Mobileye Global Inc. (NASDAQ:MBLY) is a global leader in advanced driver assistance systems "ADAS," and autonomous driving technologies. The company operates vision-based ADAS. Moreover, its EyeQ technology integrates computer vision and machine learning, enabling Mobileye to leverage its AI capabilities to further improve its position in this ultra-lucrative space.

Mobileye has formed key partnerships with industry heavyweights like BMW, Volkswagen, Ford, Geely, Nissan, and others. Remarkably, Mobileye supports roughly 50% of the global ADAS market share, with its EyeQ chips in about one out of every three new vehicles.

The future of driving is autonomous, and given Mobileye's unprecedented market positioning, the company is positioned for massive growth ahead. This dynamic became more evident when Mobileye reported its earnings recently.

Despite the uncertain environment, Mobileye delivered a solid 83% YoY revenue increase and reaffirmed full-year guidance. This was a welcome development considering that the company's previous earnings were perceived as soft.

Mobileye One Year Chart

Given the recent volatility, Mobileye has been one of the worst-hit stocks, declining by roughly 50% since the start of the year. If we go back to its post IPO-high of around $48, Mobileye was down by about 77% off its highs during its worst. However, Mobileye may be around a significant low point here, and the recent earnings announcement changes everything, in my view.

It illustrates that Mobileye's business is expanding rapidly, and the company should post considerable growth despite the slower economic atmosphere. On the back end, the company has considerable growth prospects and positive headwinds due to the increasing autonomous trends in the automotive market.

In addition, Mobileye's business goes beyond cars, and the company's systems may be implemented across wide industries in future years. The company should deliver more than $2 billion in sales next year, and 20-30%+ sales growth could continue beyond that.

Are You Getting The Returns You Want?

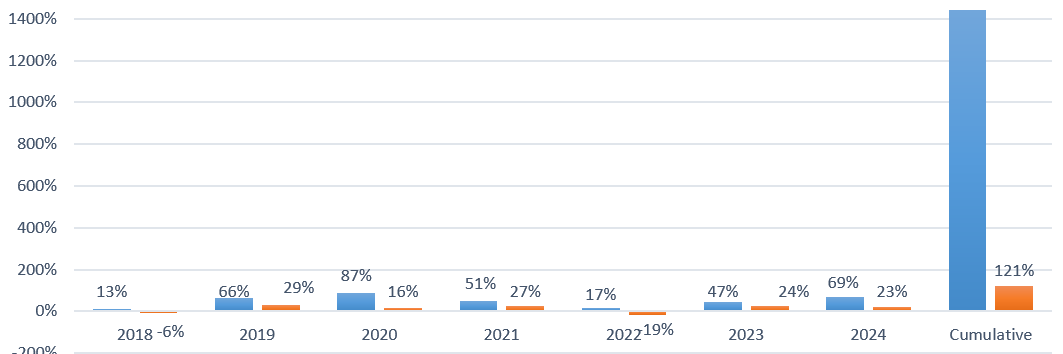

- Invest alongside the Financial Prophet's All-Weather Portfolio (2024 69% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Don't Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!