This article was written by

Jonathan Weber holds an engineering degree and has been active in the stock market and as a freelance analyst for many years. He has been sharing his research on Seeking Alpha since 2014. Jonathan’s primary focus is on value and income stocks but he covers growth occasionally.

He is a contributing author for the investing group Cash Flow Club where along with Darren McCammon, they focus on company cash flows and their access to capital. Core features include: access to the leader’s personal income portfolio targeting 6%+ yield, community chat, the “Best Opportunities” List, coverage of energy midstream, commercial mREITs, BDCs, and shipping sectors,, and transparency on performance. Learn More.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SU, CVE, CNQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

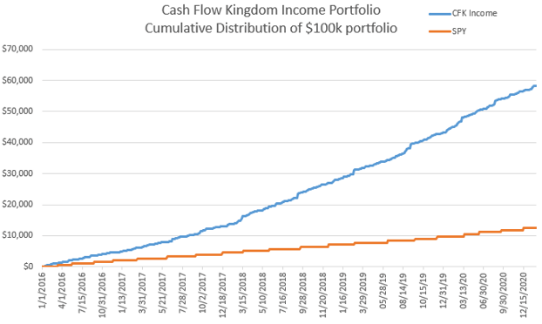

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!