Abstract Aerial Art

By Paul Wightman

At a Glance

- Traditional trade routes, particularly the Asia to Europe route, are experiencing more frequent disruptions

- The container trade is projected to grow around 3.6% each year through 2028

The container freight market is undergoing significant changes that could have major implications for global trade flows.

The latest report from the UN Trade and Development (UNCTAD) agency estimated that global trade saw a record expansion to $33 trillion in 2024, an increase of 3.7% from 2023. Volatility is rising on the back of the ongoing conflict in the Middle East, which is bringing risk management strategies around hedging costs to the fore.

Rising Risks in an Uncertain Market

The container market is an integral part of the overall shipping market, with over 90% of global goods shipped by sea. Of this, around 60% is transported in containers. The potential shifts in global trade are causing uncertainty in the container markets, and in many cases key shipments are being re-routed to other destinations where possible. These developments are raising questions around the cost of shipping, with the main trade lane from production centers in Asia to destinations like the U.S. or Europe being some of the most impacted due to the sheer volume of goods transported on these routes.

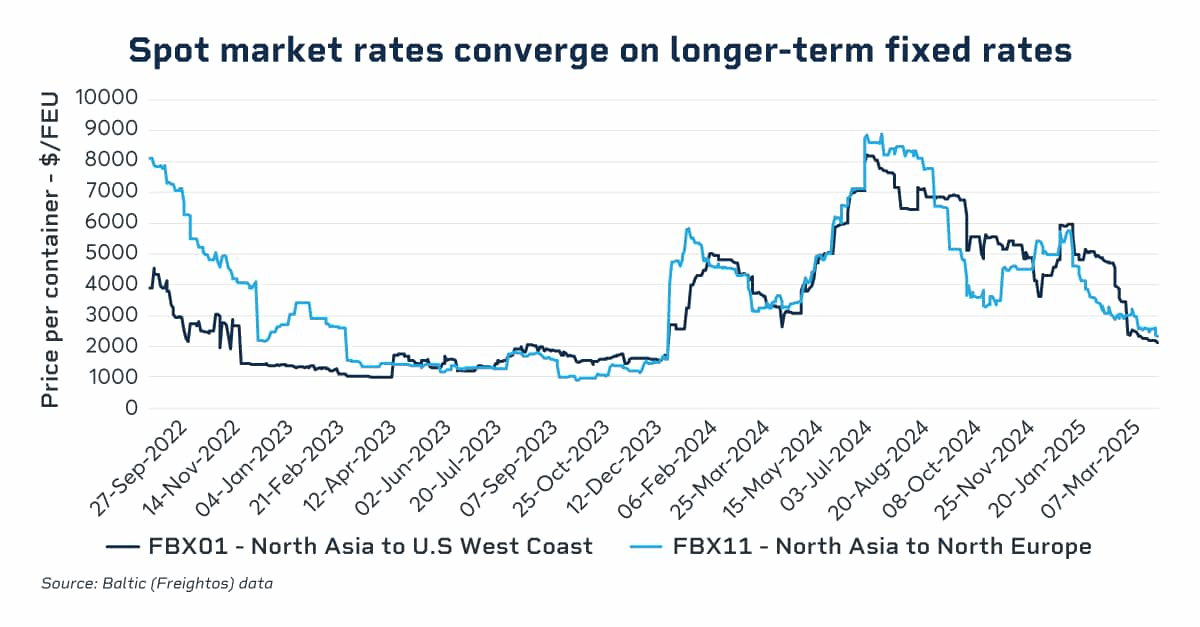

The softening of the spot market rates continues to challenge the long-held belief that the longer-term fixed term contracts are beneficial to the market. Declining spot rates edging toward the level of the longer-term fixed prices are prompting some major liners and freight forwarders to re-consider rates that are more closely tied to the spot markets, and indices such as the Baltic Index (FBX) represent a good reference price for this trade.

With the continued uncertainty regarding the cost of freight, more companies – from the liners to the freight forwarders and the cargo owners – are evaluating their trading strategies. Managing the cost of freight typically brings some degree of price certainty to the supply chains for moving goods from the point of production to the point of consumption. Companies are looking at what they hedge, which could contribute to the continued development of the financial markets in container freight at exchanges like CME Group.

