ScottOrr

At a Glance

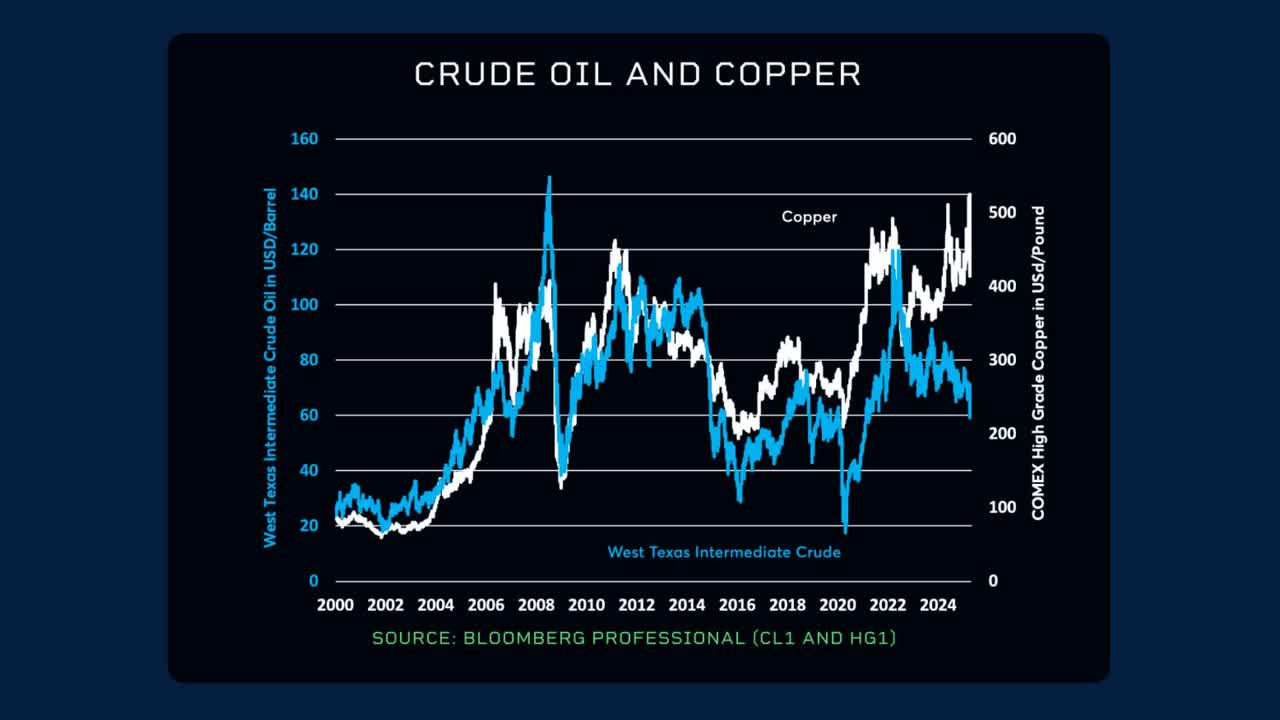

- For most of the past two decades, copper and crude oil prices have moved in tandem

- The rise of electric vehicles and global energy transition initiatives are fueling copper demand

Can copper remain an outperformer among commodity markets? While copper prices experienced a sharp correction in early April, they are still at historically elevated levels and have outperformed other commodities that were once closely correlated.

Take crude oil as an example. From 2000 to summer 2022, copper and West Texas Intermediate (WTI) crude oil prices generally moved in tandem. When oil prices were low, copper prices tended to be low as well, and vice versa.

However, this trend began to shift in late 2022, coinciding with the passage of the U.S. Inflation Reduction Act. This legislation paved the way for large investments in the energy grid and electric vehicle (EV) charging infrastructure, and copper prices began to diverge from oil.

