J Studios/DigitalVision via Getty Images

The title of this article may seem inflammatory as many are struggling to afford the inflated cost of living, but we believe it is economic truth. In this article we will show that apartment rental rates are significantly below equilibrium and that rent is likely to rise materially as a more normal market is restored circa 2027.

We will begin with 4 data points suggesting rent is below trend, follow with an exploration of the forces that knocked rental rates out of equilibrium, and conclude with actionable investment opportunities brought about by this event.

4 key data points

We shall start with the idea of January 2017 as the baseline for the apartment market. The economy was chugging along with moderate growth while apartment supply and demand were in balance. It was well before the wonkiness brought about by the pandemic or the extremes of inflation.

Since 2017, quite a bit has happened in the economy and with it, apartment rental rates got left in the dust. Here are 4 changes from January 2017 to the start of 2025:

- 28% national apartment rent increase

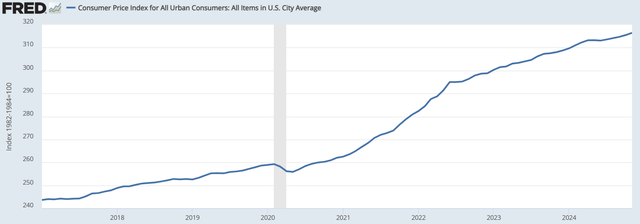

- 30% CPI inflation

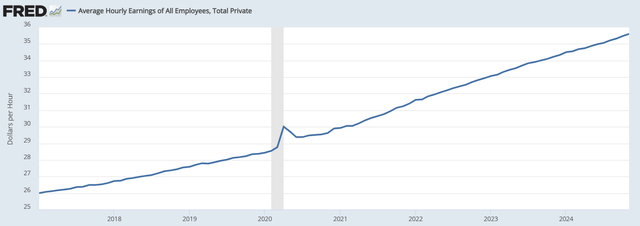

- 37% wage growth

- 78% home price appreciation

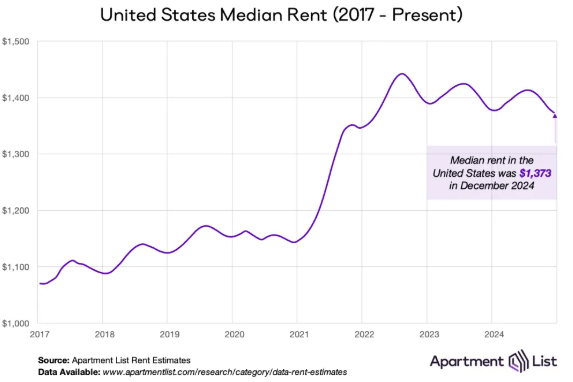

Data from Apartment List shows rents have increased about 28% since the start of 2017.

Apartment List

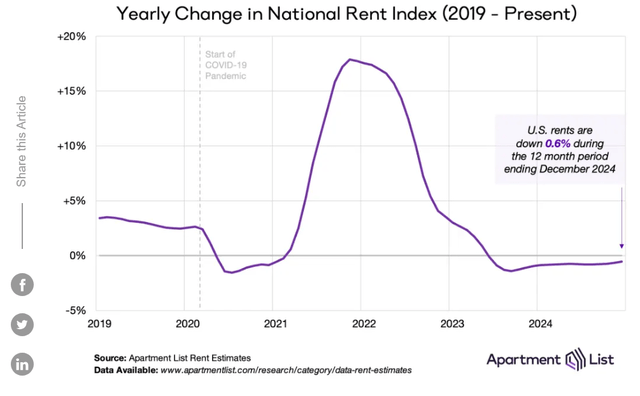

Renters really felt the surge in the 2021-2022 era in which rental rates went up about 20% in a single year. That pace of change created a narrative that apartments were jacking up rents and pricing people out of their apartments.

This narrative resonated with a large portion of the population feeling the pinch of inflation. It became easy and popular to point to the 20% jump in rental rates as a culprit.

However, if we look at the longer run numbers, it is clear that apartment rent growth has not been rapid. It was simply lumpy - concentrated in a single year period. In the rest of the last 8 years, apartment rents have been basically flat.

A 28% increase over an 8-year period of high inflation is really not that much. In fact, it was outpaced by general inflation as measured by CPI.

Federal Reserve data shows 30% CPI inflation since the start of 2017. On a relative basis, apartments actually got slightly cheaper.

