guvendemir

It’s still a long road ahead for The Boeing Company (BA).

The beleaguered aircraft maker, which in 2024 welcomed a new CEO, endured a strike and worked through a big capital raise, remains on investors’ radars despite the turmoil. Dhierin Bechai, Investing Group leader for The Aerospace Forum, has been bullish on the aircraft maker. But the Seeking Alpha analyst also warns that the company is not yet out of the woods.

The defense may remain a slow and steady performer for dividend investors in 2025, but the business could encounter some disruption with change coming to Washington next month. Investors can also expect some turbulence in the airline sector, but some companies may present opportunities, Bechai says.

His outlook for 2025 follows:

Seeking Alpha: Boeing, as everyone knows, is working through its turnaround. A new CEO, talk about selling non-core businesses, improving its financial picture, etc., are among the items investors have been watching. What could derail these efforts, not only in 2025, but beyond next year?

Dhierin Bechai: Boeing faces several challenges. The first one is getting the production of the Boeing 737 MAX program back to 38 airplanes per month and growing the production beyond that level, for which the company requires the FAA to lift the ban to produce more than 38 Boeing 737s per month. Failing to obtain approval from the regulator effectively caps Boeing’s ability to post significant cash flow growth and deleverage efficiently.

Boeing

Another item with the FAA is the certification of the Boeing 777X family and the MAX 7 and MAX 10. If Boeing fails to obtain timely certification, this could once again add to costs.

On the topic of selling non-core assets, this part of shaping up Boeing is not so much to raise cash but to position Boeing for the future and decide which parts of the company are future-proof and can or should be invested in for Boeing to excel once again. It's not so much a matter of raising cash to pay debt, but doing less and doing that better.

The aerospace supply chain remains fragile, so that's also an item that could derail Boeing’s plan. But, realistically, the biggest risk for Boeing is… Boeing. If Boeing did not learn the simple lesson that it needs to put quality first to avoid costly stoppages and reworks, then all efforts would be for nothing. A high-quality airplane that generates free cash flow as a positive outcome rolling out of the factories should be the objective for Boeing rather than solely having free cash flow objectives.

Seeking Alpha: What are the opportunities this endeavor can deliver for the company?

Dhierin Bechai: If Boeing does what it needs to do, it should allow the company to financially recover through the production of high-quality airplanes at higher production rates, attract more orders again, and eventually develop and build the next-generation airplane. Boeing’s development of an all-new jet has stalled for 4-5 years now, they are steps behind.

Seeking Alpha: You covered Boeing’s $22 billion capital raise. What do investors need to know about this move?

Dhierin Bechai: That it was absolutely necessary for Boeing to raise cash from shareholders. Boeing returned virtually all of its free cash flow to shareholders before the crisis struck. Making shareholders part of that recapitalization is fair and provides Boeing with an opportunity to reset itself. It's one of the elements that was required for Boeing to address debt maturities in the upcoming one to two years, but perhaps more importantly, it was a prerequisite for Boeing to eventually be able to start looking at the future of its commercial airplane portfolio again and develop a much-needed new airplane. Absent the capital raise, Boeing would be unlikely to develop a new airplane within the next 10 years, and as a result, shareholder value would diminish either way.

Seeking Alpha: Boeing is part of the aerospace/defense sector you cover. Defense, obviously, is more of a long-term play, mainly for the dividends. That said, with the Trump administration taking control in January, could there be potential disruption in this business?

Dhierin Bechai: There could be. There's no way that from one day to the other things will be vastly different, but in several buckets, there could be some changes or disruptions. Firstly, sentiment could change. Trump has said he will bring peace, and that would, of course, not be good for the defense industry, or at least for sentiment among investors.

Secondly, arms sales are part of trade as well. Trump has been threatening trade wars against allies. That could result in two things: Either the Allies will use defense as a way to ease any trade wars, or the Allies engage in a trade war and, as a result, try to procure even more defense equipment outside of the US. We are at the start of international arms sales increasing. Between 2019 and 2023, trade exports have grown 40%, and defense FMS grew to $238.4 billion in 2023 from $170.1 billion in 2019. This also marks a 110bps expansion for defense as part of the trade pie.

