lerbank

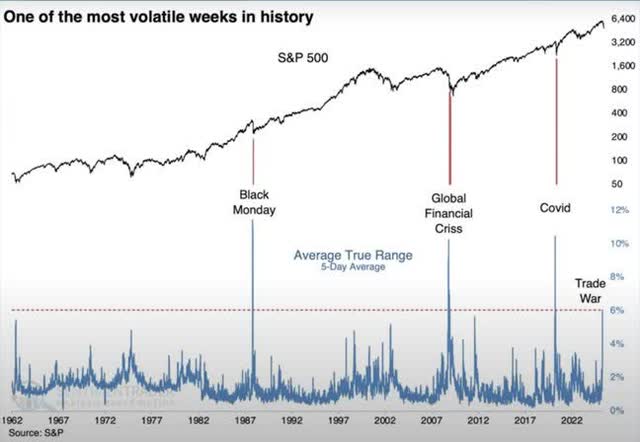

The last few weeks have seen a complete market shift. From being focused on deregulation, a pro- business administration, and accelerating earnings growth, to 100% of the attention now on tariffs and a trade war. The cause is simple, one man’s misguided policy, to put it politely. The question now is what to do. In this report we will detail our specific investments, overall strategy, and outlook.

To start, some of our comments or data will be outdated by the time we publish because that is how fast policy, sentiment, and headlines are moving right now. A good place to start is on the idea of “headlines”, their impact, not only on the market but more importantly on one’s state of mind.

Like what we’ve seen in past panics, investors sell first and ask questions later. This leads to selloffs where there is nowhere to hide but it also leads to opportunities where companies with minimal to no exposure to the problem go on sale. We’ll summarise the recent earnings announcements of our investments and comment on why we think their businesses will continue to perform well.

Tariffs & Trade War

No market sell-off, panic, or recession is the same. This time is unique because the market knows the solution. Past recessions, wars, Covid, etc., the market didn’t know the solution in the aftermath and had to work through it. This time it has been driven by one man’s decision making.

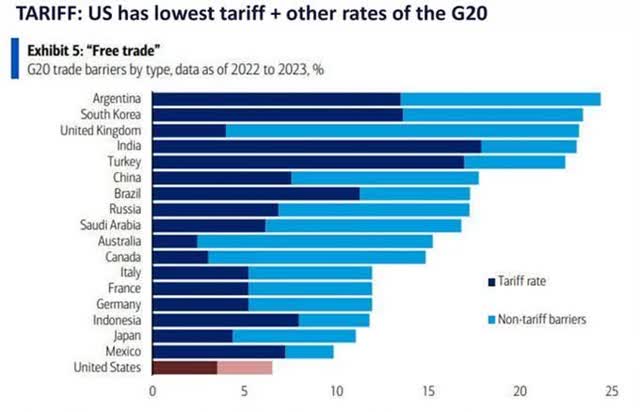

As the table below shows, the US does have a point about more tariffs being placed on US goods than the other way around. However, the execution in trying to address this has been an unmitigated disaster. The reasoning behind the trade war has been opaque. Are the tariffs being used to raise government revenue, motivate better trade deals, increase domestic manufacturing, protect certain industries, isolate China, etc. His justifications continue to change, and the issue is that this tariff strategy is not what he ran his campaign on and not what the market expected.

Figure 1 - G20 Tariff Rates (Bank of America Global Research)

There are a few main outcomes here.

He actually wants to bring manufacturing back to the US from places like Vietnam and China. The issue is that the US currently has more job openings than unemployed workers (The Fed considers the US at full employment). The second, these aren't jobs that Americans want to do, especially at market wages.

The Cato Institute completed a poll where 80% of Americans agreed the country would be better off if more people worked in manufacturing. However, when these same respondents were asked if they would be better off in a factory instead of their current work, 75% said no. Americans love the idea of more Americans working in manufacturing, but not themselves. As of the date of this poll, there were 600,000 open manufacturing positions in the US. 1

Even if you agree with the tariffs and reasoning, the issue is that businesses aren't going to invest capital to onshore manufacturing without knowing the state of play. That's why the end game can't really be trying to bring iPhone manufacturing or shoe manufacturing back to the US. Apple (AAPL) or Nike (NKE) aren't going to invest the ridiculous amount of capital to do that if in 4 years there's a new administration that repeals the tariffs or in a week or a month Trump changes his mind.