Wage growth over the same period was 37%.

Wage improvement was much smoother which made it less noticeable, yet it greatly outpaced apartment rent growth.

Thus, relative to income, apartments have become substantially more affordable. This data may seem to contradict the studies showing rent to income ratios over 30% for much of the U.S.

Both are actually true.

Apartments have become more affordable relative to average wages and rent to income ratios are high.

The confounding factor here is that average household size has decreased materially. Multi-generational households are less prevalent and people on average have fewer roommates. 3 rent payers has quite a different feel than 2 rent payers in a household. As such, even though wage growth has materially outpaced rental rate growth, rent to income ratios have remained high.

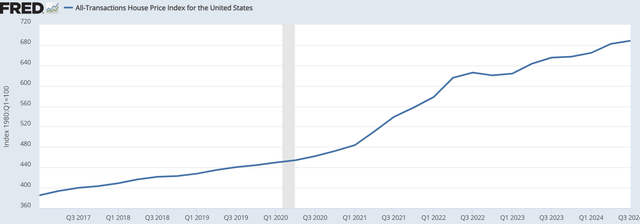

Apartment rental rates have really gotten blown out of the water by the cost of home ownership.

Home prices are up ~78% since the start of 2017.

Historically, the cost of home ownership amortized into monthly payments was on par with apartments.

Today, however, apartments are substantially cheaper than owning a home.

The extreme increase in home prices means larger mortgages and people are having to pay higher rates on those mortgages with 30-year rates around 7%. Even for those who can buy homes with cash, the cost of ownership has surged.

Home insurance rates are up due to cost of wildfires and hurricanes being somewhat subsidized over the entire country. Repair and maintenance costs surged and property taxes have increased at least proportionally with home values.

Overall, apartments are dramatically more affordable relative to homes as compared to the balanced 2017 environment.

I estimate apartment rents are 10%-20% below equilibrium.

Why are apartment rents so cheap?

The short answer - oversupply.

Zero interest rate policy was one of the most equilibrium breaking forces in the history of economics. Things get crazy when capital is essentially free.

Not only was the Fed Funds rate at 0, but the 10-year treasury yield dipped below 1%. Real estate companies could put out long term senior notes at absurdly cheap rates. We observed REITs issuing long dated debt in the 50 to 150 basis point range.

With capital that cheap, any project passes underwriting. They could build to stabilized yields of 4% and it would actually be enough.

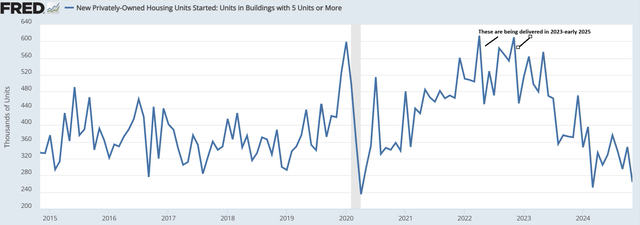

With hurdle rates that low, developers were just throwing capital at anything that could get investors excited. Well, the 20% rental rate growth in apartments circa 2021-2022 got people very excited so that became the epicenter of developer focus.

The floodgates opened and apartment construction starts hit the highest level in over 30 years.

That wave of developments from 2022 and early 2023 finished development and opened to leasing throughout 2024 and will continue to be delivered through the first half of 2025.

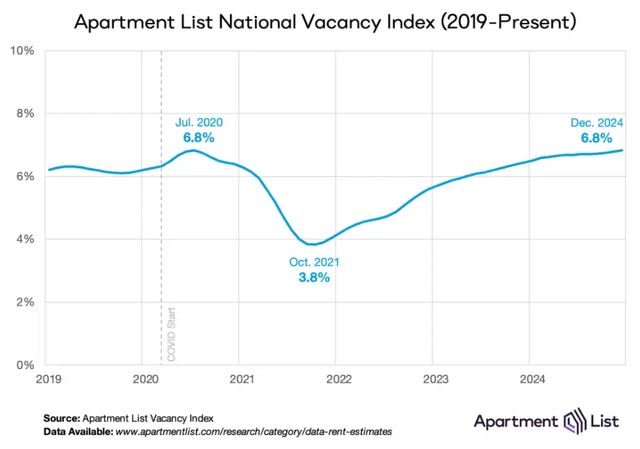

While demand for apartments remains strong, the magnitude of supply overwhelmed demand causing vacancy rates to rise to 6.8% to close out 2024.

