Mongkol Onnuan

The preferred investment landscape is always changing. While many preferreds have appreciated nicely, thereby diminishing the forward returns, others are freshly opportunistic. We still see specific securities with substantial capital appreciation potential, others with outsized current yield, and a select few with both.

This article will examine recent changes to the fixed-income environment and delve into how it impacts the forward return potential for REIT preferreds. We will then discuss some of the individual securities that look particularly lucrative due to significant mispricing.

Changes to fixed income and impact on REIT preferreds

The changes themselves are just basic macros of which many may already be aware, so I won’t spend too much time on this.

- Yield curve uninverting.

- Fed Funds rate cut 75 basis points and potentially a bit more in coming months.

- Passage of time converting many formerly fixed-rate preferreds into their floating rates.

- The neutral Fed Funds rate (referred to as R*) is now perceived as higher (maybe 3%-3.5%) versus former 2%-2.5%.

More relevant to the individual investment opportunities is how these macro changes have impacted REIT preferreds.

REIT preferred prices have risen

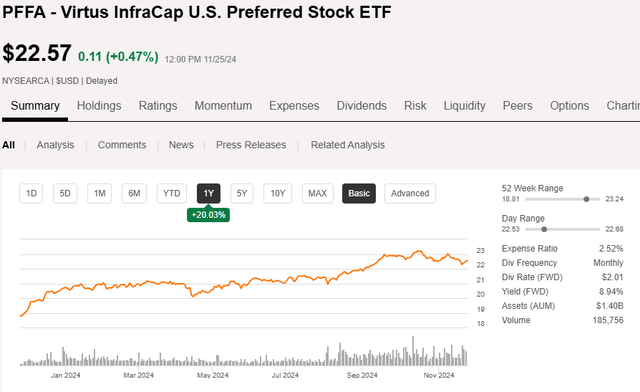

REIT preferreds, as loosely represented by the Virtus InfraCap U.S. Preferred Stock ETF (PFFA) have gone up about 20% over the last year.

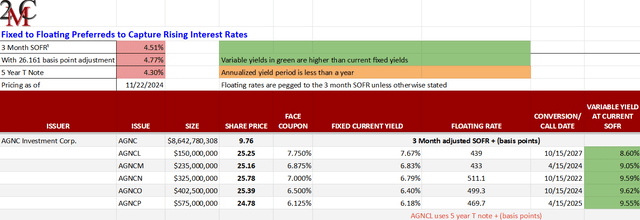

That of course represents the group as a whole, while individual securities moved disparately. With this upward move, many of the REIT preferreds in which we previously called for substantial upside now have a more flattish outlook. The AGNC Investment Corp. (AGNC) preferreds are a good example of this. When they were trading in the low $20s or in some particularly opportunistic instances, below $20, they had not only high yield, but substantial capital appreciation potential.

Today, however, they all trade right around $25 which is their par value such that the forward return is basically just the yield.

Portfolio Income Solutions as of 11/22/24

Source: Portfolio Income Solutions

Given that the M, N, and O have converted to floating yield, and they have healthy adjustments over SOFR, the current yield on these is still quite solid so it is a viable dividend play for income, just don’t expect appreciation beyond that.

Despite the rising tide in preferreds, there are a few that remain deeply discounted to par.

Still steeply discounted with even higher yields ahead

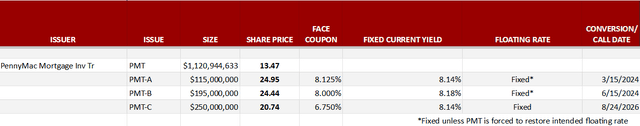

PennyMac Mortgage Investment Trust (PMT) made waves when it dodged its responsibility to convert its preferreds to floating rate on the prespecified dates.

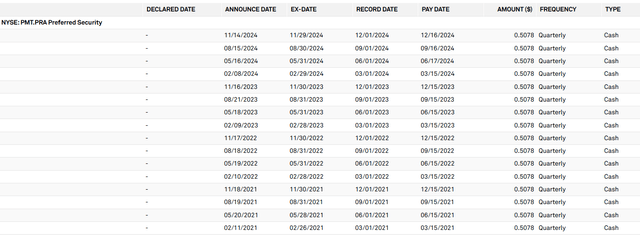

PMT preferred A was supposed to start paying a floating rate in March 2024, but here is its dividend history.

S&P Global Market Intelligence

One could potentially speculate on buying PMT-A with the idea that perhaps they will eventually be forced to honor the floating rate which would be significantly higher, and they could potentially have to pay the missed extra dividends.

It is very difficult to discern the probability of that occurrence, so I would rather play the C series which trades at $20.74 as of the screenshot.

Portfolio Income Solutions as of 11/22/24

Note that the fixed current yield of all three issues is essentially the same, ranging from 8.14% to 8.18%. The C series, however, has roughly 20% capital appreciation potential on top of the dividend, due to its substantial discount to par.