What is more likely, is that Trump is coming out hard in order to bring countries to the bargaining table. For example, the day after the tariff announcement, Vietnam reached out saying that they will bring their tariffs down to zero and would like to negotiate. The end outcome here could be that countries get rid of or lower their tariffs against American products and the US responds in kind. This opens up more free trade and lowers costs of goods overall.

Like the UK who has said that instead of immediately putting retaliatory tariffs on, they will sit down with the US to negotiate new trade terms. Or Israel, who the day before the announcement took all tariffs off American goods. From a headline perspective, we believe this is the worst the tariffs will be and now countries will come to the bargaining table. As new deals are announced, the sentiment from here should improve.

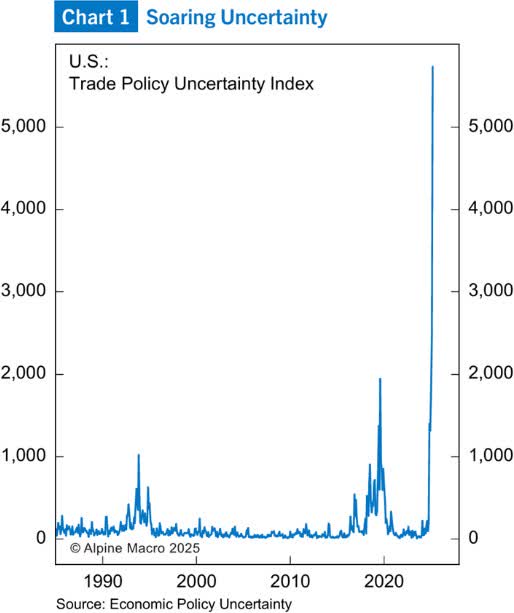

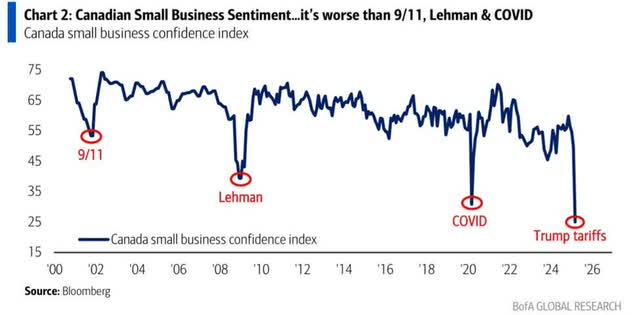

Without a quick reversal of policy and new trade deal announcements, the Republicans most likely lose the Senate and the House in 2026 … which could lead to impeachment. Trump will have to lower the temperature. Now that Trump has blinked and rolled back the absurd levels of tariffs, we believe that uncertainty has peaked. That being said, market volatility most likely remains elevated because a lot of damage has already been done to consumer and business confidence.

The outlier here is China, which is where the real battleground is. We would be skeptical having any kind of business exposure there. That being any import/export, technological reliance, or financial reliance.

Canada will have to wait until after our election on April 28 th to have any concrete idea on how we will handle this on our side of the border.

Media

We want to briefly touch on the impact of media on the stock market. The increase in social media use has exacerbated emotional extremes. In our opinion, this can be closely linked to higher swings in sentiment. There could be also other factors at play, like less time spent analyzing businesses (wasting time), or consuming fake news without knowing it.

We recently hosted an investor webinar where we referenced the correlation between time spent on social media and negative impacts on investment returns. The original conversation was with a data scientist but there are public academic studies that show the higher the time and activity on social media the higher the cases of depression and anxiety. 2

The only reason we’re mentioning this here is that over the last few weeks, some concerned investors have sent and asked about multiple Twitter/Facebook posts that refer to the stock market and political decisions in some way.

The current media landscape reminds us of the Gell-Mann Amnesia Effect. This is something we can all relate to. You’re reading the paper, watching the news, scrolling social media and a story pops up about something where you are an expert. It could be nutrition, exercise, construction, legal, golf, farming, Italy, or whatever. You read the article, and you know it’s complete garbage. You think the author has no idea what they are talking about. The Gell-Mann Amnesia Effect comes into play as you turn the page and read a different article on a different subject. Right after acknowledging poor information or interpretation of the last article, you take the next article as true because it is outside your circle of competence. The point being, someone else that read that article you thought was garbage took it as being true and now you’re taking the next article as true.

