sankai/iStock via Getty Images

Dear Partners,

Atai Capital returned 3.1% in the fourth quarter, bringing our full-year 2024 returns to 7.7% net of all fees. This compares to a 25% total return for the S&P 500 (SP500, SPX) , an 11.5% total return for the Russell 2000, and a 13.7% total return for the Russell Microcap for the year.

Atai Capital | Russell Micro | Russell 2000 | S&P 500 | |

Q4-2024 | 3.1% | 5.9% | 0.3% | 2.4% |

2024 | 7.7% | 13.7% | 11.5% | 25.0% |

Since Inception | 28.4% | 24.3% | 30.3% | 57.9% |

Annualized | 13.3% | 11.5% | 14.2% | 25.7% |

Portfolio Commentary:

We initiated one new core position during the quarter and sold out of three non-core holdings. One non-core holding was sold upon nearing fair value, while the other two were divested due to our theses not playing out as anticipated.

As of writing, ~58% of our portfolio consists of businesses with market caps smaller than $250M, and our top five positions make up ~55% of our portfolio.

What Is a Business Worth?

Assuming perfect foresight, the value of most businesses would be equal to the present value of all the cash flows they will generate over their lifetime. I say "most" because some businesses derive value from sources unrelated to their cash flows. Take NFL franchises, for instance: their worth to owners isn’t tied solely to profit but also to intangible benefits like prestige, influence, legacy-building, and an opportunity to win the Super Bowl. Furthermore, there are only 31 franchises you can purchase (Green Bay is a non-profit), and many likely aren’t for sale, regardless of what you could offer. These businesses grow revenues at 7% annually on average and sell for 10x revenues. Operating margins vary by franchise, but these are unlikely to be great investments if you were to rely solely upon the cash flow they would generate.

However, unlike NFL franchises, investors don’t acquire stocks for ancillary reasons; the driving force behind every share purchase is the expectation of monetary returns. Therefore, the only thing that matters in the long run is the present value of that business’s cash flow. Furthermore, if we could accurately predict these cash flows, we would not care about the risk or volatility of those cash flows – put simply, the cash from an AI company is worth the same as from an auto manufacturer. However, with the future being unknown, It is our job as investors to forecast what we believe those cash flows will be and then determine a price we are willing to pay. If we are less certain about what those cash flows could be or if there is more risk, we might demand a steeper discount. Additionally, there are endless factors at play when determining what a business is worth in the present – just a few of these would include interest rates, growth prospects, competition, industry dynamics, governance risk, and returns on capital. I believe the following quote from John Templeton captures this idea perfectly.

“ The difficulty of determining what any stock is really worth is very great indeed. No two security analysts will agree on the worth of a stock, or even on the definition of the word.”

Market Commentary:

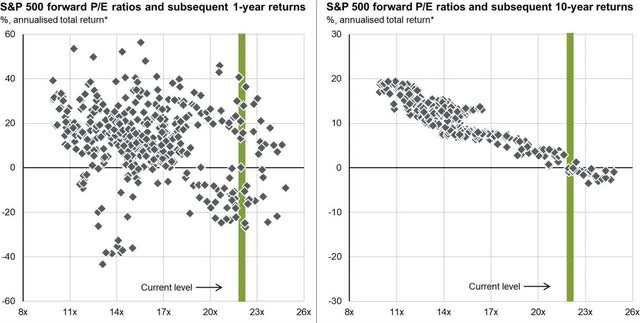

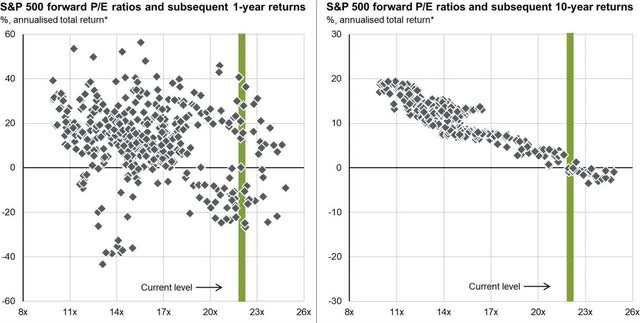

Some of you have likely come across the below charts circulating online (the right one, in particular). They illustrate annualized returns over 1-year and 10-year periods, with each square corresponding to a monthly data point spanning over 27 years—from 1988 to January 2015.

