VisionsofAmerica/Joe Sohm/DigitalVision via Getty Images

Real Estate Weekly Outlook

U.S. equity and bond markets posted their best week since the November election as benchmark interest rates tumbled after a critical slate of inflation data showed surprisingly muted pressure in December, a

Read The Full Report on iREIT+Hoya

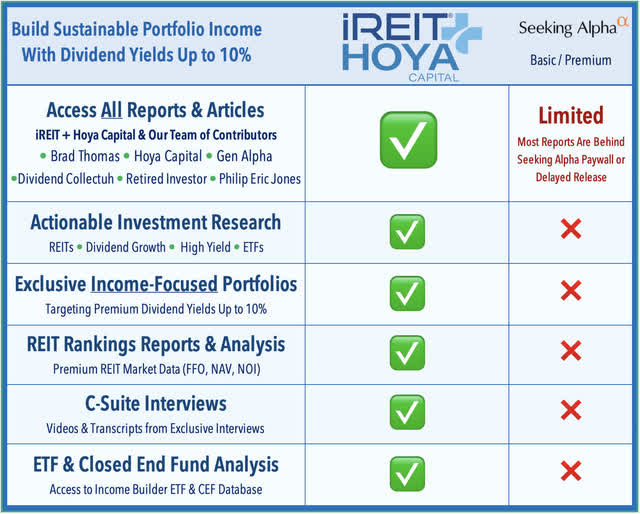

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.