In times like these, we remind ourselves to stay within our circle of competence. Trust but verify and remain focused on critical thinking.

Sentiment (Fear and Uncertainty)

Our past commentary spoke to market sentiment so we’ll only touch on it briefly here. The March 2025 BofA Fund Manager Survey 3 reported the largest monthly drop in U.S. equity exposure ever, and the largest corresponding rotation to cash since March 2020. This is an example of the sell everything mindset and where emotion takes over logic.

In the last 35 years the Fear Gauge (VIX) has reached the current level (+50) six times. In each case, the market was higher a year later, usually significantly so. Even though the current day to day is uncertain and the real economic impacts of the polices haven’t worked their way into the economy, the market looks forward and sees the decline in earnings coming. The stock market looks ahead and bottoms 9-12 months before the earnings bottom. You can’t wait for the dust to settle and still expect to find attractive panic like prices. This is why investing at max pessimism has historically led to higher returns. Many reading this will agree this point is intellectually true, but actually investing during drawdowns is emotionally challenging. People panicking now are looking at daily headlines, while the market bottoms and shifts its focus to where we’ll be in 9-12 months. As an example, the stock market bottomed 13 months before the worst was seen for earnings in the 2008/2009 financial crisis.

DKAM Investments & Strategy – “Buy What Grows When The Economy Slows”

As mentioned, the panic has led to many stocks selling off 30-40%+. You could confidently argue that companies reliant on import/export trade, and especially reliant on China, deserve to decline. Their costs increase and demand declines. That being said, our focus is on niche growth companies. Most are service businesses which are asset light, and we aren’t seeing much if any sustained impact on fundamentals.

For investors with a longer time frame, an exercise we find helpful is to view your investments as private businesses. If the company’s stock wasn’t public and its price didn’t fluctuate day to day, how would you view that business? Do you trust the management team? Are they continuing to grow the business and improve the overall value of the company? Ignoring how the stock is trading, do you like how the business is executing? This is why we focus on quality compounders. These companies have products/services that generate cash for the business which they can reinvest back into their business at high rates of return to generate even more cash. In times like these, their stock price might be down but they’re going to generate even more profits this year than last and the same for next year.

Company | Market Cap | 2025 Revenue Growth* | 2025 Earnings Growth* | 2025 PE* | 2026 PE* |

Zedcor (OTCPK:ZDCAF) | $310M | 85% | 107% | 21.8x | 12.8x |

Propel Holdings (OTCPK:PRLPF) | $935M | 41% | 72% | 6.8x | 5.1x |

Cipher Pharmaceuticals (OTCQX:CPHRF) | $293M | 54% | 66% | 10.1x | 8.6x |

VitalHub (OTCQX:VHIBF) | $551M | 63% | 62% | 20.2x | 17.9x |

Gambling.com (GAMB) | $413M | 32% | 57% | 8.4x | 7.2x |

Enterprise Group (E:CA) | $97M | 33% | 42% | 7.9x | 6.6x |

MDA Space (OTCPK:MDALF) | $2,986M | 45% | 37% | 14.5x | 13.2x |

GoEasy (OTCPK:EHMEF) | $2,534M | 22% | 23% | 7.4x | 6.1x |

Constellation (OTCPK:CNSWF) | $97B | 20% | 21% | 27.4x | 23.9x |

VerticalScope (OTCQX:VFORF) | $99M | 3% | 4% | 3.4x | 3.1x |

Average | $10,551M | 40% | 49% | 12.8x | 10.9x |

| *DKAM Estimates **Avg. Market Cap $974M excluding CSU |

Like past panics in 2008/2009 and 2020 our strategy focuses even more so on staying as close to the businesses as possible. Even more than normal, we want to speak with the management team, travel to see the business on site, independently research how the product is doing in the market, keep an eye on competitors’ products, etc. Knowing that your company is doing well in the “real world” will alleviate the stress of watching the stock price everyday.

Our fund is concentrated and focused on our top ten investments. With this pullback, they are trading on relatively subdued multiples, leading to us being optimistic on the fund’s future returns over this time period because we know these companies well. Our portfolio trades at a cheaper multiple than the TSX Index or the S&P 500 while delivering significantly higher growth. The set-up from here should support significant outperformance, similar to past returns following panics.