With the prior section of this letter in mind, I don’t think anyone would find it surprising that when you pay 20x+ earnings for the S&P 500, your following 10-year returns have never been more than 5% annually since 1988. Despite this, there were undoubtedly several years over any decade where your returns would have been attractive (as demonstrated by the chart on the left). However, continuing to hold onto the S&P 500 has always resulted in sub-optimal results over the long term when paying a high multiple. The chart on the left also demonstrates that valuation does not seem to matter much in the short term, and returns in any given year are mostly random.

These observations are hardly unexpected as paying a higher multiple means you need a business to meet lofty growth expectations and avoid multiple compression. Yet, as companies expand and reach maturity, growth eventually decelerates, making multiple compression a natural and expected outcome. On the other hand, when you pay a low multiple for a business, the expectations that the company must meet to generate an attractive return are generally much lower – The S&P 500 trades at ~22x earnings today for reference.

While the above charts provide valuable insights, they also have some limitations that we should acknowledge. To start, they only cover 27 years of data, and since each square corresponds to a separate month, the strong correlation between earnings ratios and returns could differ over longer or different time horizons (we expect that the trend would still look relatively similar over any period). Earnings ratios also fail to account for the capitalization of these companies accurately, and there is also the fact that actual earnings are being overstated due to the wide adoption of stock-based compensation, which many analysts and companies wrongly add back to their earnings. Another interesting data point is that the top ten stocks in the S&P 500 make up ~38% of the index today, compared to the prior high of ~27% during the dot-com era. With these stocks trading at 29x earnings, they bring the index's overall earnings multiple up; excluding these ten stocks, the remaining companies still trade at an average multiple of ~19x earnings. However, when looking at the infamous MAG7, it is important to point out that they are undoubtedly some of the best businesses the world has ever seen, which, despite their size, are still growing at attractive rates and thus are potentially worthy of their hefty multiples, excluding Tesla (TSLA).

Looking past lofty valuations, there are also plenty of new uncertainties in the markets, such as tariffs that were going to happen, then did not happen, then got delayed, and are supposedly now going to happen again, maybe? Furthermore, the AI space had a pretty big shake-up in late January with the release of an open-source chain-of-thought model, DEEPSEEK R1, that reportedly can run and was trained at a fraction of the cost when compared to something like OpenAI’s flagship O1 model - NVDA dropped 17% in one day on this news and both AI and Wallstreet pundits are still debating its actual impact and what it means for the “AI revolution.”

So, what are we supposed to do with all this information? Well, I don’t believe in predicting markets, so with that in mind, we will continue to buy good-to-great businesses at attractive prices when opportunities present themselves, and when they don’t, we won’t.

AstroNova Inc. (ALOT) Update:

AstroNova has often been our largest position since inception and one that I have discussed at length in prior letters. As a recap, the thesis hinged on a return to normalized earnings in both their test and measurement segment (tied to narrowbody aircraft production) and their production identification segment (temporary ink/supplier/retrofit issues). Since our original purchase in January 2023, the business has performed as expected. At the end of their fiscal Q2-2024, the company (before Boeing strikes and shipment delays at PID, so a “semi-normal” quarter) was doing north of $21M in run-rate EBITDA – this compares to just $11M at the time of our original purchase. However, while the business has performed well, management’s poor capital allocation has cost us and taken away a good amount of our upside, for now at least.

In May 2024, AstroNova announced their $20M acquisition of MTEX, which we covered in our Q2- 2024 letter. At that time, it appeared that MTEX was a decent-to-great use of capital; it had high EBITDA margins (20%+), double-digit topline growth, some synergies, and perhaps most importantly, new technology that AstroNova’s legacy products could benefit from. Meanwhile, it also appeared they had paid around 10x 2024 EBITDA for the business, not bad.

Sadly, in their FY-Q2 report, many of these assumptions were proven false, with only the last point still valid today. MTEX in FY-Q2 put up a $1.4M operating loss and produced only $0.8M in revenue, and in the most recent quarter, FY-Q3, MTEX put up $1.7M in revenue and a $1.1M operating loss.