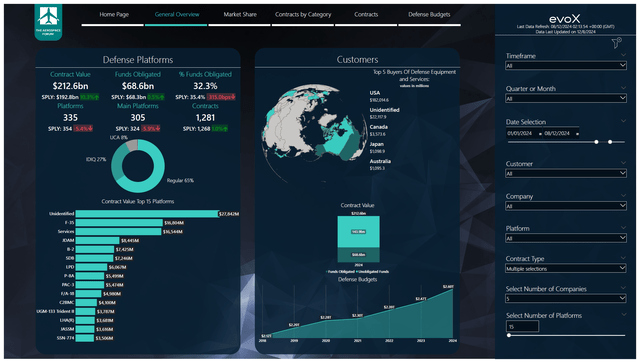

The Aerospace Forum

So, this is where growth can either be maintained or destroyed. If Trump is all about trade, he will recognize the important position that growing arms exports have for trade in general. The Aerospace Forum developed a monitor that tracks defense contract awards. Currently, there are contracts valued at $5.1 trillion for 145 companies and joint ventures. That monitor shows that the contracted value of $212.6 billion year-to-date is up 10.3% compared to the same period last year, and that indicates that there's significant growth momentum ahead. Even more so when we consider that many sales campaigns have yet to be finalized and combined backlogs of defense contractors are of the magnitude of hundreds of billions of dollars.

Thirdly, Trump is seen by some as running a country like a company, and one of his aims now seems to reduce costs in government. And the impression is given that a lot of cuts can be made, including in the defense industry. Almost as if state-of-the-art jets such as the F-35 could be made at a fraction of the cost. That's simply not true.

There can be some cost cuts because overall, the mechanism is just simply too complex, but the impression that's being given now is that defense companies overcharge while it's simply the entire mechanism, including the procurement process, that adds costs. The DoD wants to have a lot of advanced capabilities, for which it, in essence, is not adequately funded. That's not the mistake of the defense industry. During Trump’s first term, calling out defense contractors such as Boeing to drive down costs was seemingly a daily routine. However, we now see that many defense contractors have been taking the risk of fixed price development contracts that will never be profitable, and the defense contractors owe it to their shareholders to not engage in those contracts again. So, Trump calling out defense contractors via the media and social media again could very well create a hard line between the US government/White House and the industry as a whole. Transferring risk back to the industry could ultimately end up hurting the entire defense base, and that includes customers. A continuous risk transfer or drive down on costs can result in future contracts getting priced higher and not lower to offset previous losses or leave the US and allies with less capable products in the future.

Seeking Alpha: On airlines - the case can be made that these companies are very challenging from an investor standpoint. It’s a rocky business. For example, the Spirit Airlines bankruptcy. But maybe there are some airlines worth watching in 2025?

Dhierin Bechai: I believe that in the US the LCCs are less desired at this point whereas the legacy carriers (Delta Air Lines, Inc. (DAL), United Airlines Holdings, Inc. (UAL), American Airlines Group Inc. (AAL), Alaska Air Group, Inc. (ALK)) are more desired. US legacy carriers have mastered or are mastering branding and loyalty programs, while most carriers have already been adjusting their cabin segmentation to derive more value from their cabins and provide an alternative to LCCs. LCCs, on the other hand, currently seem to have little means to offset margin pressures. I also believe that SkyWest, Inc. (SKYW), which operates under capacity agreements, provides a shielded investment opportunity.

Seeking Alpha: You also cover airlines outside of the US. And you cover the airport “infrastructure” plays. What catches your eyes among these companies as we head into the new year?

Dhierin Bechai: In Europe and looking at airlines, we're seeing a bit of the opposite. Legacy carriers with the exception of International Consolidated Airlines Group S.A. (OTCPK:ICAGY) are not doing great. Airlines such as Deutsche Lufthansa AG (OTCQX:DLAKF) and Air France-KLM SA (OTCPK:AFRAF) (primarily KLM) are not doing great. And while there's pressure on low-cost carriers as well, they're less reliant on cost-cutting and revenue efforts to restore profits. Airlines with holiday packages in their offering such as easyJet plc (OTCQX:EJTTF) and Jet2 plc (OTCPK:DRTGF) seem to be positive differentiators. In Asia, we're seeing that yields are currently under pressure, and in Latin America, we see some headwinds from currency effects.

Many of the airlines that I cover outside of the US will enter 2025 in a somewhat challenging spot. At the same time, I do believe that it leaves many airlines significantly undervalued. This means that if airline investors would be for a change to value a stock based on forward earnings rather than fundamentals, many airlines actually do have significant upside.

Airport infrastructure stocks, with the exception of several names such as Aena, TAV Havalimanlari Holding A.S. (OTCPK:TAVHY), and the Airport of Flughafen Zürich AG (OTCPK:FLGZY), are also not doing great. In Europe, that seems to be mostly due to the significant capex. In Mexico, the tariff regulation changes and concession taxes that were abruptly announced in 2023 destroyed a lot of momentum. While there still is an upside for many airports in Mexico, it does seem that investors have lost trust in the Mexican government to provide a stable investment climate. Elon Musk’s Tesla, Inc. (TSLA) is set to open up shop in Mexico, so in some way, I don’t expect trade and political tension to be a real threat to Mexican airport operators, which also can capitalize on the nearshoring trend. But it's simply the sentiment that's subdued. Sentiment reversal would unlock significant upside for many names.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense, and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.