Earnings Summaries

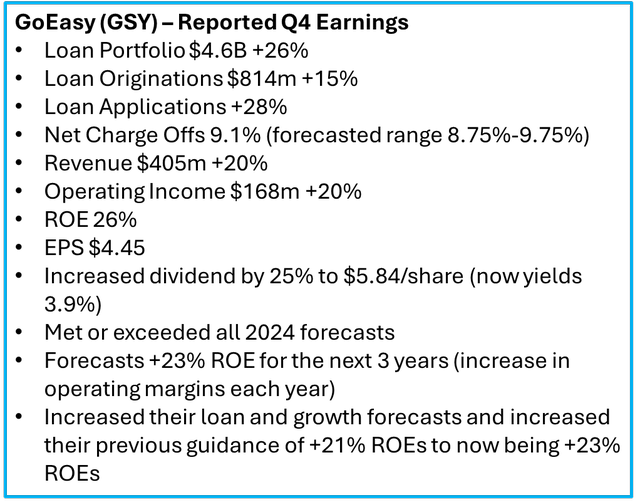

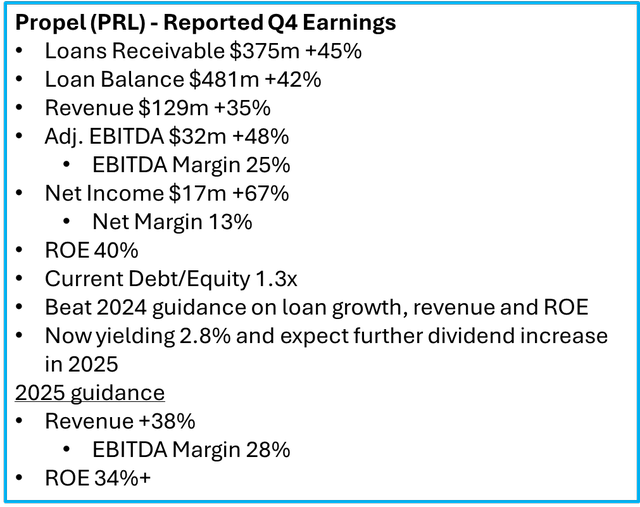

We’ll start with the most topical earnings summaries and important commentary for GoEasy (GSY) and Propel (PRL:CA).

GoEasy (GSY) and Propel (PRL:CA)

Propel & GoEasy are in the same boat as the stocks have sold off on macro economic headlines, but the business fundamentals remain strong. We have seen past declines in these stocks as people make assumptions about lenders in a slowing economy. The fundamental flaw in that assumption is that as banks tighten their lending standards due to uncertainty, the result of that is the quality of loan books for Goeasy and Propel actually increase. People selling only know these businesses at a high level and don’t understand the resiliency of the client and the short-term lending model of the business. This is an example of an opportunity born out of the market uncertainty.

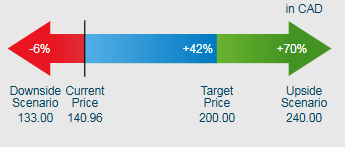

Below is the upside/downside graphic BMO uses to illustrate the one-year asymmetrical risk-reward for GoEasy at these levels. When the market sells off broadly like this (2008/2009, 2018, 2020, 2022), the downside for many quality companies becomes extremely limited with significant upside because the companies continue to grow earnings. We would put many of our investments in the same boat as GoEasy and expect a significant rebound. These are the types of investments we’re adding to at these levels.

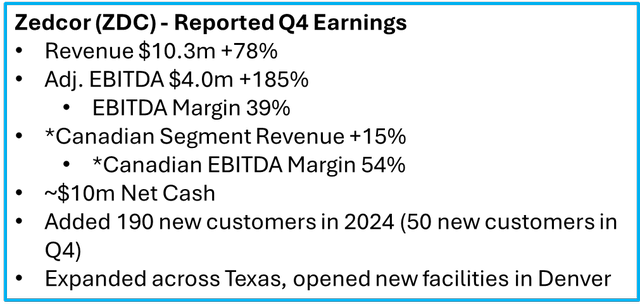

Zedcor (ZDC:CA)

This is the first quarter where Zedcor split out the financials of its Canada and US divisions. This is very helpful because you can see how profitable the business is at scale. The Zedcor business in Canada is more mature with six established branches. The Canadian business grew revenue 15% in Q4 2024 with 53% EBITDA margins and +35% operating margins. As Zedcor scales out their US business division, their profit margins will grow considerably which will boost the overall consolidated margins of the business.