These numbers are obviously far from the assumed 20%+ EBITDA margins and well short of what we thought to be $12M+ in annualized revenue. To put it simply, management essentially took $20M of shareholder capital and threw it into a fire, and that fire continues to grow every day that MTEX remains unprofitable - not surprising in the least, the share price has declined materially off the back of this acquisition, which in turn made AstroNova our largest detractor for the year.

From our understanding, part of this poor performance is related to AstroNova doing a complete realignment of MTEX’s reporting structure, which covers everything from sales and marketing, manufacturing, technology, finance, and human resources – all of which now report directly to AstroNova leadership. Originally, MTEX was meant to be run far more independently after the acquisition. But once AstroNova got into the guts of the operations, they quickly realized that they needed to implement several changes and more closely integrate the business. One such example that led to this is that MTEX would frequently discount ink heavily, or in some cases offer it for free, just to sell more printers to customers (sacrificing higher margin long-tail recurring revenue for one-time lower margin revenue). This realignment has understandably slowed down the sales process for MTEX and further delayed the fulfillment of their backlog.

Furthermore, management on the recent earnings call discussed that they believe to have discovered specific details inconsistent with the information originally provided by the seller and are “seeking potential remedies from the seller under these agreements.” This is not at all surprising to us, given MTEX’s performance thus far. One needs not to look any further than MTEX’s supposed “annual reports” on their website from 2021/2022 and compare those financials to their performance thus far to understand that they are/were likely fraudulent, or at the very least presented in a misleading and false manner. Clearly, there may have been some nefarious and less-than-truthful things going on with what the seller was communicating to AstroNova. The only way you would acquire something like this is if you were to forgo necessary due diligence checks, and management has more or less alluded to doing so in the recent public call. The only logical conclusion I can come to for doing this is if there were other interested buyers (which management did not deny when asked on the original M&A call) also willing to forgo these crucial guardrails, making the deal time-sensitive and a potential bidding war. Regardless of how this came to fruition, it is apparent that neither the board nor management asked the right questions.

However, reading between the lines and given the timing of the old CFO’s “retirement” (roughly a month after the deal was announced), we can infer he was likely fired over this transaction. Still, even if we were to believe that the old CFO was responsible for this debacle, that does not relieve Greg nor the board of their responsibility in this matter as the buck stops with them as far as I’m concerned, and this acquisition should not have been made without proper due diligence.

So, where are we today, and what have we done about this? If it’s not clear from my writing thus far, I am frustrated with this outcome and would have considered selling some of our shares in AstroNova had it not been for my conversation with Greg and the new CFO, Tom DeByle, after FY- Q2. During this conversation and a few afterward, we pushed Greg relentlessly on this acquisition, what happened, why it happened, how we’re going to fix it, and, more importantly, how we will avoid another significant error like this going forward. Greg, luckily, took responsibility, and we believe he has learned from it. Self-reflection is very important as an investor and capital allocator, people make mistakes (ourselves included), so we are willing to forgive management this time around since there was an acknowledgement of this mistake and they have performed well excluding this incident. However, this transaction might more accurately be classified as a blunder today on part rather than just a small mistake. Sadly, it has negatively impacted us and all AstroNova shareholders, at least for now.

However, it was not Greg’s “self-reflection” that kept us in AstroNova; instead, it was the new CFO, who we believe is fighting well above his weight class. Tom was previously the CFO of Standex, a multi-billion-dollar public industrial company, from 2008 till late 2019. During his time at Standex, Tom oversaw earnings per share go from $1.49 to $4.72, EBITDA margin expansion from 8% to 15%, seventeen different acquisitions, numerous non-strategic divestitures, $40M in permanent cost savings, and a 400% increase in Standex’s share price.

From our research and conversations with him, Tom is an intense straight shooter and, in our opinion, acts as a good balancing act to Greg, who usually comes off as too stoic. During our conversations with Tom online and in person at Southwest Ideas, we heard him reiterate that sometimes “the best acquisition is the one you don’t make.” MTEX would have “ never happened in the way it did if he was here,” and “there will not be another acquisition like this one.” We like Tom and believe he is a massive improvement from the prior CFO (whom we never had a favorable opinion of). We believe that Tom likely has a lot of work to do to “right the ship,” and that will take some time, but we are confident that he will find many ways to cut costs, improve efficiency, increase inventory turns, and create value at both MTEX and AstroNova.