With the deliveries remaining in 2025, I suspect vacancy rate will climb into the 7s.

This supply surge forces landlords to compete for tenants. Buildings in initial lease-up frequently offer incentives to draw tenants in so existing apartments have had to lower rents to compete.

National average rent declined slightly in the back half of 2023 and throughout 2024.

So, the reason apartment rents are so cheap right now is because the supply and demand equilibrium was broken by the zero interest rate environment. An unnatural level of supply is presently being delivered resulting in oversupply that in turn causes rental rates to be below equilibrium.

Restoration of equilibrium

Apartment starts slowed materially in the back half of 2023 and further slowed in 2024 so apartment deliveries will be below trend in late 2025 and 2026. A year or 2 of below trend supply should restore equilibrium at which point the intense price competition between landlords will subside.

With more normalized competition, apartment rents can return to equilibrant levels. As discussed earlier, apartment rents are atypically cheap relative to wages, relative to general inflation and especially relative to the cost of home ownership. Therefore, we anticipate 10%-20% rent growth as equilibrium is restored.

Timing of rent growth

With the currently scheduled pace of deliveries and consensus demand growth I think fully normal rents would be achieved early to mid-2027. This could move in either direction depending on general economic strength and various cultural factors that influence household formation.

Investment opportunities

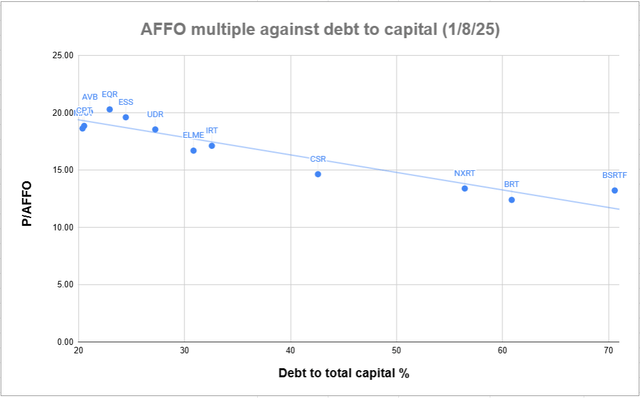

Apartment REITs are trading at substantially cheaper multiples than they used to. On Portfolio Income Solutions we maintain a data sheet continuously tracking apartment REIT valuation and as of 1/8/2025 the average apartment REIT trades at 17X AFFO.

2MC – Portfolio Income Solutions

This relatively low valuation is likely related to the weak rental rate growth in 2024 and forecasts for continued weakness in 2025.

We see this pocket of low sentiment as an opportunity. While we believe the market is correct about weak rental rate growth in at least the first half of 2025, we don’t think the market is factoring in how sharply development starts have declined.

In other words, the market is pricing in long-term oversupply while we view the oversupply as more temporary.

Once supply and demand equilibrium is restored, rental rates should rise 10%-20%. As this becomes more apparent, the apartment REITs should trade at higher multiples.

A variety of apartment REITs are in consideration.

- Coastal apartment REITs Essex (ESS) and Avalon Bay (AVB) are less oversupplied as this development wave was focused on the sunbelt.

- Midwestern apartment REITs like Centerspace (CSR) have generally more stable supply/demand dynamics with CSR growing earnings through 2024 and expected to grow in 2025

- Sunbelt apartment REITs like NexPoint, (NXRT) Independence Realty (IRT) and Camden (CPT) are getting clobbered by the supply wave but they also trade at the most discounted multiples. These markets also have the highest long term population and job growth

- Canadian apartment REIT BSR REIT (OTCPK:BSRTF) is steeply discounted to NAV and seems well positioned as a buyout candidate.

Beyond regional considerations, we have found wide variance in the balance sheets and management capabilities of the various REITs.

Given the timing of growth starting in the back half of 2025, it might be slightly early to get in, but the valuation is favorable and the long-term fundamentals are strong. As such we have begun nibbling and will build our position over time.

Stay tuned for more apartment sector research.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

REITs are cheap relative to the broader market making it a great time to get in to the right REITs. To help people get the most updated REIT data and analysis I am offering 40% off Portfolio Income Solutions, but you can only get it through this link.

https://seekingalpha.com/affiliate_link/40Percent

I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic REITs.