Their US business is seeing significant growth, and many existing customers are pulling them into new geographies like Vegas, Phoenix, Jacksonville, and Tennessee. After seeing their recent results and sitting down with management, we might still be conservative on how fast and for how long they can grow at this elevated pace. The initial success of their new Z-Box product, continued growth in Canada, and geographic expansion with customers in-hand, leads us to a larger addressable market calculation than originally assumed. The ROI per tower is significant, the runway for growth is massive and management execution has been great. We’ve continued to be buyers of any pullback in the stock.

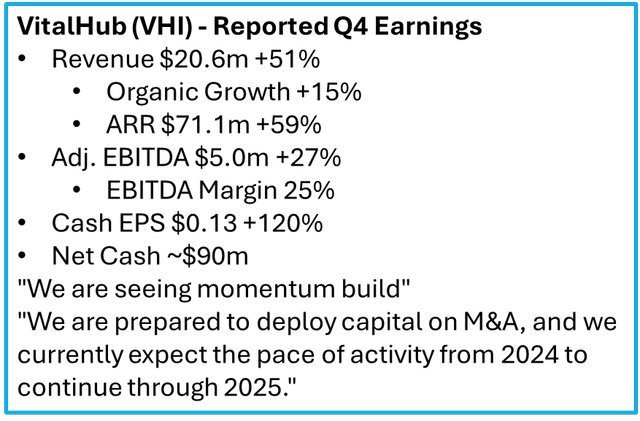

VitalHub (VHI)

We would suggest and we own companies that have zero exposure to the US. Companies like VitalHub have no exposure to the US, and like they just said on their recent conference call, "we see no impact of tariffs on our business." This business is also recession reliant with their focus on healthcare and selling into Canadian, UK, & Australian health departments.

VitalHub just reported a very attractive acquisition. In normal markets, we would have expected the stock to be up significantly on the back of this news. The acquisition grows VHI revenue by ~30% and they paid less than 1x revenue while VHI trades at ~6x revenue. They should also be able to improve margins quickly like they have done many times in the past.

In addition to further acquisitive growth, organic growth should remain high. For example, Ontario is increasing healthcare data reporting requirements and VitalHub owns 2 of the 4 software providers that are compliant with these new regulations. Again, we view this stock correction as an opportunity as we see VitalHub continuing to grow and being worth significantly more in the short, medium, and long- term.

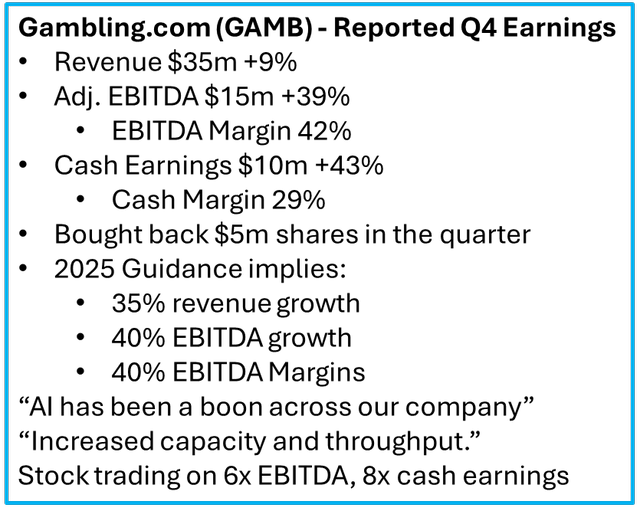

Gambling.com (GAMB)

We view GAMB as the online gambling equivalent of what Expedia does for the travel industry. They provide player acquisition services for online casinos/online sportsbooks but don’t provide gambling services themselves. This is equivalent to how Expedia provides acquisition services for hotels and airlines. The company has been consistently growing and profit margins have been high and improving.

We became even more interested after they recently announced the acquisition of Odds Holdings, which provides real-time odds data. This broadens GAMB’s capabilities and gives the company access to a significant amount of underlying data.