So, is there any silver lining to MTEX itself outside of us getting a much-needed new CFO? Yes, there is still a small possibility of MTEX being a meaningful contributor to AstroNova’s business looking a few years out. While we don’t know MTEX’s “true” earnings power today, management seems to believe they’ll have it back to profitability in 2025. More important, however, is the technology that came with this acquisition. We believe that AstroNova will be able to utilize MTEX’s printhead technology to help diversify and lower their reliance on ink suppliers, increasing margins and lowering supply-related uncertainty moving forward. Additionally, there are also some software programs they picked up; one such example is MTEX’s “TRAX” software, which increases visibility into customers' ink supply, maintenance, printer usage, and reduces friction for customers when restocking Ink. However, going forward and until proven otherwise, we are assuming no profitability for MTEX out of conservatism and instead assume the business gets to B/E this year or next – which seems feasible on its current trajectory. While there is still the slim possibility of this acquisition not being a total waste of capital, I am giving them no such credit and remain hopeful we’ll get some sort of compensation from the seller.

As of writing, the company has a market cap of $88M and an enterprise value of $137M. We believe they will do mid-to-high twenty millions of EBITDA in 2026 as narrow body production continues to ramp and their product identification business benefits from cost saving initiatives. Looking out to 2027, we see them doing around, if not upwards of $30M in EBITDA driven by $4M+ of Honeywell royalty expenses falling off and straight to the bottom line. These assumptions imply AstroNova is trading for less than 5.0x and 7.0x 2027 EBITDA and UFCF, respectively, before any incremental cash generation. These multiples seem overly draconian to us, and we will continue to strongly recommend that management implement a substantial buyback if shares remain depressed after deleveraging the balance sheet. However, if there should be further poor capital allocation, we will not hesitate to voice our opinion more openly towards both management and the board and believe there would be a substantial number of other investors who’d follow suit.

Conclusion

Turnover in our portfolio was notably higher this year than in 2023, driven by trimming larger holdings such as Bel Fuse and Turning Point Brands as they approached our estimated fair value. Additionally, there was a concerted effort on my part to clean up and refine the portfolio, which involved replacing lower-conviction ideas with higher-conviction, higher-quality names as opportunities arose. As a result of this refinement, I believe the portfolio is in a much stronger position, and I remain optimistic about our future returns.

As a reminder, we are open to new clients, and if you know someone who might be a good fit, please feel free to pass along my contact information.

As always, I am humbled by and grateful for the opportunity to invest your capital alongside my own, and I will continue to make every effort to compound that capital at attractive rates.

Cordially,

Brandon Daniel

Founder & Portfolio Manager | Atai Capital Management | LCbdaniel@ataicap.com

“ If you spend 13 minutes a year on economics, you’ve wasted 10 minutes.” – Peter Lynch

| Disclaimer: This letter expresses the views of the author as of the date cited, and such views are subject to change at any time without notice. The information contained in this letter should not be construed as investment advice, and Atai Capital Management, LLC(“Atai Capital”) has no duty or obligation to update the information contained herein. This letter may also contain information derived from independent third-party sources. Atai Capital believes that the sources from which such information is derived are reliable; however, Atai Capital does not and cannot guarantee the accuracy of such information. References to stocks, securities, or investments in this letter should not be considered investment recommendations or financial advice of any sort. Any return amounts that are reported within this letter are estimated by Atai Capital on an unaudited basis and are subject to revision. Atai Capital’s returns are calculated net of a 2.00% annual management fee and reflect a client’s performance who would have joined the firm on its inception date (01/03/2023). Actual Individual investor returns will vary based on the timing of their initial investment, the impacts of additions and withdrawals from their account, and their individually negotiated fee structure. Atai Capital believes showing returns net of a 2.00% management fee better reflects actual performance as of 02/17/2025 since no account that Atai Capital currently manages is charged a fee more than the stated 2.00% management fee. Past performance is no guarantee of future results. Index returns referenced in this letter include the S&P500, Russell Microcap, and Russell 2000. Atai Capital’s returns are likely to differ from those of any referenced index. These returns are calculated from the respective provider’s websites, Essential Intelligence for the S&P500 and ftserussell.com for the Russell Microcap and Russell 2000, and include the reinvestment of all dividends in both cases. |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.