Volatility and Disruptions Continue

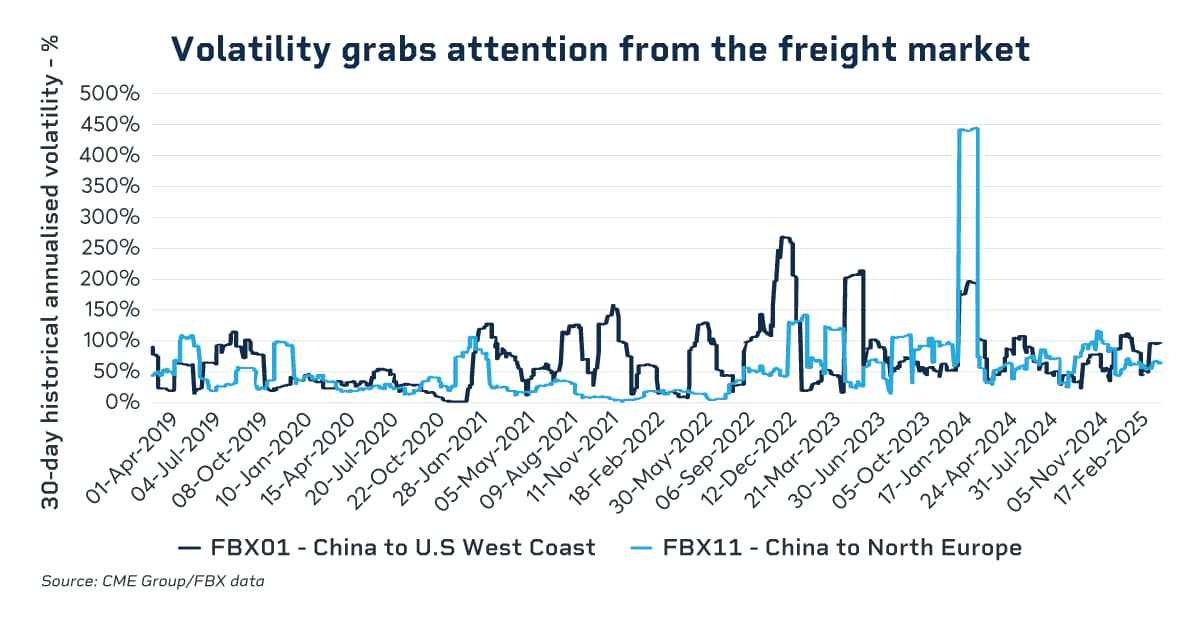

The Baltic (FBX) freight indices, which are a leading industry benchmark for the trading of container freight, remains volatile across many of the trade routes. The North Asia to Europe and North Asia to the U.S. West Coast routes are two of the most volatile amid the policy shifts, disruptions in the South China Sea and re-routing away from the Suez Canal on the back of more frequent attacks on shipping off Yemen.

