, the stakes are high for not only GenAI’s long-term advancement but also its more immediate progress over the next few years. Given this scenario, we feel fortunate to hold a Portfolio of durable growth businesses with strong balance sheets, competitive advantages, and recurring revenues. We continue to target mid-teens or better earnings growth even in tougher macroeconomic environments with expectations for continued mid-teens returns that will track that earnings growth as it has for our long-term track record. As we mentioned last quarter, our Portfolio continues to trade at parity with the Russell 1000 Growth Index, which hasn’t happened since the technology bubble peak in 1999-2000. We find this even more compelling given that we expect mid-teens earnings per share growth for our Portfolio over the next five years, but only high-single-digit earnings growth for the Index.

We remain focused on protecting and growing our clients’ capital in a disciplined and consistent manner, driven by the fundamentals of our Portfolio holdings.

Thank you for your interest in Polen Capital and the Focus Growth strategy. Please feel free to contact us with any questions or comments.

Sincerely,

Dan Davidowitz, Damon Ficklin and Brandon Ladoff

| Important Disclosures & Definitions: Disclosure: This commentary has been prepared without taking into account individual objectives, financial situations or needs. As such, this commentary is for informational purposes only and is not to be relied on as, legal, tax, business, investment, accounting or any other advice. Recipients of this commentary should seek their own independent financial advice. Investing involves inherent risks and any particular investment is not suitable for all investors; there is always a risk of losing part or all of your invested capital. No statement herein should be interpreted as an offer to sell or the solicitation of an offer to buy any security. Unless otherwise stated in this commentary, the statements herein are made as of the date of this commentary. Certain information contained herein is derived from third parties beyond Polen Capital’s control or verification and involves significant elements of subjective judgment and analysis. While efforts have been made to ensure the quality and reliability of the information herein, there may be limitations, inaccuracies, or new developments that could impact the accuracy of such information. Therefore, this commentary is not guaranteed to be accurate or timely and does not claim to be complete. Polen Capital reserves the right to supplement or amend the content contained herein, but has no obligation to provide the recipient with any supplemental, amended, replacement or additional information. Any statements made by Polen Capital regarding future events or expectations are forward-looking statements and are based on current assumptions and expectations that are susceptible to change. Such statements involve inherent risks and uncertainties and are not a reliable indicator of future performance. Opinions and views expressed constitute the judgment of Polen Capital as of the date herein, may involve a number of assumptions and estimates which are not guaranteed, and are subject to change. Statements regarding Polen Capital’s research should be interpreted as either forward-looking statements or understood as Polen Capital’s opinion. The commentary is not intended as a guarantee of profitable outcomes. Source: All data is sourced from Bloomberg unless otherwise noted. All company-specific information has been sourced from company financials as of the relevant period discussed. Definitions: Headwind: refers to factors or conditions that can impede the performance or growth of investments, sectors, or entire economies. These obstacles could be economic, political, or market-related and can affect investment returns negatively. Tailwind: refers to favorable conditions or factors that can propel asset prices or financial markets upwards. These can include economic growth, technological advancements, regulatory changes, or other external influences that enhance the performance of investments. Peak-to-trough: refers to the period between the highest point (peak) and the lowest point (trough) in an economic cycle or in the price movement of a particular asset or market. Magnificent 7: a group of seven large, high-performing technology stock market companies: Apple, Microsoft, Amazon, Alphabet (Google's parent company), Meta Platforms (formerly Facebook), Tesla, and Nvidia. These companies are known for their significant market impact and have been key growth drivers in major stock indices. Free Cash Flow: the cash a company generates after subtracting cash outflows to support operations and maintain its capital assets. Reflects a company’s ability to generate cash. It is the cash remaining after a company pays its operating expenses and capital expenditures. Calculated by taking operating cash flow (on the cash flow statement) and subtracting capital expenditure (typically purchases on property, plant, and equipment, which is also found on the cash flow statement). Price-to-earnings (P/E) ratio: the ratio for valuing a company that measures its current share price relative to its per- share earnings. Earnings per share (EPS): a company's net income subtracted by preferred dividends and then divided by the average number of common shares outstanding. Forward P/E multiple: a valuation metric that measures the ratio of a company's current stock price to its estimated earnings per share over the next 12 months. Contribution to relative return: a measure of a security’s contribution to the relative return of a portfolio versus its benchmark index. The calculation can be approximated by the below formula, taking into account purchases and sales of the security over the measurement period. Please note this calculation does not take into account transactional costs and dividends of the benchmark, as it does for the portfolio. Contribution to relative return of Stock A = (Stock A portfolio weight (%) - Stock A benchmark weight (%)) x (Stock A return (%) – Aggregate benchmark return (%)). All company-specific information has been sourced from company financials as of the relevant period discussed. |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.