Getting all the way to $25 would likely require interest rates to go significantly lower, which is not my base case, but this could reasonably trade to about $23.50 even on the consensus path of interest rates.

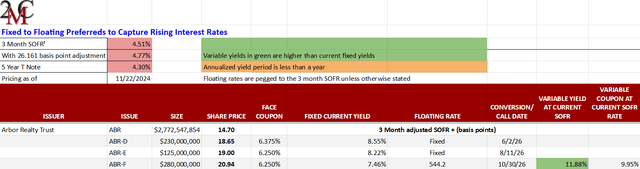

Arbor Realty Trust, Inc. (ABR) also has various discounted preferreds.

Portfolio Income Solutions as of 11/22/24

ABR-D and ABR-E are fixed rate with current yields of 8.55% and 8.22%, respectively. These would function similarly to PMT-C in that there is a solid current yield with additional capital appreciation potential.

ABR-F is even more interesting to me because of the incredibly generous 544 basis point spread its floating conversion offers over SOFR. SOFR largely mirrors the Fed Funds rate which would make variable rate coupon a whopping 9.95% which translates to an 11.88% yield due to the discount at which it trades.

It was previously believed that the Fed Funds rate would go down substantially, but Fed commentary has increasingly moved toward a higher neutral rate. Most observers of the Fed now suggest a neutral rate of 3% to 3.5%. Using the low end of that range, ABR-F’s floating rate coupon would still be 8.442%. That is of course the coupon against the par value so in buying ABR-F at $20.94, it would be a yield of just over 10%.

Conversion to floating is scheduled for 10/30/26 which makes the SOFR at that time an unknown. However, because the spread over SOFR is so large at 544 basis points, it is difficult to imagine an interest rate environment in which ABR-F’s converted yield is not huge.

Therefore, I think it is likely that ABR-F will trade up to par at the time of its conversion which portends substantial capital appreciation in addition to a healthy yield while we wait.

Another category of opportunistic preferreds worth covering are those which appear to be trading at a premium, but aren’t, actually.

Dirty price versus clean price

Bonds have something called clean pricing versus dirty pricing which refers to the difference between their listed price and the price at which they actually transact which includes accrued interest of the partial period.

Unlike bonds, preferreds always trade at their listed price such that any accrued dividend in the current dividend period functions as a sort of discount.

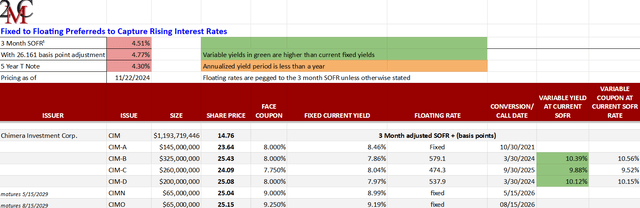

The liquidation preference of a preferred is its par value plus accrued dividends. So even though the par value of Chimera Investment Corporation (CIM) Chimera Investment Corporation 8% PFD CUM SER D (CIM.PR.D) is $25, its liquidation preference right now is closer to $25.50 because of how close it is to the ex-dividend date. Chimera preferreds go ex-dividend on 12/2/24. Thus, even if we buy CIM-D at the present $25.08, and it gets redeemed tomorrow, it would still be profitable.

Due to accrued dividends being part of the liquation preference, the liquidation preference is usually slightly higher than the par value of $25. This is relevant for the Chimera preferreds because the B and D are redeemable presently.

Portfolio Income Solutions as of 11/22/24

These preferreds also offer a very generous spread over SOFR which makes their current yields over 10%.

They might get called away from us at some point, but since the accrued dividend is larger than the premium to par, redemption would be a slightly profitable event for investors.

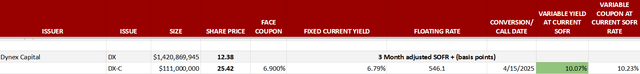

Dynex Capital, Inc. (DX) Preferred C is in a similar situation.

Portfolio Income Solutions as of 11/22/24

It goes ex-dividend at the end of December which makes the accrued dividend largely cancel out the premium to par.

High yield due to mispricing

There are many ways to find dividend yields in excess of 10%, but many securities trade with yields that high because they are extremely high risk.

No stock is without risk, but we believe the preferreds listed above are high yield due to mispricing rather than outsized risk. REIT preferreds get very little institutional attention due to their small size and obscurity which makes them fertile ground for mispricing. The variable rate conversion features are particularly misunderstood by the market which has been a repeated source of mispricing allowing opportunistic entry pricing that at least historically corrects toward fair value as conversion arrives, and the higher dividends start to flow.

Based on risk level, I think these should trade around 8% annual total return, but mispricing is affording yields as high as 10% as well as some capital appreciation potential for those still discounted to par.

The REIT market has gotten egregiously underpriced making it a great time to get in to the right REITs. To help people get the most updated REIT data and analysis I am offering 40% off Portfolio Income Solutions, but you can only get it through this link.

https://seekingalpha.com/affiliate_link/40Percent

I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic REITs.