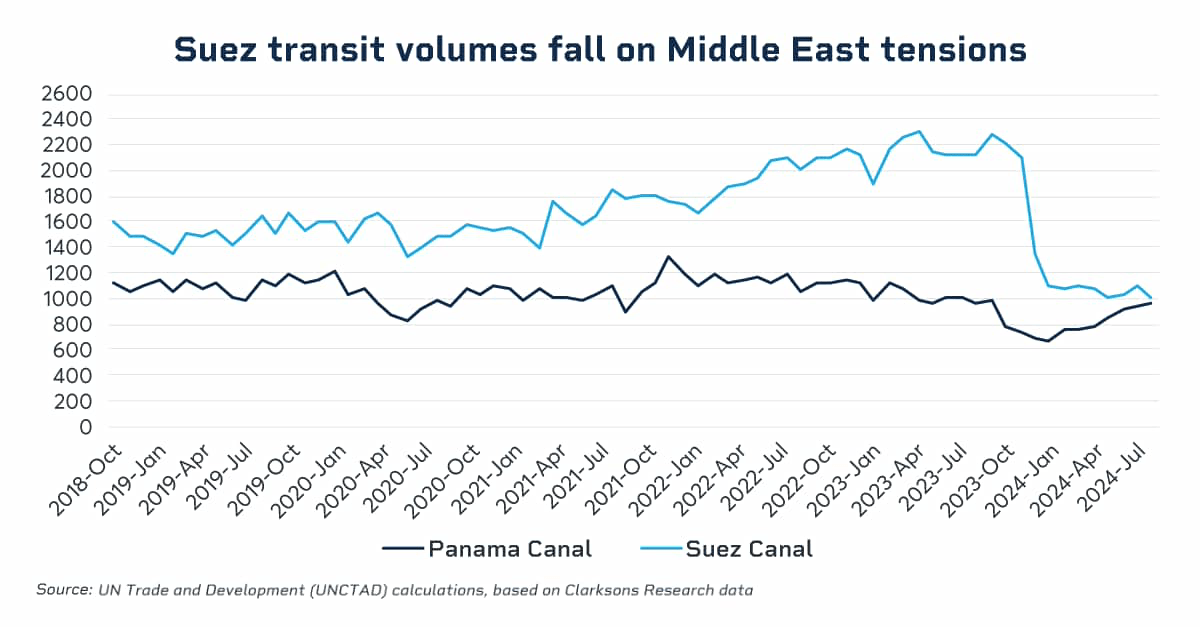

The latest 2024 UNCTAD report shows that there was a total of 23 million Twenty Foot Equivalent Units (TEUs) traded in 2024 between Asia and Europe, which highlights the important role that the Suez Canal plays in maritime trade.

Disruptions to the traditional trade routes, most notably in the Asia to Europe route, have also become more frequent. It is important to note that the ongoing conflict in the Middle East has contributed to a greater disruption to freight entering into and exiting from the Suez Canal, which has forced owners to take much longer diversions to arrive in Europe. Businesses that rely on imports or export to global markets have had to plan much further ahead, or in some cases, divert goods to other markets. This has all been a contributing factor to the overall volatility in the freight price.

Growth Outlook in Containers Appears Robust

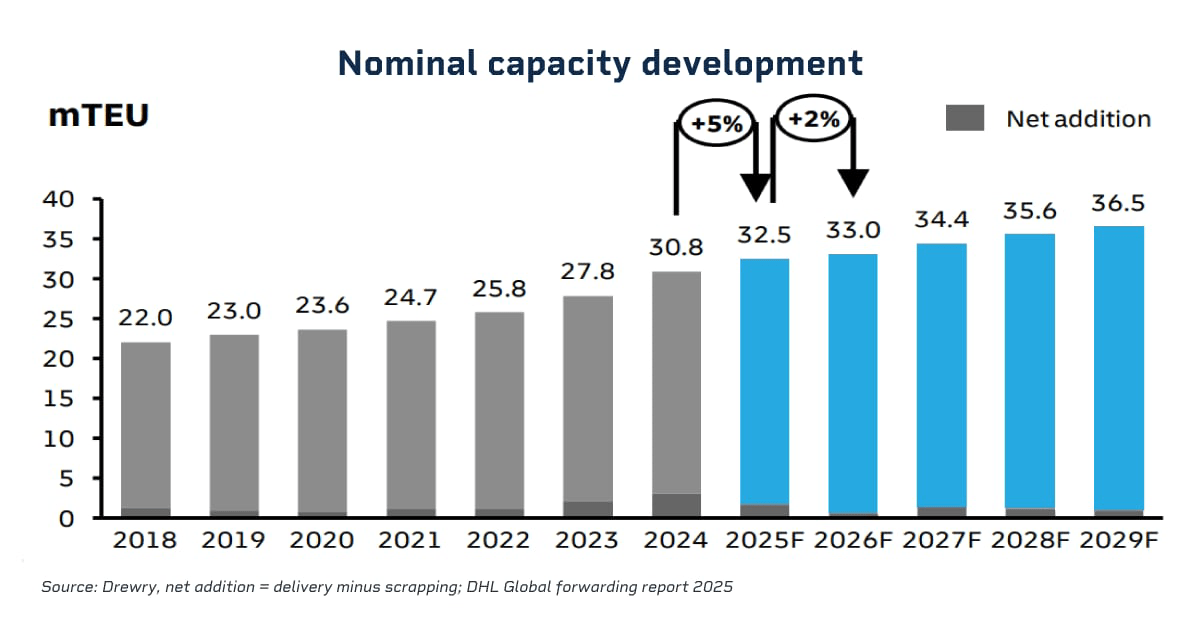

The latest report from UNCTAD shows that there were 59.36 million TEUs shipped on the main East-West routes in 2024, a rise of around 5% on the prior year. The DHL Global Forwarding report for 2025 shows that on a longer-term basis, the container trade is expected to grow 3.6% on average from 2024 to 2028. In volume terms, this would mean adding a further 6.1 million TEUs of capacity per year.

The volatility in the container freight market looks set to continue considering the number of geopolitical events that are disrupting supply chains of key goods. Freight routes are being diverted, cargoes are taking longer to be delivered, and all of these factors are contributing to heightened levels of volatility. As companies along the supply chain look to hedge price risk in the market, the container freight market could see a higher level of activity in the months ahead.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.