This article was written by

I am Gen Alpha. I have more than 14 years of investment experience, and an MBA in Finance. I focus on stocks that are more defensive in nature, with a medium- to long-term horizon.

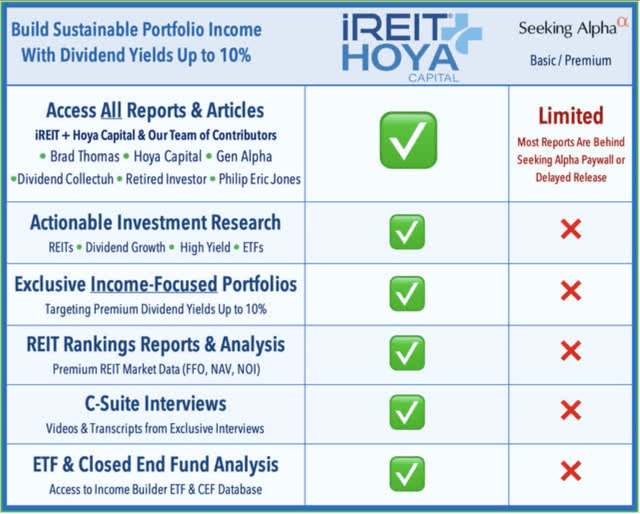

I provide high-yield, dividend growth investment ideas in the investing group

iREIT®+HOYA Capital

. The group helps investors achieve dependable monthly income, portfolio diversification, and inflation hedging. It provides investment research on REITs, ETFs, closed-end funds, preferreds, and dividend champions across asset classes. It offers income-focused portfolios targeting dividend yields up to 10%.

Learn more

.

Analyst’s Disclosure:I/we have a beneficial long position in the shares of AAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.