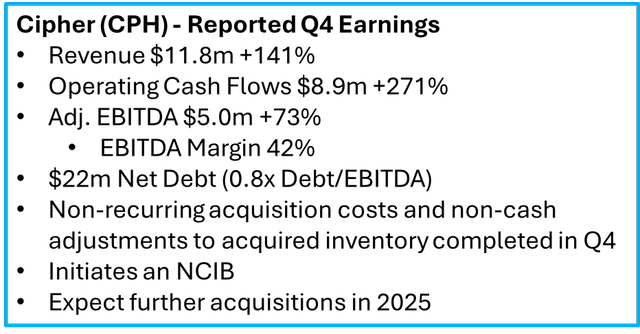

Cipher (CPH:CA)

We expect licensing revenue of Absorbica in the US to return to growth as they transitioned their sales strategy late in 2024, which resulted in overlapping costs and a temporary slowdown in sales. Late 2025 and into 2026, Cipher should begin to announce out-licensing deals for Natroba. We also expect them to acquire complementary products to add to the inventory of products their established salesforce can sell.

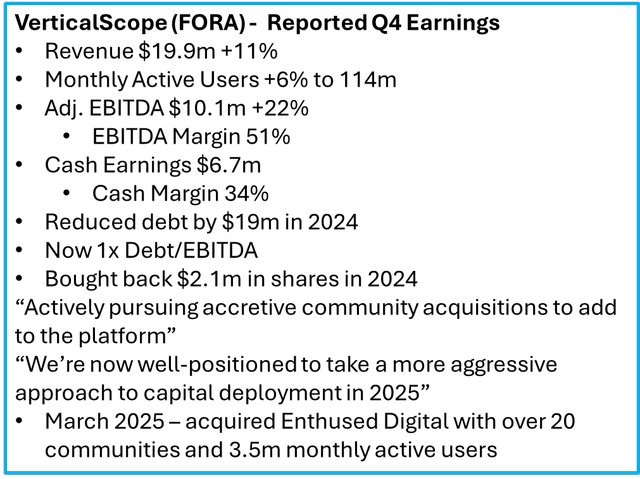

VerticalScope (FORA:CA)

As you can see from their results, VerticalScope reported strong growth, margins, and earnings. They have paid back a majority of their debt, are aggressively buying back stock, and returning to their acquisition strategy. That being said, they recently announced that the most recent Google algorithm update is putting negative pressure on organic growth and margins. Google typically updates their search algorithm 3-4 times per year. For the most part, VerticalScope has benefitted from these updates as Google prioritizes authentic content, like user generated content in forums. This time, FORA has seen some of their search result ranks drop from 1 st to 2 nd or 3 rd. It is obviously a negative for the company in the immediate term. Google is now fairly open with their algorithm and FORA’s SEO team is now working on altering the strategy and mitigating the impact.

VerticalScope doesn’t simply rely on Google for traffic since they own their forums and control authenticated emails of their users. From an organic perspective, they are working on AI summaries of posts within their communities as well as implementing AI translations which allows their content to travel internationally as well as opening up international markets for M&A as they can translate that content across the globe.

Based on capital deployed this year for M&A (should end up in the ballpark of $20m USD), plus the buyback, the stock is most likely trading on less than 3x 2026 earnings. 4 At that valuation, plus upside from growth initiatives and LLM data licensing deals, we feel confident that the stock will end up being materially higher from here.

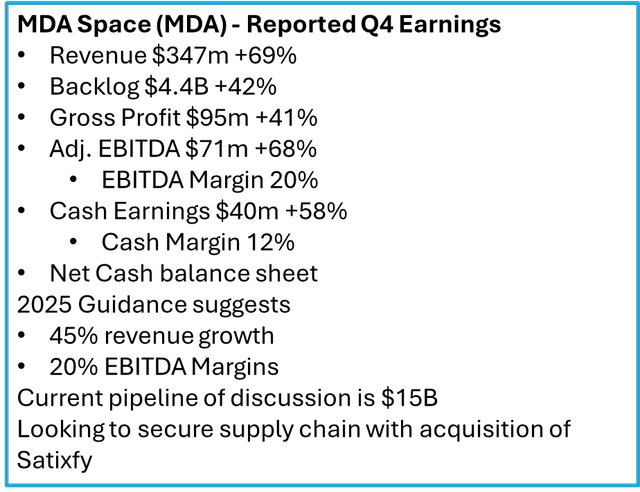

MDA Space (MDA:CA)

After the quarter, MDA announced that their backlog increased from $4.4B to now over $5B. Net profit margins continue to increase with scale and the pace of growth within the sector appears to be growing, supplying a strong tailwind to the business.