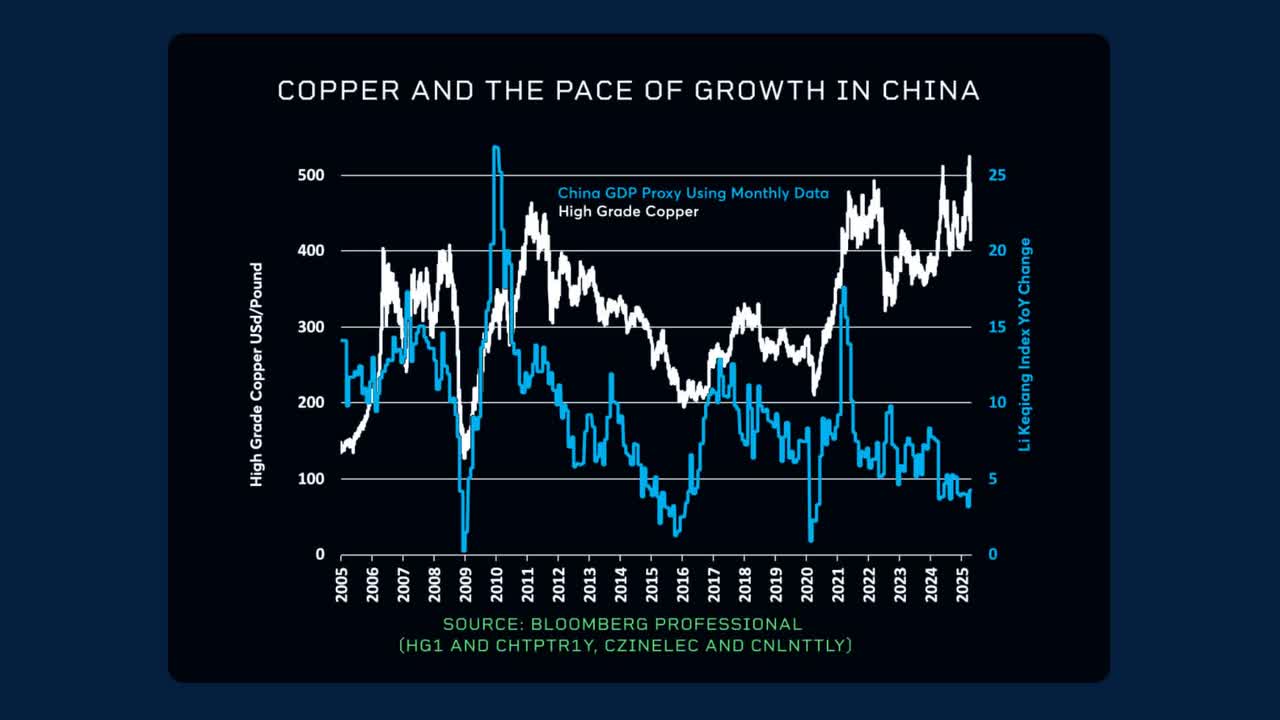

The rise of EVs has been particularly notable. In the U.S., EV sales grew from nearly zero in 2010 to 11.4% of all vehicle sales by 2024. In China, the shift has been even more dramatic, with EVs accounting for over 50% of new car sales in 2024. This surge in EV adoption may explain why copper prices have diverged from Chinese economic growth patterns.

From 2005 to 2021, periods of rapid Chinese growth were often followed by high copper prices, and slower growth periods were associated with lower prices. However, since 2021, despite a slowdown in Chinese growth, copper prices have reached new records, driven by strong energy transition demand both in China and around the world.

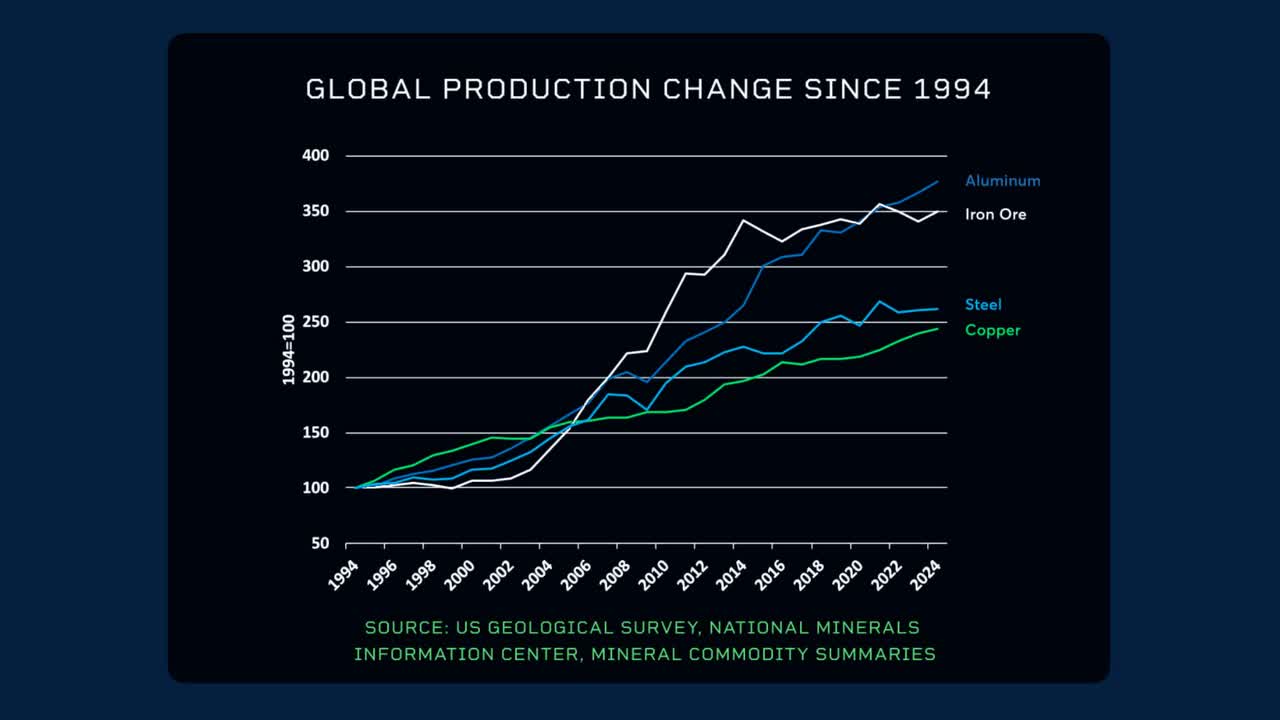

Additionally, strong global demand has met with limited supply growth. Among industrial metals, copper has seen the slowest supply growth over the past few decades.

It is a lengthy process to bring new copper mines online. On average, it takes about 17 years from the start of exploration to the production of copper from a new mine. Given the supply constraints, the future of copper prices will largely depend on continued demand driven by the energy transition.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.