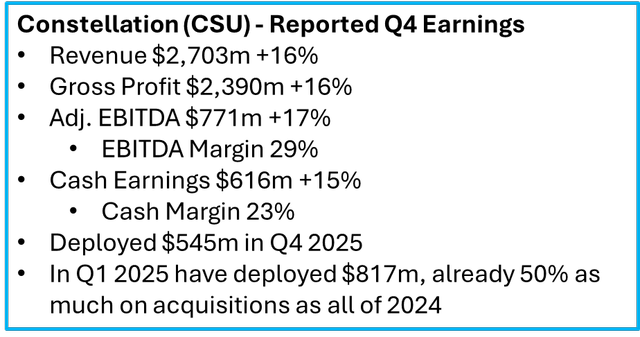

Constellation Software (CSU:CA)

Constellation has once again been deploying capital at a fast clip. Margins have remained high and based on capital deployed to date, they should report strong 2025 numbers.

Enterprise Group (E:CA)

Enterprise Group’s stock has declined significantly this year. Partly due to the overall market and partly due to expectations being too high for their Q4 and upcoming Q1 earnings. Our prior coverage of the company probably had a hand in setting expectations, but we want to distinguish between their recent results and the medium to longer term investment thesis.

Enterprise is currently in control and rolling out a “new” technology to the energy sector. We recently met with their Head of Business Development in Calgary which reinforced the insight that Enterprise is at the start of a technology S curve. These nat gas turbines are more reliable (+10x), cheaper (2x), safer, and less pollutive. BUT, just like any disruptive and superior technology it takes time for acceptance.

There are early adopters, late adopters, and those in between. Enterprise started rolling this out in 2022 and raised a relatively significant amount of capital late in 2024 to really ramp growth. The stock has recently been penalized without giving the company the opportunity to deploy the capital and ramp investment.

The current outlook in Western Canada and developments around LNG, like LNG Canada and other LNG pipelines coming online soon, puts Enterprise on pace to have a record year in 2025 and even more so in 2026. Both ourselves and the company, are at fault for a disappointing quarter and the result on the stock price, however, continuing to dig into the turbine ROI and growth opportunity, we are still confident in the medium to long-term opportunity and have used this correction as an opportunity for further investment.

Final Thoughts

Overall, our goal is to own companies that are growing revenue and earnings independently of what Trump does. Breaking down the above investments, one can see the limit to tariff risk, the limit to recession risk, and the resiliency built into their earnings ability.

When stocks decline and become cheaper, the forward returns on those companies increase and long-term investors should be buying. However, one’s emotions work in the opposite manner. In this case, there are real risks to certain company’s profits. Are we interested in buying companies reliant on imports/exports, like car companies, parts manufacturers, etc.? The answer is no. However, our job is to know companies inside and out and there are businesses where their stock prices have declined but their day-to-day operations will remain strong. We will continue to take advantage of this niche in the market.

Within the last couple of days, we have seen the market starting to show signs of discerning between winners and losers. China-reliant companies are getting hit harder than others plus some winners in our mind are starting to show signs of bottoming.

What has been reassuring is that during recent one on one conversations with our investors, they too see the opportunity here. The Sequoia Fund is a famous investment manager that started in the 70’s. In their 1978 letter to shareholders, they had a great metaphor for times like these.“If anyone offers you a new Mercedes for $2,500, take it and don’t worry about the outcome of the Salt talks or the Middle East situation.” There are definitely value destroying policies in place right now but there are also high-quality businesses for sale at discount prices. If one’s investment horizon is more than a few months, then buying high quality assets at discount prices is a winning strategy.

We recently hosted an Investor Webinar discussing many of the above topics. If you would like to watch the replay, it can be found HERE, with passcode: 92zKU7o?

J.P. Donville & Jesse Gamble

| Footnotes 1 https://www.cato.org/sites/cato.org/files/2024-08/Globalization%20Survey_2024.pdf 2 JMIR 11/23/2016 Vol 3, No 4 3 https://www.bloomberg.com/news/videos/2025-03-18/bofa-survey-shows-biggest-ever-drop-in-us-equity- allocation 4 DKAM Estimate |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.